Summary:

- Algonquin Power & Utilities Corp and ATCO Ltd. have similarities but three main differences.

- We examine the companies from the lens of valuation, growth opportunities and debt load.

- One is clearly better than the other.

master1305/iStock via Getty Images

We have covered Algonquin Power & Utilities Corp. (NYSE:AQN) previously. On our last coverage we chose to stay out of the common shares and Algonquin Power & Utilities Corp – Units (AQNU), which essentially tracked the total return of the common units. Instead we suggested that there were opportunities for the long side in the preferred shares, should they hit our desired target levels.

We have also written about ATCO Ltd. (TSX:ACO.X:CA) previously. The firm has some similarities and some significant differences from AQN. Today we highlight three main differences between the two that have us buying ATCO and still giving the cold shoulder to AQN.

Fundamental Setup

At the core, both are Canadian companies and have heavy exposure to regulated utilities. In the case of AQN, in the most recent quarter, about 70% of the adjusted EBITDA came from regulated utility services and the bulk of the rest came from renewable energy. AQN’s renewable side has a large investment in Atlantica Sustainable (AY).

ATCO gets its regulated utilities exposure via its holdings of Canadian Utilities (CU:CA). This segment provides about 85% of its operating income with the rest coming from its other two areas of interest. These include an industrial business that manufactures modular buildings and provides site support services, and also in a fast growing ports business.

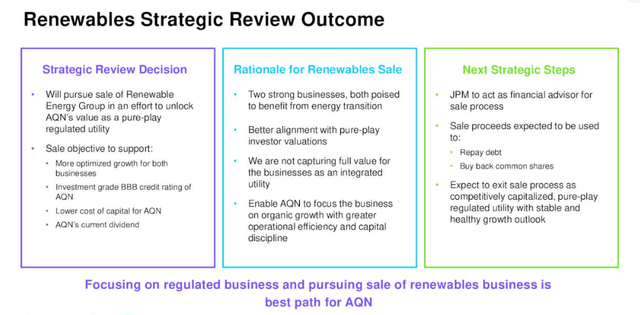

While AQN may seem to have a heavier non-utility focus, that is likely to change in the future. The company spent years going headlong into renewables in an empire-building mode, but has now decided to completely exit the segment.

AQN Q2-2023 Presentation

So pretty soon it will be about as complete an exposure you can get for regulated utilities today. With that background, let us look at what three considerations allow us to choose one of these over the other.

Valuation

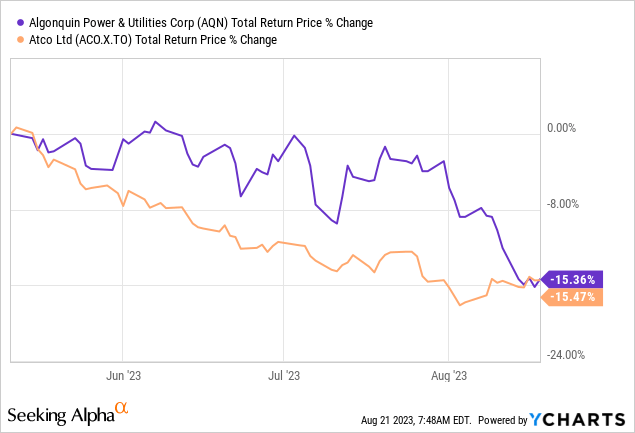

Since we last covered AQN, both AQN and ATCO have tumbled lower to about the same extent.

There is a generalized pressure on all utilities as risk-free rates have been rising. After years of saying there is no alternative, investors are being given the wake-up call that there is indeed a risk-free 5% plus yield to be had. An extension of that is that utilities have to roll over lots of debt and each rollover today is going to reduce your cash flow. So a repricing lower in general makes sense. In this environment, valuation is critical as overpaying is likely to have nasty long term consequences.

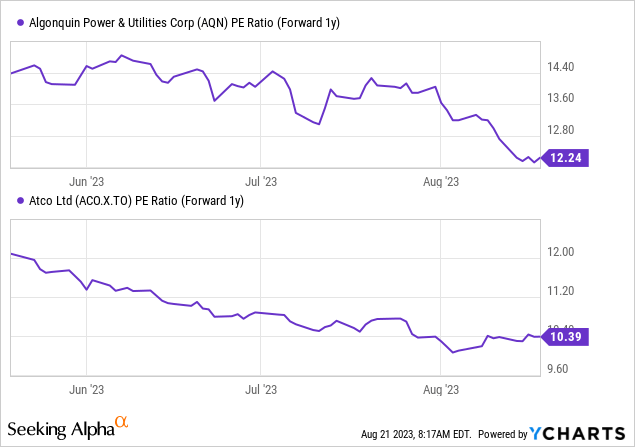

The good part is that both companies are now quite inexpensive. On a forward P/E basis both are trading in value territory, though ATCO is still clearly cheaper.

