Summary:

- Chinese Retail Sales growth data is a leading macroeconomic indicator of Alibaba’s domestic ecommerce business. Oct 2024’s reading suggests upside potential in Q3 FY25.

- The integration of ecommerce businesses into one reporting unit will lead to lower visibility of individual domestic vs international drivers of revenue and margins.

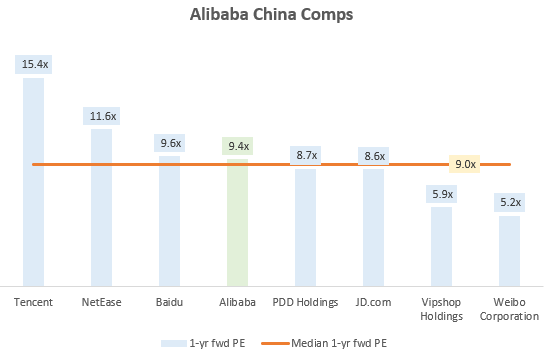

- At a 1-yr fwd PE of 9.4x, Alibaba is fairly valued vs Chinese comps.

- Relative technicals vs the S&P500 are bearish but sellers are losing steam, increasing chances of upside and hence outperformance.

- I overestimated the impact of Chinese fiscal stimulus measures on BABA stock. In reality, it looks like the stimulus does not benefit businesses or household consumption as much, which is what matters most for Alibaba’s fundamentals.

Robert Way

Performance Assessment

My ‘Buy’ call on Alibaba (NYSE:BABA) (OTCPK:BABAF) (NASDAQ:BABX) has not played out well as it has lagged the S&P500 (SPY) (SPX) (IVV) (VOO) by more than 25%:

Performance since Author’s Last Article on Alibaba (Seeking Alpha, Author’s Last Article on Ali Baba)

Thesis

I am revising my stance to a ‘Neutral/Hold’ upon consideration of the following:

- Leading China Retail Sales growth data suggests upside in the domestic ecommerce business

- Integration of business units will lead to lower visibility of segmental drivers

- Alibaba is fairly valued vs Chinese comps

- Relative technicals are bearish but sellers are losing steam

- Chinese stimulus is a key risk monitorable

Leading China Retail Sales growth data suggests upside in the domestic ecommerce business

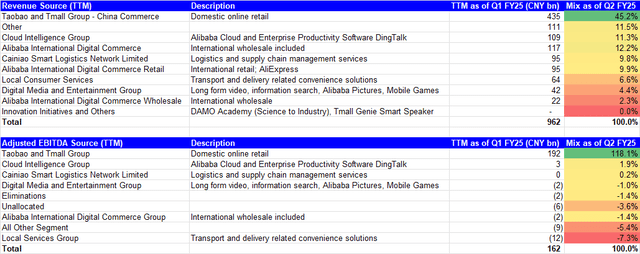

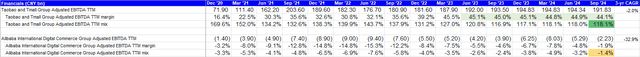

Alibaba’s most important segment is its Taobao and Tmall Group retail business segment since it makes up 45.2% of TTM revenues and 118.1% of TTM adjusted EBITDA as of Q2 FY25:

Revenue and Adjusted EBITDA TTM MIx (Company Filings, Author’s Analysis)

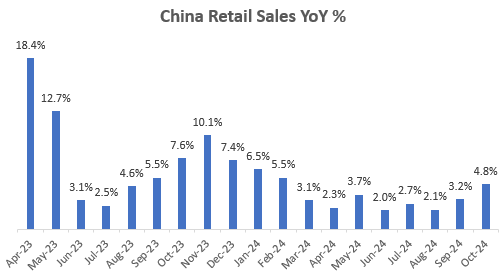

Since Alibaba is a retail market leader in China, I posit that monthly macroeconomic data on China’s Retail Sales is a useful indicator of during-quarter momentum for Alibaba’s retail business.

China Retail Sales YoY (Trading Economics, Author’s Analysis)

Oct 2024’s print of 4.8% YoY China Retail sales growth shows a meaningful growth acceleration from the 7 quarters prior. I view this as a positive tailwind for Alibaba’s Q3 FY25 results.

Integration of business units will lead to lower visibility of segmental drivers

Recently, management announced that the Taobao and Tmall segment and the Alibaba International Digital Commerce (AIDC) segment would be merged together into a single reporting group representing Alibaba’s overall ecommerce operations – both domestic and international. My concern with this move is that it would mask the more granular visibility of how the domestic and international ecommerce segments are performing.

