Summary:

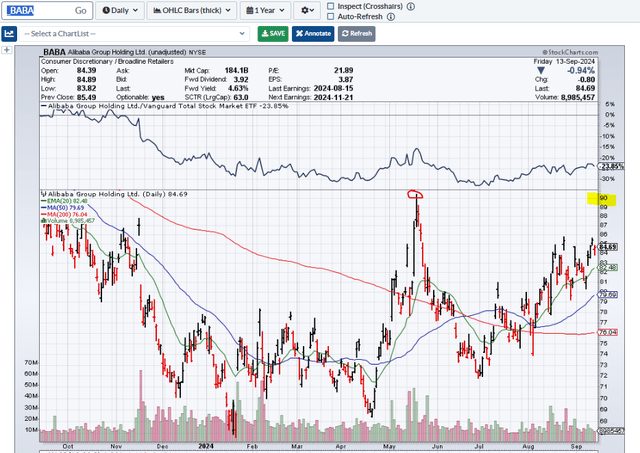

- We had previously rated Alibaba a Buy with a $90 price target.

- Q1-2025 results showed revenue growth but declining income, EBITDA, and free cash flow, with net income down 27%, despite lower share count.

- Beijing has softened towards BABA, but the macro data keeps getting worse for Mainland China.

- We go over some recent news and tell you why we are once again shifting out to the sidelines.

Manuel Milan

On our previous coverage of Alibaba (NYSE:BABA), we saw enough data on the positive side of the ledger that we were able to give it a buy rating.

It would be extremely unlikely for BABA, with the margins they have, but a recession does make it possible. But assuming they can hit their estimates below, we see material upside to the stock. We are raising this to a Buy, with a $90 price target in one year.

Source: They Don’t Ring A Bell At The Bottom

We did get that $90 mark fairly quickly and those that took on that trade at the depressed February 8, 2024 prices, made a quick buck.

We look at the recent results, and the deluge of China data. While the stock is a good distance away from the $90, we go over why we are now moving back to neutral.

