Summary:

- Recent Chinese stimulus has driven Alibaba stock up, validating my recommendation to buy long-dated call options for explosive upside while capping downside.

- With BABA’s implied volatility at extreme highs, it’s time to close long calls and start selling out-of-the-money puts to capitalize on premium decay.

- Shorting puts expiring in under 60 days offers a reasonable risk-reward, given the high IV and the Chinese government’s support for economic stability.

- Alibaba’s strong fundamentals, massive buyback program, and potential in AI make shorting puts a compelling strategy amidst current market conditions.

maybefalse

A few weeks ago, I published “Alibaba Call Options: Michael Burry Backs Up The Truck,” where I analyzed the recent developments and catalysts for Alibaba (NYSE:BABA) stock. I concluded that the best way to play it would be to purchase OTM, long-dated call options. The reasoning was that further declines were possible and that the calls would allow for explosive upside while capping the downside at the premium paid.

This thesis has played out spectacularly. Chinese stocks have soared following the massive stimulus announced by the PBoC on 24 September 2024. Sentiment was awful but has turned decisively bullish in the face of this macro development. We are seeing the market quickly revalue Chinese assets in the light of this stimulus. The Chinese government wants to restore confidence and is determined to do it with policies which will dramatically expand the amount of RMB liquidity.

BABA’s 1-month chart is as follows.

The charts for FXI and many other Chinese tickers all look very similar. My suggestion was to purchase BABA’s 120 calls, expiring in September 2025. These were trading at $320 per contract when I wrote the article. As of Friday 27 September 2024, the same calls were trading at over $1200 – roughly a 4x on invested capital.

At the time, I received some comments saying that short puts were a better choice because long options meant you are paying theta (time decay on an option’s premium). My reasoning for choosing long calls was that I viewed short volatility (especially downside) as inherently risky for Chinese assets, given the unpredictability of the CCP. I also disliked that gamma (option convexity) would be working against me. Given the awful sentiment, any reversal in sentiment would likely have been met with an explosive upside, which means that having convexity would be a good thing. Long calls were the better choice.

As it stands, short puts have likely dramatically underperformed long calls.

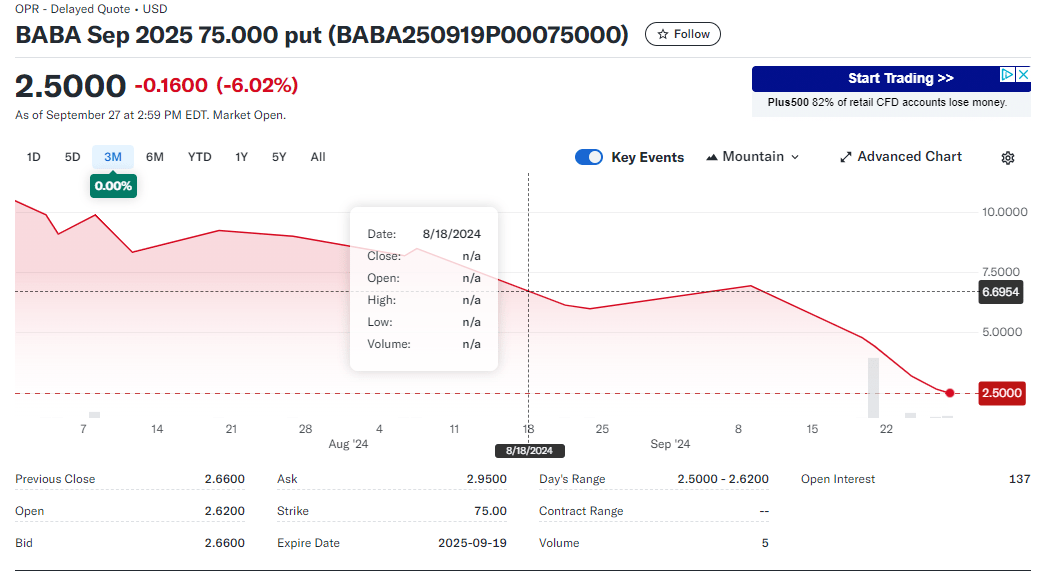

On 18 August, the BABA 75 put expiring in September 2025 was about $670. Now it is $250. Shorting this contract would have been a 62% gain, which is nowhere close to a 4x.

