Summary:

- Alibaba’s stock remains a soft ‘buy’ due to attractive pricing and a recent regulatory victory, despite mixed performance across its diverse operations.

- The company’s Taobao and Tmall Group saw a slight revenue decline, but Alibaba International Digital Commerce Group and Cloud Intelligence Group showed significant growth.

- Investments in technology and user experience have impacted short-term profits, but these are strategic moves for long-term improvement.

- Despite challenges, Alibaba’s valuation is compelling, especially when compared to similar firms, justifying a continued soft ‘buy’ rating.

Robert Way

One company that I have been following for some time is Alibaba Group Holding Limited (NYSE:BABA). With a market capitalization of $195.8 billion as of this writing, the business is one of the largest on the planet. Those who do follow the company closely know that it’s the largest e-commerce company that is based out of China. But at its core, it has a lot of different operations. Some of these, recently, have been performing very nicely. Others, on the other hand, have seen some weak spots. All in all, the stock does look attractively priced, and management just received an important regulatory victory that should help to push shares higher. Given these factors, I have no problem keeping the company rated a soft ‘buy’ for now.

This rating is something I have been consistent about for quite a while. The last time I rated the company a ‘buy’ was back in June of this year. Since then, things have gone quite well. The S&P 500 is up 2.2% over that window of time. By comparison, Alibaba is up a whopping 12.1%. This is on top of another 7.3% the stock was up from the prior. I wrote about it at a time when the S&P 500 was up only 5.3%. Although not all of my calls have been this good regarding this particular candidate, I do suspect that the long-term outlook for shareholders should be mildly positive.

A necessary disclosure

In this article, I reference all figures in US dollars. Management actually provides US dollar figures for the most recent quarter. But to make sure that we aren’t comparing apples to oranges here, I am translating prior year figures into US dollars at the same exchange rate that management used for the most recent quarter.

A mixed bag

Before I get into the fundamentals regarding Alibaba, I would like to touch on a development that occurred a couple of weeks ago that should prove bullish for the company. For three years, the Chinese government had been investigating Alibaba over monopolistic practices that were alleged. This investigation followed a $2.8 billion fine that the company was hit with back in 2021 for the same reasons. But since then, the Chinese regulator, the State Administration for Market Regulation, had been keeping a close eye on the company to ensure that it became compliant with that nation’s antitrust regulations.

According to that regulator, the rectification work that the e-commerce business was forced to undergo saw ‘good results’. This is not the end of the picture. Moving forward, Alibaba will be forced to standardize certain operations and to further improve both the quality and efficiency of its compliance. I do not know how long this part of the process will take. But the fact that regulators in China are pleased with progress is a big positive for shareholders. Unlike the US, the Chinese government has significantly more flexibility in how it deals with violations of its laws. So this should be viewed in very much a positive light.

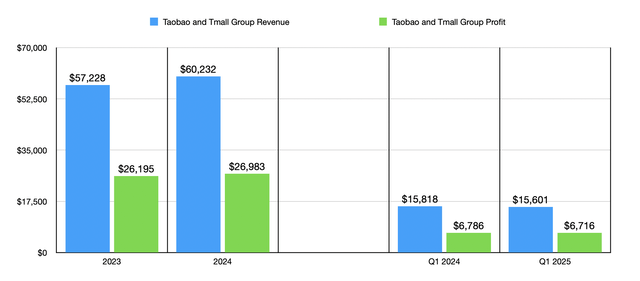

Now, moving on to fundamentals, when I last wrote about the company earlier this year, we had data covering through the final quarter of the 2024 fiscal year. Results now extend through the first quarter of 2025. Before we get into the company as a whole, I do think it would be useful to look at each of its major operating units as they stand individually. The most significant set of operations is known as the Taobao and Tmall Group. This includes the company’s consumer and business-to-business e-commerce operations.

Even though you would expect this part of the company to continue growing, we actually have seen some contraction as of late. Revenue in the first quarter of 2025 came in at $15.60 billion. This is actually down 1.4% compared to the $15.82 billion the company reported just one year earlier. Even though this is disappointing to see, management claims that the drop was largely attributable to a decline in sales of consumer electronics and appliances that was orchestrated by the firm. The company made this decision to reduce certain direct sales, likely because of low margins and expected weak demand. This is not to say that all parts of that business performed poorly. Its wholesale commerce business in China jumped 16% year over year thanks to certain value-added services that the company provided to paying members. And customer management revenue grew by 1%.

The business saw a similar decline, about 1% in total, when it came to segment profits. These fell from $6.79 billion to $6.72 billion. Interestingly, management rhetoric regarding this had nothing to do with the decrease in revenue. In fact, they said that segment profits fell because of higher investments in things like the user experience, as well as greater investments in technology infrastructure.

