Summary:

- The Chinese government’s recent stimulus package provided a temporary boost to Alibaba Group Holding Limited stock, but technical indicators suggest the momentum is fading.

- Additionally, I don’t expect the stimulus to help with Alibaba’s fundamental challenges.

- These challenges include its pressured profit margins and intensifying competition from JD.com and PDD Holdings.

- BABA’s valuation has become less attractive due to recent price surges, trading at a premium compared to its peers JD and PDD.

William_Potter

BABA stock and China Stimulus

My last work on Alibaba Group Holding Limited (NYSE:BABA) was published shortly after the company reported its FY Q1 earnings in early September. The article served as a review of its earnings. In particular, I expressed my concern about the unevenness of its financials as I see “mixed results in FY Q1 earnings and persisting margin pressures and growth uncertainties” going forward.

Since that writing, a key development that surprised me – and also the market, judging by BABA’s price movements – was the stimulus package the Chinese government has announced. For readers unfamiliar with the details of the package, they are quoted below for ease of reference:

Seeking Alpha News: The People’s Bank of China (PBOC) announced measures on Sept. 24 to lower borrowing costs and inject more money into the Chinese economy, in addition to easing mortgage payment burdens for households. Also, the PBOC said it would cut the cash reserve requirements for banks by 50 basis points to free up 1T yuan ($142B) in new lending. Meanwhile, the PBOC cut its benchmark seven-day reverse report rate by 0.2 percentage points to 1.5, among other interest rates.

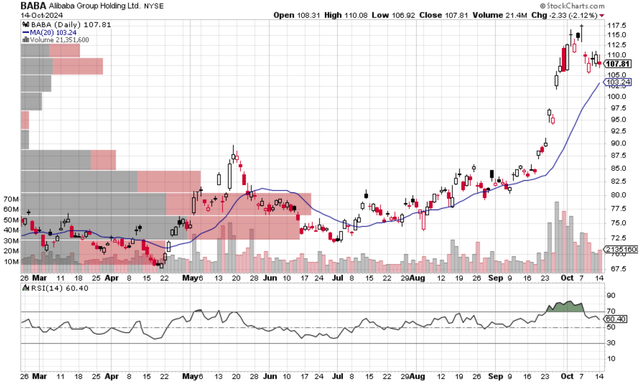

After the stimulus package was unveiled, BABA stock prices enjoyed some of its best rallies, as seen in the next chart below. Against this background, the thesis of this article is to explain A) why the momentum generated from the stimulus package is losing steam judging by the technical trading patterns, and B) why the stimulus package could not solve the fundamental problem that BABA faces in terms of profitability and growth potential.

Let me start with the technical trading patterns. Judging by the price-volume pattern and Relative Strength Index (“RSI”) shown above, I see a lack of indicators suggesting further upward movement in its stock price in the near term. Firstly, the price action of BABA has entered a consolidation pattern since early October in my view. The price has fluctuated within a relatively tight range of $105 and $115 for about two weeks now. Its current price now sits slightly above the 20-day moving average (“MA”) of $103 only. Secondly, the trading volume has become much lower in the recent trading days compared to those immediately after the unveiling of the package as seen. These trading patterns suggest to me that there is a lack of a strong buying interest net to support continued price rallies in the near term.

Finally, the RSI, a momentum indicator, serves as another reflection of the lack of buying pressure. As seen, the stock has been in an overbought regime for about two weeks since the release of the stimulus package, with RSI exceeding 70. However, the RSI has cooled off substantially in the past 1~2 weeks and is currently hovering near a level of 60.

Next, I will shift to the longer-term and fundamental aspect and explain why I am not optimistic about the stimulus package to solve the fundamental problem facing BABA or China’s economy.

BABA stock: profitability in focus

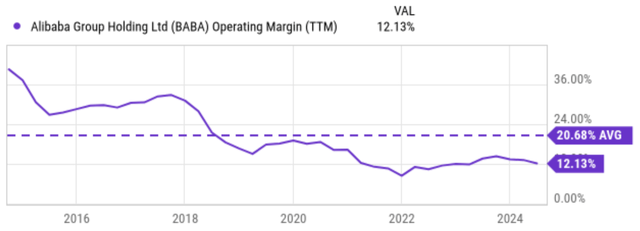

As argued in my earlier article, BABA’s profit margin has been under pressure due to higher costs (ranging from goods sold, SG&A expenses, etc.). As illustrated by the chart below, in the past 5 years, despite some fluctuations, its operating margin declined from over 36% to the current level of 12.1% only.

Looking ahead, I see several reasons that could keep challenging BABA’s profits. I will detail two of them here: the macroeconomic uncertainty and also the competition intensification in the sector.

As just mentioned, I don’t expect China’s recent economic stimulus policies to solve these problems for BABA at a fundamental level. Instead, I am afraid that China’s recent economic stimulus policies may not yield the desired macroscopic results at all, for several reasons. My first concern is that these stimulus policies could further raise the country’s debt burden and strain the local government’s finances. China’s economy is already grappling with a significant debt burden, particularly at the local government level.

