Summary:

- Alibaba completed its 3-year regulatory rectification, easing concerns and enabling domestic growth with China’s support.

- Stock trades at $82, with a 2024 target of $94 and a bullish potential of $107.

- Dual-primary listing in Hong Kong targets $12 billion and attracts mainland China investors for increased liquidity.

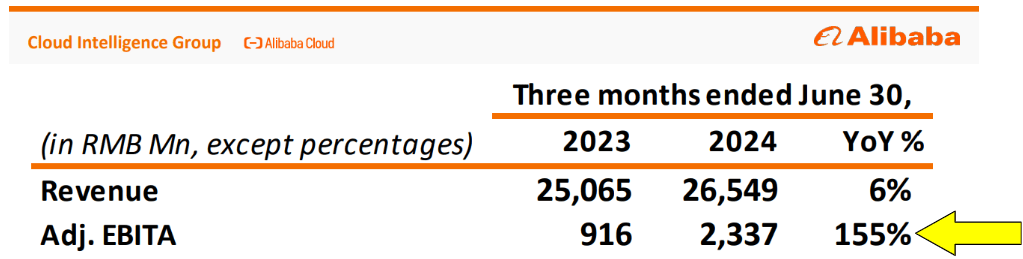

- Alibaba Cloud grew 6% YoY, AI-related revenue surged, and adjusted EBITA rose 155% to RMB2.3 billion ($316 million).

- Despite revenue growth in Q1, Alibaba’s net income fell, and free cash flow dropped, signaling deepening profitability and cash flow concerns.

Robert Way

Investment Thesis

Despite the recent gains since our last coverage, Alibaba Group (NYSE:BABA) (OTCPK:BABAF) remains pressured by the global “Avoid China” / value trap sentiment. Investor skepticism continues to weigh on the stock, impacting its valuation and global expansion.

However, completing Alibaba’s three-year regulatory rectification after its 2021 antitrust delicate signals the potential for a narrative shift. As China bolsters Alibaba’s domestic growth, regulatory concerns are easing, creating a more straightforward path for operational stability and expansion, reaffirming our long-term positive outlook on the stock.

Alibaba has faced intense competition over the past few years, leading to a decline in its market share. Still, recent leadership changes have begun to stabilize the company’s position. Under new CEO Eddie Wu, Alibaba has focused on customer retention, improving user experience, and enhancing its monetization strategy. While its gross merchandise value (GMV) has rebounded in line with the overall retail market, customer management revenue (CMR) has lagged.

However, management is confident that CMR growth will soon align with GMV, driving profitability. With its massive scale, loyal customer base, and strategic focus on innovation, Alibaba remains well-positioned for long-term growth, mainly as it refines its monetization efforts.

