Summary:

- Algonquin is looking to divest its renewable energy group to address debt and keep its investment-grade credit rating.

- The utility is currently paying out a 7.1% dividend yield that’s 224% covered by adjusted FFO realized during its most recent quarter.

- A sale of its 42% stake in Atlantica Sustainable Infrastructure would have to be completed against poor stock market conditions for renewables.

LITTLE DINOSAUR/Moment via Getty Images

Algonquin Power & Utilities Corp. (NYSE:AQN) has lost roughly 17% of its value over the last year with total returns still poor at 12% following a $0.07 per share dividend reduction. The utility company last paid a quarterly cash dividend of $0.1085 per share, left unchanged sequentially and $0.434 per share annualized for a 7.12% dividend yield. I’ve owned a small position in the equity units of (NYSE:AQNU) for a while now, recommending them over the commons when I last covered the ticker. These have performed better on a total return basis with a lower loss of 6.1%, however, they come with a mandatory conversion to the common shares on June 15, 2024.

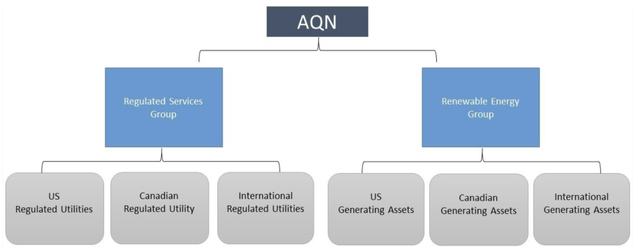

AQN has always been a halfway house between a utility and a renewable yieldco and is currently in a state of flux with management updating on its strategic redirection during their most recent third-quarter earnings call. AQN will essentially move to become a pure play-regulated utility with the divestment of their renewable energy group (“REG”) sometime in 2024. This includes a roughly 42% equity interest in Atlantica Sustainable Infrastructure plc (AY). REG owns renewable natural gas, wind, solar, hydroelectric, and thermal facilities with a combined net generating capacity of roughly 2.2 GW. Roughly 81% of REG’s electrical output is sold through long-term contractual arrangements with a weighted average remaining contract life of approximately 10 years at the end of the third quarter.

Algonquin Power & Utilities 2022 AIF

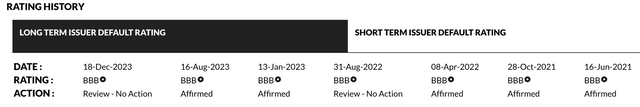

There should be a raft of buyers with the traditional oil and gas companies also likely takers. TotalEnergies SE (TTE) in 2022 acquired a 50% stake in the sponsor of renewable energy yieldco Clearway Energy, Inc. (CWEN) (CWEN.A). However, the backdrop for a sale of REG is dire with elevated interest rates collapsing valuations and threatening earnings across the renewables space. The collapse of NextEra Energy Partners, LP (NEP) has cast a large shadow over the industry and AQN might not receive the type of bids required to maximize shareholder value creation. This is a core risk as the utility moves to protect its “BBB” investment grade credit rating from Fitch. This has increasingly faced reviews in recent years against AQN’s large total debt load of $8.4 billion at the end of its third quarter.

