Summary:

- Alibaba’s shares have surged 38.30% in the past month, driven by China’s largest stimulus package since the pandemic and positive Q1 2025 earnings.

- Despite recent gains, Alibaba remains undervalued compared to U.S. tech stocks, trading at 11.57 times forward EPS and 15.76 times FCF.

- Risks include potential policy changes by the CCP, geopolitical tensions, and emerging competitors, but Alibaba’s strong balance sheet and liquidity mitigate these concerns.

- With $135.36 billion in cash and investments, Alibaba is well-positioned to benefit from China’s economic growth and stimulus efforts, potentially reaching $150 by end of 2024.

maybefalse

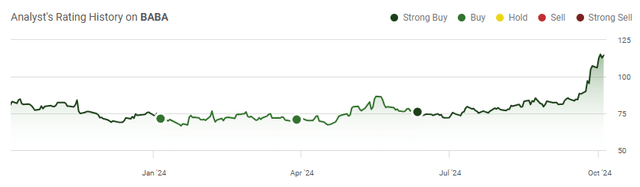

After spending more than a year below $100 and falling to a 52-week low of $66.63, shares of Alibaba (NYSE:BABA) have gone parabolic as they have appreciated 38.30% in the past month and 71.89% from their lows. The bears were in control for quite a while as BABA fell by more than 75% from their 2020 highs when shares exceeded $300. Every negative narrative was thrown at BABA, from China invading Taiwan to delisting fears. No matter what the bear case was, I have been bullish on BABA because China’s economy is too important to the global stage, and as China’s economy expands, BABA should theoretically generate more revenue as its services are relied upon by both consumers and businesses. I thought that the valuation didn’t make sense, considering that at one point, BABA traded at a market cap that was close to the total cash on the balance sheet between cash on hand and long-term investments. Things heated up after China’s Central Bank announced the largest stimulus package since the pandemic in hopes of reaching a target GDP growth of 5%. If China gets anywhere close to this, BABA should be a huge winner, and the macroeconomic landscape is setting up well for its underlying business. I believe that the recent share appreciation in BABA could be just the beginning, as shares still look massively undervalued compared to U.S. tech stocks.

Following up on my previous article about BABA

I wrote my previous article about BABA at the beginning of June (can be read here), and since then, BABA has reported its Q1 2025 earnings, and massive stimulus came out of China. BABA has appreciated by 44.97%, and its total return is 48.13% over this period when the dividend is taken into account. In contrast, the S&P 500 has appreciated by 7.44% over this period, but even though BABA has outpaced the S&P 500 recently, it’s still in the red over the past 5-years by -32.76% while the S&P 500 has appreciated by 94.82%. I am following up with a new article to discuss why I believe BABA will continue to appreciate it, as the recent appreciation could be the beginning of a long-term rally.

Risks to investing in Alibaba

While I am very bullish on BABA, there are many risk factors that may affect my investment thesis. No matter what, the CCP is still in control of China, and at any point, it could change government policies that could impact BABA’s business operations. If the recent moves from China’s Central Bank are unsuccessful and fail to get the economy out of a decelerating environment, then BABA’s business could be impacted by less spending by consumers and businesses. There are geopolitical risks to consider, and if China eventually invades Taiwan, it could pull many nations into a global conflict and potentially cripple the global economy, including China’s. As technology advances, we can see new competitors emerge in the Chinese landscape as the adoption of cloud computing and AI increases. BABA could face competitive challenges that impact its market share and profitability. There is still an underlying sentiment to some degree not to trust the numbers coming out of China, and that could be a red flag from China’s GDP growth to BABA’s financial reporting. Anyone interested in investing in Chinese companies, please do additional due diligence as there are additional risk factors to consider.