There are two caveats to these numbers. The first being that the sale of AQN’s renewable energy business will dictate what that forward P/E looks like. Assuming a sale of the renewable energy business occurs at about a 11.0X EV to EBITDA level, it will be neutral to the earnings metrics. If we see something closer to 12.0X we could see about a 5% increase in earnings per share for 2024 via debt reduction and buybacks. If AQN got 10.0X EV to EBITDA, earnings estimates could decline by as much as 10% for 2024 and 2025 as debt reduction would once again become the focus. We see 11.0X as the most likely multiple here so we are comfortable with the forward estimates and ATCO comes out on top.

Debt

While the P/E ratio is valuable, we have to see it in relation to debt. P/E ratios and dividend yields can make a stock look cheap when they are dialing up the risk via debt. That was the case with AQN back last year when the company was flirting with high debt levels while promising investors a stream of endless dividend growth. Fortunately the company slashed its dividend as reality broke through. It also got bailed out as the Kentucky Power acquisition did not close for regulatory reasons. But the company is still holding on to a 6.0X debt to EBITDA level. ATCO in comparison is at 4.7X. This reinforces our view that ATCO’s cheap valuation is not a byproduct of leverage.

Growth Opportunities

We would love to say that both these companies have opportunities for fast growth, but the reality is likely to be the opposite. Utilities tend to grow slow even when times are good and the current interest rate changes will likely make even 4% growth in earnings per share difficult. AQN will have a slight disadvantage even here. With a 5% interest rate environment, we see debt to EBITDA ratios closer to 5.0X as sustainable. So AQN will have to deleverage, while ATCO can maintain status quo. ATCO’s two side businesses have also been growing a bit faster than what we saw for the utilities segment.

AQN offers a 6% yield today versus about 5% for ATCO, but the payout ratio of 80% for AQN versus 55% for ATCO positions ATCO for better dividend growth.

Verdict

AQN delivered an adjusted earnings per share of $0.08 for Q2-2023, about 20% below consensus. This pushes annual guidance to the bottom of its previous range. The company also announced that its CEO Arun Banskota would be departing and will be replaced by board member Chris Hunskilson. There are a lot of distractions ahead for AQN as it tries to get a clear coherent plan out while trying to sell its renewable business. We don’t see that as conducive to delivering good returns. A lot of AQN shareholders bought this company for the renewable energy business and will likely be exiting over time. So on every front ATCO appears to be a better choice to us than AQN.

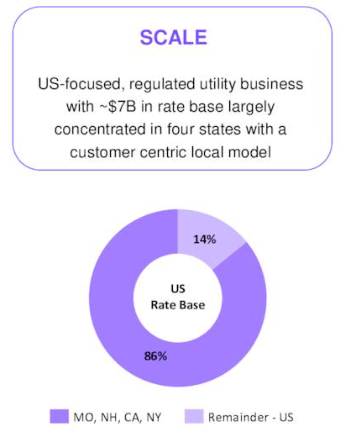

There is one risk here for ATCO that is higher than that for AQN. ATCO’s regulated utility business is primarily exposed to Alberta, Canada. AQN on the other hand is extremely diversified.

AQN Q2-2023 Presentation

We don’t see this a deal breaker for ATCO if it is part of diversified portfolio, but investors should consider position size when any company lacks geographic diversification. Finally, we want to point out that we are open to buying AQN under $6.00 per share, where we think it would offer a better risk-reward.

Taxation

Both company dividends qualify for the dividend tax credit in Canada and generally investors will prefer having these in regular (non-RRSP or TFSA) accounts. For US Citizens, the dividend is treated as a qualified dividend, but there will be 15% tax withheld for which you receive a tax credit. That tax withholding can be avoided by using tax deferred accounts.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACO.X:CA, AY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

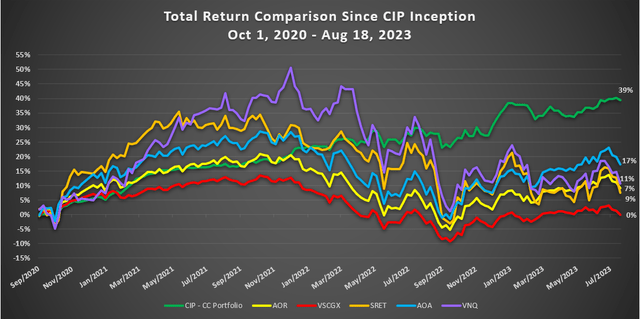

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.