Summary:

- Algonquin is divesting renewable assets to focus on regulated services, aiming for stable profits and dividends.

- The company’s regulated services are under-earning but expected to improve with new rate approvals, particularly in New York and Bermuda.

- Algonquin’s financial leverage will decline post-renewables separation, aided by recent dividend cuts.

- Despite challenges, Algonquin is undervalued, with potential equity growth from pending rate cases and improved operating profits.

coldsnowstorm

Algonquin Power & Utilities Corp. (NYSE:AQN) is streamlining and simplifying its business. The company is divesting its renewable assets to concentrate solely on Regulated Services, which are expected to provide stable and predictable profits as well as dividends.

In our previous article Algonquin Stock Likely To Double After Renewables Separation, we focussed on the asset-based valuation of the business, arguing that Algonquin trades at a 50%+ discount.

However, not all regulated utilities can achieve the same profitability and asset valuation multiples do differ.

In this article, we will drill down into the largest utilities operated by Algonquin and asses the operating performance as well as regulatory challenges.

We want to point out that the full benefits of the renewables separation will take time to play out and over the next couple of quarters reported earnings might even decline.

We remain optimistic about Algonquin’s long-term growth potential, though.

Regulated Services Group has not reached its full potential

The returns generated by the regulated activities of Algonquin fall within a reasonable range, however, they are lower than the maximum allowed profitability.

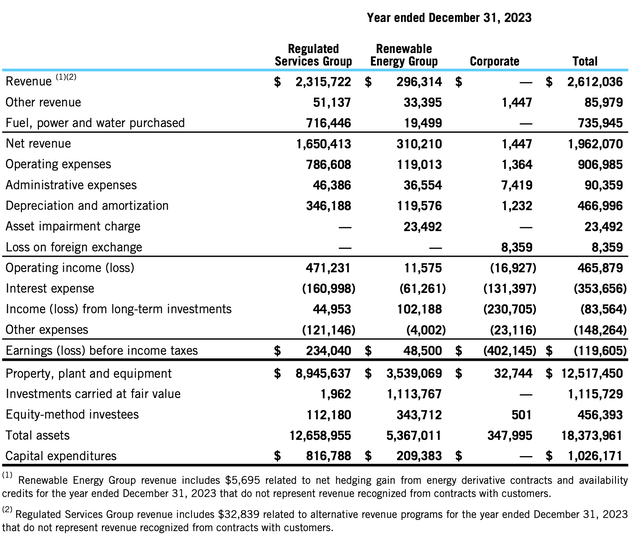

The Regulated Services Group, i.e. the ‘good’ part of Algonquin delivered ~$350 million of pre-tax earnings last year. This would translate to a ~10% pre-tax return on regulated equity.

Business segments (Algonquin)

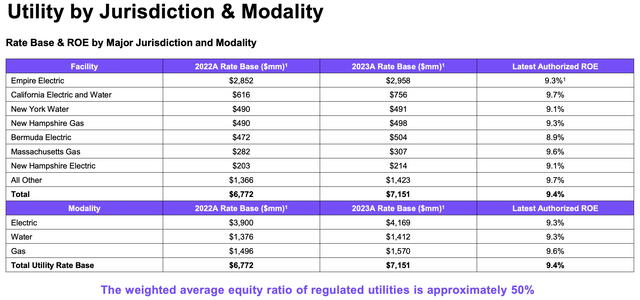

Algonquin has an overall rate base of $7.2 billion and an authorised RoE of ~9.4%. The maximum allowed after-tax profit is therefore about $340 million. Algonquin is under-earning slightly but not by a great margin.

Rate base and returns by facility (Algonquin)

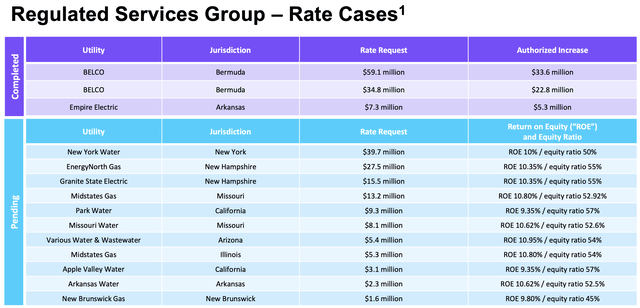

As new rate cases are being filed, and rate increases are approved, the earnings of the business will gradually improve. Most recently rates in Bermuda “BELCO” were raised by a considerable amount.

