Summary:

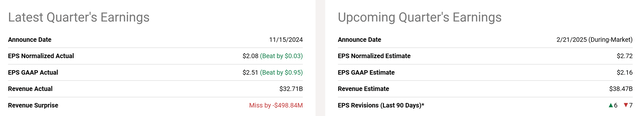

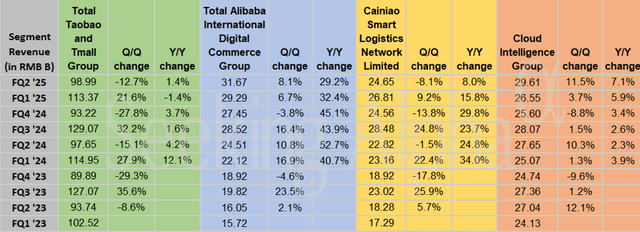

- Alibaba Group Holding Limited’s fiscal Q2 earnings report showed better-than-expected EPS and YOY growth across all segments.

- However, the most encouraging sign in my view is the improving inventory data.

- The data indicates that the worst might be over for BABA, with stronger sales cycles and better cash flow ahead.

- Alibaba stock’s low valuation enhances the stock’s attractiveness further, with a PEGY (P/E to growth and yield ratio) is only 0.79x.

Andrii Yalanskyi/iStock via Getty Images

BABA stock: Q2 recap

My last coverage on Alibaba Group Holding Limited (NYSE:BABA) was published back in mid-October 2024. That article was titled “Alibaba: China Stimulus Impact Is Losing Steam (Technical Analysis).” As the title already hinted, the focus was on the China stimulus plan and the technical trading patterns. To be more explicit, that article rated the stock as a HOLD based on the following analyses:

The Chinese government’s recent stimulus package provided a temporary boost to Alibaba Group Holding Limited stock, but technical indicators suggest the momentum is fading. Additionally, I don’t expect the stimulus to help with Alibaba’s fundamental challenges.

Since publishing that article, there have been a few important developments surrounding BABA stock. In the rest of this article, I will concentrate on the top one development in my assessment: the release of its FY Q2 earnings report (ER). Overall, it was a strong quarter in my view. The company delivered better than expected EPS results (see the first chart below) and also reported YOY growth for all of its segments (see the second chart below).

The financials released in this ER have already been dissected by several other analysts since it came out and thus here, I won’t repeat what has already been said before. In this article, I will focus on an angle that has not been discussed thus far: improving inventory data. Next, I will explain why the improving inventory data suggests to me that the worst might have passed for BABA. These considerations have led me to upgrade my rating on the stock to BUY from my earlier hold rating.

BABA stock: Q2 inventory in focus

My investment approach toward growth stock is heavily shaped by the thoughts of Peter Lynch (I try to learn from the best). I benefited tremendously from Lynch’s insights on the use of inventory data, especially for many growth stocks that lack meaningful earnings in their high-growth stage. In the case of BABA here, I found Lynch’s following insights on inventory data particularly relevant for BABA given the financial data it reported recently:

To start, unlike many other financial data that are more open to interpretation, inventory is one of the less ambiguous financial data. Lynch also explained why inventory levels can be a telltale sign of business cycles. Especially for cyclical businesses, inventory buildup is a warning sign, which indicates the company (or sector) might be overproducing while the demand is already softening. Conversely, depleting inventory is a sign of strong demand.