Q1-2025

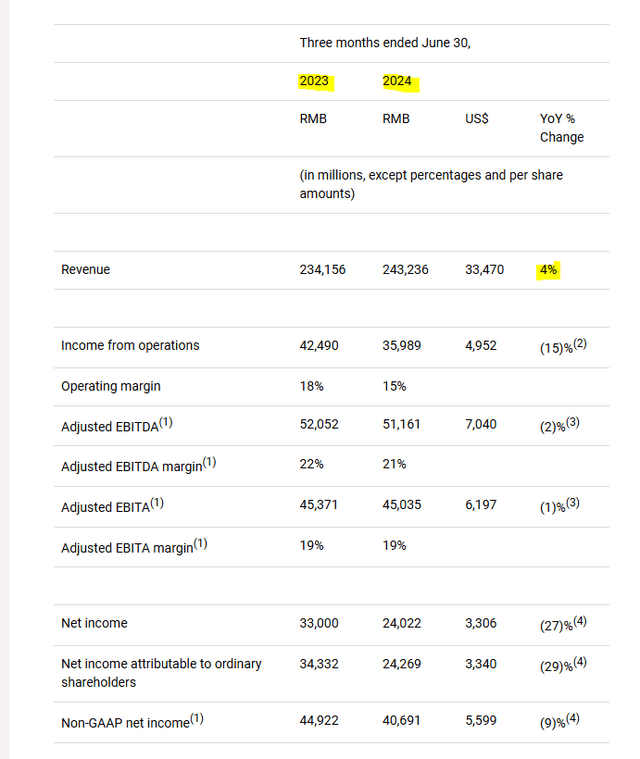

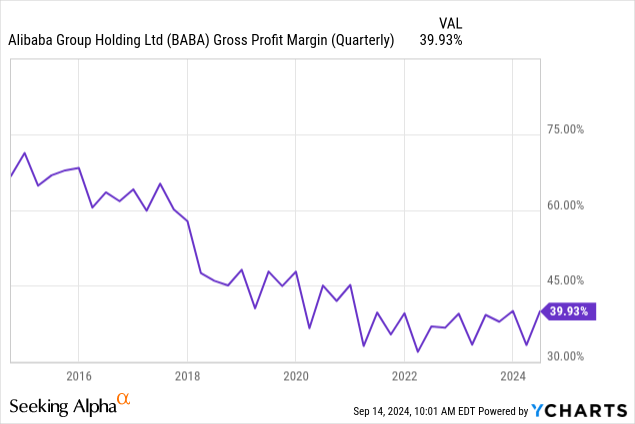

BABA has a fiscal year ending in March, so the recently reported quarter was Q1. While the earnings on the Non-GAAP front beat estimates, it was a fairly poor showing by any realistic observer. Revenues were up 4% year over year, but it was all downhill after that. Income from operations, adjusted EBITDA and adjusted EBITDA margins were all trending lower.

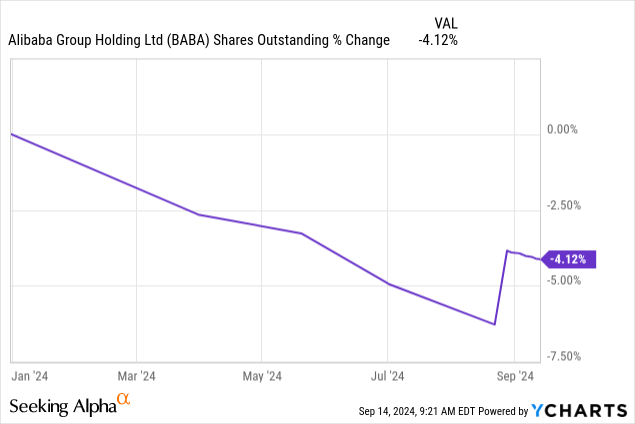

Net income was down by 27% while the heavily adjusted number was also down 9%. We will note here that the revenues missed the tepid estimates as well. We did so badly on all these metrics, despite having a lower share count.

The commentary was optimistic as BABA expects its unprofitable lines to reach a modicum of positive returns in 1-2 years. So far it has been e-commerce and cloud that have driven the bottom line. A key negative besides the overall tepid results was the extremely high rate of reinvestment required in the businesses. Free cash flow was down more than 50% year over year.

Analyst Expectations

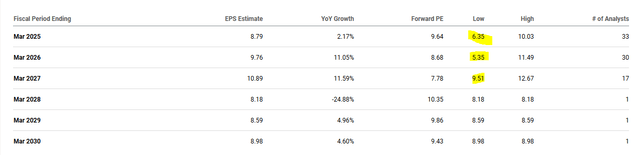

There is a fairly huge divide in the analyst community and one can see that in the gap between the low end of estimates and the mean estimate.

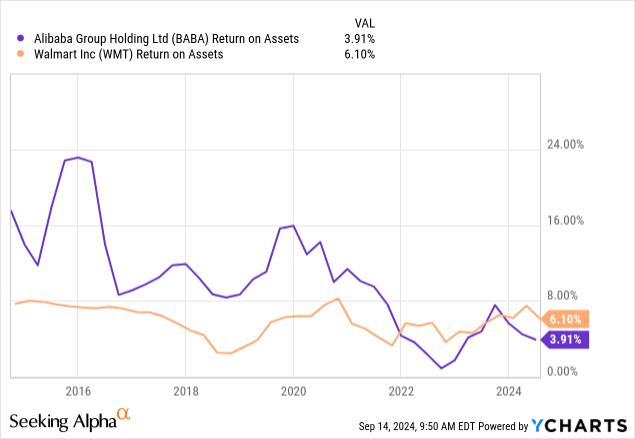

Funnily, the only analyst who has estimates beyond fiscal 2027, is lower than the 2025 number for both 2028 and 2029. Of course the key argument is that BABA is cheap whichever way you slice it. Look at those low P/E ratios. But those P/E ratios only tell half the story. BABA is down at these levels because it has started producing some of the lowest returns on assets you can find.

