Summary:

- Alibaba’s AI and cloud businesses show strong growth potential, with advancements in AI models and increased enterprise investment in AI workloads.

- The e-commerce business has stabilized with high-single-digit GMV growth and innovative tools like Quanzhantui, despite intense competition and market maturity.

- Projected 5% revenue growth in FY25, driven by 2% e-commerce, 5% AI and cloud, and mid-teens growth in logistics.

- Initiating a ‘Buy’ rating with a one-year target price of USD $150 per share, supported by DCF valuation and strategic focus on high-margin businesses.

maybefalse

Alibaba (NYSE:BABA) has extended their business far beyond e-commerce, growing in areas such as AI, cloud computing, logistics and digital entertainment etc. I am encouraged to see Alibaba has begun to stabilize their e-commerce business during the quarter. In my view, their unique proposition in AI and Cloud could drive future growth. I am initiating with a ‘Buy’ rating with a one-year target price of USD$150 per share.

Growth From AI and Cloud

Over the past year, Alibaba has made solid progress with their AI large language models. In April 2023, Alibaba rolled out their ChatGPT-style product, Tongyi Qianwen, which supports both Chinese and English languages. In October 2023, Alibaba released version 2.0, aiming to deliver performance comparable to ChatGPT 3.5. In May 2024, the company rolled out version 2.5, similar to ChatGPT 4 Turbo.

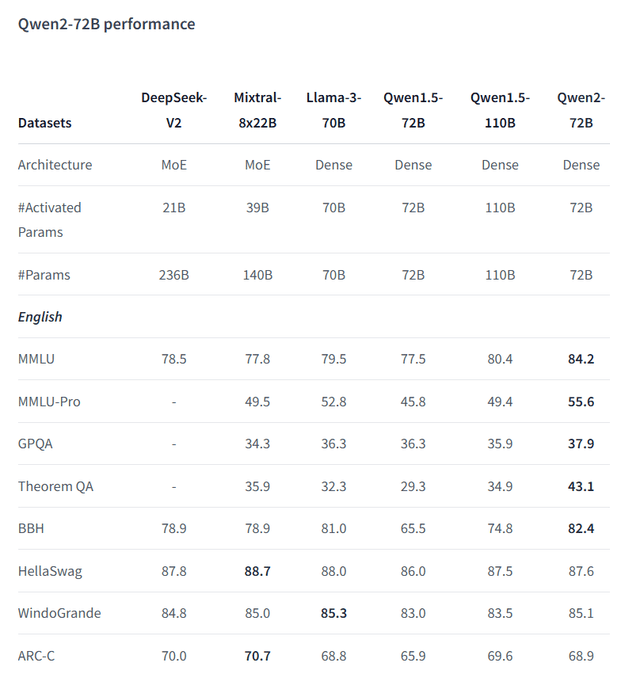

In addition, Alibaba open-sourced their Qwen1.5-110B model on the Hugging Face platform in April 2024, attracting tremendous attention from developers. As shown in the table below, Qwen AI models can deliver performance comparable to Llama and other large language models.

Over the recent earnings call, the management indicated that Alibaba will continue to invest in their AI models and plans to implement their AI plus cloud strategy, promoting integrated services to enterprise customers. In addition, among their cloud customers, budget allocations for AI have significantly increased compared to last year, demonstrating enterprise customers are investing more in AI workloads.

In Q1 FY25, Alibaba delivered double-digit revenue growth for its public cloud business, with triple-digit-growth in AI related products. It is encouraging to see their AI and cloud business gaining growth momentum in China.