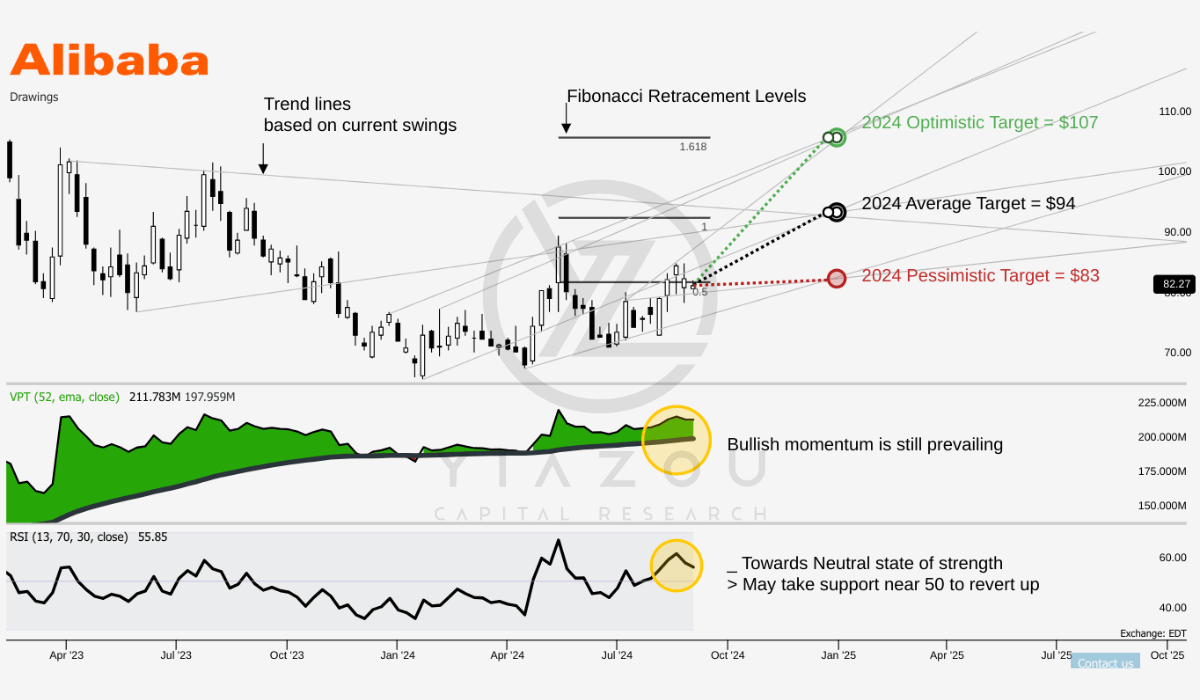

Alibaba Stock May Hit $94 In 2024, Momentum Is Still Bullish

With the current price of BABA hovering around $82, the average price target for 2024 is $94, which aligns with the 1.0 Fibonacci level, indicating potential for a moderate upward trend. The optimistic target of $107 corresponds to the 1.618 Fibonacci level and suggests a significant bullish move if market conditions are favorable. Conversely, the pessimistic target of $83.00 matches the 0.5 Fibonacci level. That reflects potential market downturns or consolidation periods.

The RSI value 55.85 indicates neutral momentum, with no clear bullish or bearish divergence. However, the RSI trend is downward, suggesting a potential weakening in price momentum. Yet, it is still above the critical 50-mark, considered a bottom touchdown for long setups. This indicates that while there is downward pressure, the stock might still find support and potentially rebound.

The Volume Price Trend (VPT) line is currently sideways but is reverting upwards, with the VPT at 211.78 million, above its moving average of 197.96 million. This suggests that buying interest might stabilize after a period of volatility and provide a potential setup for accumulation.

Yiazou (TrendSpider)

