Summary:

- Alibaba’s Q1 earnings showed mixed results, with 4% revenue growth but a 27% decrease in bottom line; however, the company’s strong cash position and low debt are positives.

- Ali Cloud is gaining market share domestically and investing heavily to compete globally.

- The company’s AI and international expansion efforts are promising but still unprofitable; long-term investments should yield returns.

- Despite risks, BABA’s strong balance sheet and potential for growth make it a strong buy.

Ayman Zaid

Introduction

Alibaba (NYSE:BABA) recently reported its Q1 earnings, so I thought I’d take a look at the company’s performance and see whether anything significantly changed since the last time I covered the company. I will cover the main parts of the company that will help the company in the long run, and even with conservative estimates, the company is a good investment; therefore, I am upgrading to a Strong buy and will continue to accumulate shares over the next while, as my position right now is relatively small.

Since the last article back in April, the company’s share price returned almost 20% vs. SP500’s (SPY) almost 6%, so I may have timed the bottom back in April, but anything can happen, and we will see those prices once again.

Q1 Results

Starting from the top, BABA’s top line came in at $33.47B, which is 4% growth y/y, and a miss of $685m on consensus. The company’s adjusted earnings per ADS came in at $2.29, a decline of 5% y/y, but a beat of $0.20 on consensus estimates.

In terms of operations, operating income was 15% lower due to the “reversal of share-based compensation expense, in relation to mark-to-market adjustment of Ant Group share-based awards granted”. This reversal happened in June 2023, which makes it look worse than it is. It makes June 2023’s numbers look better. The company’s bottom line decreased by 27% due to decreased income from operations and increased impairment of the company’s investments.

In terms of the company’s financial position, BABA is sitting on almost $63B in cash and equivalents, against $25B in long-term debt. The cash pile can easily cover the debt outstanding, while the company’s operating income easily covers the company’s interest expense on debt, having an interest coverage ratio of around 18x as of Q1 ’25.

Overall, I think the results were quite a mixed bag. The revenue growth is still rather low for a company like BABA that is involved in tech, and the lack of concrete improvements in margins is not great either. However, things are starting to turn around in my opinion, and I will go through some of the reasons why I think it is still a steal at these prices in the next section.

Comments on the Outlook

Cloud and AI

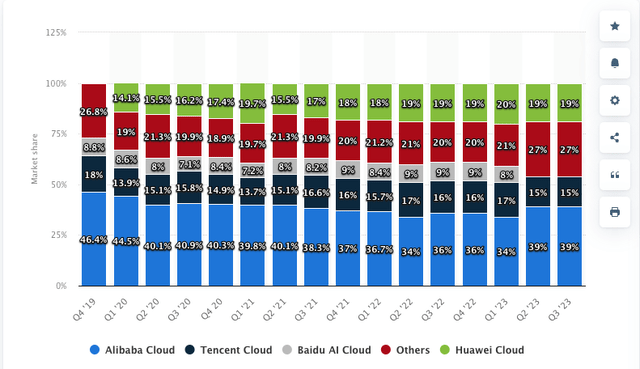

In terms of worldwide market share, Ali Cloud, or Aliyun, occupies quite a low spot when compared to the big three cloud providers of the world, mainly Amazon’s (AMZN) AWS, Microsoft’s (MSFT) Azure, and to an extent, Google’s (GOOGL) Cloud Platform. These three control 66% of the worldwide cloud infrastructure market. Juggernauts. However, I don’t think it’s fair to compare them to Alibaba just yet. China on its own has a huge market and requires a lot of cloud services. Here, Alibaba Cloud is leading the way, controlling more than a third of the cloud infrastructure market. That gap was much bigger back in 2019, but other local cloud providers like Tencent (OTCPK:TCEHY) and Huawei and most likely the three mentioned managed to take some of that dominance from BABA, however, the most recent quarters available, suggest that BABA managed to take some of that back once again.

Alibaba is also heavily investing in the surrounding regions, where the big three are currently leading the competition, however, further investment from the company in the future may be able to shift the rankings. A lot of investors saw that the company’s free cash flow decreased by a whopping 56% y/y, however, when you see that the company aggressively increased expenditures related to Aliyun, the decrease, in my opinion, is justified. The company is trying to be a lot more competitive globally and is trying to gain even more market share domestically, so I think these sorts of investments should bear fruit in the long run.

It will be a lot harder to gain momentum outside of China and surrounding regions; however, the transcript mentioned that Aliyun was a major cloud service provider for the Olympic Games in France, which provides a lot of exposure for the company, and may signal that the global audience is open to alternatives of the big three, well-established cloud providers. This tells me that BABA has the necessary infrastructure for such a large-scale project as the Olympic Games. The company possesses the technical capabilities and global reach needed to support such a project. Another reason may have been the cost-effectiveness, but the Olympic Games is such a high-profile event, I don’t think the organizers in France would skimp out on the best quality of service to save a few bucks, which means that Aliyun is just as good, or even better than the big three.

The numbers that the cloud is achieving right now, in terms of revenues aren’t very impressive, and I would like it to improve, I do like the way these have progressed over time, especially in terms of operations. The segment’s EBITA increased by 155% y/y, which signals much better efficiency and profitability, and I believe there is a lot more room for growth.

