Summary:

- Alibaba’s restructuring consolidates domestic and international e-commerce under Jiang Fan, aiming to reverse market share losses in China’s mature e-commerce market.

- Jiang Fan’s success with AIDC doesn’t guarantee a turnaround for Taobao Tmall Group due to different market dynamics and competitive pressures.

- Concerns exist about Jiang managing both TTG and AIDC, risking underperformance in both units amid fierce competition from PDD, TikTok, and Amazon.

- We remain cautious on BABA, recommending higher-growth stocks like PDD, given China’s lack of consumption-oriented catalysts and policies.

1971yes/iStock via Getty Images

Alibaba (NYSE:BABA) (OTCPK:BABAF) recently made a major strategic restructuring of its business units by combining domestic e-commerce and international e-commerce under one roof and appointed Jiang Fan, who previously oversaw BABA’s global e-commerce business, to lead the consolidated unit.

This marks the third major leadership change for BABA’s core revenue generator, Taobao Tmall Group, or TTG, in the past two years. We note that Trudy Dai Shan assumed the role in December 2021 to replace Jiang Fan. Shan was on the job for less than two years and was subsequently replaced by Eddie Wu on an interim basis in September 2023. Almost a year after this change, Jiang Fan is reassuming the role that he previously held.

This move is significant given that BABA is repositioning its proven leader in TTG Jiang Fan back at the helm to drive BABA’s e-commerce turnaround. Worth noting that Jiang Fan was considered one of the rising stars in BABA but was marginalized to oversee less important business units in AliExpress and International Core Business Units, which include Lazada, at the time.

Over the past two years, it was evident that Shan was not able to address the ongoing market share loss BABA was facing in China to emerging peers such as PDD (see: PDD: Shop Until You Drop), Douyin, and Tencent, and that Eddie Wu also lack the expertise to run the e-commerce business.

Given that Jiang Fan has been relatively successful in driving BABA’s AIDC business, which has maintained a healthy growth rate vs. TTG, BABA is putting Jiang back at the helm to turn around the business that he once oversaw.

Company Report, Astrada Advisors

The market had a muted reaction to Jiang’s comeback, and we would agree with the market assessment in that it is too early to tell how or whether Jiang can be successful in turning around TTG.

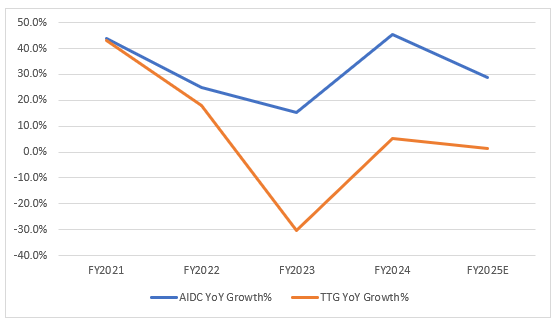

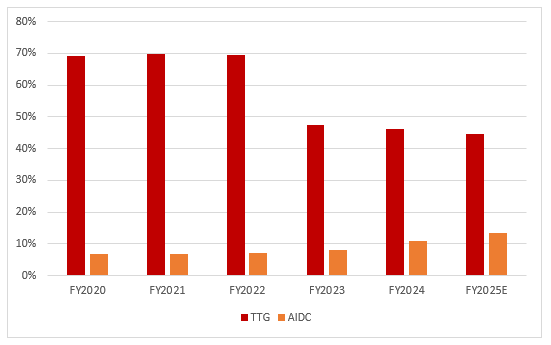

For starters, a successful track record in AIDC does not guarantee success in TTG, given the different dynamics. We note that BABA’s AIDC business has enjoyed a period of fast growth due to a combination of low base effect and lower shipping cost and time post covid.

Worth reminding investors that AIDC only accounts for around 13% of BABA’s total revenue vs. 7% in FY2020. This business segment’s high growth rate benefited from the low base effect, given the rising e-commerce penetration and improvement in cross-border logistics in ASEAN and EMEA regions.

Company Report, Astrada Advisors

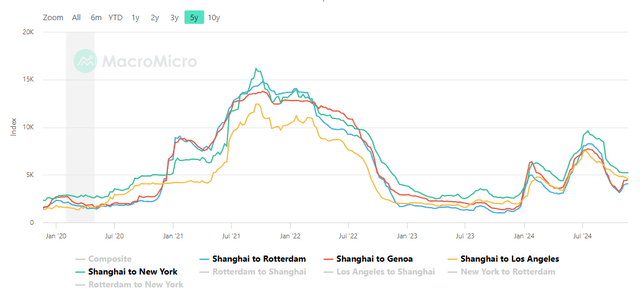

The decline in the container index from Shanghai to the US and Europe post-Covid and the constraint consumers in both the US and Europe created a value-seeking consumption environment that benefited low-cost goods from China and allowed the resurgence of the once sleepy AliExpress, which now largely relies on AEChoice in the wake of Temu’s success.

