Summary:

- I reiterate my buy rating for Alibaba due to its bullish momentum and completion of the 3-year regulatory rectification process.

- Alibaba International Digital Commerce Group is a long-term growth catalyst, leveraging AI and expanding global e-commerce, driving significant revenue growth.

- Technical analysis confirms a strong bullish trend with price targets around $119, supported by increasing trading volume and MACD indicators.

- BABA’s robust cash flow supports shareholder returns via share repurchases, demonstrating confidence in long-term growth and financial stability.

Robert Way

Investment Thesis

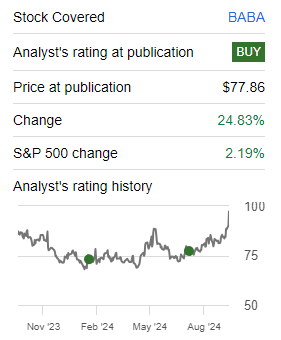

I reiterate my buy rating for Alibaba Group Holding Limited (NYSE:BABA) (OTCPK:BABAF) given its bullish momentum and recent developments such as the completion of the 3-year regulatory rectification process. In July, I published a bullish article where I discussed my optimism given the company’s solid fundamentals and strategic positioning. Since then, the stock has gained 24.83%, outperforming the S&P 500 significantly.

Seeking Alpha

In this follow-up coverage, I will discuss Alibaba International Digital Commerce Group [AIDC] as a long-term growth catalyst. I find the AIDC to have key strengths that will propel this stock to long-term growth while hedging against key risks such as geopolitical tensions and economic uncertainty. Given this background, I believe BABA is poised to sustain its current upward trajectory in the long run making it a good investment opportunity.

BABA Completes A Regulatory Rectification Process

Alibaba just finished a three-year regulatory rectification process that was required following the company’s $2.8 billion penalties for monopolistic behavior in 2021. During this process, BABA stopped its monopolistic “choose one from two” policy, which made retailers pick between it and its rivals. The company has reached a major milestone with the conclusion of this process, which suggests that it conforms with Chinese antitrust laws and may also relieve some regulatory pressure. This milestone has several implications for its stock performance.

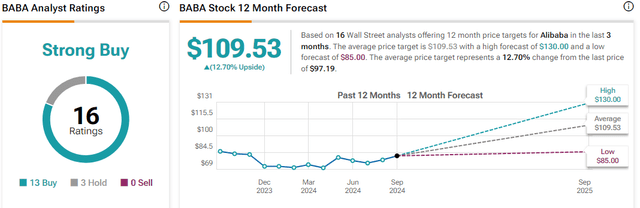

First off, it triggered a positive market reaction. The stock rose significantly after the news, indicating investor confidence in the company’s prospects now that regulatory worries have been resolved. In premarket trading, its American depositary receipts (ADRs) increased by 4.5% to $84.67. Furthermore, the conclusion of the rectification procedure is likely to increase confidence among investors because it indicates that BABA is now in conformity with regulatory requirements and can concentrate on expansion and innovation. Above all, with regulatory difficulties behind it, the company can now focus on expanding its business operations and pursuing new prospects, which might boost its stock performance in the long run. The consensus 12-month price target of $109.53, based on 16 Wall Street analysts issuing strong buy recommendations, demonstrates the growing investor confidence and optimism.

The AIDC: The Core Of Future Growth

AIDC is an Alibaba segment that is focused on global e-commerce. It leverages advanced technologies, such as artificial intelligence, to improve its operations. For example, it employs AI-powered solutions to help cross-border businesses with functions such as translation, content production, and product returns. This area is critical to the company’s goal of expanding its global footprint and driving growth in the global e-commerce market.

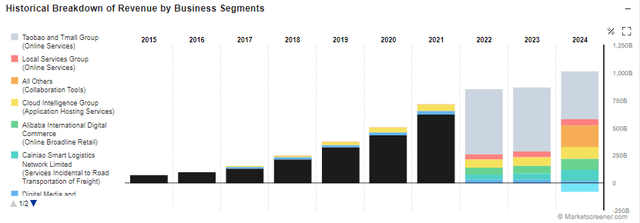

AIDC has been a key driver of the company’s recent success and is expected to play an important role in its future expansion. For example, in the MRQ, AIDC recorded 32% revenue growth, and its revenue contribution has steadily increased since 2022, from $61.08 billion in 2022 to $102.6 billion in 2024.