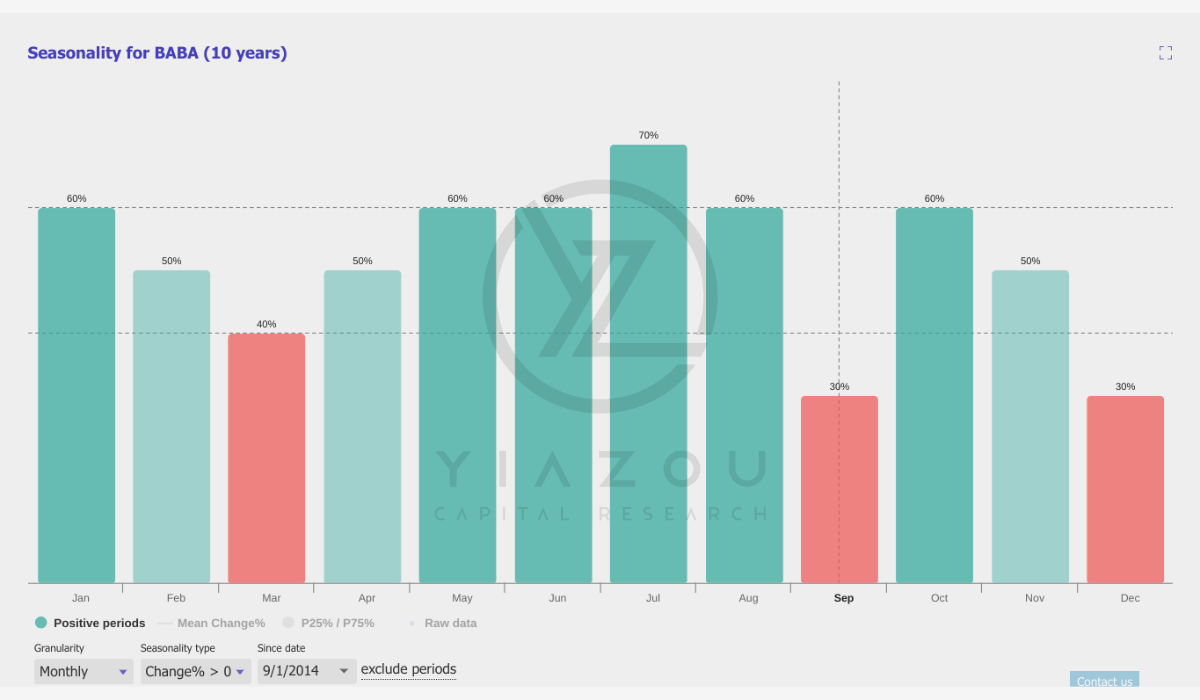

September historically represents a weak month for BABA based on a 10-year seasonality analysis, showing only a 30% probability of positive returns. This significantly underperforms compared to stronger months like July and June, which have shown positive returns 60-70% of the time. With such low historical returns in September, the stock’s outlook remains cautious.

This underperformance may allow investors to wait for a potential dip before entering, especially for those looking to capitalize on more favorable market conditions. If Alibaba continues its seasonal trend, September may offer a lower entry point for investors anticipating a rebound in the months ahead. However, as always, it’s essential to consider the broader market and Alibaba’s strategic developments.

Yiazou (TrendSpider)

Alibaba Targets $12 Billion Windfall with Dual-Primary Listing in Hong Kong

Alibaba is shifting its listing status in Hong Kong from secondary to dual-primary. This strategic change targets mainland China’s 220 million stock investors and unlocks up to $12 billion in capital. This substantial funding will improve Alibaba’s financial stability and market valuation. Alibaba’s business relies heavily on China, where it generates the most revenue, and a dual-primary listing aligns Alibaba with its core market.

