Summary:

- Alibaba’s stock is poised to rise due to multiple positive catalysts and a reasonable valuation.

- China’s recent economic measures, including lowering the 7-day reverse purchase rate and required reserve ratio, aim to boost liquidity and stimulate economic activity.

- These economic stimuli are expected to benefit BABA and other China-based companies by increasing economic activity/consumer sentiment.

- Alibaba’s technical indicators are strong, showing the stock is back in a long-term uptrend, further supporting a positive outlook.

Robert Way

Alibaba (NYSE:BABA) has multiple positive catalysts that are likely to improve the company’s fundamentals and drive the stock higher. The valuation is reasonable, allowing room for the stock to increase further as earnings possibly increase at a higher pace than recent years. Alibaba’s technicals look positive with the stock back in a strong long-term uptrend.

I previously wrote about Alibaba in August of 2023 where I identified the stock at a key technical level with long-term upside potential. My thesis at the time was that the stock could drop in the near term (over a few months), but I expected a recovery over the longer term (at least a year or more). I expected the reopening of China’s economy after the pandemic to be the catalyst for the stock.

The stock was trading at just under $96 at that time. I didn’t expect the stock to drop below $90. However, the stock did drop to a 52-week low of just under $67 as China-based stocks remained out of favor for longer than I expected. Plus, BABA missed earnings estimates in FQ3 2024 and FQ4 2024 which kept the stock suppressed.

Despite the drop in price in late 2023 and early 2024, the stock remains in the long-term bullish trend on the monthly chart that I identified in my last article. The stock did increase over 20% since my last article. There are new positive catalysts for Alibaba, which is driving the continuation of my coverage.

Alibaba’s Positive Catalysts

Alibaba needed a strong catalyst to change the sentiment for the stock back to positive. The most obvious catalyst for Alibaba is the Chinese government’s recent economic stimulus. China lowered the 7-day reverse purchase rate to 1.5% from 1.7%. China also lowered the required reserve ratio for major banks to 9.5% from a previous rate of 10%. These changes went into effect on September 27, 2024. These along with some other measures are designed to increase liquidity in China’s economy, which can have a stimulus effect. Alibaba and other China-based companies can benefit from this stimulus as economic activity is likely to increase as a result.

I view the stimulus as a strong potential game-changing catalyst for Alibaba. This stimulus can help improve Alibaba’s fundamentals in my opinion. Revenue can improve as consumer sentiment turns positive from the stimulus effects. Increased consumer sentiment towards Alibaba’s offerings can help drive revenue/earnings growth and the stock higher.

Alibaba derives about 43% of total revenue from its Taobao and Tmall business segment. This is a higher percentage of revenue than any of the company’s other segments. So, increased consumer sentiment as a result of the stimulus efforts in China is likely to help drive Alibaba’s growth from these sites. If consumers and merchants are feeling more positive and confident, then they are more likely to drive increased sales at the Taobao and Tmall e-commerce websites.

Alibaba also implemented strategies to increase sales for Taobao and Tmall. BABA has been making efforts to enhance the user experience on these sites. These efforts include: offering price-competitive products, membership program benefits and technology, and improved customer service. Alibaba’s technology includes algorithms to improve the matching of products to customers’ needs. Alibaba increased its range of suppliers for more competitive prices.

Earlier this year, Alibaba launched an AI-powered marketing tool known as Quanzhantui across its entire platform. Quanzhantui features automated bidding and dashboard visualization for optimized targeting and performance. The goals for this tool are to increase merchant’s marketing spend and to improve their marketing efficiency. Alibaba stated that it has achieved increased merchant adoption of Quanzhantui.

In September 2024, Alibaba launched a new AI-powered sourcing agent and new financial and logistics solutions. These solutions are designed to help small and medium-sized businesses to increase sourcing efficiency and to navigate cross border trade more efficiently. The AI-powered sourcing agent works by providing more accurate search results for global supplier and product sourcing. It should also help new businesses to get started quickly and to better understand global sourcing as it relates to them. This is accomplished through conversational searches with natural language queries on the alibaba.com website. The tool provides detailed supplier comparison info with quotes.

Alibaba’s new tools can help drive growth for the company as the user experience is improved across its platforms. The stimulus in China adds to the likelihood of improved consumer sentiment, which can drive higher economic growth, including Alibaba’s e-commerce.

Valuation

Since Alibaba is expected to return to a growth trajectory for both revenue and earnings according to consensus estimates, I think the PEG ratio is the best valuation measure. Alibaba is currently trading with a PEG ratio of 1.3. This is below the PEG ratio of 1.9 for the Internet Retail industry. The growth stocks that I cover that trade with PEG ratios between one and two tend to perform well as the companies continue their growth. In the case of Alibaba, it is a matter of achieving a new growth trend after underperformance in recent years.

Consensus estimates show that Alibaba is expected to grow earnings at 11% for FY26. This would be a significant improvement over the 3.6% expected EPS growth for FY25 which ends in March. Frankly, I think these estimates will most likely be revised upwards due to Alibaba’s strategies and China’s stimulus. These factors are likely to increase business activity for Alibaba’s largest revenue generators, Tmall and Taobao.

