Summary:

- With Alibaba’s domestic e-commerce segment, TTG, struggling, as competition intensifies and online retail sales’ growth softens, can the company revive perfomance?

- The Cloud Intelligence Group certainly shows promise from a profits’ perspective, with a 155% YoY EBITA growth in Q1 FY 25, which could outpace TTG’s absolute EBITA by FY28.

- However, it remains to be seen whether this profit growth can continue. In the meantime, there continues to be risk from TTG’s lacklustre performance.

- Despite attractive forward multiples, Alibaba is then a wait and watch stock, leading to a Hold rating.

Robert Way

When I last wrote about China’s e-commerce giant Alibaba (NYSE:BABA) a couple of months ago, the challenges it faced looked far more daunting than the upside presented by its muted market multiples. This resulted in a rating downgrade to Hold.

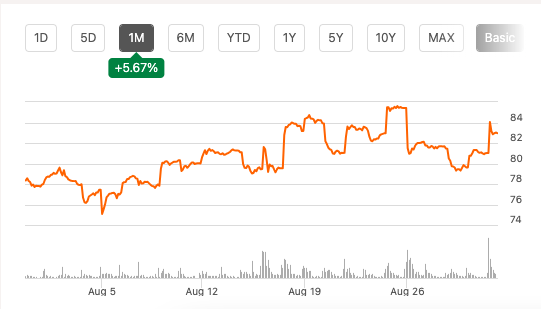

However, the stock is up by 12% since, with a 4.6% single-day increase following its first quarter results (Q1 FY25, year ending March 2025) a couple of weeks ago. This is encouraging. But the question is, can it be sustained, especially as the company’s domestic e-commerce segment sags?

Price Chart, 1m (Source: Seeking Alpha)

Focus on domestic e-commerce and cloud intelligence

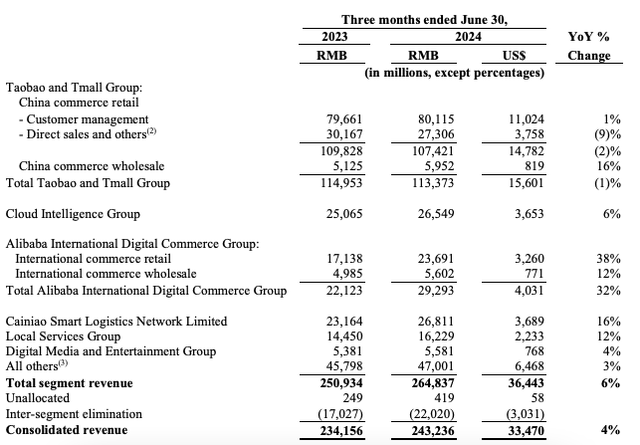

The drag on Alibaba’s revenue growth is undeniable. At 4% year-on-year (YoY) in Q1 FY25, it’s much lower than the compounded annual growth rate [CAGR] of 7.3% over the past three years.

The drag comes from the big domestic e-commerce segment, the Taobao and Tmall Group [TTG] (see table below), which brought in 46% of the revenues during the quarter. This is disappointing, and even more so going by its huge profit contribution.

That its adjusted EBITA is higher than the company’s total number, as other segments lose money, puts it into perspective. It’s even worse news that challenges likely to persist for it, especially as Alibaba loses market share to competitors.

But the company has a strategy. And that’s to grow its Cloud Intelligence Group, which is seeing a fast rise in its earnings, albeit with a small base, and is also the biggest contributor to EBITA after TTG. Can it happen, though?

Revenues, Q1 FY25 (Source: Alibaba)

TTG’s financials worsen

Let’s first look at TTG. Right from the word go, TTG’s challenges are more than evident. It saw a 1% year-on-year (YoY) contraction in revenues in the latest quarter. This compares unfavourably to the segment’s already softening growth of 5% in FY24. The adjusted EBITA also saw a 1% YoY decline compared to a 3% increase in FY24.

While the fact that gross merchandise value [GMV] grew by high single digits is a positive, it’s not comforting. The same trend was reported in Q4 FY 24 as well, but it hasn’t translated into revenue growth, quite the opposite.