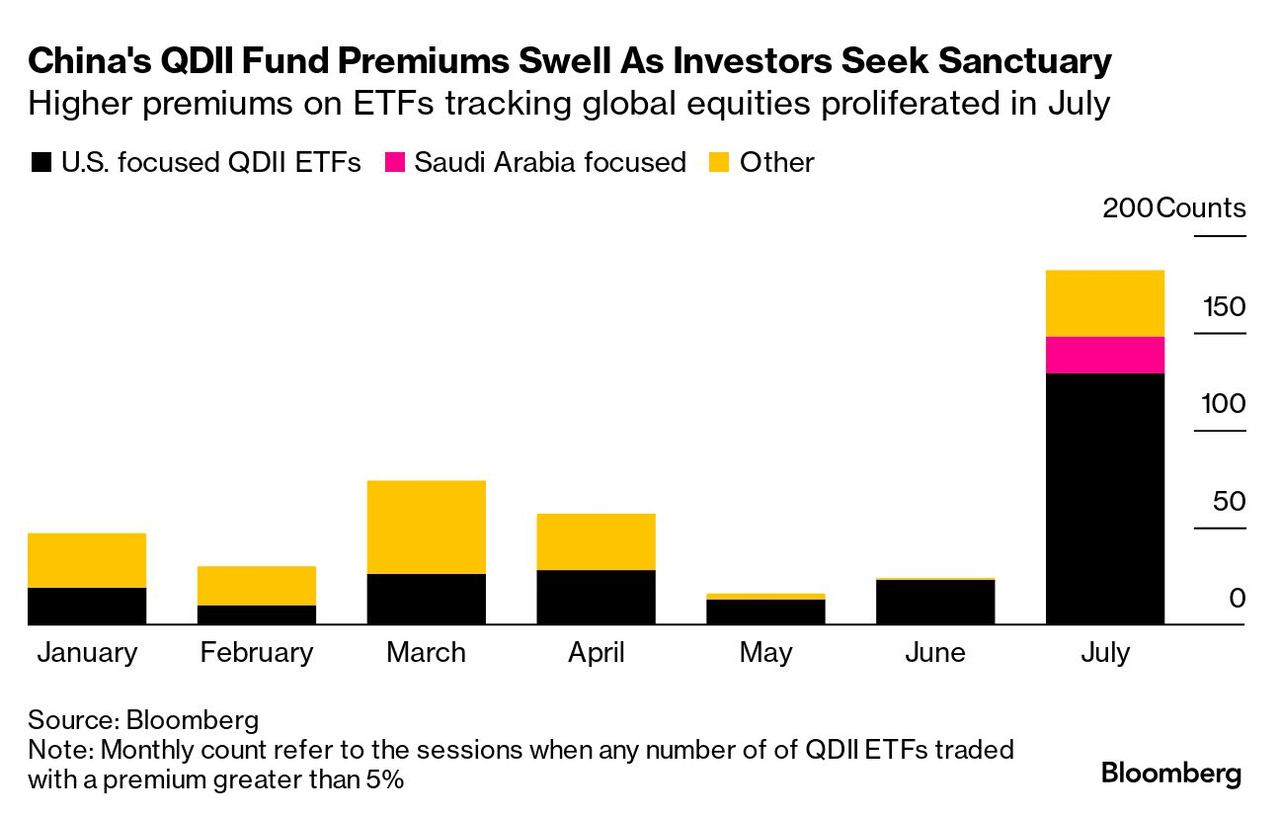

With the shift in listing (effective on August 28), Alibaba is set to qualify for the Stock Connect program. This program lets Chinese investors buy shares of Hong Kong-listed companies and has gained popularity for diversifying domestic investments. Inclusion in this program could attract significant mainland capital.

Mainland investors make up about one-third of the Hong Kong stock exchange turnover, holding roughly HK$2 trillion in stocks, and Alibaba’s market cap is HK$1.5 trillion (~$200 billion). This presents the potential for increased liquidity and trading volume. The dual-primary listing aligns with a broader trend in Chinese tech. Companies like Tencent (OTCPK:TCEHY), Meituan (OTCPK:MPNGF), and Xiaomi (OTCPK:XIACF) benefited from the Stock Connect program, and these stocks saw significant gains after inclusion.

With that, Alibaba’s performance could similarly improve. Precedents like Tuhu Car and Shandong Hi-Speed Holdings saw stock price jumps. After the news, Alibaba’s shares rose in Hong Kong, while the Hang Seng Index fell slightly. Looking forward, this suggests that the positive market sentiment for Alibaba founders’ aim to share capital gains with Chinese investors is nearing completion. Therefore, this could enhance Alibaba’s stock’s reputation and valuations in the domestic and US capital markets.

Bloomberg Alibaba’s E-Commerce Growth Driven by Tech and Customer Engagement

Alibaba is the leading e-commerce player, with the main platforms driven by Taobao and Tmall. The company’s objective has been to enhance the user experience in diverse ways, with the strategy ensuring user retention and higher purchase frequency. This is demonstrated in the positive results of such efforts in Q1 fiscal 2025: high-single-digit online GMV growth and double-digit order growth YoY, which bear testament to solid increases in active user engagement and purchase frequency.