Taobao and Tmall Business

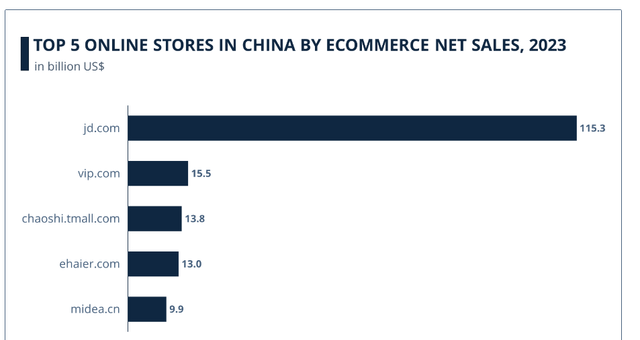

As described in ECDB’s report, China’s eCommerce market has experienced remarkable expansion over the past decade, surpassing US$2 trillion in 2024. However, the market is approaching its maturity, and intense pricing wars among top players, including JD.com (JD), VIP.com (VIPS) etc., have created margin pressure for these online store operators.

To navigate the industry growth challenges, Alibaba has focused on recommendation and matching algorithms while shifting their resources to higher margin businesses. In Q1 FY25, Alibaba achieved high-single-digit online GMV growth and double-digit order growth year-over-year for their Taobao and Tmall business.

During the earnings call, the management indicated that Alibaba has seen steady growth in GMV and order volume, as well as stable market share in China. I think Alibaba will focus on monetization rate and quality growth for their e-commerce business. Key areas include:

- Alibaba launched a top-tier 88VIP membership package in 2018, offering merchandise discounts and free access to their video and music streaming services. In Q1 FY25, the company reached 42 million 88VIP members. The premium member base could help Alibaba improve shopping frequencies and increase its take rate.

- In April, Alibaba introduced their new marketing tool, Quanzhantui, an algorithm featuring automated bidding, optimized targeting and performance dashboard visualization. The new marketing tool can potentially enhance merchants’ monetization and improve traffic utilization and conversions.

- Lastly, Alibaba has been leveraging their own AI technology in their e-commerce business, to better match products with user needs, and increase traffic conversion rates.

Recent Result and Outlook

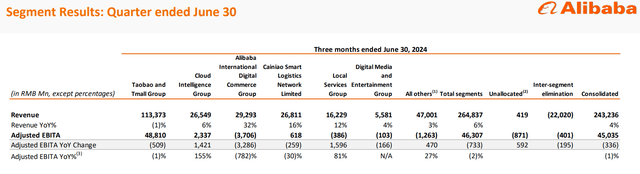

Alibaba released their Q1 FY25 result on August 15th, reporting 3.9% revenue growth and 9.4% decline in adjusted net income. As detailed in the table below, Alibaba Cloud business grew by 6% driven by double-digit public cloud growth with increasing adoption of AI-related products.

My key takeaway from the quarter is the stabilization of their e-commerce business. As discussed previously, China’s e-commerce market has faced intense pricing competition and heavy promotions. Taobao and Tmall group have been navigating the challenging market through value-added services including premium membership and marketing tools etc. The management expressed strong confidence in the ongoing improvement of the monetization rate.

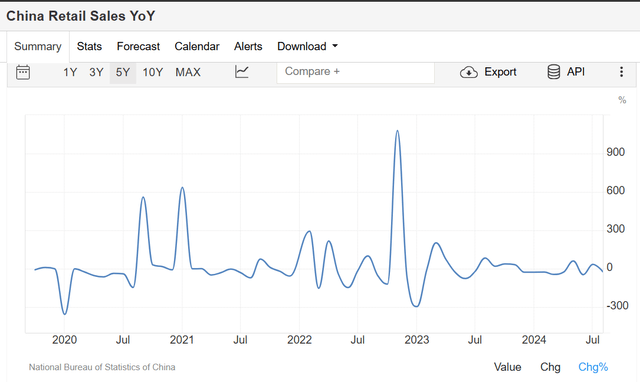

China’s retail sales have experienced weak growth in the post-pandemic period, as depicted in the chart below. Soft consumer sentiment has put pressure on overall retail sales, affecting both online and physical stores.