BABA put price (Yahoo!)

Now That The Rally Has Begun, What Should We Do?

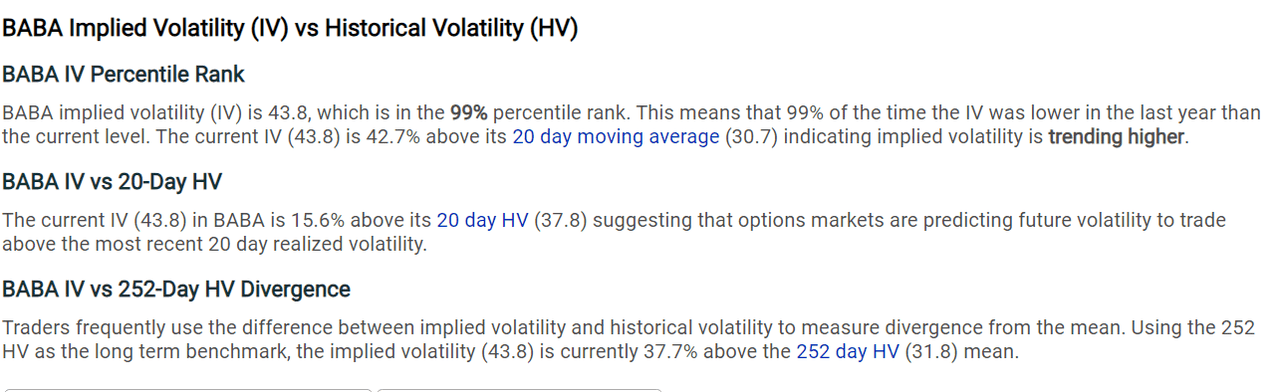

At this point, I think it would make sense to close out the long calls. BABA and FXI IV rank are both at the 99th percentile, meaning both tickers have had the highest implied volatilities in a year. This means that options are at relative nosebleed highs, based on the trend of IV.

BABA IV rank (marketchameleon)

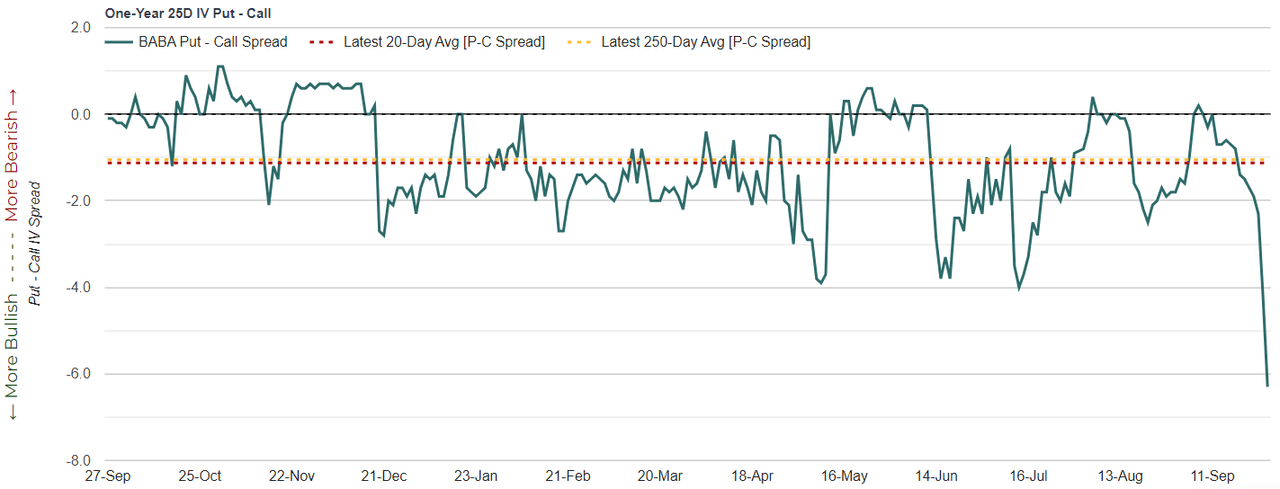

Moreover, the IV skew between BABA calls and puts have reached extreme levels of bullishness. The IV of 25 delta call options are over 6 points higher than the IV of 25 delta put options. This spread generally oscillates between -2 and 0, so the current situation means there is tremendous demand for OTM calls. This is very abnormal, to put it lightly.

