Summary:

- Alibaba’s core business turns stable with record monthly active users and 46M loyal VIP members.

- Political risk is at the lowest point since COVID; reduced market share ironically helps by easing monopoly concerns, while platform opening initiatives like WeChat Pay integration show alignment with government priorities.

- Cloud and AI are showing strong momentum since COVID—triple-digit growth in AI products, with open-source strategy building ecosystem advantage and the Qwen 2.5 model outperforming Meta’s Llama 3.

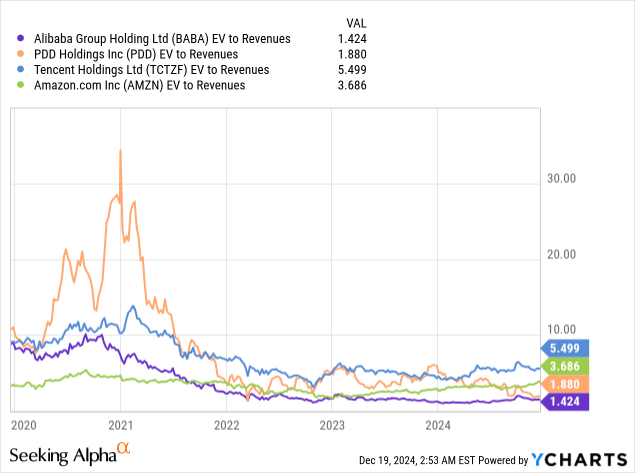

- Trading at a significant discount to peers even with a 50% China discount, while loss-making segments are expected to turn profitable within 1–2 years and international commerce is growing 29% YoY.

maybefalse/iStock Unreleased via Getty Images

Alibaba (NYSE:BABA) has shown disappointing headline numbers recently. But there is a transformation story with emerging strengths in Government relations, AI, cloud computing, and international commerce that the market seems to be missing.

Unimpressive performance

The company’s latest earnings show slow growth in the major performance measures: total revenue increased only by 5% YOY to $32. 4 billion, despite missing the estimates by $498. 84 million, while the consolidated adjusted EBITA declined by 5% to $5. 56 billion. The core commerce business is essentially stagnating, as can be seen from the fact that Taobao and Tmall Group’s revenue increased only by 1%. Even the highly acclaimed cloud division, which management has highlighted its potential in AI, recorded a seven percent growth. Perhaps, the most alarming is the drop in the free cash flow by 70% to $1.88 billion from $6. 19 billion in the previous year. International commerce, which grew by 29%, is still unprofitable with worsening performance, as adjusted EBITA dropped to – $397 million from – $52. 6 million a year ago.

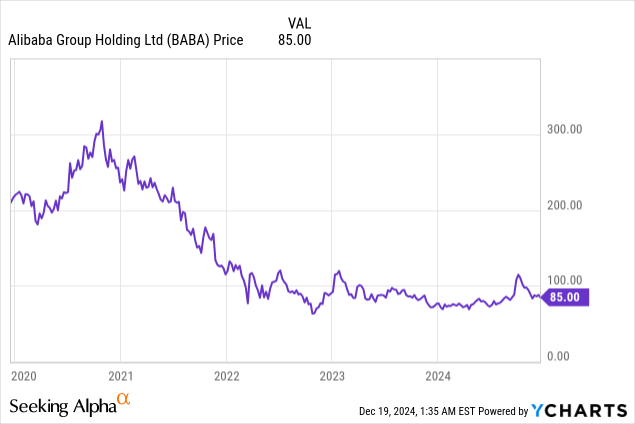

This quarter feels like a summary of the last 5 years of BABA. The company that was once a game changer in China’s digital economy with new and innovative ideas seems to be losing its way. Since its peak in 2020, BABA traded at $300 per share and was viewed as China’s dominant tech giant. Today, with the stock hovering around $80, it is considered as a loser in the Chinese tech segment. The company has also seen a drop in its market share from 80% to 40% of China’s e-commerce market, with the competitors such as PDD Holdings (PDD) and ByteDance challenging its position. This change in perception makes the market to significantly underestimate the future of BABA while overestimating the risks that may occur in the political and competitive environment of China.

To be fair, I think BABA’s market share decline is a result of the development and diversification of China’s extremely large e-commerce market rather than wrong management. It is true that BABA is rather late in the social e-commerce game which was popularized by Pinduoduo and Temu, as well as TikTok. However, Taobao and Tmall are actually doing ok and the company’s transformation efforts are beginning to bear fruit. From Q1 2024, we can observe that GMV is increasing at a higher rate than it has been for the last two years. Its marketing tool “quanzhantui” seems to be a good way of revitalising the BABA ecosystems and engaging the users. For instance, in this quarter, the company recorded the highest number of monthly active consumers and 46 million 88VIP members. GMV also grew as the number of orders increased by double digits. While BABA’s China ecommerce business may still lose market share, it is at a slower rate. I believe all competitors will reach new equilibrium once they find their consumer segmentations.

Political Environment and Government Support

Another important aspect is the regulatory environment, which was a major challenge previously, but I believe has been eased to a great extent. BABA’s market share has been cut down, which is beneficial for the company as far as the monopoly issue is concerned. The recent efforts made by the company include allowing WeChat Pay on its platforms and enhancing the platforms’ integration as a way of meeting regulatory requirements while at the same time growing the customer base.

There was a sentiment that said, ‘China or communism is not investable. ‘ However, China is not North Korea, they do have a market-driven economy. I think that the worst of government censorship is already over. We also notice change in the government’s policies with stimulus measures towards private sector and consumption as well. BABA is in line with the government’s strategy, especially in the technological and AI aspect. The company has also participated fully in the government’s trade-in programs for electrical and household items, as well as other measures that reflect the company’s commitment towards the policy objectives. This convergence along with the light regulatory burden shows that the political risk is at its lower than it has been since COVID.