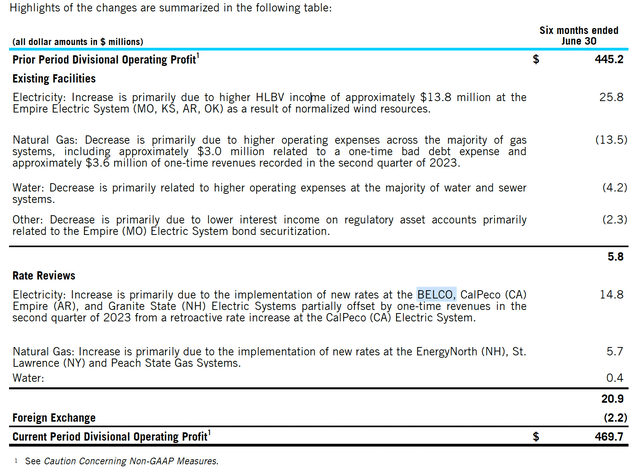

During the first half of this year, rate reviews contributed ~$21 million to the operating profit growth of the regulated utilities division. The natural gas networks are experiencing cost pressures, however. Renewable power development projects within Empire Electric System, have also resulted in significant accounting gains. We are somewhat suspicious of the sustainability of this income source.

Operating profit bridge (Algonquin)

New York Water rate increases have also been approved recently and are not recorded in accounts just yet. The New York State Public Service Commission approved a 9.2% rate increase in 2024 and 4.5% hikes in 2026 and 2027 for Nassau County customers. This rate change and the new rates went into effect Sept. 1, 2024. The operating profit growth will pick up as these rates come into effect.

Pending rate cases (Algonquin)

Having said it, New York Water is a challenging asset. Private water operators in New York State are subject to Special Franchise Tax, which inflates water bills to their customers. New York Water Company has faced continuing pressure to municipalise, as water rates of public suppliers tend to be considerably lower.

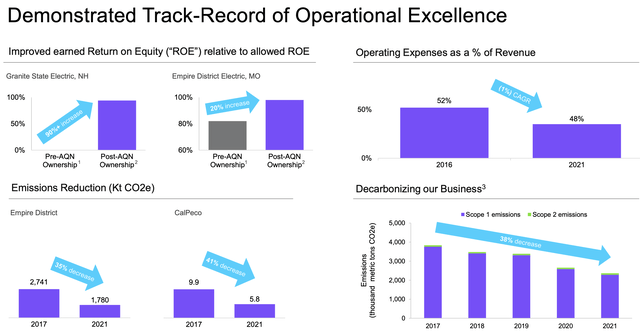

Algonquin was built by improving underperforming assets

Regulatory issues have been in focus for years, but they did not prevent Algonquin from acquiring the New York Water utility. The water assets were acquired in 2019-2022 for $608 million, for considerably lower asset valuation multiples than the water industry averages. The discount was most certainly a direct consequence of these aforementioned regulatory issues.

Having said that, the deal seems to be working out for Algonquin as the assets have not been municipalised yet and rate increases have now been approved. The returns generated on this investment will improve.

Algonquin has long grown through acquisitions of underperforming and undervalued regulated assets. The current profitability numbers indicate that it has been quite successful in turning them around. Even Empire Electric, the largest utility of Algonquin, was under-earning before it was acquired in 2017.

Operational excellence examples (Algonquin)

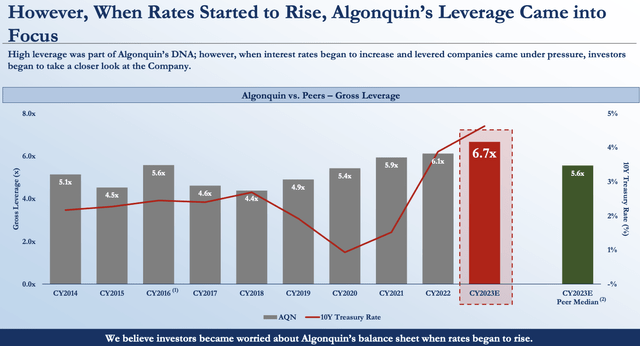

Most recently Algonquin had tried to acquire Kentucky Power. The agreed price was ~30% lower than the market average value for these types of assets, however, there were issues. American Electric Power (AEP) owned Kentucky Power was over-leveraged and under-earning, with regulated returns of merely 5% on equity. Profitability improvement could have taken care of the leverage problem, but this deal definitely had an elevated risk profile. When interest rates started rising, this deal fell through.