But can this be turned around? We don’t think this will happen any time soon.

China Data

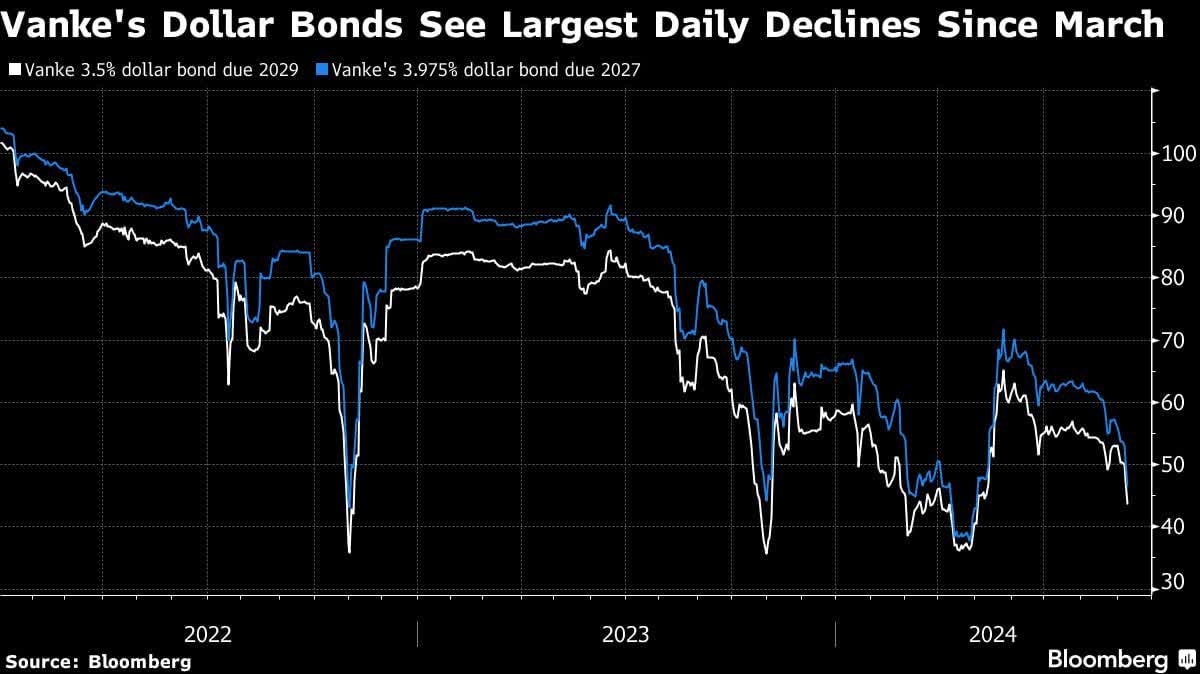

The biggest kahuna for China is its property market. We have defined that as the largest bubble on the planet and this is after being aware of what multiples AI stocks trade at these days. There is no end in sight to the problems.

Despite Chinese regulators’ efforts to jump start the real estate sector, the residential slump continues to deepen. In August, the value of new-home sales from the 100 biggest real estate companies fell about 26.8% from a year earlier to 251 billion yuan ($35.4 billion), according to preliminary data from China Real Estate Information Corp. That compares with a 19.7% decline in July.

“The market has been looking for more decisive policy support towards the property sector, unfortunately this has not been forthcoming,” said Clement Chong, head of fixed income research at Eastspring Investments. “Investors’ confidence around a sustained recovery in the property sector is not very high at the moment,” he added.

Source: Bloomberg

Property developer stocks are getting deeper into distress.

Bloomberg

China’s attempts to stabilize continue to fail on multiple fronts.

