Summary:

- The People’s Bank of China’s (“PBOC”) recent monetary measures, including cuts to reserve requirements and repo rates, aim to revive the Chinese economy and bolster investor confidence.

- Alibaba Group Holding Limited is well-positioned to benefit from these measures due to its strong share buyback program and competitive pricing strategies.

- Alibaba’s valuations are compelling, trading at a significant discount to the sector, with expected earnings growth of 10% CAGR through FY26.

- Despite past antitrust scrutiny, Alibaba’s resolved disputes and the PBOC’s liquidity measures make it a strong buy recommendation.

Robert Way

Investment Thesis

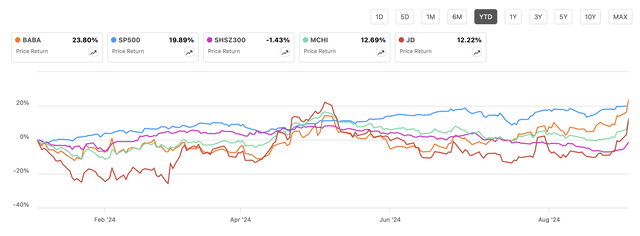

September 24th will be a day to remember for many investors who are exposed to Chinese stocks.

China’s CSI 300 Index (SHSZ300) notched its best gain in almost four years after the People’s Bank of China, or PBOC, announced a slew of monetary measures aimed at reviving the Chinese economy. These include cuts to bank holdings reserve requirements as well as the seven-day repo (repurchase) rates, among other measures.

Exhibit A: Chinese stocks are bid up to their highest levels on an intra-day basis since 2020 after China announced monetary revival measures. (Seeking Alpha)

For now, markets have cheered the moves across most sectors of the Chinese stock market as fiscal conditions are expected to get relatively loose from prior levels.

The impact is not expected to be immediately felt among Chinese consumers who are still shying away from spending at pre-pandemic levels. But these measures should do enough to restore investor confidence in the midterm.

After assessing the full impact of the monetary stimulus announced today as well as the forward outlook, I expect Alibaba Group Holding Limited (NYSE:BABA) to be a solid winner among a few other names that I have been covering lately.

I recommend buying a Buy rating on Alibaba.

Key Takeaways From The Chinese Monetary Policy

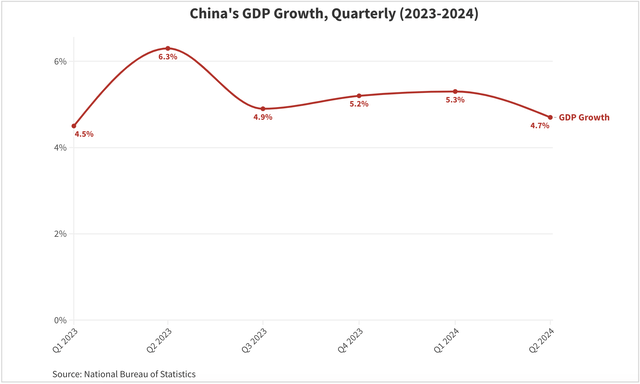

Amid structural issues still plaguing China’s property sector along with a weak consumer, the Chinese government has been attempting to pull many monetary and fiscal levers for quite some time now to revive a decelerating economy. This may have become more of a necessity than a choice for the government since the country’s Q2 GDP dipped below 5%, under the government’s 2024 growth targets of 5% growth.

Exhibit B: China’s GDP by quarter which dipped below 5% to 4.7% in Q2 2024 (Author)

The most recent monetary package announced by the PBOC today is aimed at further invigorating the economy as well as supplanting the economy from various growth pillars. Here are a few takeaways from my perspective:

- The PBOC’s strongest move from their announcement, in my opinion, was to bolster the beleaguered Chinese equity market and restore investor confidence. It did this by unveiling a package allowing institutional investors to use the PBOC’s swap facility, allowing large institutions such as securities firms, hedge funds, etc. to purchase equities on the Chinese stock market.

- Plus, the PBOC also announced initial plans to set up a re-lending facility for listed companies such as Alibaba to buy back shares. This particular move by the PBOC is expected to add at least ~¥800 billion ($113 billion) worth of liquidity support, with ¥500 billion from the swap facility and ¥300 billion from the re-lending facility.