Higher rates have forced Algonquin to abandon this sizeable acquisition and they have also opened up leverage-related issues for Algonquin itself. The company was forced to cut dividends and has started implementing a broader strategic realignment.

The balance sheet leverage will improve

Algonquin is currently burdened with high leverage, but the separation from its renewable assets will help the company improve its balance sheet.

At the end of the second quarter, Algonquin was carrying $8.3 billion of debt while generating close to ~1 billion of EBITDA from the regulated utilities operations.

|

Algonquin Leverage, $ million |

June 30, 2024 |

|

Debt now |

8,300 |

|

Atlantica Sustainable net proceeds |

775 |

|

Renewable Energy Group net proceeds |

1,600 |

|

Renewable Energy Group earnout |

200 |

|

Debt after separation |

5,725 |

|

Regulated services EBITDA |

930 |

|

EV/EBITDA |

6.16 |

Algonquin financials, our estimates

After the renewables separation, Algonquin will be close to reaching the peer median leverage levels, which should alleviate some of the investor concerns.

Higher levels of retained earnings, after the recent dividend cut, will also help the business to reach peer median leverage levels.

Leverage levels (Algonquin)

It has not been smooth sailing so far

Algonquin laid out its restructuring plan in August of 2023, but the share price has gone down by 30% since. Not everything went according to plan.

Algonquin’s stock price has slumped to the level of about $5 per share after the company announced the most recent dividend cut this August.

Additionally, analysts were disappointed by the announcement that Renewable Energy Group’s net disposal proceeds will be only $1.6 billion, excluding any potential earn-out. This sale reflects a substantial discount to book value, with the company expecting to record an estimated pre-tax loss of around $1 billion in the upcoming quarters.

Earnings have also been pressured by rising interest payments. In FY2023, interest expenses increased by 27%, impacting Group earnings despite steady performance in regulated operations. This trend continued, with interest costs rising an additional 21% in the first half of FY2024.

|

Q3 2023 |

Q4 2024 |

Q1 2024 |

Q2 2024 |

|

|

Net Debt |

8430 |

8,516 |

9,090 |

8,292 |

|

Interest |

94 |

88 |

103 |

106 |

|

Debt cost, % |

4.5% |

4.1% |

4.5% |

5.1% |

Algonquin financials

That said, the primary risks have now materialized, giving us a clearer picture of the balance sheet and strategic direction. The separation from renewables and focus on deleveraging are expected to curb further debt cost growth.

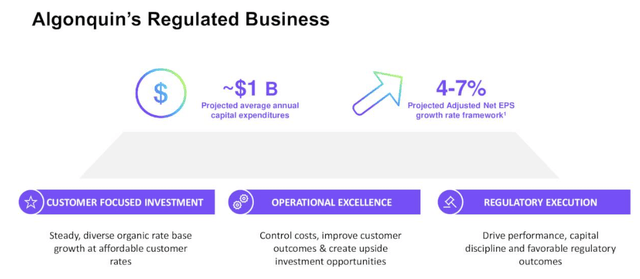

Regulated Services Group is set to grow

In today’s higher interest rate environment, Algonquin plans to focus on organic investment rather than acquisitions. The company is targeting 4% to 7% annual EPS growth in its regulated business, aligning with asset base expansion. However, growth may be uneven, as it depends on the timing of rate case approvals.