The Chinese government unveiled their economic stimulus plan on September 24th, aiming to reverse the deflationary environment, and boost economic growth. I think it is too early to determine whether this stimulus could be effective. To be conservative, I forecast Alibaba’s Taobao and Tmall revenue will grow by 4% annually, driven by 2% traffic growth and 2% increase in take rate.

For their cloud and AI businesses, I think big tech companies including Alibaba, Baidu (BIDU) and Tencent (OTCPK:TCEHY) possess significant technology advantages over small players. I anticipate Alibaba will sustain the current growth momentum, with their AI and cloud revenue growing by 7% annually. Lastly, I project their logistic business will grow by 15%, in line with industry trends.

As such, I calculate Alibaba will achieve 7.5% normalized revenue growth. In FY25, Alibaba just began stabilizing their e-commerce business, and China’s economy remains at the bottom of the cycle. Considering these factors, I forecast Alibaba’s revenue will grow by 5% in FY25, assuming 2% e-commerce growth, 5% AI and Cloud growth and mid-teens growth in other businesses.

DCF Valuation

As discussed above, I forecast Alibaba will grow their revenue by 5% in FY25 and 7.5% from FY26 onwards. On the margin side, I am considering the following factors:

- During the earnings call, the management noted that the company will focus on competitive sustainable growth margin and scalable public cloud products, which would enhance their gross profits over time. In addition, the company plans to strengthen its synergies between cloud and AI business, as both share similar customer base.

- Alibaba has been scaling down their direct sales business over the past few quarters. In Q1, the direct sales business declined by 9% year-over-year. As Alibaba lacks economies of scale in their direct sales business, it is hard to generate margin leverage from the low-margin business. As such, I think Alibaba is making the right decision to scale down their low-margin business.

As such, I project 20bps annual margin expansion in my DCF model, assuming 10bps from gross profits and 10bps from SG&A operating leverage. The cost of equity is calculated to be 10% assuming: risk-free rate 3.7%; beta 0.9; equity risk premium 7%. As I calculate the intrinsic value for their ADR shares, the risk-free rate and equity risk premium are based on US market conditions.

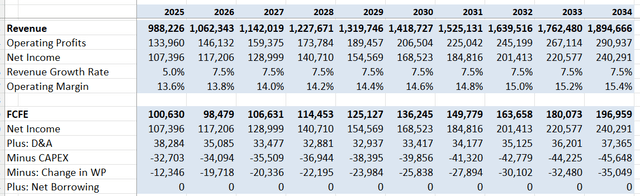

I calculate the free cash flow from equity (FCFE) as follows. Please note, all the figures are in RMB millions, except for percentages.

Discounting all the future FCFE at a rate of 10%, the one-year target price is calculated to be USD $150 per share, considering 1 ADR equals 8 ordinary shares, as per Nasdaq’s disclosure. Please note that the exchange rate used in the model is 1 USD to 7.06 RMB.

Key Risks

- PDD (PDD) is an e-commerce platform that offers lower price by enabling group purchases. PDD has been relying on heavy discounting to boost their sales. The rapid growth of PDD could create significant challenges for Alibaba’s Taobao platform. To stay competitive, Alibaba needs to provide more value-added services for both merchants and buyers.

- To grow their AI business, Alibaba relies on high-end GPUs from Nvidia (NVDA) and AMD (AMD) for AI training and inference. With the tightening export restrictions, Chinese internet companies might struggle to obtain sufficient GPUs for training large AI models.

- As reported by Reuters in September 2024, China’s State Administration of Market Regulation has completed three years “rectification” following a record $2.75 billion fine levied in 2021 for monopolistic practices. The regulator will continue to monitor and guide Alibaba’s operations. It is unclear whether the regulator will create additional challenges for Alibaba’s growth businesses including AI and cloud in the future.

End Note

I think Alibaba is well positioned for the future growth in the AI and cloud business. The management has made the right decisions for better monetization in their e-commerce business. I am initiating with a ‘Buy’ rating with a one-year target price of USD $150 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.