Additionally, Alibaba’s user retention and engagement matter much more, equating to a higher customer lifetime value. Growth is fueled by investment in price-competitive products, customer service, membership benefits, and technology. Further, the number of members of 88VIP, representing Alibaba’s premium customers, grew in double digits to over 42 million members in Q1. Increasing the number of premium memberships shows that Alibaba is putting maximum effort into retaining high-value customers. It also invests in technology to continually improve user experience and operational efficiency. In April 2024, Alibaba rolled out an AI-powered marketing tool called Quanzhantui. The system boasts features of automated bidding, targeting optimization, and visualization of performance dashboards. Hence, the adoption rate by merchants is increasing, enhancing Alibaba’s e-commerce revenues.

More importantly, though, Alibaba’s AI-driven strategy gives it a strategic lead in the competitive e-commerce market. Other positives include Taobao and Tmall enjoying stability in market shares since the platforms are now returning to a growth path. The stability in the market share is finally a result of strategic investments in improvement regarding user experience. With that, the 6.18 Shopping Festival has strong GMV growth YoY. Moreover, Alibaba’s user-friendly promotions and competitive pricing have helped it capture a big market share in China.

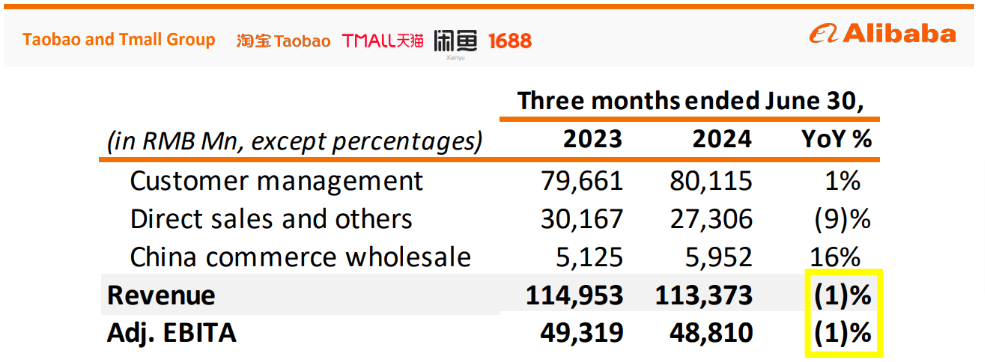

E-commerce platforms were more financially resistant to these upheavals. Revenue from Taobao and the Tmall Group reached RMB113.4 billion for Q1, down just 1% YoY. Expenses were contained, and EBITA was adjusted mainly to diminish the impact, offsetting the slight revenue decline. Adjusted EBITA for the quarter came to RMB45.035 billion ($6.197 billion), down 1% YoY. One of Alibaba’s core strengths is maintaining profitability while implementing growth initiatives. Full-year revenue was up 1% YoY, reflecting the monetization of Alibaba’s large user base. Though the take rate decreased due to low monetization from new models, overall revenue growth was still positive. Indeed, Alibaba balances between growth in user base and GMV, optimizing monetization. Such a balanced strategy supports long-term top-line growth and profitability.

June Quarter 2024 Presentation

Moreover, Alibaba’s International Digital Commerce Group (AIDC) has had 32% YoY revenue growth, reaching RMB29.293 billion ($4.031 billion) in Q1. Cross-border businesses, particularly the Choice business on AliExpress, drove this growth. AliExpress has expanded by including local merchants, enriching product offerings, and meeting local consumer needs, significantly boosting revenue.

Finally, Alibaba’s strategic investments in South Asia and Europe have shown strong results. AliExpress recorded a 17% YoY order increase based on successful market penetration and customer base expansion. Price-competitive and value-for-money products have increased customer engagement and may continue to increase purchase frequency, further driving revenue.

Cloud Powers Ahead: Surging AI Demand Fuels Double-Digit Growth and Global Recognition

Alibaba Cloud (a vital part of Alibaba’s business) has substantial growth in the cloud computing market. For Q1, Alibaba Cloud’s revenue reached RMB26.549 billion ($3.653 billion), a 6% YoY increase. This rise is driven by growing public cloud services and AI product demand. AI-related revenue has grown at triple digits annually. Alibaba’s leads in AI cloud services, like merging cloud and AI, strengthen Alibaba’s growth potential.