BABA IV skew (marketchameleon)

When you own something, the best time to sell it is usually during times when there is extremely, abnormally high demand for it. I think exiting long calls would be good, especially because IV is likely to come back down.

If you want to continue trading BABA options, I suggest selling puts expiring in under 60 days in the 5-40 delta range. Shorter maturities maximize theta. I think it is also better to be short volatility only over the short term. I still believe there are substantial long-term risks in Chinese stocks. The immediate future seems very much clear of such risks, given the dovishness of the PBoC and Chinese government.

Selling puts makes sense at this time because IV is likely due to fall back down. I don’t think BABA will crash back to the $75-85 range in the next 60 days. The sentiment has decisively shifted, now that the CCP has thrown its weight behind supporting the Chinese economy at all costs. This takes away some of the risks in selling puts (discussed more below). Think of the high IV that is due to come down and the dovish CCP that is pumping Chinese stocks as two layers of margin of safety for the short put trade.

The other thing to do is to just leave it and find something else to trade. There’s no dire need to sell puts and take on more risk in BABA. Personally, I dislike the idea of owning BABA shares. I don’t see it as a long-term hold, given the political risk from the CCP. However, a speculative buy to ride the bullish momentum could also be considered.

Risks To Trade and Risk Management

The risks to selling OTM puts expiring under 60 days, is that the trader stands to lose the difference between the strike price of the put and the BABA spot price, if the option expires OTM. Thanks to the convexity of options, this could be multiples more than the premium received for selling the put.

Therefore, it only makes sense to sell the puts if you believe that BABA won’t go down or if you are comfortable owning BABA at the strike price of the put, even if BABA has a big pullback. One way to mitigate risk is to sell cash secured puts, in which you already have the cash to buy 100 BABA shares at the strike price, should the put be exercised.

Another risk management procedure would be to close the position at a predefined stop loss. For instance, if the market value of the put ever becomes 3x the premium received, then you will just buy back the put and realize the loss. When selling naked options, it is advisable to have some robust risk management procedures in place.

For puts with less than 60 DTE, your timeframe is for the next 60 days. Given the bullish sentiment around the Chinese stimulus, I think the risk-reward is quite favorable for the next 60 days. It would look very strange for the CCP to suddenly come out with a very hawkish tone within such a short time of announcing this stimulus.

Last Thoughts: Fundamental Picture For BABA Is Good

I covered this in the last article, but BABA’s fundamentals as a business are considerably good. The only real question was that, like all Chinese companies, the CCP has an outsized influence. BABA is running with a massive buyback program, which will put a sustained bid on shares. Meanwhile, even more recent developments, such as the launch of many bleeding-edge open-source AI models, makes the case for BABA as a possible AI play too.

BABA has long been one of the major big tech companies in China, especially considering the long-term dominance of Alibaba Cloud. BABA certainly has the data and human capital needed to build and remain competitive in AI. If they can roll out impressive products in AI and take market share from Western alternatives, then we could see AI become a very meaningful segment, which will power many more buybacks in the near future.

My thoughts on all this? Assuming the CCP doesn’t do anything drastic, BABA could be a value tech stock right here and now. It is dreadfully undervalued based on most metrics, and it has the potential for driving significant growth in the AI space – just see Seeking Alpha’s quant grades for profitability and valuation, in which most of the grades are B or better. But this is, again, assuming the CCP doesn’t do anything drastic. That is a big assumption for me. I continue to rate the stock a Hold, but view the BABA options market as a viable venue for intelligent trading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.