The PEG ratio is based on expectations of annual average earnings growth of about 10% over the next 3 to 5 years for Alibaba. I also think this average will increase as the effects of Alibaba’s strategies and the stimulus are fully realized.

Overall, Alibaba’s reasonable PEG ratio should allow the stock to increase approximately in-line with earnings growth. The stock could even outperform the pace of earnings growth if investor sentiment significantly increases for Alibaba’s stock. China’s stimulus could be the driving factor for increased sentiment for China-based stocks.

Technical Perspective

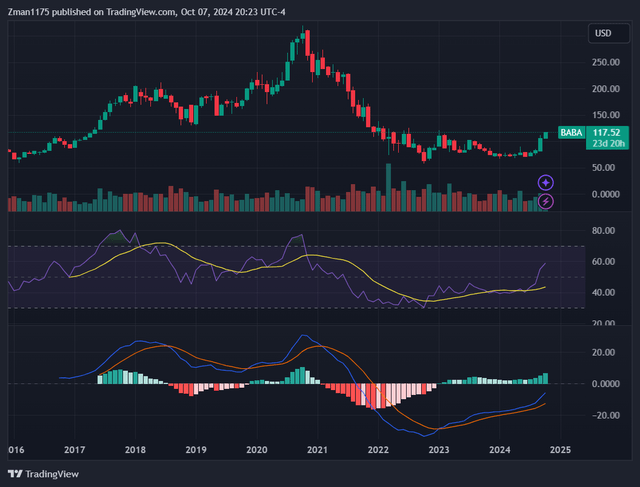

Alibaba’s (BABA) Monthly Stock Chart with RSI and MACD (TradingView)

I will point out that Alibaba is overbought on the daily and weekly charts. So, a short-term pullback could occur after the quick recent run-up in price. However, the chart above is the monthly chart which gives a multiple-year perspective (each candle represents an entire month). Here we can see that the price is bouncing higher from a multi-year support level going all the way back to 2016. The stock price is not yet in overbought territory on the monthly chart. So, there is plenty of room for the stock to increase over the long-term.

The purple RSI indicator in the middle of the screen increased above its yellow moving average and above the 50 level which is bullish for the stock. The blue MACD line (bottom of the chart) increased above the red signal line. The histogram turned green with rising bars indicating that positive momentum is increasing. These are all bullish technical signs for Alibaba’s stock.

While short-term pullbacks can occur at any time, I expect the stock to make a strong recovery if consumer sentiment increases as a result of the stimulus. I also expect Alibaba’s recent strategies to materialize to drive revenue and earnings growth at a higher pace than the company achieved in recent years. That should support Alibaba’s stock to maintain a long-term upward trend over the next year and perhaps beyond.

Room for Improvement

Alibaba currently has room to improve its key return profitability metrics based on lackluster performance over the past 12 months. BABA’s return profitability metrics are lagging in the single digits as I prefer to see companies with double-digit metrics. Here’s Alibaba’s return profitability metrics:

| Return on Equity [ROE] | 7% |

| Return on Invested Capital [ROIC] | 6% |

| Return on Assets [ROA] | 4% |

source: Seeking Alpha

The possibility exists for Alibaba to improve these returns if its strategies prove to be successful and if consumer sentiment increases from the stimulus. Improvements in returns can help drive earnings growth higher. BABA’s net income margin was 7.4% for the trailing 12 months. I expect the return metrics and the net income margin to increase over the next year as Alibaba benefits from the stimulus and its strategies.

Risks to the Investment Thesis

It is possible that China’s stimulus doesn’t have the expected effect on consumer sentiment as it relates to Alibaba. This could lead Alibaba to underperform over the next year. The stock would likely underperform if BABA’s revenue and earnings expectations were not met.

It is also possible that Alibaba’s strategies fail to produce the desired increases in revenue and earnings. While the company’s new tools could benefit its customers, it is possible that they fail to drive significant growth. BABA could miss revenue/earnings expectations as a result, driving the stock down and to underperform the broader market.

Alibaba’s Long-Term Investment Outlook

I’m leaning towards the China stimulus and Alibaba’s strategies to drive higher revenue and earnings growth over the next year and possibly beyond. Alibaba’s growth is likely to be higher over the next year as compared to the lackluster pace of recent years. The valuation is still reasonable and the long-term technical outlook is bullish. As a result, Alibaba’s stock has the potential to perform much better over the next year than it has in recent years. This can be driven by increased sentiment for the stock and stronger revenue and earnings growth from the catalysts that I discussed.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The article is for informational purposes only (not a solicitation or recommendation to buy or sell stocks). David is not a registered investment adviser. Investors should do their own research or consult a financial adviser to determine what investments are appropriate for their individual situation. This article expresses my opinions and I cannot guarantee that the information/results will be accurate. Investing in stocks involves risk and could result in losses.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.