AIDC

The company’s attempt to expand beyond China has shown decent revenue growth in the latest quarter, and I am not expecting this segment to turn profitable for a little while longer because BABA is continuously investing in global reach, to improve customer satisfaction by improving delivery times even more, looking across the organizational setup of the segment to see where efficiencies can be made to further optimize logistics, and continue to invest in new products and innovations. Artificial intelligence, although there is very little evidence to show how it will improve operations across the business, the company is banking on meaningful effect on efficiencies and boosting user experience. My biggest concern here is if all the AI hype will actually be worth it in the end. All the companies are heavily investing in AI. Billions are being injected into the technology, while there are still no revenues to support all this investment. I hope we will see the results soon, and I hope it is worth it. Nevertheless, I am sure these companies like BABA know what the future savings should look like and if they are investing so heavily right now, it means it will be worth it. I’ll take all such comments at face value for now.

It is not unusual to see a segment grow its top line significantly while still being unprofitable. It happens to many companies due to heavy investments, so all the plans that the company has in store for AIDC in terms of efficiency in the long run, should bear fruit in the end. Additionally, it’s not unheard of for companies, in order to take market share, to undercut the competition, and I am sure this plays a decent role in AIDC’s operational underperformance.

Financial Position

The last reason why I think the company is a steal at these prices is its balance sheet, which reminds me of Meta Platforms’ (META) back when it was truly hated still at the beginning of 2023. As of Q1 ’25, the company had around $62B in cash and equivalents, against $24.5B in long-term debt. The company is flushed with cash and easily covers the debt outstanding. Furthermore, the company made around $5B in operating profit while paying out around $300m in interest expense on debt for the quarter, which means BABA’s interest coverage ratio is around 16x, well above the 2x that analysts consider healthy and 5x requirement from me because I like to be much more conservative. This position allows for a lot of flexibility in how the company may spend its resources, and I am sure the management will use all that capital to continue to innovate, expand its reach, and maintain its competitiveness going forward.

Let’s look at an updated valuation model of BABA.

Valuation

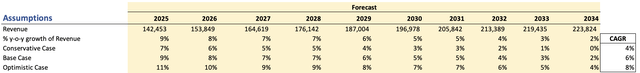

As usual, I will keep it conservative but realistic. For revenues, I am not expecting the company to achieve as high of growth as it had in the last 10 years. Its 10-year CAGR sits at a whopping 30%, which I don’t think it is realistic given that its 5-year CAGR dropped to around 16%, while in the last 3 years, it dropped to -1.4%. Negative growth is also unreasonable because the last few years following the explosive growth of the pandemic lockdowns, so the comparisons are hard. In the latest transcript, the company mentioned that they expect the company to see a double-digit growth return in the second half of the year. Now that is great news; however, I am going to take these comments with a grain of salt, so for my conservative estimates, I am going to grow the company’s top line at around 6% CAGR over the next decade.

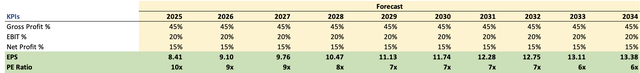

For margins and EPS, analysts are expecting $8.78 of earnings per ADS, which translates into around 2% growth y/y. That seems reasonable to me. However, I lowered my assumptions slightly more and kept margins fixed throughout the model period to keep it conservative.

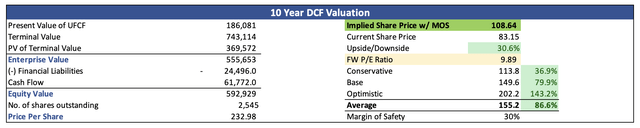

For the DCF analysis, I was going to use the company’s WACC as my discount rate, but in case the assumptions above are not conservative. The company’s WACC is around 7.23%; however, I went with 10% to keep it conservative. I am also using 2.5% as my terminal growth rate. Additionally, I went ahead and discounted the final intrinsic value by another 30%, as I had in my original calculation, for consistency. With that said, BABA’s (conservative) intrinsic value is around $109 a share, which means it is still trading at a discount to its fair value.

Risks to the Thesis

The biggest risk I see, that may limit the company’s upside potential, is the negative sentiment toward anything China. Many investors are not fans of the omnipotence of the Chinese Government to take control in an instant and change a company completely. BABA is not new to this. It is a real risk that the government may decide that BABA is doing something that is not in the best interest of the economy and step in and disrupt progress. I say to that, keep your position manageable and be fine with losing it if something like this ever happens. The risk is worth it in my opinion. Especially now that Beijing concluded its probe against BABA over monopolistic practices, which means this risk is ever small.

As I mentioned earlier, all the investments in AI are still yet to yield any profits. In theory, AI sounds like it should improve efficiency and save corporations a lot of money, but what happens if the cost savings do not outweigh the investments? Then we have a problem. Billions may be wasted, but on the other hand, a lot will be saved too once the companies stop injecting all of that money into something that turned out to be not worth it.

The international part of the company may continue to lose a lot of money, and may not take off in the end, which will force the company to divest the venture, potentially wasting billions also.

Closing Comments

I believe, given the risks and my conservative estimates, the company deserves a rating upgrade to a strong buy. The reasons above tell me that there is a lot of potential to perform well going forward, and with the mitigated risks of China stepping in once again very low now, coupled with the company’s outstanding balance sheet, I am confident that we will see the share price continue its trajectory higher over the next 3 to 5 years. I have a very small position right now, which I am going to add to over the remainder of the year, depending on where the global economy is heading. There are a lot of jitters in the markets. The talks of recession started to resurface over the last month, and volatility keeps everyone on their toes.

Nevertheless, the company’s share price should see a turnaround eventually and hopefully, we won’t be disappointed. A company like BABA requires a lot of patience.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.