Growth Engines: Cloud, AI, and International

The market’s pessimism overlooks three powerful growth engines that could drive BABA’s future value: Cloud/AI leadership, international expansion, and local services innovation.

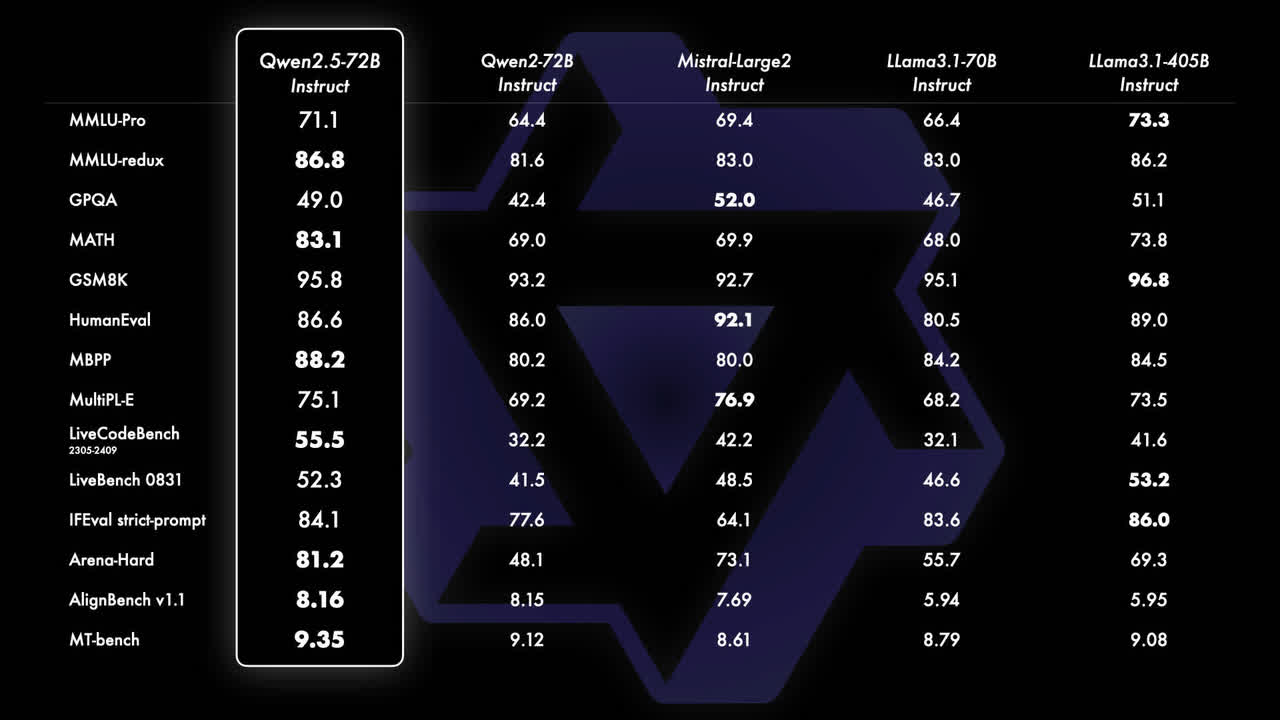

In cloud computing and AI, BABA has been performing actually very well. The AI related products have recorded triple digit growth for five straight quarters, while the public cloud revenue grows at double digits. The company is investing heavily in the AI infrastructure since it sees it as a generational play. By providing AI models freely open source, BABA is in the process of creating a strong ecosystem which may sustain the platform usage and computing needs in the long run. Their LLM model Qwen 2.5 is already outperforming META’s LLama3. The competition with Huawei in cloud services is usually misinterpreted as BABA seems to losing market share. Huawei is essentially a government owned company, so it’s understandable that they have gained a large share of the market in government and state-owned enterprise contracts. But this doesn’t mean BABA’s cloud product is not the best, as they still dominate in the commercial segment.

Qwen Model performance (qwenlm Website)

As for the international aspect, the company’s revenue from international commerce has increased by 29% y-o-y. AliExpress, particularly its Choice program, is gaining significant traction globally. It is actually beating Temu in terms of web traffic. The new AliExpressDirect model which uses local inventories for faster delivery shows the company’s efforts in enhancing the experience of the users. Trendyol’s performance in Turkey and the establishment of cross-border fulfillment network are also signs of strength in the quarter.

The often-overlooked mapping business (Gaode) is also a huge opportunity, which have reached 300M DAU. In a country as big and diverse as China, mapping and local services are still untapped goldmines (think about Google map). Recent results indicate that this division is growing steadily and starting to capitalize on its revenue streams.

Bottom Line

It is widely known that BABA is cheaper than its peers from the perspective of a number of factors (P/E, EV/Sales). It also has a strong share buyback plan for the first half of FY2025 which is $10 billion, whereas others do not have any. I think it presents an attractive value from here, even if one deducts 50% political risk of China as a market.

Most importantly, BABA has the qualitative factors that, I think, are the most indicative of future stock price directions. These factors are all mentioned during the call which are totally achievable:

- Loss-making segments turning profitable within one to two years

- Cloud/AI business acceleration and monetization

- International expansion success

- Potential reduction in political risk premium

Some challenges still exist, such as political and legal factors, competitors, and operational issues, but they are already reflected in the current multiple. I think BABA is undervalued and if one is willing to look for the positives amid the negativity, it presents a good mix of value and growth. I think this is still a high-quality company that can consistently adapt, innovate, and execute.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.