In May, China’s central government urged more than 200 cities to buy unsold homes to ease oversupply. More than three months later, only 29 have heeded the call.

The glacial pace of implementation — driven in large part by the unattractive economics of the plan for local governments — underscores the challenge President Xi Jinping faces as he tries to arrest a record property slump that’s threatening to undermine the country’s growth targets.

Source: BNN Bloomberg

The problem is that prices are still ridiculously high. Just look at the rental yields which are lower than even the ultra-low interest rates.

Local bureaucrats are reconciling the demands from Beijing while trying to be prudent about costs. Buying apartments at this point makes little financial sense for those officials, as apartment prices are expected to drop at least another 30% in major cities before stabilizing, according to Jefferies Financial Group Inc.

Estimated returns from turning inventory into affordable housing are also below the cost of funding. Rental yields in China’s tier-1 cities averaged just 1.4% in 2023, compared with the central bank’s funding rate of 1.75%, according to Macquarie Group Ltd.

Source: BNN Bloomberg

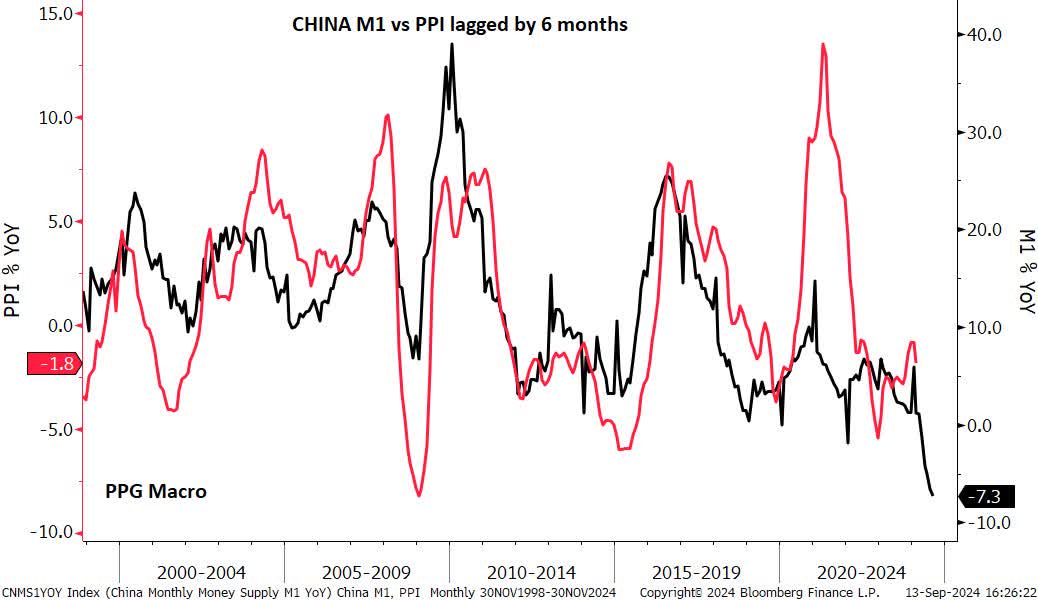

We might get another deflationary shock in the months ahead, especially if the rest of the world joins the recession.

PPG Macro Via Bloomberg As Shared On X

Under these circumstances, it would be imprudent to just ignore the macro and run after BABA because it is cheap.

Verdict

The biggest positive development for BABA has been that Beijing has realized that the deflationary wave in the country will be made worse if it destroys its own stock market. The recent news from the Antitrust watchdog essentially validates that this is their opinion.

China’s antitrust watchdog has ended a three-year regulatory “rectification” process of Alibaba and praised the internet giant for its compliance, after fining the company $2.8B in 2021 for monopolistic practices.

The State Administration for Market Regulation (SAMR) said that, over the past few years, it has been inspecting Alibaba’s process to become compliant with antitrust regulations, and the rectification work has achieved “good results.”