The one positive, however, is that Alibaba adds that orders increased in double digits YoY, which isn’t something mentioned in the last earnings report. This could suggest that the company’s price cuts undertaken last year to stay competitive are starting to pay off. But still, it’s too early to say whether and when it will show up in the financials.

Challenging market conditions for domestic e-commerce

This is especially so as China’s online retail sales growth figure isn’t encouraging either. The number has grown by 9.5% YoY for the January-July period, a come-off from the 11.5% YoY figure seen for the January-May period, the last I checked.

Added to this is the heating up in competition. Following its results, Temu owner PDD Holding’s (PDD) co-founder Chen Lei said “Competition is here to stay and is expected to intensify in our industry”, adding that ““High revenue growth is not sustainable, and a downward trend in profitability is inevitable.”

PDD has been growing at a scorching rate, with a CAGR of 58.4% over the past three years. With a market share of 26% as of 2023, the company has eaten into Alibaba’s share, which fell to 46% in 2023 from 52% in 2021.

While Lei’s latest statement sets expectations for the company, and might even suggest that Alibaba can reclaim some lost share, it can’t be taken for granted. What it does indicate is that the market isn’t in a truly conducive place for TTG’s growth right now.

Cloud intelligence Group is promising

However, Alibaba isn’t just working on a revival in its online retail sales, it’s also growing its Cloud Intelligence Group. In its strategy update letter, it mentioned its focus on AI as one of the strategic directions for it. Now, AI has applicability across business lines, but it’s hard to miss that this followed the company’s focus on invigorating the group.

This was evident in price cuts for over a hundred products in Q4 FY24 and focus on “high-quality revenues” as opposed to “low margin” ones. And it appears to be paying off. Here’s how:

- The segment showed a pickup in revenue growth to 6% YoY from 3% YoY the quarter before.

- Notably, it says AI related products saw a triple digit revenue growth.

- The AI Cloud Platform’s paying users increased by 200% quarter-on-quarter (QoQ).

- The segment’s EBITA grew by a huge 155% YoY in Q1 FY25 compared with an already robust 49% increase in FY24.

- It has also improved the adjusted EBITA margin to 8.8% compared to 5.6% in Q4 FY24.

Can cloud intelligence’s profits exceed TTG’s?

If the cloud intelligence segment continues to grow its EBITA at the latest rate, by the end of FY28, it would outstrip TTG. This can be a significant development considering that at USD 322 million, the figure is just 5% of TTG’s EBITA as of Q1 FY25.

Further, if the revenue growth rate continues at the present rate as well, by Q1 FY28, its revenues will be 30% of TTG’s, up from 23.4% as of Q1 FY25. This, of course, is nowhere close to the progress possible on the EBITA front, but it’s still encouraging.

Moreover, the company has other growth areas in Alibaba International Digital Commerce [AIDC], which saw 32% YoY revenue growth in Q1 FY25 and Cainiao Smart Logistics Network, which saw a 16% YoY revenue growth. And they aren’t small in size either, bringing about a fourth of the company’s total revenues in the quarter.

The risks

Alibaba’s future looks promising from this standpoint. But there are risks ahead. The most obvious one being that the market environment for TTG can result in a deeper drag than is being witnessed presently. While there are green shoots in the segment, they aren’t enough to suggest that growth will certainly come back soon.

Next, while the profit growth for cloud intelligence is certainly impressive, it remains to be seen whether it can continue. This is particularly worth watching from FY25 onwards when the favourable impact of price cuts and strategic targeting of revenue wears off. It will determine whether or not the segment can take over TTG in absolute profit levels anytime in the foreseeable future.

Finally, while AIDC continues to see growth, it always runs the risk of adverse developments in foreign markets, as I discussed the last time as well. If the segment is impacted, the company’s growth can slow down further.

What next?

The risks might not play out, but even if things continue to remain the way they are, it’s still not easy to make a Buy case for the stock. Cloud services hold immense potential in bringing profit stability and growth to the company, but I’d like to see sustained three digit growth over time in them to become convinced that it can actually happen.

In the meantime, the domestic e-commerce segment remains lacklustre and a solid turnaround looks unlikely as well, going by the market conditions. This is enough to overwhelm the otherwise attractive forward multiples, with the forward non-GAAP P/E at just 9.1x compared to the stock’s five-year average of 17x. I’m retaining a Hold rating on BABA.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—