Alibaba still looks undervalued to me after going through the numbers

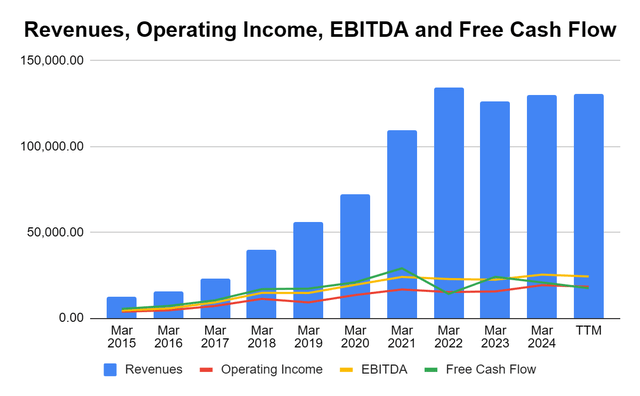

Currently, BABA is trading at a market cap of $266.57 billion as its share price has reached $114.53. When I look at the underlying business, BABA still looks massively undervalued. BABA has $61.77 billion in cash on hand and another $73.59 billion in long-term investments. This places their liquidity at $135.36 billion, which is 50.78% of their market cap. BABA has minimal debt on the balance sheet, with $24.49 billion in long-term debt and $33.04 billion in total debt. When investing in BABA at these levels, you’re getting a net cash position on the balance sheet between current and long-term investments of $102.32 billion in addition to an asset base that is generating $130.75 billion in revenue and $17.44 billion in free cash flow (FCF) over the trailing twelve months (TTM). BABA started the new fiscal year by generating $33.37 billion in revenue, which was an increase of 4% YoY, which is interesting considering that the new stimulus from China’s Central Bank hadn’t occurred. Even with the recent share appreciation, investors are still getting a lot for their money when investing in BABA.

Steven Fiorillo, Seeking Alpha

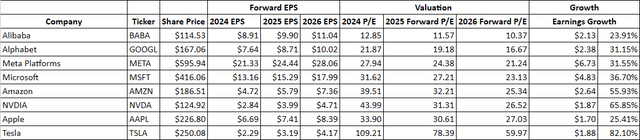

Putting risk factors and business operations aside, BABA looks extremely undervalued, based on the numbers. After looking at the consensus estimates for the Magnificent Seven and BABA, the valuations still seem disproportionate. The cheapest valuation is Alphabet (GOOGL), as it trades at 21.87 times 2024 earnings and 16.67 times 2026 earnings. The Magnificent Seven as a group trades at an average of 44 times 2024 earnings and 28.56 times 2026 earnings. BABA, on the other hand, is expected to generate $8.91 in EPS for this fiscal year and trades at 11.57 times its forward EPS. Looking out over the next 2 years, BABA trades at 10.37 times earnings. Before the share price increase, BABA traded in the single digits on forward valuations across the board. I believe that in addition to getting a great value based on the balance sheet, investors can also get a growing business that is very undervalued compared to how the rest of big tech trades and shares of BABA may close the gap over the next year.

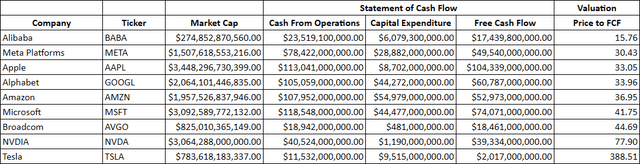

In addition to looking at the forward EPS, I am also looking at FCF because it’s my favorite measure of profitability. I don’t like to measure companies on just one profitability metric, especially one that can be impacted by taxes or charges. FCF is simply cash in vs. cash out and is a harder metric to distort, which is why I am also a big fan of looking at FCF. In the TTM, BABA has generated $17.44 billion in FCF and trades at 15.76 times its FCF. The closest Magnificent Seven company is Meta Platforms (META), as META trades at 30.43 times its FCF of $49.54 billion. There are 4 Magnificent Seven companies that trade for 30-40 times FCF and 3 that exceed 40 times. I want to pay the lowest multiple possible for great companies, and paying 15.76 times BABA’s $17.44 billion in FCF is inexpensive compared to the alternatives.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

