Summary:

- AQN missed top line numbers in Q2-2024, with revenues declining year over year by 5%.

- It announced the sale of its renewable energy business for up to $2.5 billion.

- The company adjusted its common share dividend reducing it by approximately 40% for Q3-2024.

- The second dividend cut opened the floodgates on the downside.

When Life Gives You Lemons, Hurl Them At Algonquin Merbe/E+ via Getty Images

We have had a long history with following Algonquin Power & Utilities Corp. (NYSE:AQN). We jumped shipped ahead of the first dividend cut and then turned stayed out over the course of the next year or so. We turned bullish near $5.50 as the stock showed promise of a value play. We are updating our outlook with the recently released transactions and the Q2-2024 results.

Q2-2024

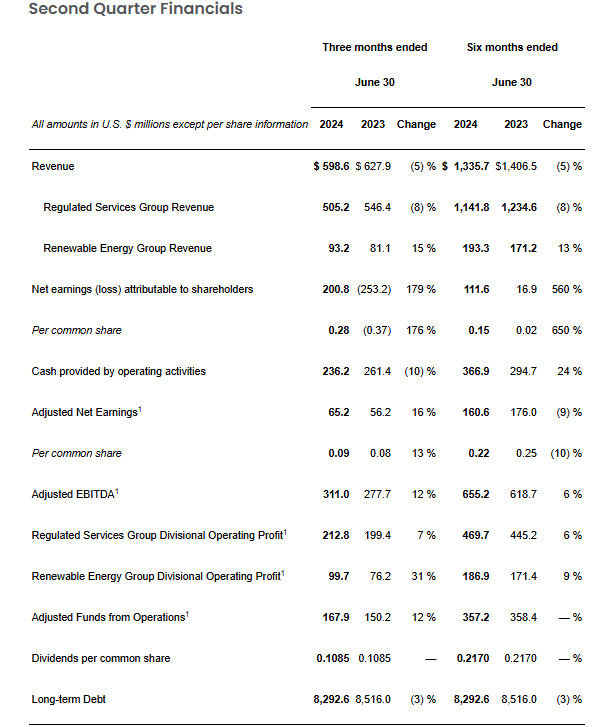

AQN missed the top-line numbers but exceeded the bottom-line estimates. The top-line miss was quite substantial and showed that AQN did not have the analysts well-prepared for what was about to come. Notably here, revenues declined year over year by about 5%. This does not reflect either of the transactions that were announced.

AQN Press Release

AQN’s beat on earnings was a welcome relief, as it has had a very hard time converting its revenues to EPS. At the end of Q2-2024, the debt stood at $8.3 billion, and that number is around which this entire drama revolves.

Asset Sales

We have covered the previously announced transaction involving the sale of Atlantica Sustainable Infrastructure PLC (AY). AQN announced its sales of renewable energy business (while retaining the hydro assets). So in essence, this marks a complete exit of the area that AQN chased down like a rabid dog during the ZIRP (zero interest rate policy) era. A lot of those capital decisions in that timeframe ranged from poor to extremely poor and were not really designed for a normal interest rate environment. On the plus side, the price obtained was about 10% higher than what analysts expected on average. Here we are using just the $2.28 billion and not even counting the potential extra payout.

On August 9, 2024, the Company entered into an agreement to sell the renewable energy business (excluding hydro) to the Buyer for total consideration of up to $2.5 billion excluding debt, consisting of $2.28 billion of cash at closing (subject to certain closing adjustments) and up to $220 million of cash pursuant to an earn out agreement relating to certain wind assets (the “Earn Out”). The purchase price represents a compelling value relative to other precedent transactions. The transaction was unanimously approved by the Company’s board of directors.

Source: AQN Press Release

So this validates the sum-of-the parts thesis that has been in play for us since the October 2023 bottom. But it seems that we continue to overestimate management’s ability to get their entire act in order. The press release was accompanied by this nugget, which no doubt blew upon the doors for another selloff.

- Common share dividend adjusted to a more sustainable level – The Company has declared a third quarter 2024 dividend of $0.065, representing a reduction of approximately 40% compared to its second quarter 2024 dividend, and representing an annualized dividend of $0.26 per common share. This decision is intended to create longer-term value for shareholders as the Company focuses on improving its earnings and capital sustainability in a higher cost of capital environment.

Source: AQN Press Release

It also had some self-imposed constraints on capex.

- Capital spending to be reduced in the near-term – AQN plans to restrain its Regulated Services Group capital expenditures to slightly above maintenance requirements while pursuing timely recovery of and on current investments made on behalf of customers.

