Summary:

- Alibaba has outperformed the broader U.S. market since June 5, delivering a 6.7% total return.

- Despite a 12.9% decline over the last twelve months, Alibaba is up 6.4% YTD, outperforming the iShares MSCI China ETF.

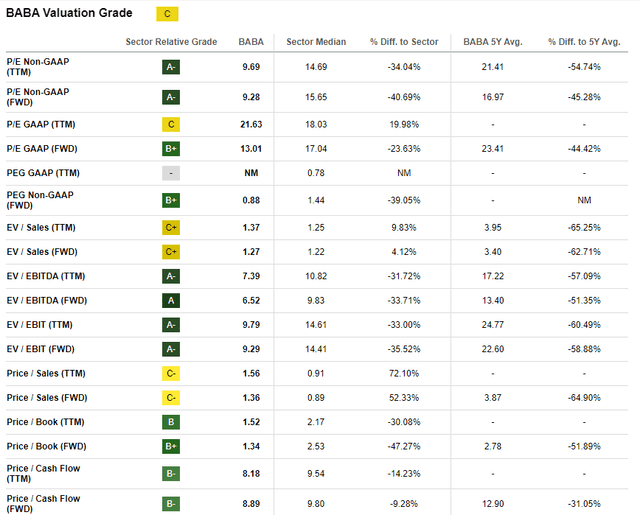

- Valuation ratios indicate substantial undervaluation, with current multiples significantly below historical averages.

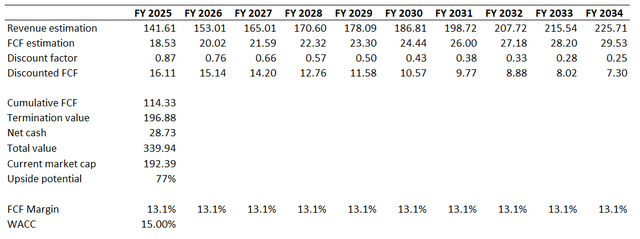

- My DCF simulation, using an aggressive WACC and conservative revenue growth assumptions, underscores substantial undervaluation.

Robert Way

Investment thesis

My previous bullish thesis about Alibaba (NYSE:BABA) aged well as the stock outperformed the broader U.S. market since June 5 with its 6.7% total return. I think that there are no reasons to become less bullish about Alibaba’s long-term prospects. The company continues delivering solid revenue growth. Despite a temporary pullback in the EPS, its profitability is still strong and will help to accumulate value for shareholders. The financial position is a fortress, which is also a vital bullish indicator for a company that relies on growth and innovation. A new positive catalyst is the robust macroeconomic environment in China as I believe that the monetary policy is supportive, and the country’s economy is in early stages of a recovery phase of the business cycle. The valuation is still extremely attractive. All in all, I reiterate my “Strong Buy” rating for Alibaba.

Recent developments

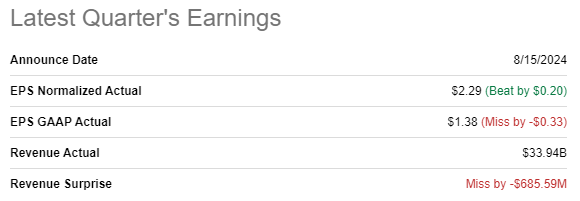

Alibaba released its latest quarterly earnings on August 15, missing consensus revenue and GAAP EPS expectations. On the other hand, there was a positive adjusted EPS surprise. I do not consider revenue miss to be a big problem since it was insignificant from the relative perspective.

Seeking Alpha

Revenue grew by 4.6% YoY, but the adjusted EPS decreased from $2.41 to $2.29. The EPS shrinkage is mostly explained by the increased SG&A and R&D spending. Nevertheless, I think that the EPS YoY decline is not dramatic, as Alibaba’s profitability metrics are still stellar.

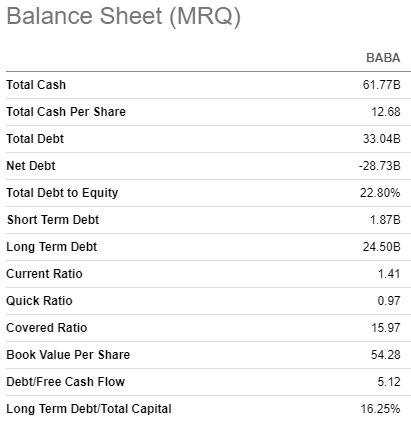

Moreover, Alibaba is well-known for its aggressive reinvesting in growth and innovation. Therefore, I do not think that a temporary pullback in profitability is a sustainable trend. Alibaba also boasts a fortress financial position, with a massive $62 billion cash pile as of the latest reporting date. The total debt is substantially lower compared to the outstanding cash balance, and liquidity metrics are in great shape. Therefore, I believe that Alibaba is able to exercise strong financial flexibility, which is crucial to be able to drive growth and innovation. In my previous thesis, I have explained in detail that Alibaba is investing hard to be the undisputed Chinese AI powerhouse.

Seeking Alpha

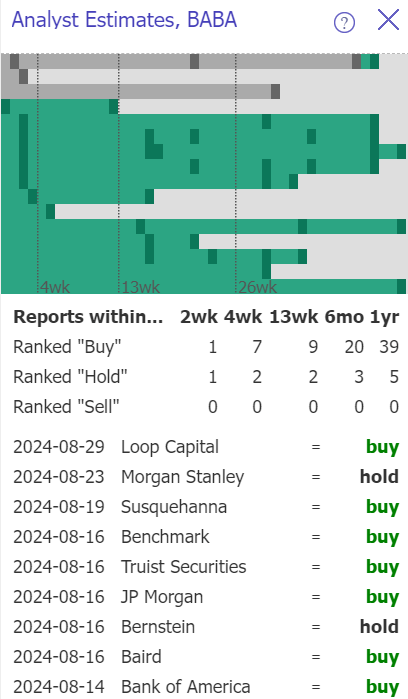

It is also crucial that Wall Street analysts are quite bullish about Alibaba after its latest quarterly earnings release. Several prominent analysts reiterated their buy ratings for BABA in August, which is another positive sign for investors. According to Nasdaq, Alibaba’s consensus target price for the next twelve months is $109.53.