I find several strengths of AIDC that, I believe, will help it drive sustainable future growth. To begin with, it has a diverse portfolio. It consists of several global wholesale and retail businesses, such as Alibaba.com, Trendyol, AliExpress, and Lazada. Alibaba’s varied portfolio relieves its reliance on any one market by enabling it to access a range of markets and client categories. Some of the markets that AIDC has enabled Alibaba to reach are South Asia through the Lazada platform and Turkey through the Trendyol platform, among others. This expansion not only broadened BABA’s market footprint but also aided its overall growth by tapping into new client bases and increasing global sales.

This explains the double-digit revenue growth previously mentioned, which was way above its domestic operations, and most of them saw single-digit growth. Although the company didn’t give a definite figure for its international orders growth, the CEO did mention they experienced a steady growth in orders. However, in Q4 of 2024, the AIDC marketplace saw a 20% growth in combined orders speaking volume on the prospects of BABA’s international expansion. Further, according to Statista data as of 15th August 2024, Alibaba has shown consistent and strong growth for its international customers, a testament that AIDC is helping the company grow its client base, which bodes well for its future growth.

The second strength is AI and technological innovation. BABA is employing generative AI technology to improve its worldwide marketplace. AI-powered tools help cross-border merchants with translation, content development, and product returns, hence increasing efficiency and customer experience. For instance, the launch of a conversational sourcing engine driven by AI streamlines international business-to-business (B2B) e-commerce. This technology makes it easier for retailers to match customers with acceptable products and suppliers on third-party marketplaces and Alibaba’s global wholesale networks.

The localized user experience is the third strength. Notable is the company’s emphasis on providing improved and localized user experiences to various consumers across the globe. This includes initiatives like the full-consignment and semi-consignment options provided by AliExpress Choice.

These three are just a few of the AIDC’s many strengths. While they are worth discussing, the main focus is on potential growth opportunities. Here is why I see it as a major growth catalyst. With the global e-commerce market projected to expand at a CAGR of 18.9% between 2024 and 2030, AIDC’s strong market presence and technological advances position Alibaba to capitalize on this growth opportunity.

Alibaba can increase efficiency in areas like cross-platform product listing, product information, multilingual search, and targeted recommendations by utilizing AI and other cutting-edge technology. This could improve the general consumer experience and encourage customer loyalty.

In conclusion, Alibaba’s AIDC strengths will be essential to the company’s further expansion. BABA is well-positioned to prosper in the dynamic global e-commerce market by leveraging these strengths.

Comparative Analysis: AIDC Vs. Domestic Market

To analyze the performance of AIDC against its domestic operations, we can look at several key factors. The first parameter I will use is revenue growth. In the MRQ, the AIDC revenue grew by 32%, reaching $4.03 billion. The international commerce retail sub-segment grew by 38% to $3.3 billion. While Alibaba remains the dominant player in China’s e-commerce business, its domestic growth has been more modest, possibly due to market saturation. In the MRQ, the Taobao and Tmall group segment saw a slight revenue decline of about 1% YoY. All of the other domestic segments experienced slower growth than the AIDC, with China Commerce Wholesale coming closest at 16%. This without a doubt implies that AIDC is currently BABA’s leading revenue growth driver.

The other parameter is market expansion. The international segment enables Alibaba to enter emerging markets with great growth potential. For example, AliExpress and Trendyol have been increasing their supplier base and developing localized services to fulfill various consumer demands. AliExpress has seen significant growth in its orders, surging by 60% YoY in 2023. Trendyol is one of Turkey’s leading e-commerce platforms, having expanded its customer base to approximately 1.5 million clients and hoping to reach 6 million by the end of the year. The enormous potential in foreign markets outweighs the growth prospects in the domestic market and this can be justified by the company’s Chinese market share declining from about 70% to below 50% in 2023 majorly due to increasing competition in the domestic market which I believe resulted from the regulatory rectification.

The last parameter that I would consider is strategic partnerships. Strategic agreements, such as the one with Magazine Luiza in Brazil, assist Alibaba in increasing its international presence and brand recognition. For instance, the collaboration will enable both organizations to tap into each other’s customer bases, expanding the size of their market. The two platforms have over 60 million active users and over 700 million monthly visits combined. Partnerships within China are equally important, but the opportunities for new, impactful partnerships are limited compared to the global landscape.