The lack of discount e-commerce platforms outside of China provided enough demand for all Chinese e-commerce companies, including BABA, thereby allowing AIDC to enjoy a period of relatively fast growth and steady consumer demand.

At the business level, Jiang was instrumental in streamlining AIDC’s overall operation and implemented a localized strategy catered to different markets. Worth noting that the AIDC unit that Jiang Fan initially took over was extremely complex as it encompassed multiple sub-units, such as AliExpress, ICBU, and Lazada, which operate under diverse models serving highly fragmented markets with complex supply chains and user base. The complexity of all these businesses presented a significant challenge from a managerial perspective.

However, Jiang was able to deliver with his focus on AliExpress as Temu was starting to emerge, launching aggressive subsidies to merchants that use AliExpress to expand overseas. Brands working with AliExpress could list their products and drive sales across multiple platforms, including Lazada, Miravia, Daraz, and Trendyol, thereby saving merchants’ operational costs.

Jiang was also an earlier champion of the fully managed model that Temu started with back in 2022, and deployed different strategic approaches for different regions such as profitability-focus for Southeast Asia where competition remained intense, and growth-focused in Turkey where e-commerce penetration remains low.

All these factors allowed Jiang to achieve success when managing AIDC with AEChoice accounting for ~70% of AliExpress’ total orders this year and becoming a major driver of order growth for BABA.

When turning around TTG, we believe Jiang is unlikely to benefit from the two macro tailwinds that he enjoyed while managing AIDC given that TTG has grown in scale, so there are no low base effects and that China’s e-commerce market has reached maturity with material expansion in total addressable market.

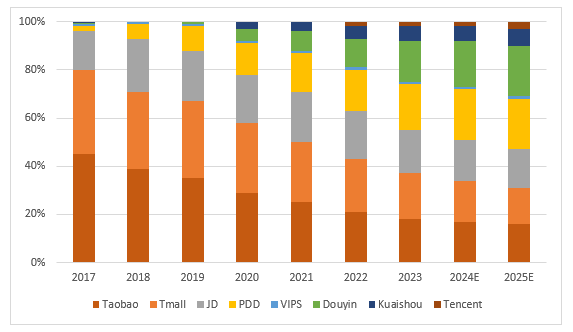

Today’s TTG faces a very different competitive dynamic than what it faced in 2020 when Jiang left. Back in 2020, TTG combined accounts for close to 60% of China’s e-commerce market, per Quest Mobile estimate, while JD was the clear number two with 20% market share and PDD held 13%.

Douyin/TikTok only accounted for 5%, while smaller rival Kuaishou only held a 3% share at a time when e-commerce streaming was starting to take off with a debatable business model on whether e-commerce is shifting from consumer search for products vs. products being pushed to the consumers. Consumers in North America are no strangers to this phenomenon with the co-existence of Amazon and TV infomercials, which arguably could be considered the early form of streaming e-commerce.

The dynamic is very different fast-forward four years with TTG only accounting for 35% of China’s e-commerce GMV with PDD close second with 21% and JD at third with 17%. Douyin/TikTok e-commerce has more than tripled its market share to 19% at the expense of TTG. Orchestrating a turnaround will be much more difficult given BABA’s current market share loss has yet to stabilize, as indicated by the ongoing user churn and investments to retain both merchants and users (See: Alibaba: The ‘Value Play’ That Keeps On Disappointing).

Company Report, Astrada Advisors

We are also concerned about whether Jiang is capable of managing both TTG and AIDC simultaneously, given the strategic importance behind both businesses. For TTG, the key objective here is to first stabilize the market share loss and drive revenue reacceleration. For AIDC, the key objective is to capture a greater share of the ex-China discount e-commerce market in light of the growing competition from PDD, TikTok, Shein, and now Amazon (See: Amazon: Keeping Up With Temu For The Long Haul).

With a growing focus on turning around TTG, there could be less focus on AIDC, leading to a worst-case scenario in which Jiang fails to stabilize TTG’s underperformance while AIDC loses out to PDD, TikTok, and Amazon similar to how TTG lost out to PDD and Douyin in China.

In conclusion, we remain on the sideline with BABA, as we believe Jiang’s comeback is unlikely to shift the narrative in the near term and that BABA is likely to remain a value trap due to the lack of consumption-oriented catalysts and policies in China. We recommend investors to seek higher growth stock such as PDD that is trading at a discount relative to peer growth with the additional optionality of global expansion (See: PDD: Near-Term Correction Doesn’t Deter Our Bullish Bargain Hunt).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.