- Additionally, the PBOC has also cut the short-term repo rates by 20 BP to 1.5% while also cutting the bank reserve requirement ratios by 50 BP.

- And finally, in what, I believe, is a mid to long-term impactful move for the Chinese consumer, the PBOC added several measures to help Chinese consumers, especially those exposed to property investments. The Loan Prime Rate will be cut by ~20 BP as well as reducing the down payment for new homes.

- This is another crucial monetary policy item implemented by the PBOC. However, I’m not sure when exactly this tailwind will impact the Chinese consumer since most elements of this policy item were aimed at helping the mortgage payments side of the consumer’s obligations. Still, I feel encouraged by this move to stimulate the consumer since I felt this was essential.

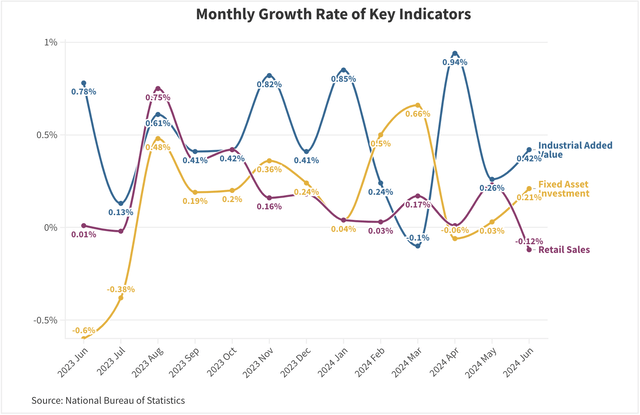

- Until now, most fiscal and monetary measures were not entirely focused on the consumer; thus retail spending was lagging.

Exhibit C: China’s financial metrics for manufacturers vs. consumers (Author)

Why Alibaba Is a Solid Winner Of This Package

If one overlooks the PBOC’s liquidity measures aimed at bolstering the beleaguered Chinese markets that I mentioned earlier in the key takeaways, the consumer-focused measures aimed at the Chinese consumer would probably have a longer-term impact on the economy.

That’s because most of the measures are aimed at alleviating the Chinese consumer’s mortgage expenditure burden, and the full impact could take at least 3-4 quarters to understand how much of a relief it really is for the consumer.

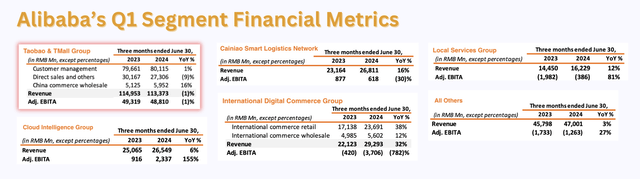

Still, despite this midterm tailwind, Alibaba and another peer, JD.com, Inc. (JD), have begun to price their consumer products aggressively competitively with PDD Holdings (PDD) with clear intentions to capture back some share from some of Alibaba’s peers. On the last earnings call, Alibaba’s management revealed that they saw “steady growth in GMV and order volume driven by a notable increase in purchase frequency” as Alibaba rolled out “attractive prices across diverse shopping needs of consumers.”

Exhibit D: Alibaba’s segment financial metrics (Investor Presentation, Alibaba)

I expect these measures by management to have a moderate boost on Alibaba’s Tmall and Taobao group, which handles most of the consumer-related e-commerce business.

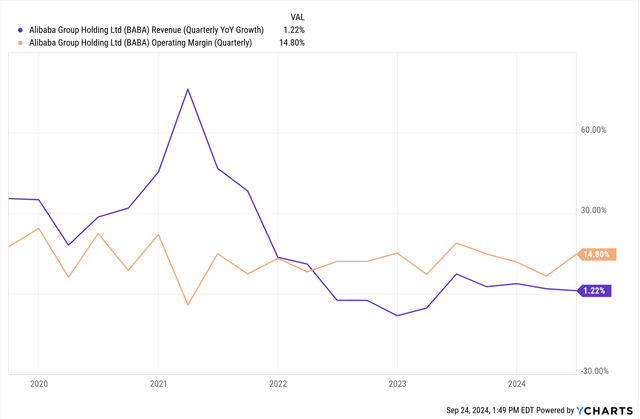

Exhibit D: Alibaba’s revenue and operating margins by quarter (YCharts)

I had noted similar trends for JD as well in previous coverage. Note that management’s efforts to boost growth in their Tmall group were before the PBOC’s monetary package announcement. If consumers do see more reason to spend as a result of PBOC’s consumer-focused measures, this would be an added boost to Alibaba and JD.

