Summary:

- Algonquin reported Q1-2023 results that met expectations.

- The rating agencies have been satisfied as the Kentucky Power transaction was abandoned.

- We look at the potential for strategic review to add value and one play we like.

24K-Production

In our last article on Algonquin Power & Utilities Corp. (NYSE:AQN), we told you that it came down to Kentucky Power play.

So our conclusion is to tell investors that you can make Algonquin Power & Utilities Corp. part of a diversified portfolio, if two conditions are met: You are sure that the transaction will not go through; and you are not interested in buying anything that is a better value today. For our part, we missed out on the recent rally, but then we also exited the stock at almost twice the price that Algonquin Power & Utilities Corp. stands at today. So we are happy not being involved here and would only consider Algonquin Power & Utilities Corp. under $7.00 a share alongside the Kentucky Power transaction being called off.

Source: It Really Comes Down To April 26

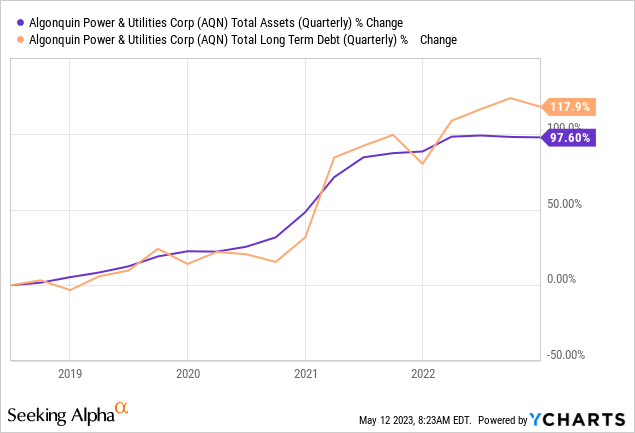

The news did indeed come in favor of AQN and its empire building plans were squashed by the regulatory authorities. Further, it was not required to pay a termination fee. The big overhang on the stock is now gone as AQN would have approached a potentially terminal 8X debt to EBITDA if that transaction went through. We look at the recently announced Q1-2023 results and announced strategic review of its unregulated renewable energy segment.

Q1-2023

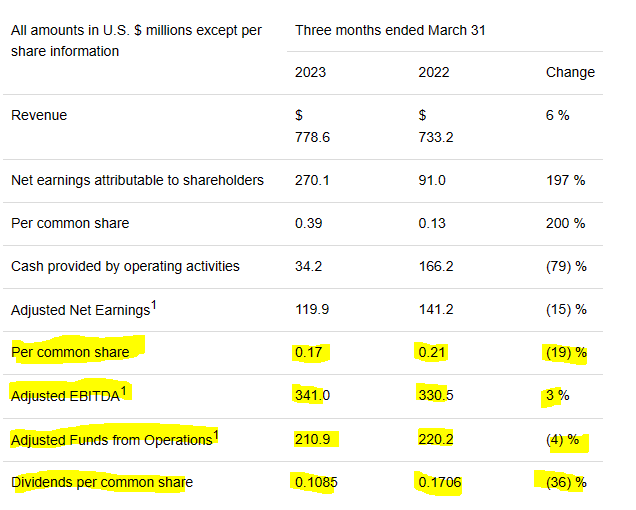

AQN’s Q1-2023 produced 17 cents in earnings per share and that was about in line with consensus estimates. Year over year, the earnings dropped by 19% and adjusted funds from operations (AFFO) dropped by 4%.

AQN Press Release

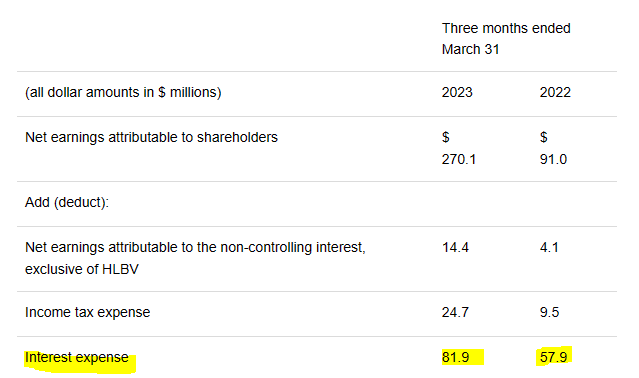

We will note that adjusted EBITDA was up 3%, but burgeoning interest expense took out that increase and much more.

