Summary:

- China’s recent stimulus package has been a saving grace for depressed valuations in big Chinese tech firms. Yet uncertainties remain on the gains’ durability, and at this time they’ve been relinquished.

- However, we believe Alibaba’s recent upsurge, driven primarily by economic stimulus pervasively applicable to its Chinese peers, continues to underappreciate impending company-specific catalysts.

- The market’s elevated interest in China’s recent macroeconomic developments has essentially overshadowed Alibaba’s recent slew of global partnerships forged — including the one with AI darling Nvidia.

- The latest developments, which follow the recent completion of Alibaba’s antitrust probe, could potentially be paving the way to a larger AI partnership on the global scale that remains overlooked.

maybefalse

Despite the absence of OpenAI’s ChatGPT or Google’s (GOOG, GOOGL) Gemini in China, the region has not been short of interest in generative AI. In fact, the nascent technology garners the highest penetration rate in China compared to other global economies. More than half of the region’s Internet users currently rely on generative AI in their day-to-day settings. This has accordingly encouraged a slew of homegrown products, from smartphones and PCs to cars and home appliances, that have touted in-house developed AI features.

One of the most pervasively used AI models in China right now is Alibaba Group Holding Limited’s (NYSE:BABA) open-sourced Tongyi Qianwen – or “Qwen.” As discussed in our previous coverage on the stock, Qwen is currently one of the most familiar large language models among Chinese developers. The large language model (“LLM”) also underpins generative AI features in key consumer and enterprise apps in China, including Taobao and DingTalk with each reaching more than 600 million active users.

We believe Alibaba’s deepening foray in AI developments in China, alongside its increasing participation in global partnerships, cement the foundation to its stock’s sustained upsurge from current levels. Specifically, the recent integration of Alibaba’s Qwen model with Nvidia’s (NVDA) Drive AGX Orin platform to enable next-generation autonomous mobility technologies is a significant milestone. The collaboration also marks Alibaba’s second with a global partner this month. Alibaba had partnered with MasterCard (MA) in early September to launch the “Business Edge Credit Card.” The latest developments build confidence that Beijing’s regulatory grip on the company’s overseas partnerships and growth strategies has indeed eased following the completion of a years-long probe.

Looking ahead, we anticipate further global penetration of Alibaba’s portfolio businesses, particularly its AI advancements, to unlock pent-up valuation gains for the stock. Specifically, Alibaba currently marks a top contender for Apple’s (AAPL) eventual Apple Intelligence partner in China, which remains underappreciated by markets, in our opinion.

We view this as a key near-term catalyst in sustaining a durable upward valuation re-rate for the Alibaba stock. Specifically, an Apple collaboration would further validate Alibaba’s AI capabilities. But more importantly, it would also structurally lift the market’s concerns about whether Alibaba is still investible given its direct exposure to the U.S.-China crossfire. This has been a key multiple compression risk to the stock recently. And an Apple partnership would likely confirm that Alibaba’s ability to participate in global growth opportunities, while also being regulatory compliant, has been effectively restored. We believe this would be key to narrowing the valuation discount between Alibaba and its U.S. counterparts, which has been primarily attributable to China-related risks. The anticipated multiple uplift is also expected to complement tangible fundamental improvements underpinning the stock’s upside potential.

Alibaba Could Be A Key Beneficiary of Apple’s AI Strategy for China

Apple’s introduction of “Apple Intelligence” AI features during WWDC 2024 in June has been a key driver to the stock’s upsurge since. The Apple stock’s climb to records was primarily fueled by investors’ optimism about an impending upgrade supercycle with the launch of an AI-enabled iPhone 16. Yet, anticipated delays to the rollout of promised “Apple Intelligence” features and an absent deployment strategy for China have been key drawbacks to expectations of pulled forward revenue growth.

Recall that much of Apple’s revenue declines in the past year have been driven by weakening iPhone uptake. This was particularly pronounced in China due to the combination of a soft consumer spending environment and intensifying competition in the region. iPhone shipments to China have been consistently losing share to local rivals, particularly Huawei, in the past 12 months. Despite pushing rare price discounts to encourage purchases, iPhone shipments fell by more than 3% y/y in China during the June quarter. The iPhone also fell out of the region’s top five sellers for the first time in four years during the period.

And Apple’s lacking AI strategy in China continues to shed uncertainty over how or when the persistent iPhone sales declines in this core growth region will be arrested. There are currently more than 300 million iPhone 12s sold during the 5G upgrade cycle that have yet to be replaced. About a third of that is in China, underscoring the importance of this market for Apple’s anticipated upgrade supercycle to materialize.