In conclusion, while Alibaba’s domestic market remains essential, the AIDC segment offers significant prospects for long-term growth and global market leadership, justifying it as the key growth catalyst for this company.

Technical Analysis: It’s All Bullish

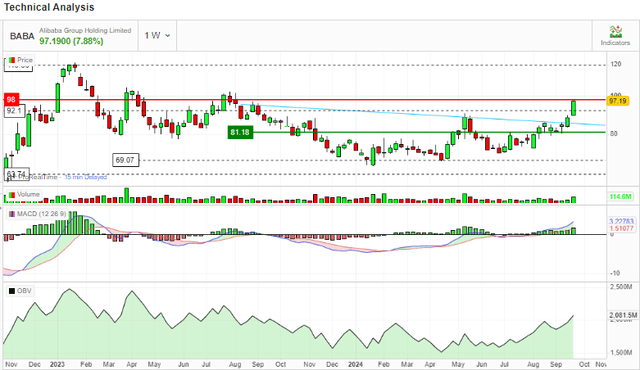

In my previous analysis, my technical analysis showed that this stock was in the early stages of its bullish momentum, is signified by the price being above the 50-day MA but below the 100-day and 200-day MAs. Currently, the price has crossed above the 100-day MA, and it’s now above both the 50-day and 100-day MAs. This is a bullish confirmation, and it signals that the uptrend is solidifying, justifying a buy decision. Above all, the price has completed what was a cup and handle pattern, and it has broken above the peak price of the handle, confirming that the bullish trajectory is fully confirmed.

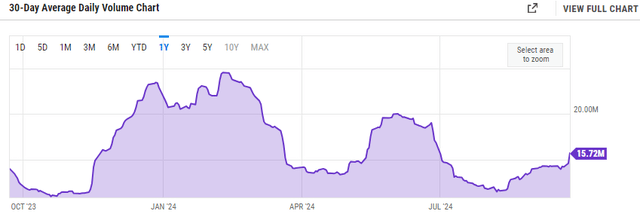

A double confirmation for this pattern is always an increasing trading volume and this has been fulfilled by the stock’s trading volume increasing from 11.45 million on August 7th, 2024 to its current volume of 15.72 million.

In addition, the MACD points out a growing bullish momentum and outlook. The MACD has moved above the signal line and both are diverging, indicating that the uptrend is becoming stronger. Further, both the MACD and signal line have moved above the zero line and the histogram is growing above the zero line, implying that the stock is in a strong upward momentum. While trading volume is essential for a sustainable bullish momentum, the OBV has soared significantly, indicating a growing demand for this stock, which is a recipe for a sustainable uptrend.

Given this apparent bullish outlook, I am seeing a strong resistance zone between the $119 and $122 region. However, there lies a major pivot point at about the $102 price range which serves as temporary resistance but not a major decisional point especially considering that the price has just broken above the 100-day MA and is yet to cross above the 200-day MA meaning there is an ample space for its bullish run. Consequently, my price target for the current bullish run is at $119 marking about 22.44% upside potential.

In a nutshell, BABA is in a strong upward momentum with a strong resistance at about $119, justifying a buy rating.

One More Thing: Returning Capital To Shareholders

BABA’s solid balance sheet and cash flow generation capacities are remarkable. As of Q1 2025, the corporation had an attractive net cash position of $55.8 billion. The free cash flow totaled $2.4 billion. Its solid cash flow production enables it to return capital to shareholders through a combination of share repurchases and dividend payments.

In the MRQ, it bought back 630 million ordinary shares, about 77 million of its ADSs, for $5.8 billion in the US and Hong Kong markets as part of its share repurchase program. This share repurchase demonstrates the company’s confidence in its long-term growth prospects and financial stability. For investors, this is a positive indicator that the company is devoted to increasing shareholder value.

Risks

While I believe AIDC will be a significant growth driver for BABA, it is not without risk. Operating in numerous countries, each with its regulatory framework, involves a risk. Changes in laws and regulations, particularly those relating to data protection and taxation, might create compliance issues and increase operational expenses, limiting the AIDC’s growth potential.

Conclusion

In conclusion, I reiterate my buy rating for BABA given its strong bullish momentum backed by a high-growth potential from its AIDC.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.