Summary:

- Algonquin Power’s quality assets and well-equipped personnel are overshadowed by its significant debt challenges and low return on assets.

- The company’s financial struggles stem from its founder’s accumulation of low-margin power supply contracts without price escalators.

- The Fed’s interest rate hikes are a symptom, not the cause, of AQN’s troubles.

- Moving forward, the critical question is how Algonquin Power can navigate its current financial predicament.

imantsu

Investment Thesis

Is there a hidden gem under Algonquin’s (NYSE:AQN) debt pile? That’s what its new activist investor, Starboard Value, thinks, pointing to its $18 billion of ‘high-quality’ assets that include:

- 13,517 miles of electric transmission lines serving 309,000 customers

- 8,482 miles of gas pipelines connected to 375,000 households

- 6,941 miles of water mains connected to 572,000 properties.

- 1,320 wind turbines and 1,516,685 solar panels

- 54 hydroelectric generators

Company photos show well-equipped field personnel with relatively modern utility vehicles and tools. Equally important, these employees don’t look miserable, unlike AQN’s shareholders, who saw their investments down by two-thirds in the past 18 months after rising interest rates pushed the company’s net income into the red, forcing management to cut dividends and sell its unregulated assets – those utility assets not regulated by state and federal commissions, lacking return-of-equity ‘ROE’ protections enjoyed by traditional regulated utility assets.

AQN’s assets might be of high quality, maintained properly, and taken care of, reducing the risk of disasters like the ones that happened to Hawaiian Electric (HE) and PG&E Corporation (PCG). But, as AQN’s employees wearing designer jeans would attest, quality comes at a cost, and AQN’s new CEO is adamant about cutting these costs, a short fix to the company’s profit margin challenges. New executives are being boarded and those of the ‘old regime’ are being banished by the newly appointed Chief Transformation Officer, Sara Macdonald. Last quarter, AQN bid farewell to its Chief Operating Officer Johnny Johnston.

The long-term impact of these changes is uncertain. Kentucky’s state officials don’t want to wait to find out, and pressured the Federal Energy Regulatory Commission to block AQN’s acquisition proposal of Kentucky Power, leading to the deal’s collapse last year, having sensed trouble when AQN’s shares dropped in late 2022.

The loss of the Kentucky deal was a big blow for AQN, which needed to dilute its financially volatile unregulated assets with stable, commission-sponsored regulated assets that AQN can pass down the high costs of materials, suppliers, and most importantly in this case, borrowing expenses, to the public, or in this case, Kentuckians. After the deal’s collapse, the former CEO resigned.

I have a contrarian view on the root of AQN’s troubles. I think its debt woes are a symptom of a deeper issue. Sure, AQN’s interest expenses ballooned when the Fed raised interest rates, pushing AQN’s net income margins into the red. But, in my view, this dramatic impact on AQN’s financials is a symptom, not the cause.

If every time a utility company goes bust each time the Fed raises interest rates, we’d still be living in the Bronze Age.

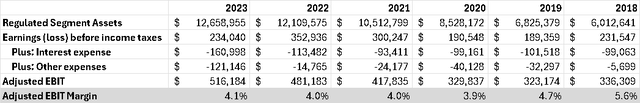

The problem is AQN’s exceptionally low return on assets. For the regulated segment, the average Adjusted EBIT margin in the past six years is 4.4%. Adjusted EBIT is adjusted by adding non-recurring expenses. It also excludes corporate expenses. It is the purest calculation of AQN’s return on assets.

When your return on assets is 4.4%, but the average interest expense is 4%, you’ve got a problem. Returns are even worse in the unregulated segment. Adjusted EBIT margin for the Renewables segment in the past six years averaged 2.3%.

USD figures in 000s (Author’s estimates based on AQN filings) USD figures in 000s (Author’s estimates based on AQN filings)

Bring in the Negotiators To Drive Growth

It is clear that AQN needs to do more to monetize its assets. That depends on the negotiation talent of AQN when they sit with state utility commissions for rate reviews that set the price charged on consumers’ utility bills or when they bid (or used bid I should say, now that the renewable segment is being sold) on power supply contracts for the likes of Meta (META).

In the regulated segment, currently, utility commissions recognize only $7.2 billion of AQN’s $12.8 billion of regulated assets for ROA calculations. When regulators authorize AQN to raise its utility bills to achieve, say 8% ROA, that’s based on the $7.2 billion, which when divided by the actual regulated asset base of $12.8 billion yields a mere return of 4.4% – 4.5% average in the table above.