CNBC report: China’s local government debt problems are a hidden drag on economic growth. In understanding China’s persistent consumption slowdown, analysts are looking at the connection between China’s real estate slump and local governments’ financing. “Macroeconomic headwinds continue to hinder the revenue-generating power of China’s local governments, particularly as related to taxes and land sales,” said Wenyin Huang, director at S&P Global Ratings.

The implementation of new stimulus measures could further exacerbate this problem in my view, leading to concerns about financial stability and potential debt defaults. Additionally, I am also skeptical that these stimulus measures can address the underlying structural issues — at least not in the near term — hindering China’s technological innovation and tech-oriented investment — where BABA’s core business is exposed.

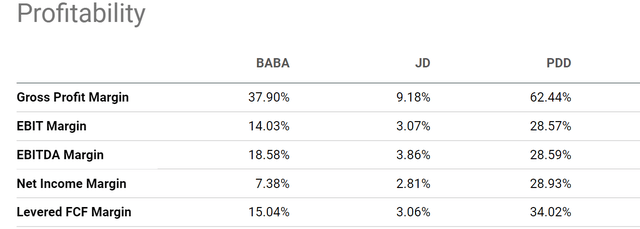

Besides the macroscopic uncertainty, I am also concerned about the competition intensification in the sector. As an example, the chart below provides a detailed comparison of the profitability metrics for BABA against two of its close domestic peers: JD.com (JD), and PDD Holdings (PDD).

As seen, the good news is that BABA demonstrates stronger overall operating profitability than JD. The key reason in my mind is that BABA’s business model is primarily focused on its marketplace platform, where it connects buyers and sellers. In contrast, JD operates a more vertically integrated model, owning and managing its inventory. JD’s model is therefore more capital-intensive and tends to lead to lower profit margins due to the costs associated with inventory management and logistics. However, the upside is that JD’s model tends to allow better quality control, customer satisfaction, and also customer loyalty.

The bigger threat comes in PDD, though, in my view. PDD’s business model also focuses on connecting buyers and sellers through its platform. Just like BABA, this model also allows PDD to avoid the costs associated with inventory management, logistics, and physical stores. However, PDD has several key differentiators that help to position itself as a value-for-money platform. The PDD platform blends shopping with social networking effectively and caters to a broader range of consumers, especially those with lower purchasing power (which is the dominant demographic in China and many parts of the world). As a result, as illustrated by the chart below, PDD boasts far superior profitability metrics over BABA across all metrics. Starting with the top line, PDD’s gross margin of 62% almost doubles BABA’s 37.9%. In terms of the bottom line, PDD’s net profit margin of 28.9% is almost 4x that of BABA’s 7.4%.

BABA stock: valuation is not that attractive anymore

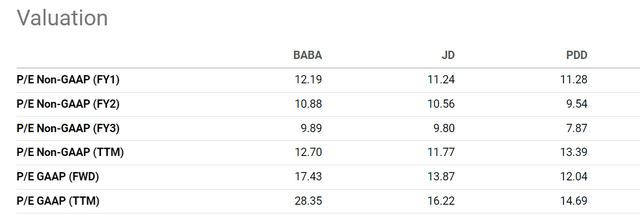

A positive mentioned in my earlier article was the cheap valuation. However, this positive has diminished substantially since that writing given the large price surges since then. As seen in the next chart below, BABA now trades at about 12.2x FY1 P/E (on a non-GAAP basis). Based on non-GAAP P/E ratios, BABA trades at a slight premium compared to JD and PDD. The non-GAAP P/E ratios for FY1 are 11.24 for JD and 11.28 for PDD. However, BABA’s valuation becomes significantly pricier when considering GAAP earnings. As seen in the chart, the GAAP P/E ratio for BABA’s forward year is 17.43, while for JD and PDD it is 13.87 and 12.04 only, respectively.

Given the competitive landscape mentioned above and BABA’s profitability pressure, I find it difficult to justify the valuation premium here.

Other risks and final thoughts

A key upside risk involves BABA’s bet on its artificial intelligence products and services. As part of the Cloud Intelligence Group, BABA’s AI-related growth was more than 100% YOY in the past quarter. The global demand for AI is very likely to further accelerate in my view for the years ahead, and BABA is well-positioned to capitalize on this trend. The company is not only a leading provider of cloud/AI services in China, but is also aggressively expanding its availability zones overseas. As an example, according to this recent CNBC news:

CNBC news (May 2024): Alibaba expanded the availability zones of its cloud computing products to Mexico for the first time, and it will build new data centers in key markets including Malaysia and South Korea. To reignite that momentum, Alibaba is betting on signing up more customers and its AI products.

All told, I am seeing no clear alpha from the stock under current conditions, and thus rate the stock as HOLD. BABA has demonstrated strong profitability in the past and is well-positioned in certain growth areas such as cloud and AI, but the company currently faces several headwinds that warrant a cautious stance. The intensifying competition within the Chinese e-commerce market, coupled with regulatory pressures and macroeconomic uncertainties, is likely to weigh on BABA’s profit margins going forward. Additionally, the stock’s valuation risks have become relatively heightened due to the recent price surges. The stock is now trading at a P/E premium compared to close peers such as JD and PDD and I find such a premium difficult to justify given the growth and profitability comparison (especially against PDD).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.