Summary:

- Alibaba’s stock is significantly undervalued, with a 247% potential upside, driven by strong fundamentals and commitment to innovation, particularly in AI.

- The company is enhancing its ecosystem through partnerships, including with Mastercard and Tencent’s WeChat, and investing heavily in AI capabilities.

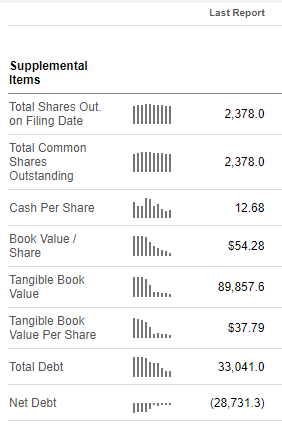

- Alibaba’s robust financial position, with nearly $30 billion in net debt, provides ample resources for growth and innovation.

- Despite geopolitical and competition risks, Wall Street analysts are optimistic, with recent positive trends in China’s PMI supporting a healthy economic environment.

Vertigo3d

My thesis

After publishing a bullish thesis on Alibaba (NYSE:BABA) on June 26, the stock rallied by 10%, climbing above a psychological level of $80 per share. The stock is still significantly undervalued as the market highly likely continues pricing in geopolitical risks. In my previous article I have described in detail why I believe that these risks are overestimated, so I will not focus on the geopolitical factor this time.

The company has ample resources and strong management’s commitment to drive innovation. It appears that the company is betting big on AI, and investors can expect more AI features unveiled soon. Alibaba also continues working on improving its ecosystem with new partnerships and useful tools for its e-commerce users and merchants. The stock is still massively undervalued, and sentiment from Wall Street analysts around BABA is improving. I think that there are several positive factors that outweigh negative ones. A 247% potential upside definitely makes Alibaba a Strong Buy.

BABA stock analysis

Alibaba continues developing its ecosystem by working on improving customers’ experiences. The company has recently partnered with the U.S. digital payments giant Mastercard (MA), which will offer a credit card rewarding businesses for cross-border and domestic sourcing purchases. It is also reported that in few weeks Alibaba will start allowing payments through Tencent’s (OTCPK:TCEHY) WeChat on its e-commerce platforms Taobao and Tmall. The information is crucial for investors because there are around 1.3 billion WeChat users.

Seeking Alpha

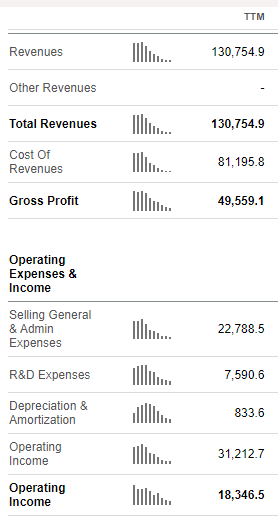

The company continues investing heavily in developing its AI potential. It has recently unveiled its AI-powered shopping assistant. According to digitalcommerce360.com, about 30,000 merchants on the B2B marketplace use BABA’s AI tools to improve product exposure. Alibaba’s TTM R&D spending is more than $7.5 billion, meaning that investors can expect new interesting features and partnerships soon. Moreover, during the FQ1 earnings call the CEO said that BABA “will continue to invest in R&D and AI CapEx to ensure the growth of our AI-driven cloud business”. Therefore, Alibaba is likely to be a major force in the Chinese AI market, which is projected to observe a 28.6% CAGR between 2024 and 2030.

Seeking Alpha

Alibaba’s strong financial position will definitely help in driving innovation. The company’s net debt is almost $30 billion. Thus, there are ample resources and financial flexibility to invest both in organic and M&A-driven growth and innovation. The company’s levered free cash flow is consistently positive, which will also add to BABA’s financial position.

Recent news about China’s manufacturing PMI also adds optimism. According to Trading Economics, the country’s general Manufacturing PMI increased from 49.8 in July 2024 to 50.4 in August. The level was above market forecasts of 50.0 as new orders returned to growth, driving faster production expansion amid better underlying demand conditions. While there is unlikely to be a direct relationship between China’s PMI and BABA’s financial performance, the trend underscores positive trends in the country’s broader economic environment.