Essentially, the longer it takes for Apple Intelligence to deploy in China, the greater the risks of further market share loss to local rivals like Huawei. This is particularly in the more affluent tier 1 markets that are less prone to current macroeconomic woes in the region. And this reality is already gradually unfolding, as evidenced through robust local interest in the latest Huawei Mate XT. Despite being the market’s most expensive smartphone, priced at $2,800 to $3,370, the Mate XT had garnered well over six million preorders leading up to its initial sales last week.

Admittedly, the Huawei Mate XT is not expected to perform as well as its mass market products like the Mate 60, which stunned the world with its technology breakthrough last year despite U.S. sanctions. But strong demand for the trifold smartphone highlights pockets of pent-up demand in China for premium products despite the region’s mixed macro backdrop.

And it has become urgent for Apple to start incentivizing consumers into pulling the trigger on an iPhone instead. Otherwise, Apple risks entrenched market share loss to its Chinese rivals. Why? It is because the steepening loss of iPhone revenue share in the Chinese smartphone market today would take years to restore – even if Apple wanted to – given the extended useful life of these devices nowadays. Every lost AI smartphone sale to a local rival is essentially a pushed-out opportunity for the iPhone until its next upgrade cycle.

For now, Apple has continued to stay mum on its AI strategy for China – the second-largest iPhone market after the United States. And there have been limited updates beyond the generic high-level commentary that the rollout of Apple Intelligence features will first begin in the U.S. later this year, with expansion to other regions thereafter.

OpenAI’s ChatGPT is currently the primary technology underpinning Apple Intelligence features in the U.S., and potentially other key regions in the future; the iPhone maker also plans to eventually collaborate with Google’s Gemini model. But these U.S.-built technologies are inaccessible in China, leaving questions about whom the beneficiary might be in Apple’s eventual launch of AI features in the region.

We believe Alibaba makes a strong contender for AI opportunities in China – not only for Apple but for other product OEMs and service providers as well. This is corroborated by its recent slew of global partnerships forged without triggering disapproval from Beijing, highlighting Alibaba’s strong regulatory compliance following the official completion of its years-long antitrust probe. The company’s diverse AI product portfolio, which spans beyond the flagship Qwen model, also caters well to varying market needs and broadens its TAM. And the already pervasive integration and familiarity of Alibaba’s AI capabilities across both consumer and enterprise use cases in China is also appealing to prospective customers like Apple looking to optimize their installed base.

Taken together, we believe Alibaba is well-positioned for impending AI opportunities. This would also complement ongoing improvements in company-wide fundamentals, and reinforce a sustained upward valuation re-rate from current levels for the stock.

Alibaba’s Improving Global Presence

Alibaba’s fall from grace recently was primarily marked by a tightening regulatory grip from the Chinese government. In the name of “common prosperity,” Beijing has unleashed harsh regulatory changes, targeting primarily China’s biggest tech companies. The harsh treatment included stringent scrutiny of overseas partnerships and securities listings, as well as antitrust crackdowns that have essentially overhauled big Chinese tech’s historical business models and stymied their once lucrative growth prospects.

In the latest development, Alibaba appears to have finally turned a page. The company received notice from the China’s State Administration of Market Regulation in late August that it has completed the three-year “rectification” period for its antitrust violations found in 2021. Admittedly, the stock did not immediately return to its historical record highs following the news. In fact, it continued to trade near the $80 range, which we had previously viewed as a potentially sustained support level given continued fundamental improvements in the underlying business. This was largely expected, as the official “notice of release” does not mean Alibaba can restore the historical business practices that had underpinned its lucrative growth patterns in the old days.

But the key is what came after Alibaba received confirmation on the completion of its rectification period. The company has already gone on to forge two global partnerships this month. And these are not any ordinary global partnerships; they are global partnerships with international players based in the United States. This is a stark reversal from the days of stringent regulatory scrutiny on overseas partnerships, particularly in the U.S., during the peak of Beijing’s crackdown on big tech practices.

Earlier this month, Alibaba had partnered with Mastercard (MA) to launch the “Alibaba.com Business Edge Credit Card.” The card targets U.S. small businesses, with exclusive perks aimed at incentivizing purchases on Alibaba.com. In addition to the anticipated positive impact on Alibaba’s fundamentals, the partnership with MasterCard to deepen its reach in U.S. wholesale and retail opportunities also reinforces confidence that Beijing’s regulatory overhang on the company has eased.

