Summary:

- Alibaba’s stock made gains from late September into early October due to the monetary stimulus for the Chinese economy.

- But the stimulus isn’t expected to fuel economic growth in a significant way, and from Alibaba’s perspective, it’s worrisome that the consumer economy in particular looks underwhelming.

- It doesn’t help that the stock’s P/E is high now either, and compares unfavorably to peers, even though the company’s performance doesn’t merit a premium valuation right now.

Robert Way

Since I last wrote about China’s e-commerce giant Alibaba (NYSE:BABA) in August, its price is up by an impressive 20%. I didn’t see any catalyst for its rise at the time, going by its underwhelming results, even as its market multiples looked alright.

But a catalyst did appear. In the form of a monetary stimulus to the Chinese economy. A spate of monetary easing measures by the country’s central bank, People’s Bank of China (PBoC) in late September, resulted in a rally in China-focused stocks. The Shanghai Composite (SHCOMP), which was going nowhere until then in 2024, is up by more than 20% since PBoC’s measures and more than 10% year to date. The anticipation of a fiscal stimulus also supports them further, though its extent is only speculative right now.

Price Returns, BABA and SHCOMP (Source: Seeking Alpha)

The question for Alibaba, though, is whether the macroeconomic story is enough to sustain its price rally. Here I argue that it isn’t and that signs of a come-off are already visible.

China’s economy still looks lackluster…

The stimulus measures could impact China’s growth positively. But only a bit. Goldman Sachs raised its forecast for 2024 from 4.7% to 4.9%. And from 4.3% to 4.7% for 2025. However, this is little solace for the following reasons:

- With growth at 5% in H1 2024, the GDP is actually expected to see a slightly slower increase in H2 2024 even now.

- Even with the forecast upgrade, the figures for both 2024 and 2025 are still lower. China’s trend growth is at 5.9%, where trend growth is defined as the average growth of the economy in the last 10 years. Further, the gap between the forecasts and pre-COVID-19 trend growth is even higher, at 7.7%.

- Not all forecasters are positive. In its just released World Economic Outlook, the IMF slightly reduced China’s growth outlook to 4.8% from 5% earlier. It also maintained its forecast for 2025 at 4.5%. The fund further points out that “Deeper- or longer-than-expected contraction in China’s property sector, especially if it leads to financial instability, could weaken consumer sentiment…”

… which reflects in retail sales

For Alibaba, the macroeconomic context is important given its massive domestic e-commerce segment, the Taobao and Tmall Group [TTG]. The division brought in 46% of the company’s total revenues in Q1 FY25, and its net income was higher than the company’s total net income due to losses in other divisions. But support from the segment is limited, with a 1% YoY revenue contraction during the quarter.

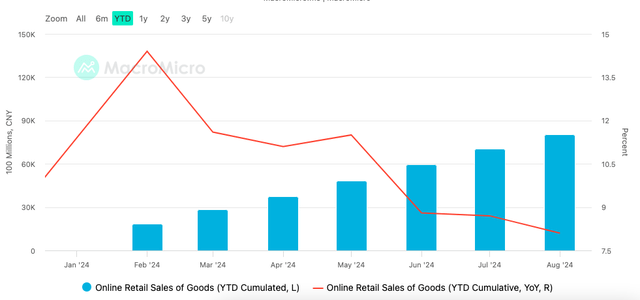

China’s online retail sales figures available for up to September don’t show improvements either. As the chart below shows, cumulative online sales growth has broadly been winding down since February and up to August. There’s some hope though, as official data for the first nine months of the year sees some improvement to 8.6% YoY, compared to 8.1% up to August. More recently, the company has reported strong demand from its Single’s Day campaign, but how far these developments translate into quarterly figures remains to be seen.

Source: MacroMicro

Doesn’t compare well with peers

Based on relatively underwhelming macro trends and forecasts, it’s hard to see any upside to Alibaba’s financials for now. But the price gains on news of the stimulus have raised the trailing twelve months [TTM] GAAP price-to-earnings (P/E) ratio to 26.4x.

It might have come off from 30.9x in early October, but it’s still higher than the 21.9x level at the time I last checked. Moreover, it’s still close to the highest levels in the past year (see chart below).

TTM, GAAP P/E (Source: Seeking Alpha)

Importantly, at this level, the ratio is unattractive compared to BABA’s peers like Temu owner PDD (PDD) and JD.com (JD), which are trading at 13.9x and 14.8x, respectively. If Alibaba’s financials were commensurately superior, the premium could still be justified. But that’s not the case either.

During the last TTM, Alibaba’s revenue growth at 5.9% is nowhere close to the 106.7% increase for PDD, even though it’s slightly ahead of JD, which grew by 3.3%. To be fair, PDD’s revenues are still less than half those of Alibaba’s, which explains part of the growth. But the fact remains – PDD’s diluted EPS growth of 137.7% over this time is also far ahead of Alibaba, which has actually seen a 14.7% decline. In fact, even JD has seen much better EPS performance than Alibaba, with a very healthy 45% rise in EPS.

There’s something to be said for Alibaba’s promising cloud services segment’s potential to contribute to profits. After seeing a 49% rise in the last financial year, the segment saw a 155% YoY rise in EBITA in the latest quarter. But as I pointed out the last time, it’s still too soon to bet solely on it right now. For context, in the past quarter it contributed to less than 11% of the company’s revenues and just 5.2% to the adjusted EBITA. In the meantime, the gap between BABA’s and its peers P/Es is still rather big, especially considering the present financials.

What next?

With this as the backdrop, it’s little wonder that BABA has already come off from the highs of early October by almost 17%. Sure, this could be a reflection of profit taking after the stock reached its highest levels in a year, but it also shows that there isn’t sustained optimism on its prospects either.

China’s stock markets might have received support from a monetary stimulus, but going by forecasts, that’s unlikely to stop macros from fizzling out for the remainder of 2024 and into 2025. This can continue to show up in TTG’s underwhelming performance, which doesn’t sit well with the stock’s high P/E and unconvincing comparison with peers. At any other time, BABA would be a Sell. But considering that its forward non-GAAP P/E at 11.4x is still lower than the five-year average of 16.6x, I’m retaining a Hold rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—