AQN Press Release

Those interest expenses jumped 42% vs 2022 and are going to be a lead anchor to earnings for the next two years at least. AQN reiterated its plan to restrain capital expenditures to just $1.0 billion. The rating agencies, pleased with the Kentucky Power acquisition dropping off, took their foot off AQN’s throat.

Credit Rating Affirmed at BBB with Outlook Improved to Stable – In April 2023, each of DBRS, Fitch, S&P and Moody’s made announcements regarding the credit ratings of the Company and its subsidiaries. DBRS and Fitch both affirmed their ratings and stable outlook, S&P revised its outlooks from negative to stable, and Moody’s affirmed its Baa2 ratings and stable outlooks of Liberty Utilities Co. and Liberty Utilities Finance GP1. These actions follow a similar improvement in outlook to stable from DBRS in February 2023.

Source: AQN Press Release

Key Announcement

AQN’s strategic review of its renewable energy/non-regulated segment might have got the bulls curious. The thought process here is that selling these assets or perhaps dropping them to Atlantica Sustainable (AY) could potentially help the company regain its focus. From our perspective, this is likely to be a nothing-burger. AQN like all other companies chasing this sector, dived into renewables head first.

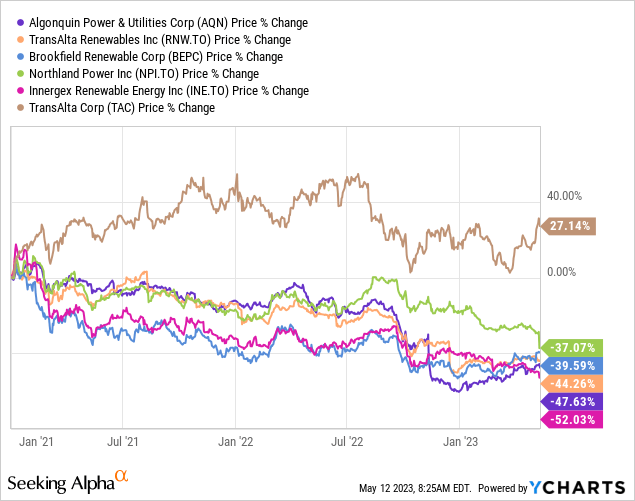

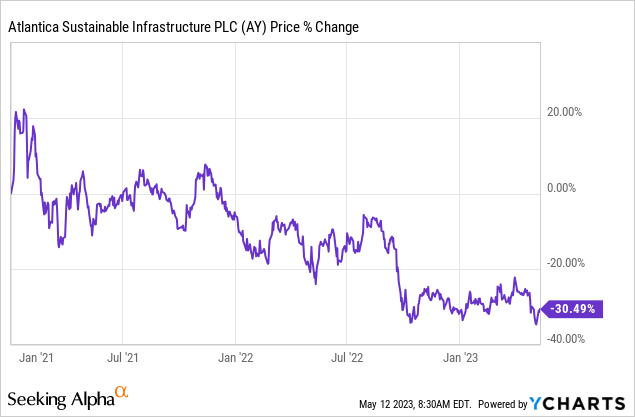

Those high valuations have now disappeared. It is not just AQN, the entire group has been creamed, including TransAlta Renewables (RNW:CA), Brookfield Renewable Corp (BEPC), Northland Power Inc. (NPI:CA) and Innergex Renewable Energy Inc. (INE:CA).

TransAlta Corporation (TAC) (TA:CA), the only one here that we actually own, has done well only on the back of its non-renewable segment. Selling assets here is unlikely to get anything close to top dollar. AY has also been beaten down alongside the other renewable names.