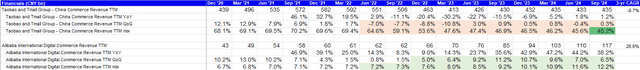

E-commerce TTM Revenue (Company Filings, Author’s Analysis)

On the revenues side, currently, the domestic ecommerce segment is hardly growing whilst the international ecommerce segment is expanding at a very healthy rate of 38.2% YoY on a TTM basis. However, when combined together, I think there is increased risk in perceiving higher-than-actual growth in the domestic ecommerce business.

On the margins front too, combined reporting would remove visibility of the steady margin expansion track on the AIDC segment:

E-commerce TTM Profitability (Company Filings, Author’s Analysis)

Hence, I am not a big fan of this amendment to the company’s segmental reporting breakup. I anticipate that Alibaba may lose the confidence of some investors with this change.

Alibaba is fairly valued vs Chinese comps

Alibaba is trading at a 1-yr fwd PE of 9.4x, which is in-line with the broader 9.0x median 1-yr fwd PE of other Chinese internet and ecommerce peers:

Alibaba China Comps (Capital IQ, Author’s Analysis)

Therefore, I conclude that Alibaba is fairly valued vs its Chinese comps.

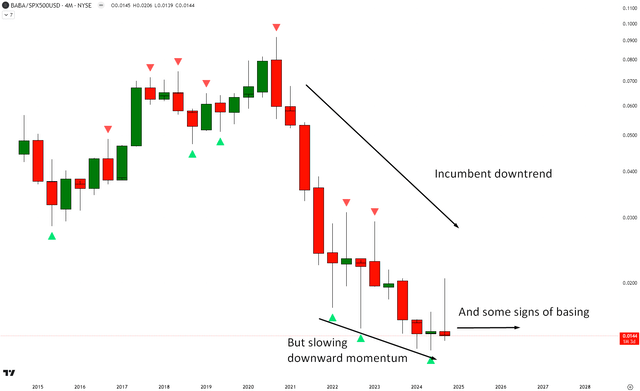

Relative technicals are bearish but sellers are losing steam

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of BABA vs SPX500

BABA vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

Technically relative to the S&P500, BABA is technically still in an incumbent downtrend. However, I am encouraged by the fact that the progress of the sellers has been slowing down and even halting as there is some evidence of a base forming based on the last 3 4-monthly candles. Altogether, I believe this increases the chances of eventual upside in the stock and hence outperformance vs the S&P500.

Chinese stimulus is a key risk monitorable

Upon reflection, I believe I got too gung-ho on China’s monetary stimulus measures. I identified increased liquidity into the Chinese capital markets as the key link on how such moves would benefit BABA stock. However, it is becoming more apparent that such a link is not as strong and that direct benefits to Alibaba’s fundamentals are limited. For example, one of the criticisms has been that current Chinese stimulus measures help the government more than businesses or households (for boosting consumption):

Until there’s a meaningful substantial focus on consumption, in our view, these stimulus measures are likely to be shorter term.

– Lombard Odier’s Asia CIO John Woods

After Trump’s election victory, some market participants expected China to ramp up fiscal buffers to support the domestic economy as a prophylactic move against tariffs. However, these hopes have so far disappointed:

I think markets are on the disappointed side as there were rumours that the policy could be larger if Trump won the U.S. election.

– ING’s chief economist for Greater China Lynn Song

So overall, I acknowledge that Alibaba may not be as big a beneficiary of Chinese stimulus policies as I had initially expected. But I continue to monitor for updates in this regard as I believe this is a major thesis-driver.

Takeaway & Positioning

I contend that China Retail Sales growth is a leading macroeconomic indicator of Alibaba’s domestic retail business. And a growth acceleration in Oct 2024 in this variable bodes well for Alibaba’s Taobao and Tmall business segment in Q3 FY25. On the slight negative side of things, I am not looking forward to the clubbing of Alibaba’s ecommerce businesses into one reporting group as that would reduce visibility on the revenue and margin tracks of the individual domestic and international ecommerce segments. At a 9.4x 1-yr fwd PE, BABA stock is fairly valued vs its Chinese peers. Technically relative to the S&P500, BABA remains in a downtrend but it looks like the sellers are being exhausted, increasing the chances of upside and hence outperformance ahead.

In my last article, I believe I was too enthusiastic on the impact of Chinese fiscal stimulus measures on BABA’s stock prospects. The reality is that the stimulus efforts are more focused on government and infrastructure rather than business and consumption, which matters more for Alibaba. Hence, revised downward expectations in this regard dampen my bullish view on the stock.

Overall, I rate BABA a ‘Neutral/Hold’.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.