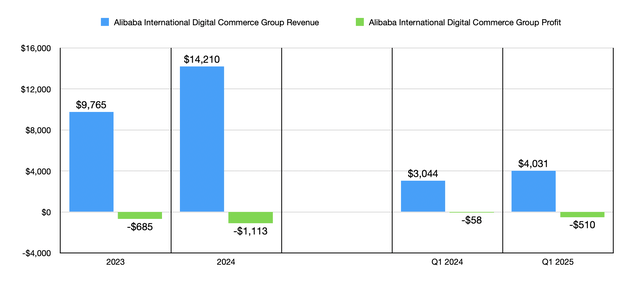

The next largest part of the company, at least during the first quarter, was the Alibaba International Digital Commerce Group. Through this unit, the company offers up international commerce retail and wholesale optionality. Most notably, this includes its famous AliExpress operation. From a revenue perspective, this was a shining star for shareholders. Revenue skyrocketed 32.4% from $3.04 billion to $4.03 billion. This was mostly attributable to a 38.2% surge in the company’s international commerce retail business that management stated was caused by improvements in monetization and a growth in its AliExpress’ Choice service. For those not familiar, Choice is a premium service that the company offers curation of the best value products, as well as things like free shipping, free returns, and more. This was initially launched in early 2023. Since then, it has been a huge growth driver for the company.

I don’t know about you, but I would expect such an increase in revenue to bring with it a rise in profits. Unfortunately, segment profits worsened. The company went from losing $58 million to losing $510 million on a year-over-year basis. Even though these operations saw significant improvements in monetization and improved operating efficiencies, management’s decision to increase investments in AliExpress negatively impacted the bottom line. It also doesn’t help that Trendyol, which is a fashion-oriented e-commerce platform owned by the company that happens to engage in cross-border shipments, also saw increased investments by the parent company.

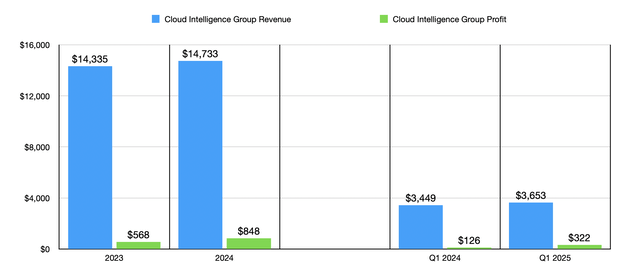

To me, the most exciting part of Alibaba is its Cloud Intelligence Group. As its name suggests, this is the company’s cloud computing operation. In fact, in the Asia Pacific region, it is the largest such cloud computing company there is. Year over year, revenue did manage to grow as the industry itself expands. That growth, however, was only about 5.9%, with revenue climbing from $3.45 billion to $3.65 billion. According to management, revenue involving public cloud products grew at a double-digit rate, largely thanks to AI-related products. But as was the case elsewhere for the company, some of the weakness was intentional. Specifically, there was a decrease in non-public cloud revenue because of the company’s decision to move away from project-based activities that, historically speaking, offer very little in the way of margin.

This decision seems to be bearing fruit. In the first quarter of the 2024 fiscal year, this part of the company generated profits of $126 million. But for the first quarter of 2025, profits were substantially higher at $322 million. This does seem to be part of a broader trend in the cloud computing market. In fact, I recently wrote an article about how Google parent Alphabet (GOOG) (GOOGL) saw improvements in its bottom line involving these operations.

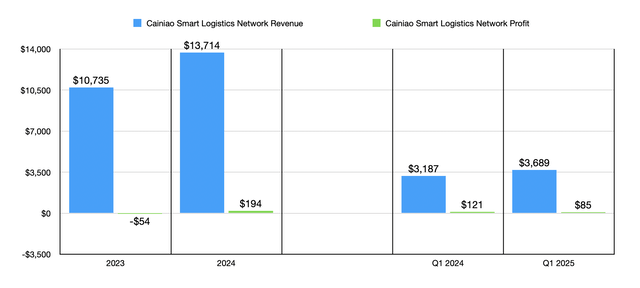

The last operating segment that I will provide some meaningful detail on is called Cainiao Smart Logistics Network Limited. This is a vital part of the company that focuses specifically on customer fulfillment. The company’s long-term goal is to guarantee that customers can have their goods delivered to them within 24 hours if they live within China. If they live outside of China, the objective is to make sure their goods can reach the desired destination in 72 hours or less. This part of the company actually saw rather remarkable growth, with revenue shooting up 15.8% year over year from $3.19 billion to $3.69 billion. This was mostly because of a rise in sales from cross-border fulfillment solutions. Honestly, I consider this very exciting because it means that the firm’s services are good enough to be in demand from customers in other nations.

