Summary:

- I see very mixed results for Alibaba Group Holding Limited’s FY Q1 earnings.

- Margin pressures and growth uncertainties are among the top of my concerns.

- The Alibaba bulls are drastically underestimating these headwinds and overstating the attractiveness of its low P/E.

- Adjusted for growth, the PEG ratio is far above the 1x threshold, even under generous assumptions.

DNY59

BABA Stock: Previous Thesis and Q1 Recap

My last article on Alibaba Group Holding Limited (NYSE:BABA) argued for a hold rating on the stock. That article was entitled “Alibaba: I Keep Disagreeing with The Crowd” and was published on the Seeking Alpha platform on July 22, 2024. In the article:

I discussed the recent bullish sentiment surrounding BABA stock and the factors contributing to it, such as its low P/E ratio and regulatory easing in China. However, I argued that the P/E ratio is not as low as it appears when compared to peers like JD or PDD. Additionally, even if regulatory easing persists, BABA’s profitability and competitive position have already weakened compared to its pre-crackdown days in my view.

Since that writing, the company has released its fiscal Q1 earnings report (ER, for the quarter ended in June). The ER provided key updates for its business in the past quarter and the results are very mixed results in my view. As such, I thought it would be helpful to reassess my previous thesis with a focus on the new developments described in its Q1 ER. As you will see in the remainder of this article, my reassessment concludes with a reiteration of my hold thesis. I think the BABA bulls are still severely underestimating the headwinds, in particular, the margin pressures and growth uncertainties ahead.

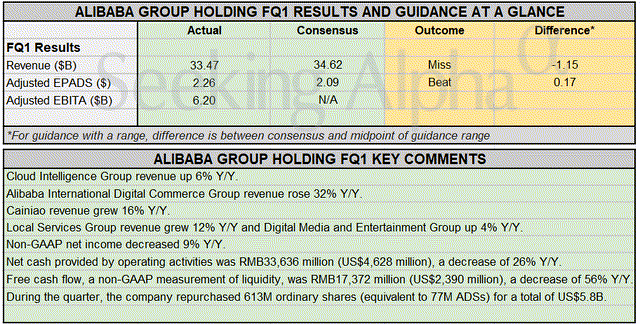

Before I dive into these issues, let me start with a brief recap of its FYQ1 financials to better prime the more in-depth analysis. As just mentioned, the results are overall very mixed in my view, with the top line missing consensus estimates and the bottom line topping it. More details of the FY Q1 ER are provided in the chart below. To wit, revenue for the quarter came in at $33.47 billion, falling short of the consensus estimate of $34.62 billion. Despite this revenue miss, adjusted earnings per ADS beat expectations, coming in at $2.26 compared to the consensus estimate of $2.09. Notably, its free cash flow shrank a whopping 56% YOY.

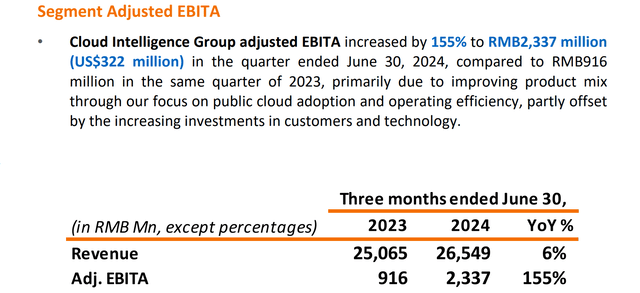

On the positive side, several of its business segments reported healthy growth. The Cloud Intelligence Group saw revenue increase by 6% year-over-year, while the Alibaba International Digital Commerce Group’s revenue surged by 32%. Cainiao, BABA’s logistics arm, also saw robust growth with revenue increasing by 16% YOY.

Next, I will explain why I do not expect a speedy growth recovery in its earnings and cash flow.

BABA Stock: Margin Pressure

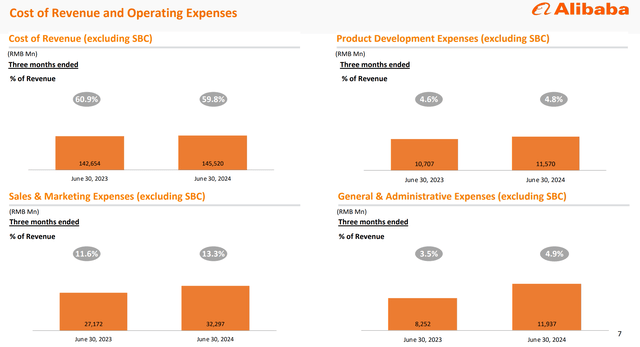

The top reason on my list is that I expect the margin pressure to persist in the years to come. BABA has been experiencing higher costs of goods and selling, general, and administrative expenses in recent quarters. As illustrated by the chart below (taken from its Q1 ER), product development expenses, sales & marketing expenses, and general & administrative expenses have all climbed substantially in the past quarter. This is both in absolute terms and also as a percentage of revenue compared to the last year.