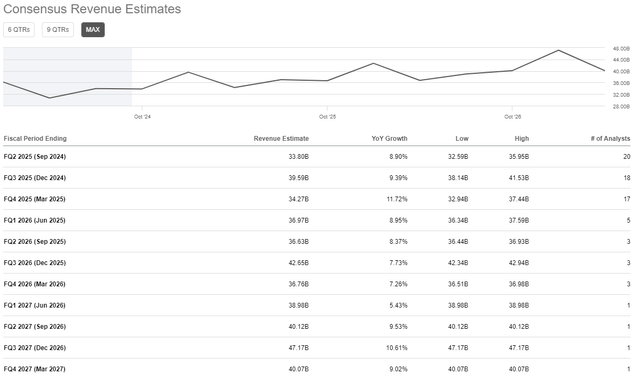

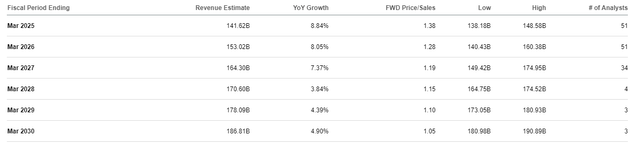

As a result of Alibaba’s commitment to growth and innovation, as well as the broader economy’s health, Wall Street analysts are quite positive about BABA’s near-term prospects. Alibaba is expected to deliver robust revenue growth over the next ten quarters, which will likely help in generating value for shareholders. The largest Wall Street names believe that the company will be able to deliver EPS expansion as well. Some well-known analysts have raised their target prices for BABA in August including BofA, JP Morgan, and Baird.

Alibaba’s revenue continues growing. The company is firmly committed to driving innovation and improving its ecosystem. What is more important, Alibaba has vast resources to finance its initiatives. I believe that increasing optimism from Wall Street analysts will also highly likely help in improving the sentiment around the stock. Chinese economy is not demonstrating the same growth pace as it did over the last several decades, but recent trends in the country’s PMI are positive and likely evidence that the economy is healthy.

Intrinsic value calculation

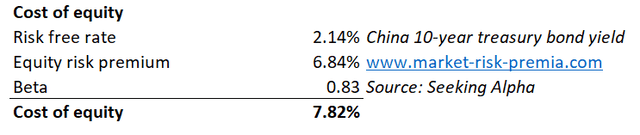

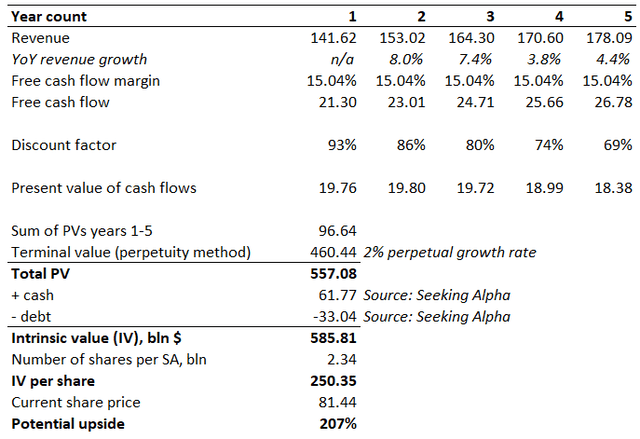

Discounted cash flow (DCF) valuation approach is the one that aged well when I determined the intrinsic value of BABA last time. Since I will be using levered free cash flow for my assumptions, the discount rate for my DCF will be BABA’s cost of equity, which is 7.82%. The cost of equity was calculated using the CAPM approach.

I am using the levered free cash flow margin instead of the unlevered FCF margin because it directly reflects the cash flow available to equity holders after interest payments, aligning with the focus on shareholder value. Alibaba’s levered FCF margin on a TTM basis is 15.04%, which is lower than the last five years’ average. Therefore, I do not incorporate this metric’s expansion in the future. To figure out free cash flow absolute numbers, I multiplied projected revenue by the flat 15.04% levered FCF margin estimates.

Revenue forecasts from Wall Street analysts are quite conservative for Alibaba, projecting mostly single-digit revenue growth rates by FY 2034. Conservativeness is crucial for a DCF model, making me use these Wall Street estimates.

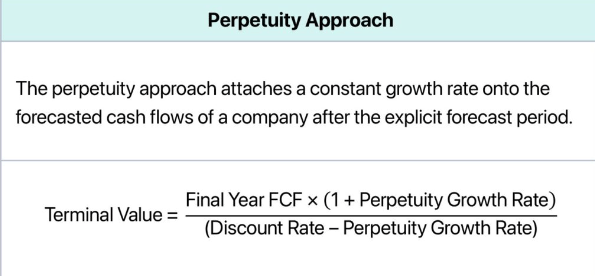

wallstreetprep.com

The perpetual growth rate is also very conservative at 2%. This assumption is very important because terminal value will be calculated using the perpetuity method. To be more conservative, I slightly adjusted the classic TV formula as I do not multiply the final year FCF ($26.78 billion) by the perpetual growth rate. Instead, I just divide it by the difference between the cost of equity and perpetual growth rate, which is 5.82%.