Unfortunately, just like what we saw with some other parts of the company, profitability for this unit did decline. Segment profits plunged from $121 million to only $85 million. But as was the case with other parts of the company, this was thanks to increased investments being made by management. Specifically, these investments have been focused on cross-border fulfillment solutions.

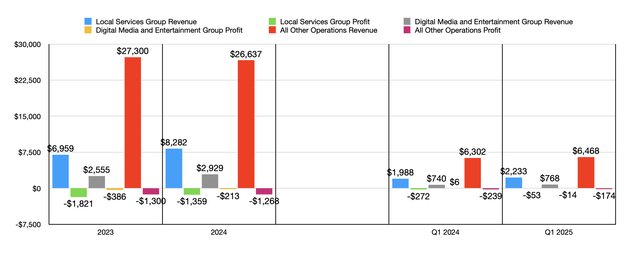

As the chart above illustrates, there are other parts of the company as well. These parts of the business saw a growth in sales year over year. The most impressive involved the Local Services Group, which focuses on food and beverage delivery, as well as the delivery of other products, directly to consumers’ homes. Sales there jumped 12.3% year over year while the bottom line improved from a loss of $272 million to a loss of $53 million.

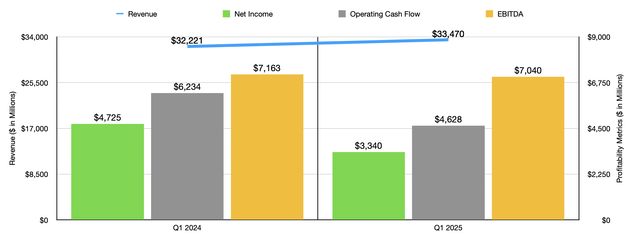

For the company as a whole, investors enjoyed growth year over year. Revenue managed to climb 3.9% from $32.22 billion to $33.47 billion. As you can probably figure, this increase was mostly because of the Alibaba International Digital Commerce Group, the Cloud Intelligence Group, and the Cainiao Smart Logistics Network segment. As great as it was to see a rise in sales, profits, and cash flows for the business declined. Net income fell from $4.73 billion to $3.34 billion. Operating cash flow dropped from $6.23 billion to $4.63 billion. And finally, EBITDA pulled back slightly from $7.16 billion to $7.04 billion.

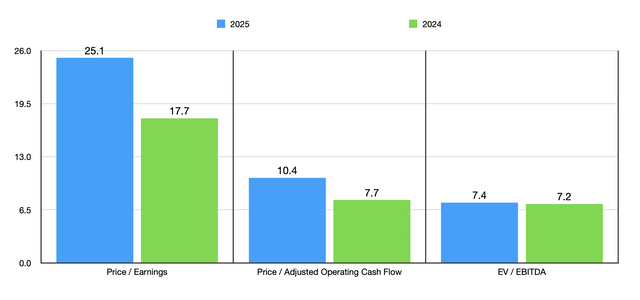

Unfortunately, we don’t have any real guidance when it comes to the 2025 fiscal year in its entirety. But if we annualize the results seen so far for the year, we would get net income of $7.81 billion, operating cash flow of $18.77 billion, and EBITDA of $26.09 billion. Using these estimates, as well as historical results for 2024, we can see in the chart above how shares of the company are currently valued. Relative to earnings, at least on a forward basis, the stock does look a bit pricey. But when it comes to the other two profitability metrics, it looks solid. In the table below, I then compared Alibaba to two similar firms. And even if we use the more conservative 2025 estimates, estimates mind you that are probably unreliable because we only have one quarter worth of data, we find that Alibaba is cheaper than either of these businesses when it comes to both its price to operating cash flow and its EV to EBITDA multiples. And on a price to earnings basis, it was in between the two.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Alibaba | 25.1 | 10.4 | 7.4 |

| Alphabet | 21.9 | 17.4 | 15.3 |

| Amazon (AMZN) | 44.2 | 17.5 | 18.8 |

Takeaway

Based on the data provided, I would say that Alibaba is most certainly facing some mixed times. A lot of the negatives that we are seeing do happen to be intentionally inflicted by management in order for the company to further improve operations for the long haul. This is the best kind of weakness that an investor can hope for. But even with these mixed figures, shares look attractively priced, both on an absolute basis and relative to similar firms. I do know that, as a Chinese company, Alibaba deserves to trade at a discount compared to American-based competitors. As I detailed in another prior article, this is because of rampant corruption throughout China and more intensive government control. But even after accounting for that, I think that shares are cheap enough to justify a soft ‘buy’ rating at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!