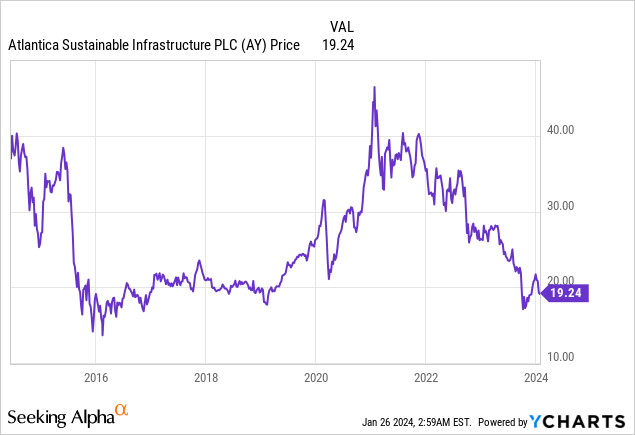

Strategic Review, Operations, AFFO, And The Dividend

For AY shareholders, a divestment at a positive valuation to a better-capitalized player could unlock some value with AY currently changing hands for a 9.3% yield versus a 6.2% yield for CWEN. AQN’s AY stake is currently valued at roughly $930 million as the renewable yieldco has also pulled back quite markedly from its 52-week highs. To be clear, AQN’s divestment of AY would have to be conducted with the yieldco’s stock trading close to its 10-year lows. Bulls would be right to highlight that the 52-week high was abnormal, driven by a mix of cheap liquidity from ZIRP and pandemic stimulus euphoria. AQN would still be leaving hundreds of millions of dollars on the table. Hence, an argument to be made for AQN to defer the divestment despite the risk to its credit rating.

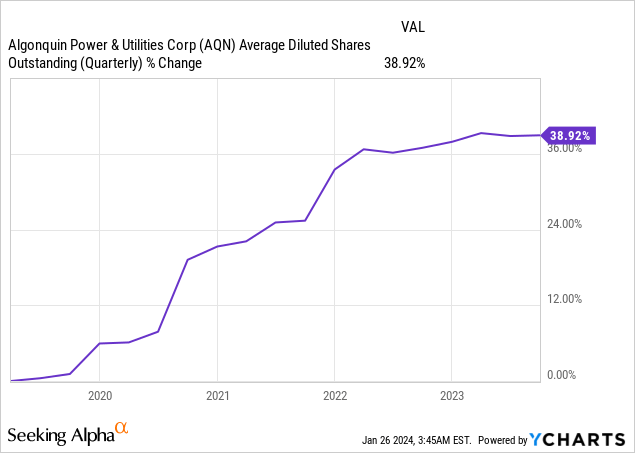

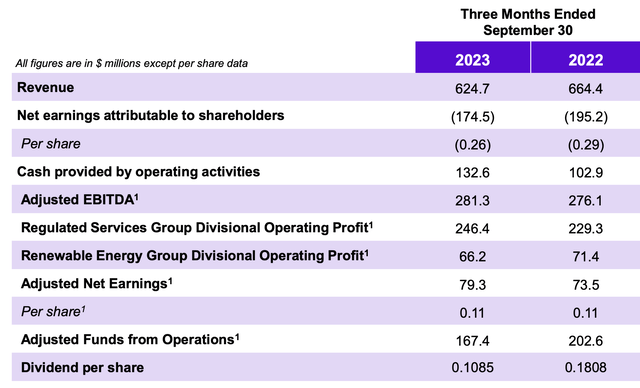

AQN reported third-quarter revenue of $624.7 million, down 6% versus its year-ago quarter and a miss by $19.22 million on consensus estimates. The company recorded adjusted EBITDA of $281.3 million, up 2% year-over-year which helped drive adjusted net earnings of $79.3 million. This was an 8% year-over-year increase on a nominal basis but at $0.11 per share was flat over the same time frame due to an expansion of AQN’s common shares. At 688,997,218 shares outstanding, the figure is up 39% over the last five years, a roughly 7.8% per year dilution rate.

Third quarter adjusted FFO, the core figure for the dividend, was $167.4 million. This was down 17% versus its year-ago period and at $0.243 per share covered the dividend by 224%. However, higher interest expenses are eating into AQN’s net income with expenses increasing by $19.2 million year-over-year to a record high of $94.2 million during the third quarter. The sale of the REG will see FFO drop with the division contributing 21% of AQN’s operating profit during the third quarter.

Algonquin Power & Utilities Fiscal 2023 Third Quarter Presentation

Critically, AQN has stated that the pending REG sale is also meant to support the current dividend which together with the substantial coverage provides a decent level of confidence that the current distribution will be maintained post-sale. It’s important to flag that AQN is mirroring its peers with this sale. Duke Energy Corporation (DUK) sold its utility-scale commercial renewables business to Brookfield Renewable Partners L.P. (BEP) for $2.8 billion in the summer of 2023. This was a 3.4 GW portfolio of solar, wind, and battery storage across the US. It implies a sales price of roughly $1.81 billion for AQN’s net generating renewables capacity. The actual sales price could be higher or lower, but I’ll continue to hold my units.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AY, AQNU, CWEN.A either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.