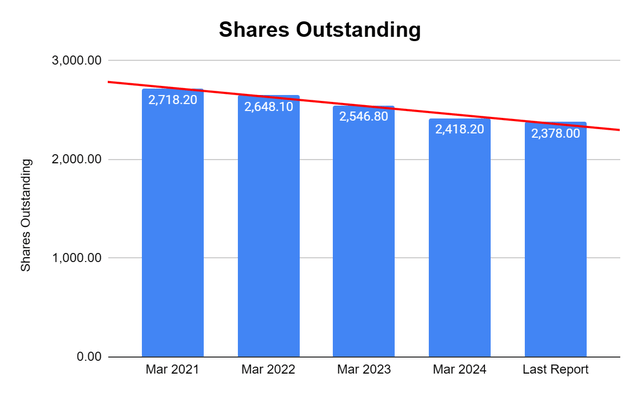

BABA has also been buying back shares by hand. In its most recent quarter, BABA repurchased 630 million ordinary shares or 77 million ADS for a total of $5.8 billion. Over the past 3 ½ years, BABA has repurchased 340.20 million ADS shares or 12.52% of the company. This is another reason why I believe shares are significantly undervalued, as BABA has been implementing a large buyback program while still having over $100 billion in liquidity on the balance sheet. As BABA continues to repurchase shares, it can artificially increase the amount of EPS it generates and even intensify its EPS expansion if revenue and margins improve.

Steven Fiorillo, Seeking Alpha

The recent stimulus should be bullish for BABA as time progresses

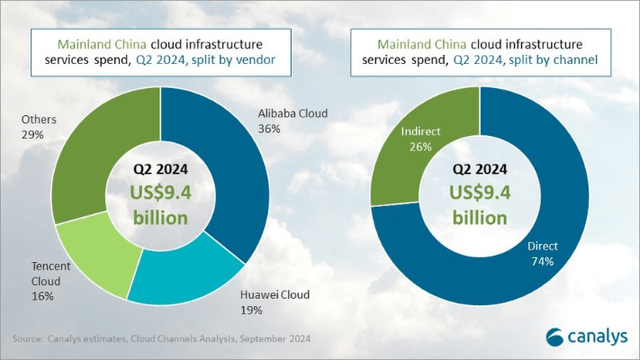

At the end of August, Beijing concluded its probe that lasted 3 years into BABA’s monopolistic practices. The State Administration for Market Regulation indicated that BABA became compliant with its antitrust regulations and achieved good results. This occurred while BABA’s cloud business grew to 36% of Mainland China’s overall spend. During Q2, cloud infrastructure spend in China increased by 8% YoY to $9.4 billion. BABA’s cloud growth was driven by its public cloud business, which generated double-digit growth in Q2. BABA just unveiled over 100 AI models at its recent Cloud event. Within these models were text-to-video tools and specific LLMs designed for automobiles, gaming, and science research. BABA is seeing more major customers migrating to BABA’s cloud for their computer infrastructure for AI development. BABA plans to continue investing in R&D, and AI CapEx as more businesses adopt an AI-driven cloud strategy.

The recent stimulus should be beneficial for BABA as China’s Central Bank is delivering more funding and rate cuts to try to get China’s growth trajectory toward 5%. They will cut the amount of cash that banks must hold in reserves by 50 bps, which will free up roughly $142 billion in new lending capacity. We could see future cuts that are similar to work toward their GDP growth goals. This is bullish for BABA for several reasons. As rates decline and there is more liquidity in the lending market, we should see business expansion across China. This should also help China add 80 million people to their middle class by 2030. BABA should benefit on both fronts because as individuals increase their standard of living, they will purchase goods that many in the U.S. consider normal, which could drive additional e-commerce sales for BABA. If the CCP is able to provide enough stimulus to get GDP growth to around 5%, BABA should be a big winner as it represents 36% of cloud infrastructure. As businesses expand and new businesses emerge, BABA should see increased demand for its cloud and AI offerings. The next several years could be very bullish for BABA as China may no longer be in a deflationary economy.

Conclusion

Many have stayed away from the Chinese trade for good reasons, but for those who are investing in Chinese stocks such as BABA, the past month has been very bullish. BABA is up over 38% this month and still trades at less than 13 times this year’s earnings. BABA has a strong balance sheet with $135.36 billion in cash and investments, which puts its liquidity above $100 billion after the $33.04 billion in total debt has been deducted. BABA is generating more than $17 billion in FCF and using its financial position to invest in its future and repurchase shares. Today, investors can still pay less than 16 times this year’s earnings and 16 times BABA’s FCF for a company that benefits a great deal from China’s stimulus policy. For the time being, BABA and the CCP aren’t at odds as the probe into their monopolistic practices has concluded, and China needs BABA to succeed to help reach their 5% GDP growth goal. I think that BABA is still very undervalued, and I won’t be surprised if we see BABA closer to $150 by the end of 2024 and working its way back to $200 in 2025.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, AAPL, GOOGL, META, AMZN, TSLA, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.