TrendSpider

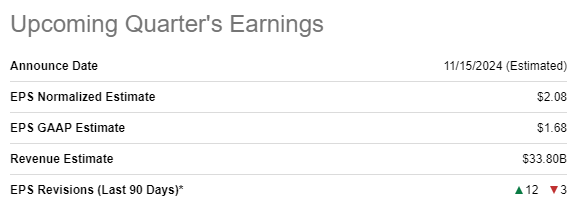

The upcoming quarter’s earnings release is scheduled for November 15. Wall Street analysts expect fiscal Q2 revenue to be $33.8 billion, which means a solid 8.9% YoY growth. The adjusted EPS is expected to decline slightly once again, but I am comfortable with this pullback as the company invests in fueling future growth.

Seeking Alpha

According to Financial Times, investment bankers are doubtful about the ability of China to achieve a target 5% GDP growth in 2024. The pessimism is explained by the Q2 4.7% GDP growth lagged notably behind expectations. On the other hand, the Q1 GDP growth was confidently above 5%. Therefore, investment bankers’ recent pessimism might be misleading.

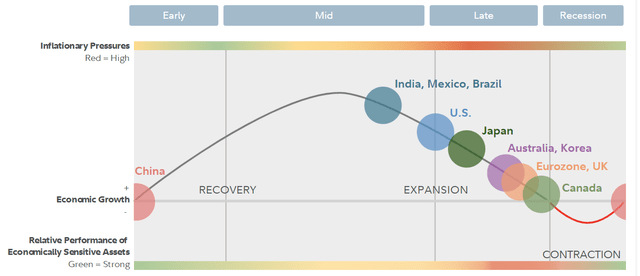

According to the Q3 2024 business cycle update from Fidelity, China is in early stages of the recovery phase. According to the below chart, from this point it is more likely to see further growth acceleration than cooling down. Moreover, the country’s Central Bank’s policy is quite supportive, as there was an interest rate cut in July.

To sum up, I remain bullish about Alibaba’s prospects. The company’s revenue growth momentum is expected to accelerate in Q3, and profitability metrics are still stellar. The temporary dip in EPS is explained by accelerated investments in growth and innovation, which is good for investors from the long-term perspective. Moreover, the macroeconomic environment appears to be favorable in China at the moment.

Valuation update

BABA declined by 12.9% over the last twelve months and gained 6.4% YTD. The stock outperforms the iShares MSCI China ETF (MCHI) in 2024, as the ETF’s price increased by a mere 1% YTD.

Most of Alibaba’s valuation ratios are significantly lower than the sector median, and all of the current multiples are substantially below BABA’s historical averages. That said, valuation ratios point to substantial undervaluation.

I am simulating the DCF model to figure out the upside potential. Gurufocus recommends to implement a 6.6% WACC for BABA. On the other hand, we all know that there are massive political and geopolitical risks surrounding all Chinese stocks and Alibaba particularly. Therefore, I use the same high 15% WACC as I did in my previous analysis. Using such a high discount rate is also useful to emphasize the extent of BABA’s undervaluation.

Consensus estimates forecast BABA’s revenue CAGR to be 5.3% for the next decade, which I consider conservative enough for my DCF model. I use a flat TTM 13.1% FCF ex-SBC margin.

My DCF simulation suggests that the business’s fair value is almost $340 billion. This is 77% higher compared to the current $192 billion market cap. The upside potential is vast, and I want to remind you that I have used extremely conservative assumptions.

Risks update

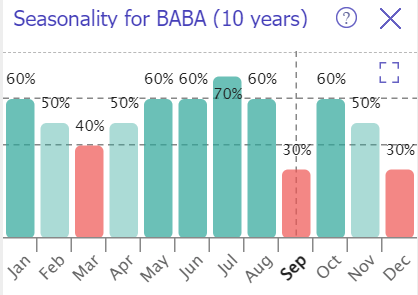

The below seasonality bar chart suggests that September and December are historically the weakest months for BABA. Therefore, there might be a temporary pullback before the stock returns to growth in mid-Autumn. On the other hand, BABA demonstrates solid momentum and this might offset historical seasonality patterns.

TrendSpider

Significant political and geopolitical risks are still in place for BABA’s investors. Relationships between China and the U.S. are still complicated, and it is very unlikely that the situation will get better if Donald Trump wins the U.S. presidential election. Readers should be aware that a substantial geopolitical factor is one of the primary reasons why Alibaba’s valuation is that cheap.

While Alibaba dominates in the Chinese e-commerce and cloud infrastructure businesses, the competition is not very far behind and is willing to overtake BABA’s crown. For example, PDD Holdings (PDD) is an e-commerce player who has been driving revenue growth aggressively in recent years. From the business scale and diversification, PDD is not even close to BABA, but PDD’s market cap is already higher. Tencent (OTCPK:TCEHY) is a prominent Chinese name in cloud and AI, with a 2% market share in global cloud infrastructure business.

Bottom line

To conclude, I believe that BABA is still a “Strong Buy”. External factors are mostly favorable, and the company efficiently absorbs macroeconomic tailwinds. Moreover, the valuation is still extremely attractive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.