Source: AQN Press Release

As those that follow utilities know, the capex is what ultimately determines the return profile, and AQN is having to restrict it to keep its debt metrics in line.

Outlook & Verdict

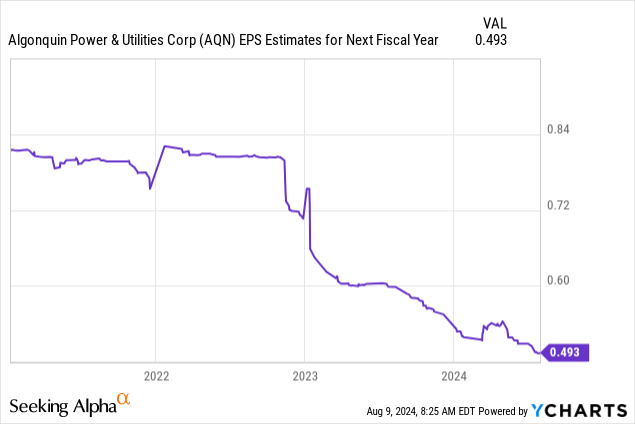

The bull case for AQN could work out from here. But the first it needs to do is actually stabilize earnings. It is great to talk about the deleveraging and we have. It is wonderful to give a high multiple to the water utilities business, and we will. But at the end of the day, there is a limit to what multiples we can place on a declining business.

We will go out on a limb here and say that even that number above is optimistic. 40 cents seems more likely in a recession after all these asset sales, and the dividend cut likely reflected AQN’s logic of keeping the payout ratio under 70%. Yes, AQN is cheaper than comparatives, but we really cannot compare AQN to other utilities that have grown their dividends and earnings over time. We have seen declining businesses priced at single digit earnings multiple without anyone blinking an eye. Here, we think a 12X multiple is appropriate until they start growing their earnings. Even if you assume that they can do the 49 cents shown above for 2025, you are likely to face a ceiling of under $6.00 per share.

We saw the news this morning and the dividend cut was nicely buried deep in the press release. So we used the pre-market euphoria and misread on the earnings to exit at $6.30 and also issued an alert for our subscribers. We think the stock likely forms a bottom in the $5.25-5.50 range, but longer-term prospects look poor. Investors who bought at the highs in 2021-2022 now have a sub 2% yield on their cost. Those that bought the mandatory convertible AQN units without understanding that it was actually a mandatory convertible have an even lower yield on their cost. There is a large disillusioned crowd looking to exit, and even deep value buyers are not thrilled with this. We are downgrading this to a Hold and focusing on other utilities to get our returns.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

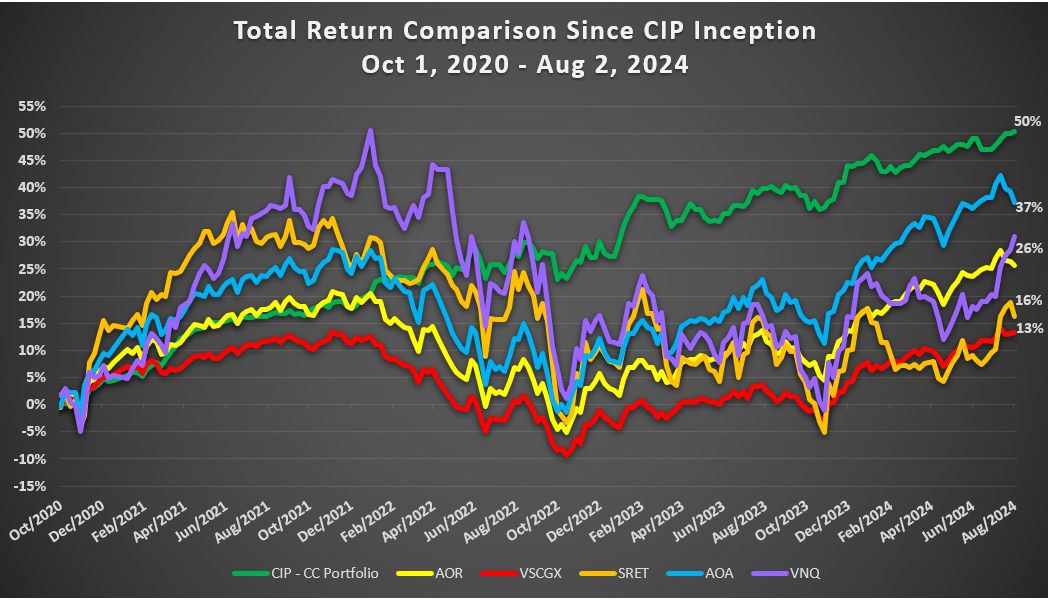

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.