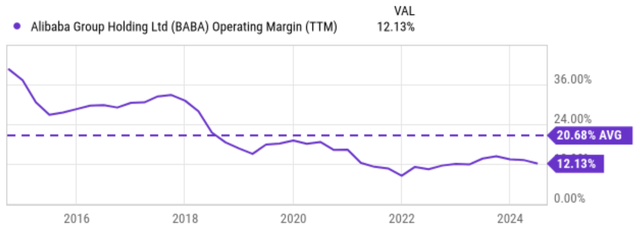

To broaden the context a bit more, the next chart illustrates the historical trend of BABA’s operating margin over the 5-year period from 2016 to 2024. As you can see from the chart, despite some fluctuations throughout the period, the overall trend is downward. It started at a high level of almost 40% in 2016, then declined steadily and reached a low point around 2022. The margin has improved a bit since then to the current level of 12.1%. But it is still among the lowest levels historically and is far below the average level of 20.68%.

Looking ahead, I see several headwinds to keep pressuring its margins. Besides the macroeconomic uncertainty (the focus of my last article), I expect the company’s recent reorganization efforts (including a fresh strategy for its largest segment, Taobao, and Tmall) to keep the operating expenses at an elevated level even though these operational initiatives may drive growth in the longer term.

BABA Stock: Growth Outlook and Valuation

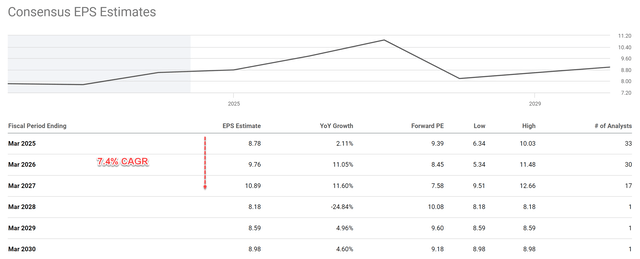

The above pressure, when combined with the current choppy macroeconomic climate and uncertain consumer spending in China, is very likely to hinder BABA growth. As an example, the next chart provides a forecast of its EPS growth over the coming years based on consensus estimates. As seen, BABA’s EPS is expected to show essentially no growth in the next 5~6 years. Its EPS is projected to grow from $8.78 in FY 2025 to $8.98 in FY 2030, an increase of only ~2%.

In terms of the forward P/E ratio, BABA’s multiples are certainly attractive in absolute terms, a key point most BABA bulls highlight. Indeed, as seen in the chart below, the stock is only trading at an FY1 P/E ratio of 9.39x.

However, such a single-digit P/E becomes far less attractive when adjusted for its growth. As mentioned above, consensus expects essentially no EPS growth in the next 5~6 years. Even for the period where the highest growth is expected (i.e., from FY 2025 to 2027), the compound annual growth rate (CAGR) is only about 7.4%. With this growth rate and a 9.4x P/E, the PEG (P/E growth) ratio is about 1.3x, substantially higher than the threshold most GARP (growth at a reasonable price) investors would like to see.

Other Risks and Final Thoughts

In terms of upside risks, its initiatives in artificial intelligence products and services have the largest potential for nonlinear growth, in my view. As part of the Cloud Intelligence Group, its AI-related products/services have been reporting triple-digit YOY growth rates in recent quarters.

For example, as illustrated by the chart below, its FY Q1 quarter reported 155% growth in its adjusted EBITA earnings. I certainly expect demand for AI to accelerate both in its domestic China market and also globally in the years ahead. Judging by my observations, it’s very likely that the technology will be utilized across various enterprises and industries. However, despite the rapid growth rate, the Cloud Intelligence division currently only comprises a relatively small piece of the revenue pie for BABA. As an example, the EBITA earnings for this segment in the FY Q1 quarter were reported to be RMB2,337 million, less than 5% of the RMB48,810 million generated by its Tmall and Taobao segments.

All told, I certainly do not see anything obviously wrong with holding shares of a sector leader at its current low P/E ratio. It is, of course, a very compelling value proposition. However, I urge investors to consider the company’s sluggish growth outlook and margin pressures too. I think the BABA bulls are severely underestimating these risks, judging by the financials it recently reported in FY Q1.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.