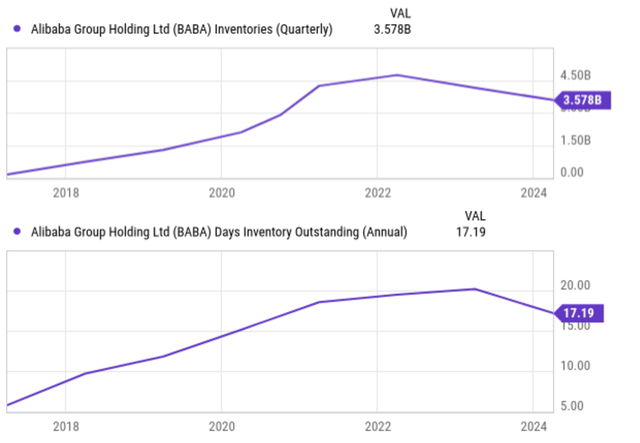

As illustrated by its balance sheet below, BABA’s inventory has shown a significant increase over the past few years. In 2019, its inventory stood at $1271 million, but by March 2021, it had surged to more than $4.2 billion in the aftermath of the COVID-19 pandemic. As the impacts of the pandemic faded, its inventory kept increasing and peaked in 2022 at more than $4.7 billion and persisted at an elevated level.

To better contextualize these above figures, the next chart shows its quarterly inventory in dollar amount (top panel) and also in Days Inventory Outstanding (DIO, bottom panel). As seen, in tandem with the increase in dollar amount, its DIO has also increased over the same period, indicating increasing inventory is not the result of growing sales. For example, in 2018, its DIO was only about 6 days, but by 2023, it had risen to over 20 days.

In the recent 1~2 quarters, the trend is finally reversing. As of its FY Q2 report, the inventory has decreased to $3.57B and the DIO has decreased to 17.2 days. These improvements suggest to me that BABA’s sales cycles are improving. A lower level of inventory stockpiling could also lead to other benefits, such as improved cash flow for other needs (growth investment, dividends, or share repurchases as to be mentioned later) and lower balance sheet risks.

Other risks and final thoughts

A few other upside risks are worth mentioning too. Recently, BABA has bought back some of its shares. To wit, the company recently repurchased the equivalent of around 77 million ADS for roughly $6.0 billion. Looking forward, I see good odds for similar periodic repurchase activities. These buybacks could offset share dilution due to issuance to employees or even start shrinking the share base. I consider them to be accretive, especially when made under its current cheap valuation.

As seen from the next chart below, BABA is priced at about 10.3x of its FWD EPS. It’s a quite low multiple in both absolute and relative terms in my mind, especially when adjusted by its growth rates. As seen, the market expects its EPS to grow by about 12.5% next year and by 9.15% the year after. Thus, the average growth rate is about 10.8% and the PEG ratio is around 1x, the gold standard for GARP investors (growth at a reasonable price).

Since I started with Lynch’s insights on its inventory data, it seems fitting to end the analysis with another Lynch’s insights. The above PEG ratio underestimates the attractiveness of BABA’s valuation for the following reasons Peter Lynch promoted:

For dividend stocks, Lynch uses a revised version of the PEG ratio – the PEGY ratio, which is defined as the P/E ratio divided by the sum of the earnings growth rate and dividend yield. The idea behind the PEGY is very simple and effective (most effective ideas are simple). If a stock pays out a large part of its earnings as dividends, then investors do not need a high growth rate to enjoy healthy returns. And vice versa. And similar to the PEG ratio, his preference is a PEGY ratio of 1x or below.

BABA recently started dividend payouts, and its current yield is ~2.2%. With its P/E of 10.3x and an average projected growth rate of 10.8%, BABA’s PEGY ratio worked out to be only 0.79x.

In terms of downside risks, the company has been investing aggressively in artificial intelligence and the cloud recently. I expect such investment to further ramp up in the years ahead. I expect these efforts to drive up spending on product development and CAPEX. However, it is uncertain in my view if these investments could garner significant customer demand in the near term, The current macroeconomic climate in China has been challenging (see my last article for more details). On a global scale, the geopolitical tensions are another concern, especially if many of the new trade policies expected from the Trump administration do materialize.

All told, my overall conclusion is that the positive catalysts outweigh the negative concerns under current conditions, leading to my upgraded buy rating. Among the positives covered in this article, the trend of its recent inventory data carries more weight in my mind and suggests to me that the company might have finally turned a corner.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.