But going back to the PBOC’s market liquidity-focused measure, which, I think, will be an immediate boost to most Chinese stocks, Alibaba will be a strong winner here. Mostly because of the company’s impressive record of buying back shares and delivering shareholder value. As seen in Exhibit E below, Alibaba has an impressive record of returning cash to shareholders.

The company would usually spend ~$2.5 per quarter to buyback ADS, which sharply increased to ~$5 billion in the past two quarters. Alibaba still has ~$26 billion of dry powder left to buy back more ADS. I suspect Alibaba could easily tap into PBOC’s liquidity program in the recent monetary measure package to return more cash to shareholders, creating more appeal for its stock.

Valuations Point To Upside For Alibaba

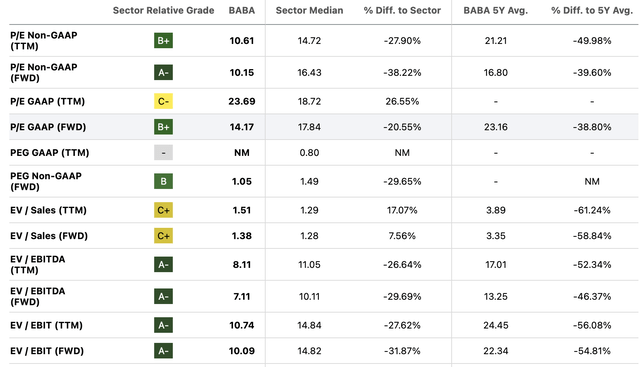

Alibaba’s valuations look extremely compelling when compared to the wider sector where it trades at a 20% discount to the sector or when looking at its history where premiums trade at a ~39% discount.

This is assuming that Alibaba is valued at 14x GAAP earnings or 10x non-GAAP earnings while the company is expected to grow its earnings ~10% CAGR through FY26 on revenues growing 8.8% CAGR through FY26.

Exhibit E: Alibaba’s valuation multiples look cheap (Seeking Alpha)

With at least a 20% discount in its valuation, Alibaba looks very appealing at current levels and in light of recent developments from the PBOC.

Risks & Other Factors To Know

Alibaba has been subject to intense antitrust scrutiny from the Chinese government over the past 3-4 years. The good news for Alibaba is that that dark cloud has been unveiled as the government ended all its disputes against Alibaba last month, which should boost investor confidence. But with most large technology companies nowadays, it is a reasonable risk investors should factor in when looking at investing in Alibaba.

While PBOC’s monetary measures are a strong welcome and a move in the right direction, the more structural question will be to ask if Chinese consumers feel adequately incentivized to begin spending again. The answer to that question will not be seen for at least another 1-2 quarters worth of data. Watching Retail Spend and other Chinese consumer touchpoint data will be crucial.

Furthermore, Chinese stocks should restart their winning ways now that the U.S. Fed has added a 50 BP cut to their interest rates. This puts downward pressure on the U.S. dollar, making it easier for the Chinese government to service its dollar-denominated debt, resulting in net inflows into the Chinese stock market.

Takeaways

The Chinese government appears determined to reinvigorate the Chinese government from multiple different viewpoints based on monetary measures announced today.

The PBOC’s liquidity measures will be an immediate shot in the arm for Chinese stocks. This is especially true for those with strong records of returning cash to shareholders such as Alibaba, while it may take time to understand the full effect of monetary tailwinds for the Chinese consumer.

But companies like Alibaba have already planned for this well beforehand and are strongly positioned to benefit from any tailwinds. I recommend a Buy on Alibaba.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JD, KWEB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.