And earlier this week, Alibaba announced a collaboration with AI darling Nvidia in the launch of new autonomous mobility technologies. This marks a significant milestone for Alibaba’s flagship Qwen model, which has been integrated into the Nvidia Drive AGX Orin platform to unlock new solutions optimized for autonomous mobility and digital cockpit applications.

The latest global developments for Alibaba essentially assuage two critical considerations for prospective customers of its nascent AI offerings – namely, regulatory compliance with the Chinese government, and technological validation. With these two barriers addressed, Alibaba is well-positioned in accessing the global AI TAM. Not only does this solidify its prospects in partaking in AI opportunities overseas, but the recent events corroborate a favorable outlook for Alibaba’s AI strategy at home too. The company essentially serves as a critical gateway for foreign companies like Nvidia, and, potentially Apple, looking to partake in AI opportunities in China. Continued global endorsement for Alibaba’s AI strategy and other offerings represents a key upside catalyst for the stock by structurally diminishing the China risk overhang that has been compressing its valuation multiple recently.

Alibaba’s Diversified AI Portfolio

Alibaba is currently most widely known for its flagship open-sourced Qwen model. But that is not where the company’s AI product roadmap stops.

The company currently monetizes primarily from the Bailian AI model repository platform, which offers access to its wide-ranging Tongyi LLMs for developers. The number of paying users on Bailian has grown by more than 200% q/q during the June quarter, highlighting the pervasive adoption of Alibaba’s AI solutions. This is similar to LLM-as-a-service offerings observed in hyperscalers like Amazon Bedrock (AMZN), Azure OpenAI Service (MSFT), and Google Vertex AI, which have been key growth drivers for the cohort’s respective cloud businesses over the past year.

In the latest development, Alibaba has also launched more than 100 open-sourced LLMs under “Qwen 2.5.” The repository is optimized by use case, targeting generative AI developments curated for verticals spanning automotive, gaming, science research and others. It also supports over 29 languages, highlighting Alibaba’s ambition to gain relevance in global AI developments.

The company’s diversified AI product roadmap is further reinforced by its prescient investments in some of China’s most prominent start-ups in the nascent field. Specifically, Alibaba has been a key investor in Moonshot, Minimax, Zhipu, Baichuan, and 01.AI. They represent five of China’s “Six Little Dragons” – a cohort of key LLM developers that have mostly already received regulatory approval for public rollout.

Alibaba’s diverse AI roadmap, spanning both internal and external developments across a wide array of use cases, makes it a suitable choice for varying customer needs. The strategy is particularly attractive for prospective global customers, such as Apple, looking to optimize penetration into a wide array of generative AI use cases, including productivity and healthcare.

Alibaba’s Deep Reach in Critical End Markets

As discussed in our previous coverage on Alibaba, its flagship open-sourced Qwen model has become a familiar choice for local developers as well. This has been reinforced by deep Qwen integration into some of China’s most used consumer and enterprise apps. They include Alibaba’s very own Taobao and Tmall shopping app, which boasts over 600 million MAUs, and the DingTalk chat and productivity app most commonly found in enterprise settings (think Microsoft Teams or CRM’s Slack), which now serves more than 600 million users.

This is a key reinforcement to the appeal of Qwen for prospective adoption by global players like Apple. Alibaba’s Qwen model effectively shows relevance, familiarity and reach into its prospective customers’ two key end-markets. We believe this reinforces Alibaba’s prospects in replicating the customer appeal and success of dominant AI models in the U.S., such OpenAI’s GPT-x and Google’s Gemini.

Valuation Considerations

We believe Alibaba’s widening reach into global opportunities, reinforced by its AI leadership in China, represents a key catalyst for unlocking pent-up valuation gains in the stock from current levels. These developments are expected to structurally diminish Alibaba’s exposure to China risks over time, and accordingly restore the stock’s multiple uplift towards levels closer to its U.S. counterparts. They are also expected to complement recent tailwinds. These include policy and stimulus support from Beijing, Alibaba’s admission into the Stock Connect program in Hong Kong, and generous share buybacks underpinned by an improving fundamental outlook under the company’s new leadership.

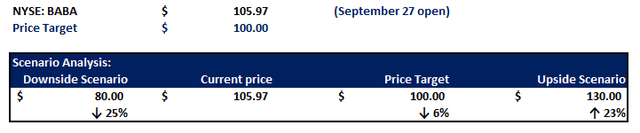

As a result, we believe the Alibaba stock is likely to keep its gains this time around with incremental upside to come. We are revising our base case price target for the stock to $100 (previously $86) to reflect its gradual detachment from previous multiple compression risks that include regulatory and geopolitical uncertainties.