Regulated business growth (Algonquin)

Algonquin plans to request that $1 billion of prior-year investments be added to the rate base, along with adjustments to pass on cost inflation. As management explained in the second-quarter earnings call:

We currently estimate over $1 billion in assets are not yet authorized in rates or receiving optimised regulatory treatment. This represents a rare capital-light path to earnings growth. An example of this is our Sarival wastewater treatment plant in Arizona. The plant is an important and currently operating asset, enabling the local community to grow, but is not yet in customer rates. Another is our Customer First SAP program, which as I mentioned earlier, just completed its final implementation

Algonquin’s management recently noted that the company is navigating its busiest rate calendar to date, leading to some delays. The implementation of a new SAP system has further contributed to these delays. As a result, investors may need to wait until 2026 to fully realize the impact of the company’s streamlining efforts.

In terms of our rate case filings, I also want to call out changes to our expected regulatory calendar in a few of our jurisdictions, namely Missouri, New Hampshire and California. In respect to these jurisdictions, we’re expecting delays of one quarter to two quarters, which will shift the beginning of our recoveries closer to 2026

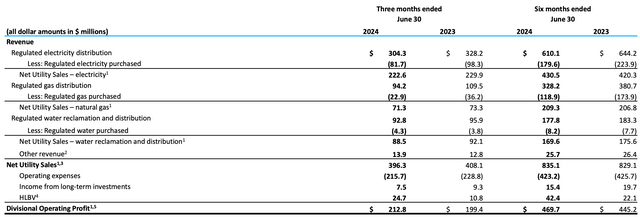

The recent financial performance and valuation

During the first 6 months of the year, the Regulated Services Division of Algonquin has generated $470 million of EBITDA.

Regulated Services Earnings (Algonquin)

Assuming that the same level of performance can be maintained for the rest of the year, the utility division will likely generate ~$940 million of adjusted EBITDA for the full year.

Regulated utility peers such as Dominion (D) or American Electric Power (AEP) commonly trade at an average 12x EV/EBITDA valuation multiples.

We can therefore deduct that the Regulated Services Division is currently worth about ~$11.3 billion. Considering that Algonquin will likely have $5.7 billion of debt after renewables separation, we can deduce that currently, the equity of Algonquin is worth about $5.6 billion, – 45% higher than the Market Capitalisation.

However, we believe that the operating profit of the Regulated Services Division could grow considerably as new rate cases are approved over the next two years.

The higher New York Water rates have recently been approved, and a number of other rate case filings are pending. The Regulated Services Group currently has pending 14 rate reviews totalling $131 million as of quarter-end. If these are fully satisfied and approved, the equity value of Algonquin could grow by as much as $1.5 billion.

Upcoming earnings announcement

Algonquin is set to report third-quarter earnings on November 7, and we anticipate these results may disappoint investors. The company is likely to record an impairment expense for its renewables division, while recent rate increases will only be partially reflected in this quarter’s accounts.

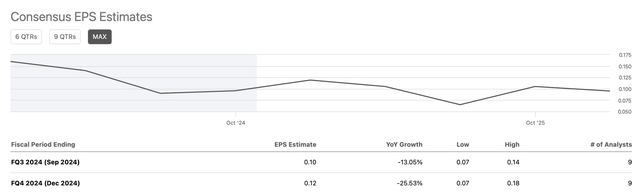

Analysts project that Algonquin’s adjusted earnings per share will decline over the next two quarters compared to last year. Shareholders will need to be patient to see the positive impacts of reduced leverage and higher rates take hold.

EPS estimates (Seeking Alpha)

The risks

Regulation is the key risk that all utilities face. In certain regulatory jurisdictions rate setting process can become politicised, especially when rates are rising significantly. New York Water, for example, is facing calls for municipalisation.

Financing arrangements are always straightforward, especially as they relate to renewable power operations. We are happy to see Algonquin exit this business, though some uncertainty exists as to how the balance sheet will look after the transaction.

We also think that the communication of the Algonquin management is not always transparent.

The Summary

Algonquin has encountered a series of challenges on its strategic realignment journey. Rising interest rates have pressured Algonquin’s earnings, while proceeds from its renewable asset sales came in below expectations.

As a result, Algonquin recently had to cut its dividend, leading to a drop in its share price. However, it appears the worst may now be behind us.

Rate case filings are expected to boost earnings from Algonquin’s regulated utilities, while proceeds from asset disposals and increased retained earnings will support the company’s deleveraging efforts.

Algonquin is undervalued.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AQN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.