Source: Seeking Alpha

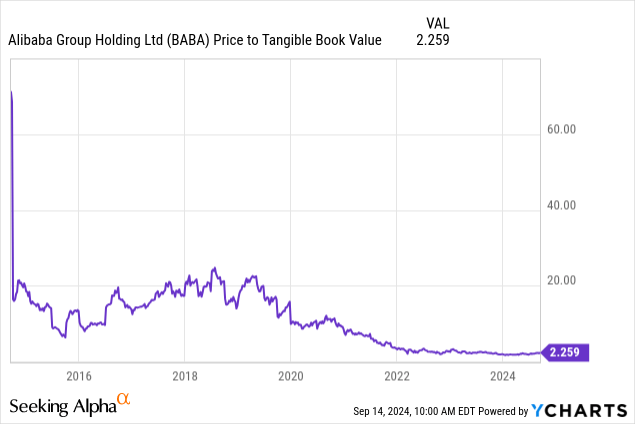

It is also unlikely that you will lose a lot of money if you own BABA here for the long-run. There is a lot of underlying value with almost half of the market capitalization supported by tangible assets.

But retailers can trade cheap when their margins look trend down.

We also think that these levels of margins have come as a result of very high levels of reinvestment into the business. So real owner’s yield, (possibly measured with free cash flow) is far lower. The stock can dive again if we hit a global recession and those earnings can at least evaporate by 50%. We also will likely see an expanding level of investments in the Taobao and Tmall Group, which will pressure free cash flow. The same could be said for Alibaba International Digital Commerce Group. BABA looks fundamentally cheap and while it is up from 25% from our February article, the valuation has not really blown up. But the macro environment looks extremely bad and we think this can stay a value trap for a long time. We are downgrading this to a Hold and will monitor the story as it develops.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

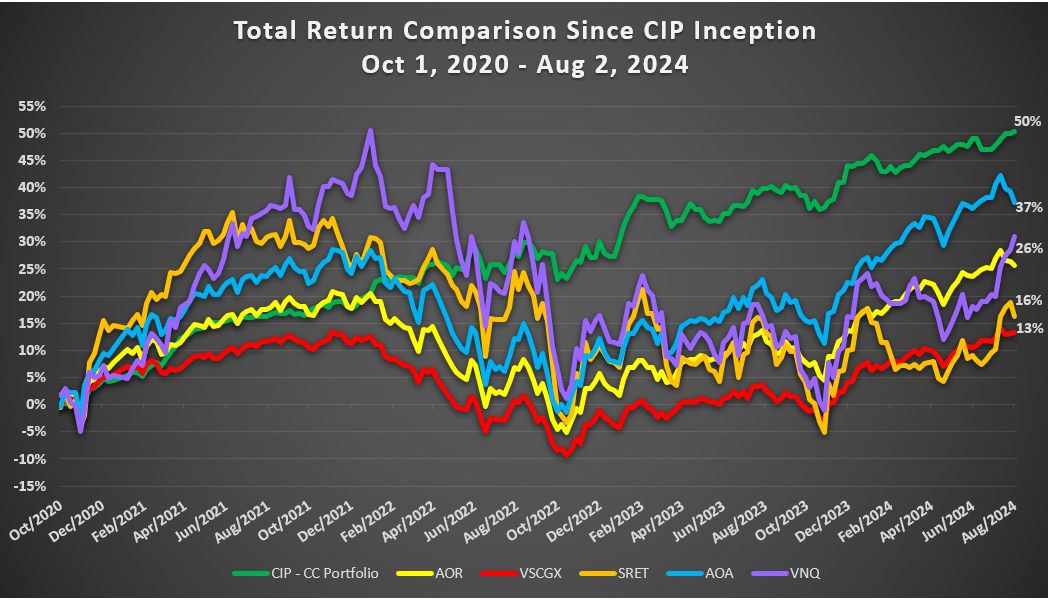

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.