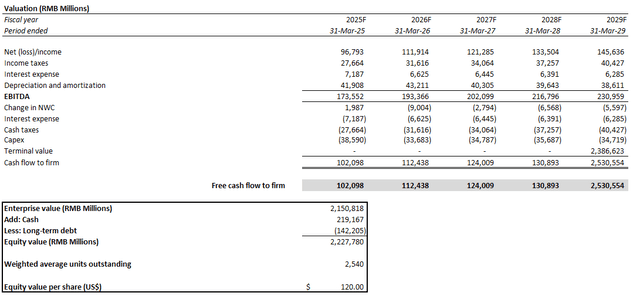

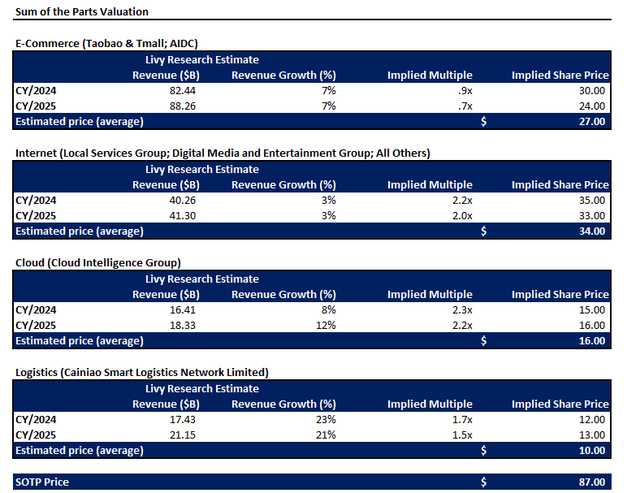

The price target is derived from the weighted average of outcomes under both the discounted cash flow (“DCF”) and sum-of-the-parts valuation approach.

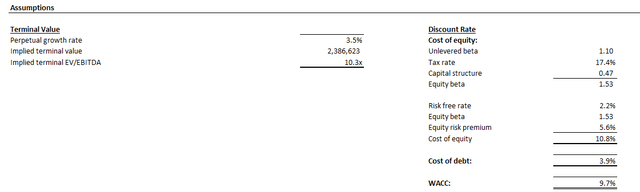

Under the DCF approach, Alibaba yields an estimated intrinsic value of $120 apiece. The analysis considers cash flow projections taken in line with the fundamental forecast discussed in our F1Q25 earnings update for Alibaba. A 3.5% perpetual growth rate is applied to projected FY 2029 EBITDA to determine Alibaba’s terminal value. The assumption applied is consistent with the estimated pace of long-term economic growth in Alibaba’s core Chinese home market, which is an adequate gauge for the company’s steady-state outlook. A 9.7% WACC in line with Alibaba’s capital structure and risk profile is also considered in the analysis.

Under the SOTP approach, Alibaba yields an estimated intrinsic value of $87 apiece. The analysis considers peer multiples on a relative basis to growth observed across the Internet, e-commerce, cloud, and logistics sectors.

Upside Scenario

In the upside scenario, we expect the Alibaba stock to reach $130 apiece. Although it is still a far cry from its historical peak, the upside scenario price is reflective of a structural easing in multiple compression risk factors specific to China big tech.

The upside scenario price is derived under the DCF approach. This approach offers a fair presentation of the company’s estimated intrinsic value, in our opinion, without dilution from peer multiples that continue to face elevated exposure to China risks. The analysis considers cash flow projections reflective of a stronger growth profile underpinned by incremental global opportunities, particularly through Alibaba’s AI capabilities. The key valuation assumptions (i.e., 9.7% WACC; 3.5% perpetual growth rate) remain unchanged from the base case.

Conclusion

Despite previous spouts of upsurge, the Alibaba stock has time and again found itself back in the $80 level recently. We believe this had represented a consistent support level, especially as Alibaba’s fundamental outlook and regulatory backdrop continues to improve.

But this time around, the Alibaba stock’s latest rally is expected to showcase greater durability. Specifically, we believe the stock’s recent upsurge, driven primarily by external tailwinds pervasively applicable to the Chinese market, continues to underappreciate Alibaba’s company-specific catalysts discussed in the foregoing analysis.

We believe Alibaba’s continued expansion into global opportunities, reinforced by its AI leadership in China, will be supportive of a long-awaited, sustained uplift from current levels. A potential partnership with Apple for its AI strategy in China is something we are keeping an eye out for in the near-term. This is especially with Alibaba being well-positioned for the opportunity given its diverse AI product roadmap and deep market reach in China.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.