Summary:

- Alibaba remains a strong buy due to its growth prospects in E-commerce, Cloud, and smaller segments like AIDC & Cainiao, despite recent share price increases.

- The company’s dual primary listing on NYSE and HKSE, and the decision to retain Cainiao, enhance its strategic positioning and valuation.

- Taobao & Tmall are stabilizing market share, driven by regulatory easing and a user-centric approach, promising accelerated revenue growth.

- Effective share buybacks and a shift from equity to cash incentives for employees will reduce dilution and benefit long-term shareholders.

vivalapenler/iStock Editorial via Getty Images

I have previously written 2 articles on Alibaba (NYSE:BABA), assigning a strong buy in both. Alibaba was a good buy for a factor of reasons; strong prospects for fundamental growth with E-commerce & Cloud growth acceleration, rapid growth from smaller segments such as AIDC & Cainiao, along with an improved operating structure and an attractive valuation.

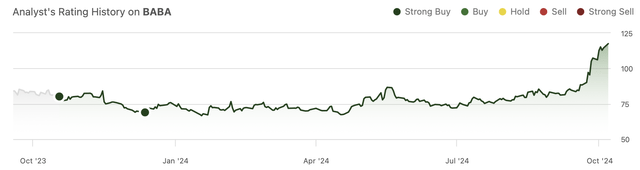

I published my previous article Alibaba: Gets Even Cheaper at just over $71, since that time, the stock price has increased 70%, comfortably outperforming the S&P 500’s return of 23%.

Previous ratings on Alibaba (Seeking Alpha )

Recent Events

Earnings

Since the last article, Alibaba has reported 2 quarters of financials. Growth remains slow, with 3.9% revenue growth in Q1 2025. The slow growth has been driven by continued weakness in the macro environment, along with tough competition within the Chinese E-commerce arena. EPS & FCF performed even worse, decreasing 25% & 52%, respectively. The decline is due to increased investments in Capex & R&D, with the company taking a long-term view towards investments.

Cainiao IPO withdrawn

Alibaba also held a special call to discuss the recently cancelled plans to IPO Cainiao. Instead, the company has offered to buy the remaining stake of Cainiao that it doesn’t already own, which values the entire segment at USD $10.3B.

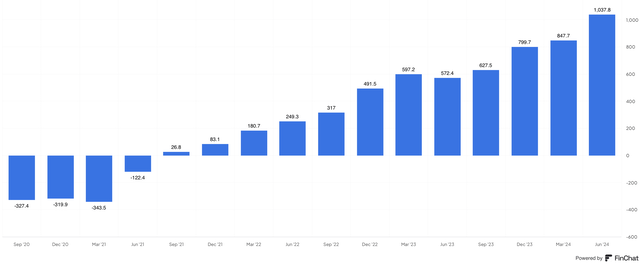

Cainiao revenue growth and profitability (Finchat.io)

Given the company’s strong growth profile and recent improvements in profitability from increased scale efficiencies despite significant investments in cross-border fulfillment capabilities and a one-time impact in Q4 2024 from employee retention incentives in connection to the cancelled IPO, the company is earning roughly $343M on a TTM basis. This means the company is being valued at 33x EBITDA for a company that is still clearly investing significant amounts in growing and expanding geographically; I believe this to be a fair valuation.

This valuation gives investors an extra insight into the sum of the parts of Alibaba Group. The decision to keep the company within the group, I believe, is the right one. Delivery is a key aspect of the E-commerce landscape, if Alibaba gave up control of its delivery segment which is deeply ingrained in the operations of all segments, it could have added significant risks to both Taobao & Tmall and to the International digital commerce group as well.

Hong Kong primary listing

Alibaba recently completed the process to be dual primary listed, with the company shares being traded on both the NYSE and HKSE. Reportedly, the listing “could unlock as much as $19.5 billion in Chinese capital” according to Bloomberg. I believe this to be another positive step, the shares rose 4.2% on their first day of trading, demonstrating the potential significant value gap that has been created over the past several years.

Alibaba remains attractive

Despite the recent run-up in share price, I believe the company remains a buy today, in the rest of the article, I will lay out my reasoning.

Taobao & Tmall Group green shoots

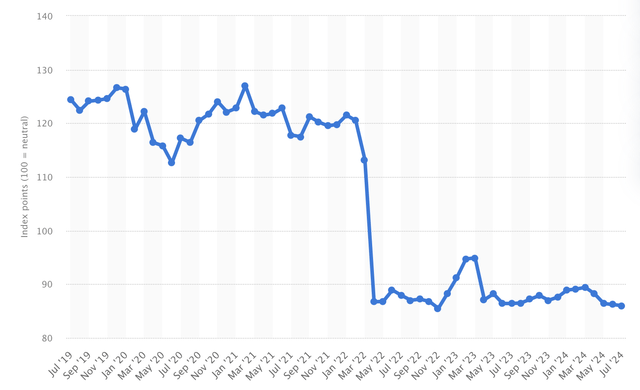

Taobao & Tmall have long been the core of Alibaba, In recent years they have faced significant headwinds from; regulation, competition and a weak economy and housing market, causing consumer confidence to be weak, as demonstrated in the graph below from Statista.

China consumer confidence index (www.statista.com)

I expect regulatory headwinds to ease, allowing the company to grow faster and act more aggressively against competitive threats (although within limits). This belief stems from the recent announcement that after 3 years and $2.8B in fines, Alibaba’s “rectification” process has been completed. The company believes that this will evolve into “a more stable operating environment in China”. I believe this to be true, allowing the company to be more competitive, which has potentially led to some of the market share stabilization.