Negotiating better regulatory coverage with utility commissions is part of what AQN’s new CEO calls capital-light growth, a replacement of the company’s past aggressive growth strategy that encompassed developing new renewable assets, and acquiring existing regulated utilities.

Sale of Assets and Paying Down Debt

When AQN sells its Renewables segment, it will become a pureplay regulated utility, enjoying the stability and safety of Federal and State commissions’ fair pricing’, that makes sure investors receive a somewhat fair return on their capital.

But LS Power, which is buying the Renewables segment from AQN, isn’t as fair as government utility commissions. They’re buying $4.2 billion worth of assets for $2.5 billion. Adding salt to injury is that AQN will only realize $1.6 billion, because of off-balance sheet debt tied to these assets. Sure, the deal leaves the Hydro assets with AQN, but, really, how much are they worth anyway, considering that they only generated $35 million in sales in 2023?

While the deal isn’t ‘fair’, it is good enough to stabilize AQN’s finances, especially when combined with the proceeds from the sale of another asset – AQN’s 42% interest in Atlantica (AY), worth about $1 billion. Management will most likely use the proceeds to pay the debt. Assuming interest expense decline proportionality with the debt downsizing, we’re looking at a 30% decline in interest expense, from $353 million to $235 million, as debt goes down from $8.3 billion to $6.2 billion. The $248 million interest expense on this debt (assuming the current 4% average interest rate remains as it is after the debt repayment) is easily covered by AQN’s ~$455 million EBIT from its regulated utility segment.

Valuation

Overall, we’re looking at $207 million in Earnings before tax next year ($455 million in EBIT, minus $248 in pro forma interest expense). With the issuance of $77 million in new shares in connection with its 2021 Green Energy units. It collected $1.15 billion and used this to pay down debt, which currently stands at $8.3 billion.

This increases the shares outstanding to 766 million.

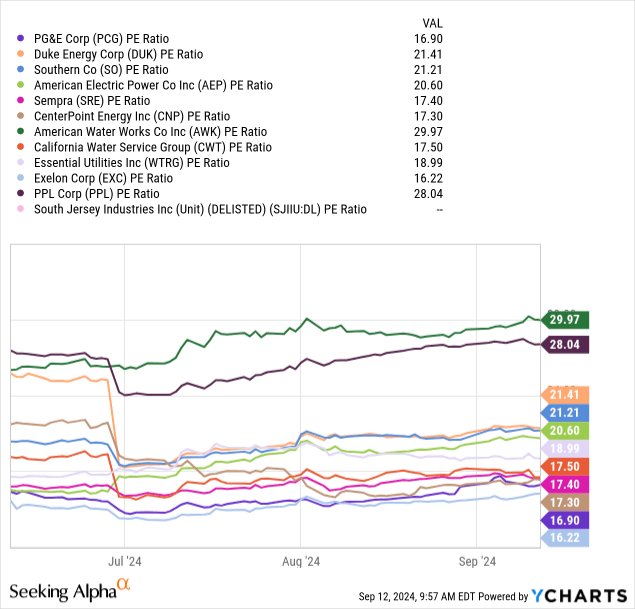

Assuming a 15% corporate tax, that’s a net income of $175 million, or 22 cents per share. Based on the current share price of 5.27, that’s a 23x pro forma PE ratio, which is in the upper range of the industry average.

Dividend and How I Might Be Wrong

AQN cut its dividend twice this year, down to $0.26. Based on our $0.22 EPS forecast above, this translates to about a 118% payout ratio. Now, the company reported delays in its rate review requests in Missouri, California, and New Jersey. But there is progress in other regions, including in New York, and Bermuda, which authorized a $33 million revenue increase in the next two years. So, our back-of-the-envelope estimate, which falls at the lower bound of Wall Street’s EPS consensus of 45 cents, might be a bit conservative. Investors might take solace that, while there might be some EPS pressure in the short run, most of the challenges are behind the company now.

Summary

Overall, I think that AQN is on the right track, transforming into a traditional utility business, and enjoying the financial stability offered by utility commissions across the US, Bermuda, Canada, and Chile.

In the short term, I think we might see some EPS pressure. The legal and professional costs of the recent transactions and any other corporate costs are not included in our estimates above.

On the other hand, we also ignore the upside rate review progress. But the prevalent theme next quarter would be the 77 million new shares, which increased the share count by more than 10% from Q2 2024.

I don’t expect a dividend cut, given the positive impact of new capital projects and rate review on EPS. But this prediction is predicated on the success of these initiatives.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.