Further, Alibaba Cloud is recognized as the top cloud provider in China for AI training and applications. In the 2024 Gartner “Magic Quadrant for Data Science and Machine Learning Platforms” report, Alibaba Cloud was the only Asia-based service provider listed globally. This recognition marks Alibaba’s strong position in the global cloud market, particularly in AI. The company’s focus on open-source development is exemplified by its Qwen 2.0 large language models, which have earned it global developer recognition. Alibaba’s advancements in reasoning, code generation, and mathematics, alongside enhanced safety and support for 27 languages, attract a wide range of clients. For instance, Alibaba Cloud’s AI technology was used in 14 Olympic (Paris 2024 Olympics) venues to create real-time, high-fidelity 360-degree replays.

Financially, Alibaba Cloud shows stability with solid revenue and profitability. For Q1, Alibaba Cloud’s adjusted EBITA rose by 155% to RMB2.3 billion ($316 million) based on an improved product mix and operational efficiency. Despite ongoing investments, Alibaba Cloud maintains a substantial margin. The triple-digit growth in AI-related revenue indicates high demand for Alibaba’s AI solutions. Therefore, the significant client adoption of Alibaba’s large language models highlights its competitive edge in AI.

June Quarter 2024

Alibaba’s Revenue Grows, but Profitability Faces Sharp Declines

Alibaba’s bottom line had mixed results for Q1. The company’s revenue grew 4% YoY; however, profitability and cash flow trends raise concerns. Income from operations declined by 15% to RMB35,989 million ($4,952 million). This drop, amounting to RMB6,501 million, stems partly from last year’s share-based compensation reversal. Even without these adjustments, adjusted EBITA fell 1% YoY to RMB45,035 million ($6,197 million). This signals issues with Alibaba’s operational efficiency.

Further, GAAP net income decreased by 27% YoY to RMB24,269 million ($3,340 million). This decline results from reduced operating income and increased investment impairments, revealing vulnerabilities in Alibaba’s investment strategy. Non-GAAP net income also fell by 9% YoY to RMB40,691 million ($5,599 million), reflecting further challenges in maintaining profitability. GAAP Diluted earnings per ADS dropped 5% YoY to RMB16.44 ($2.26). Non-GAAP diluted EPS decreased by 5%, reaching RMB2.05 ($0.28). These reductions suggest Alibaba’s diminishing ability to derive value.

A major concern is the 26% decline in net cash from operating activities, which puts a question mark on Alibaba’s capability to generate cash from core operations, the only way to fuel growth. Free cash flow plummeted 56% YoY due to elevated investments in Alibaba Cloud infrastructure, working capital changes, and reduced direct sales drove this number down.

The downtrend of free cash flow may severely restrict Alibaba’s capability to invest, repay debt, and return value using dividends or stock buybacks. The contrast between the 4% growth in revenue and the double-digit declines at the bottom line and in free cash flow suggests a slowing, increasingly unprofitable growth. For instance, sales and marketing costs were up 1.7%, while general and admin expenses rose 1.4%. Hence, the company’s focus on preserving the adjusted EBITA margins may sustain some profitability but inhibits the rapid scaling witnessed through modest revenue growth and declining cash flow.

Takeaway

BABA is still under pressure due to persistent global skepticism and the “Avoid China” sentiment. Investor concerns have negatively affected its valuation and impeded it from global expansion. Therefore, completing Alibaba’s three-year regulatory rectification after its 2021 antitrust is likely to signal a shift in narrative, with China driving its domestic growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, 9988 either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have a beneficial long position in the shares of Alibaba Group, through both NYSE: BABA and HKG: 9988. More than 97% of my position is held in 9988 through Hong Kong Exchange.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.