Competition has been a headwind to Alibaba’s growth over the last several years, with rivals such as Pinduoduo (PDD), Douyin and Kuaishou taking market share from incumbents like Alibaba and JD.com (JD). Competition in the E-commerce space will likely remain fierce for the foreseeable future. However, I believe green shoots are starting to appear after CEO Eddie Wu took over leadership and shifted focus towards price competitiveness, service and user experience in a user-centric approach. In Q4 2024, GMV growth grew double-digit as the number of quarterly buyers and purchase frequency improved, suggesting more people are using Alibaba to purchase everyday items. In Q1 2025, the positive progress continued, with market share reportedly stabilizing, breaking the trend of losses over the past several years. This stabilization is no coincidence, I believe it is the cumulative actions of putting users first, resulting in the platform becoming more attractive to both users and merchants alike.

This strong underlying progress has been masked in the numbers because of an overall lower take rate, causing GMV growth to outpace that of CMR growth. The lower take rate is due to 2 factors. First is the outperformance of Taobao vs. Tmall, this is due to the lower-priced nature of products on Taobao that are currently more appealing to consumers than more branded products that you would find on Tmall, Taobao inherently has a lower take rate, therefore causing the average overall to decrease. Second is the introduction of new models, which currently have a lower take rate.

I expect over the next year, CMR growth will accelerate, closing the gap to GMV growth. This will be driven by the increased monetization of the new tools, along with the roll-out of a new advertising tool, Quanzhantui. I believe the closing of the value gap will result in a revenue acceleration, likely around the 10% mark going forward.

Cloud Acceleration

Over the last few quarters, the Cloud group has seen slight revenue acceleration to 5.9% in Q1 2025, after experiencing multiple headwinds from the loss of a major client, reduced demand from the Internet sector and the normalization of CDN demand after COVID. I believe this revenue acceleration will continue long-term for 2 reasons.

The first reason is long-term thinking, over the past several years the company has taken several actions to improve the long-term prospects and quality of the business, including price reductions to increase the adoption of cloud in China and the revenue shift from low-margin project-based revenue towards public cloud revenue. These actions have resulted in slower growth for the segment, however longer term the business will be far more profitable and achieve higher ROIC as low-margin revenue rolls off over time, leaving a business that is similar in characteristics to that of its western counterparts’ cloud units. This improvement in profitability is evident already in the numbers. However, low margin business continues to roll off, causing headwinds to growth in the short term while uncovering a highly profitable public cloud business.

The second reason is AI growth, Alibaba has been a leader in AI since it became so popular, championing an open-source approach to drive adoption of its cloud service. Over the past several quarters, AI-related growth has sustained triple-digit growth figures. This high-growth rate means it is becoming an increasing part of the overall revenue mix; I expect over time for this AI revenue to accelerate growth as this mix shift continues, driven by the strong technology capabilities Alibaba has demonstrated and the increasing investments in infrastructure and R&D that Alibaba is committing to growth.

The combination of these two factors means Alibaba will accelerate top and bottom-line growth, resulting in a bigger and more profitable business in years to come.

More effective buybacks

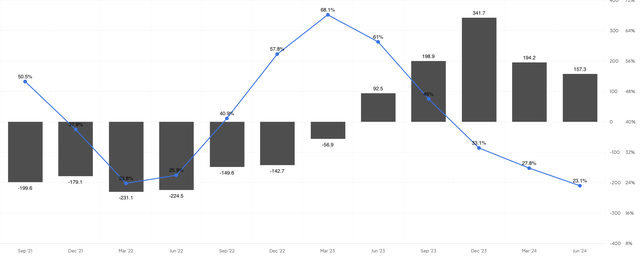

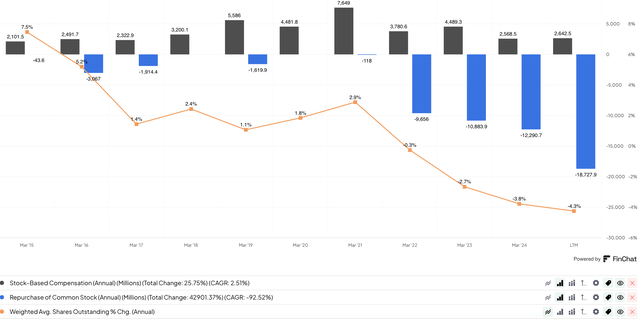

Alibaba share repurchases & SBC (Finchat.io)

Recently, Alibaba has been committing significant capital to share repurchases, resulting in shares outstanding decreasing by 4.3% in the last twelve months when accounting for SBC. These buybacks are accretive to earnings and I believe to be a very good use of capital. However, the reduction in shares outstanding has been offset modestly by SBC headwinds. In Q1 2025, Alibaba made a big change that has gone largely under the radar, Alibaba is changing the way employees are incentivized from equity to long-term cash incentives, which will be recorded as an expense. The result of these actions will be fewer headwinds from SBC dilution, effectively accelerating the reduction in shares outstanding. Given the low valuation of the company, this will be very accretive to long-term shareholders over time.

Takeaway

Despite the recent run-up in share price from several factors, including China’s stimulus, and the addition to the HKSE, I continue to believe that Alibaba remains a good stock to buy.

I believe the Taobao and Tmall Group & Alibaba Cloud segments will experience accelerated growth over the next few years along with the accretive actions from an accelerated buyback that will result in fundamentals improving over the long term, which should benefit long-term shareholders.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, JD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.