After I incorporated all the described assumptions into the DCF model, I arrived at a $250 intrinsic value per share, around three times higher than BABA’s current share price.

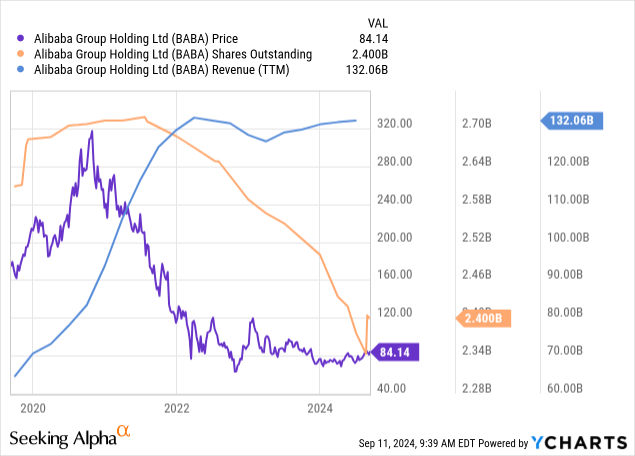

A 207% potential upside derived from my DCF model might seem unrealistic. To prove that the DCF is reasonable, I want to ask readers to take a look at the above chart. We see that BABA traded above $300 a few years ago, and the number of shares outstanding declined since then. At the same time, BABA’s top line grew notably since BABA’s all-time share price high. Therefore, I consider the upside potential realistic.

What can go wrong with my thesis?

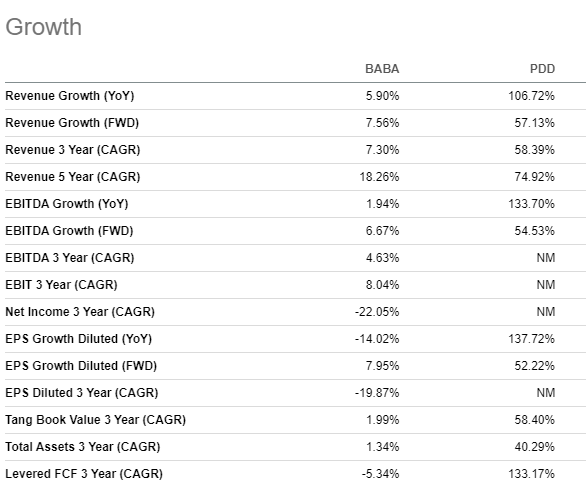

Apart from apparent geopolitical risks that I decided not to explain in detail once again, there are significant competition risks. Alibaba has strong competitors in Chinese e-commerce. For example, PDD Holdings (PDD) has been outpacing BABA’s revenue growth by a wide margin over the last few quarters. PDD’s revenue is still around three times lower compared to BABA’s. However, the trend is quite warning and certainly should not be ignored as a risk factor for BABA.

Seeking Alpha

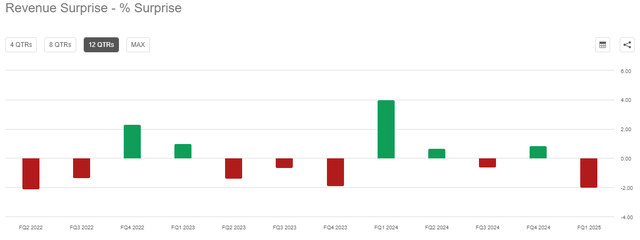

Alibaba’s quarterly financial performance against consensus estimates is not perfect, softly speaking. While underperforming in terms of the EPS has been relatively rare, BABA’s actual revenue was below consensus eight times over the last sixteen quarters. Such a low positive revenue surprise ratio does not allow the stock to use earnings releases as bullish catalysts for the stock price. Investors should be aware of it because any disappointing quarterly earnings release might be a strong negative catalyst that triggers a selloff.

Summary

I believe that Alibaba’s stock still has great upside potential. The massive discount that I have figured out in my discounted cash flow model is only explained by the geopolitical factor, which is likely overestimated. The business is strong from fundamental perspective, and the management’s commitment to innovation is strong. Alibaba has vast financial resources to invest in developing cutting-edge technologies to maximize its AI potential

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.