Summary:

- AQN investors have suffered tremendously over the past year, exceeding the panic seen in 2020.

- Diamond hands still in the game are left questioning whether there’s still hope left in Algonquin.

- With its NTM dividend yield surging to 10.7% recently, investors should expect a dividend cut. But you need to ask whether it has been priced in?

- Reward/risk is attractive enough at these levels that investors looking to average down shouldn’t ignore.

FangXiaNuo/iStock Unreleased via Getty Images

AQN Investors Have Been Hammered

Algonquin Power & Utilities Corp. (NYSE:AQN) holders were struck with a selloff over the past year that was worse than they had experienced in the throes of the COVID pandemic.

Accordingly, AQN posted a YTD total return of more than -50%, as the battering over the past six to seven months wiped out price gains dating back to August 2015. As such, the selloff after its Q3 earnings release has carried on as AQN’s diamond hands succumbed to more pain.

Is it reasonable to expect such a massive selloff to a leading multi-utilities company that’s still expected to be profitable through 2024? The extent of the selloff has likely shaken the conviction of even the most ardent AQN bulls.

Furthermore, utility investors likely belong to the “more defensive” group, who would very much prefer predictability, consistency, and, most importantly, clarity in dividend growth assumptions.

Sure, AQN is not immune to market volatility, with the last severe episode during the COVID pandemic that bottomed out in March 2020. But are we approaching anywhere near those days again?

But Is The Recession Risk Worse Than 2020?

The IMF emphasized in early December to expect downside revisions to its global GDP growth forecasts, seeing increased global recessionary risks. Notwithstanding, it was nowhere close to the hard landing scenario seen in the depths of the pandemic, as the World Bank warned back in June 2020.

Also, Edward Yardeni argued that banks have continued to lend even as they cautioned the world about a coming recession. Yardeni articulated in a recent commentary:

So what are the bankers doing to prepare for their widely expected hard landing? Not much, so far, other than lending more money to their customers. Commercial bank loans and leases are up $1,134 billion YTD to a record $11.9 trillion during the November 30 week. Commercial bank allowances for loan and lease losses showed little change YTD, down $0.3 billion to $166.7 billion. That’s well below low the pandemic peak of $220.5 billion during the September 2 week of 2020. – Yardeni Research December 12 Briefing (requires login)

So why did the market batter AQN holders into submission, dissolving more than seven years of price gains at its recent December lows?

Investors Should Expect AQN’s Dividends To Be Reduced

Dividend risk, you probably guessed it! We will discuss later whether the battering is justified. But, the market has likely priced in the potential scenario of a cut in its dividend, which is, obviously, a no-no for utility investors accustomed to AQN’s steady dividend growth over the years.

Algonquin reduced its full-year EPS outlook to a midpoint of $0.675 as it was battered by multitudinous headwinds. Management highlighted significant challenges from the surge in interest rates and construction delays affecting the completion of its renewable energy projects.

We assessed that these headwinds could continue to affect the company’s earnings prospects in 2023 as the Fed remains hawkish.

Furthermore, the company’s expected acquisition of the Kentucky Power Acquisition will add variable debt to its highly-leveraged balance sheet.

With a projected net debt to adjusted EBITDA multiple of 7.1x for 2022, the company’s earnings and, thus, its dividends could be at risk of further downgrades if growth slows further.

Despite that, the company remains confident that its asset sales strategy or asset recycling could continue to provide liquidity to fund its growth, given the volatility in the capital markets. CEO Arun Banskota accentuated:

Despite the rising interest-rate environment, we believe that there is enough interest from long-term financial and strategic investors for these very prized Renewable assets for the long term. So again, despite the rising interest rate, we continue to see robust interest. (Algonquin FQ3’22 earnings call)

AQN: Valuation Significant De-risked

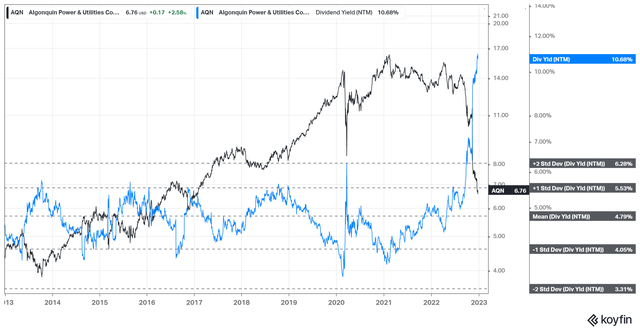

AQN NTM Dividend yield % valuation trend (koyfin)

The market has likely priced in a distinct possibility of a dividend cut for AQN by analyzing its NTM dividend yield, as seen above.

AQN’s dividend yield has surged to 10.7%, well above the two standard deviation zone over its 10Y average of 4.8%. Is this panic? Very likely. We believe market operators likely sensed blood, forcing AQN investors to bail out rapidly.

Therefore, investors should be prepared for a cut in its dividend if the company reports a worse-than-expected Q4 release or proffer a terrible FY23 outlook.

But, investors need to ask whether the company is like a Roku (ROKU), as we explained in a recent article. Do they expect AQN to turn from a highly profitable company to an unprofitable company just because there’s dividend risk?

Even the most pessimistic Wall Street analyst penciled in an FY23 adjusted EBITDA of $1.32B (10% below average estimates) or an adjusted EPS of $0.59 (17% below average estimates). So, based on the current projected dividend per share of $0.7, investors should expect a cut. But does it justify a de-rating sending its yield to 10.7%?

Takeaway

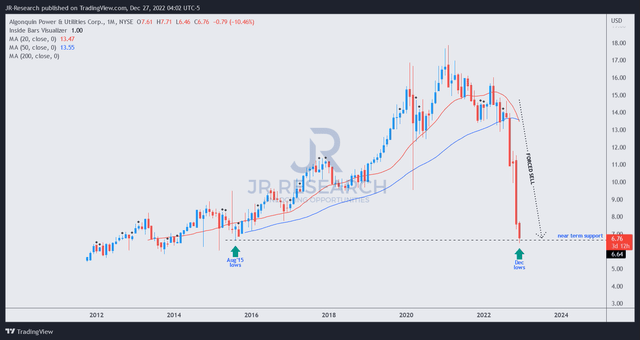

AQN price chart (monthly) (TradingView)

As seen in AQN’s long-term chart, the selloff re-tested August 2015 lows in December.

Also, the extent and speed of the decline are emblematic of forced selling moves by market operators in an attempt to compel holders to bail out quickly. We believe AQN investors still waiting for an opportunity to average down their costs could be looking at a highly attractive reward/risk set-up here.

Even setting aside its dividends, a 50% gain in price-performance terms would require AQN to reach around $10.15, a level breached in November 2022. Relative to AQN’s 10Y total return of 4.6%, we believe that’s an attractive proposition.

Rating: Buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!