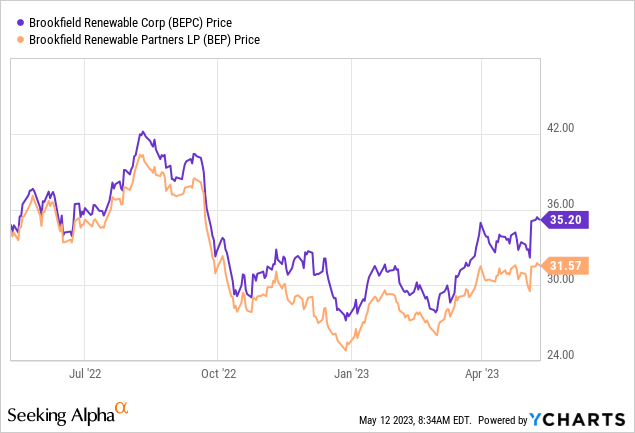

So a large equity issuance from them to buy AQN assets would not be very accretive at this point. AQN of course owns 42% of AY, so selling to AY would not exactly be getting rid of those assets. BEPC could emerge as a buyer and the key reason is that there is a big valuation gap. Brookfield Renewable Power LP (BEP) trades 3-4X EV to EBITDA multiples wide of the entire sector. BEPC thanks to existence of investors who believe that it is appropriate to pay a huge premium to not get a K-1, trades at a premium to even BEP.

So BEPC looks to be the only real candidate here with liquidity to offer a decent price. We don’t think it will be earth shattering and we don’t think it will change the investment outlook for AQN. If you recall the good old days of AQN presentations, it was this renewable segment that was supposed to power all the “once in a generation growth”.

So selling this out means AQN becomes the boring utility which your best case valuation becomes about 16X earnings. Those earnings will also drop on that asset sale, so it would bring back our fair value near $7.00 per share.

Algonquin Power & Utilities Corp – Units (Corporate) (NYSE:AQNU)

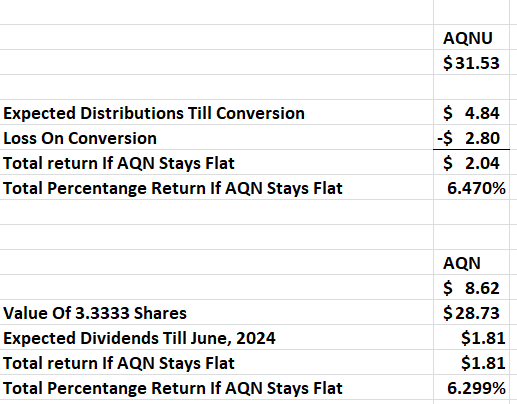

AQNU is a mandatory convertible and hence at all timelines its total return will converge to that of AQN. The two small wrinkles here are that investors price in expected dividends from AQN and often bid AQNU to a premium above what it should be priced at. So the total return on AQNU can be lower than holding AQN.

For the AQNU units at $31.53, you will ultimately receive 3.3333 shares of AQN at $8.62. So, you get $28.73 of AQN via 1 unit of AQNU. The current equation is slightly in favor of AQNU, but your mileage may vary depending on what exact price you get.

Author’s Calculations

Also keep in mind that AQNU does not get favorable tax treatment that AQN dividends get. So in taxable accounts you will pay a far higher tax rate on far higher distributions and then the “loss” won’t be taxed at the same rate either. So we would stick to AQN for those bullish on the shares, at least in taxable accounts.

The Preferred Shares

While the common and pseudo-common shares are not as cheap as we would like, Algonquin Power & Utilities Corp. PFD SER A (TSX:AQN.PRA:CA) is one that is very close to a buy. It currently yields 6.67%. It is a standard 5-year resetting issue and will reset in December 2023 at 5-year Government of Canada i.e. GOC, yield plus 2.94%. We had previously commented that this would be a buy under $18.00 CAD and it trades at $19.35 today.

If you picked it up at $18.00 CAD and the current 5-year GOC yield held, you would get an 8.25% yield locked in for five years. With the credit ratings stabilized this becomes an appealing play.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We are long BEP preferred shares.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.