Summary:

- I remain skeptical about long-term investment in Alibaba due to concerns over macroeconomic issues and end-market competition, despite recent stock gains.

- The recent rally in Alibaba seems to be driven by government economic stimuli rather than company-specific financial improvements.

- Alibaba’s financial performance shows mixed results, with declining core retail sales and net income. Growth in the cloud looks insufficient, while the international commerce segment is certainly expanding well.

- Given the overbought Chinese market and persistent macroeconomic challenges, I believe Alibaba’s growth potential is now fully exhausted, anticipating a significant correction.

Robert Way

Intro & Thesis

I have always been skeptical about long-term investment in Chinese companies, mainly due to concerns about the VIE structure and the authoritarian nature of the CCP, which I believe hampers China’s growth prospects. These concerns kept me from upgrading Alibaba Group (NYSE:BABA) stock in the past (see my detailed coverage history), even though I saw obvious signs that there should come an upswing. Well, first, we saw the co-founders Jack Ma and Joe Tsai had bought a lot of BABA stock in their personal portfolios. Second, my outlook has become even more positive on the extreme cheapness and overbought conditions of the entire Chinese equity market. Although I’ve maintained a “Neutral” rating on Alibaba instead of issuing a “Buy” recommendation, back in my May 2024 article, I pointed out the potential for a significant short- to medium-term turnaround in the stock price. I confirmed my call in mid-August, and it paid out – BABA is up almost 64% since I pointed to the co-founders’ purchases back in February:

Seeking Alpha, my coverage of BABA stock

Today, however, I believe that BABA could be facing a number of serious problems, primarily related to profit-taking by speculators and the ongoing macro problems in China.

Why Do I Think So?

The rally in Chinese stocks was actually a direct response to a series of economic stimuli from the Chinese government. The once fast-growing country began to experience typical problems of developed countries (such as an aging population and youth unemployment), so the People’s Bank of China (PBoC) decided to take unprecedented measures.

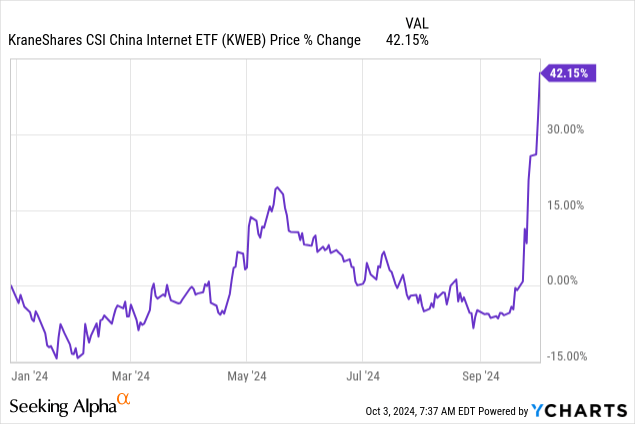

As my friend Oakoff Investments summarized it in his Vale (VALE) article, the new stimulus focus intensified in mid-September and culminated with a package of measures: reductions of 50 bps and 20-30 bps respectively in reserve requirement ratio and borrowing rates on tenors by the PBoC, and support to the capital market by the state. The latest Politburo meeting headed by President Xi (accompanied by his closest aides and trusted assistants) made a pledge to support the property industry and boost fiscal spending as China now wants to reach the official growth target of 5% for the year. Those measures triggered a big move in Chinese assets KraneShares CSI China Internet ETF (KWEB) reaching highs it hasn’t seen since early 2022.

Some analysts (like those from UBS) said this policy shock had renewed expectations that China’s growth story might turn the corner – they now expect fast policy easing to support short-term confidence and Chinese stock valuations, ultimately leading to further gains for markets. And the stimuli announced may be far from what investors should expect, as China has “room to ramp up fiscal support for the economy by issuing as much as 10 trillion yuan ($1.4 trillion) in special debt”, according to Bloomberg.

In this context, it’s not at all surprising why Alibaba, as one of the largest and most well-known Chinese companies out there, has experienced such strong growth over the past few weeks. On the other hand, this surge appears to be driven primarily by macroeconomic shifts rather than any direct financial improvements within the company itself.

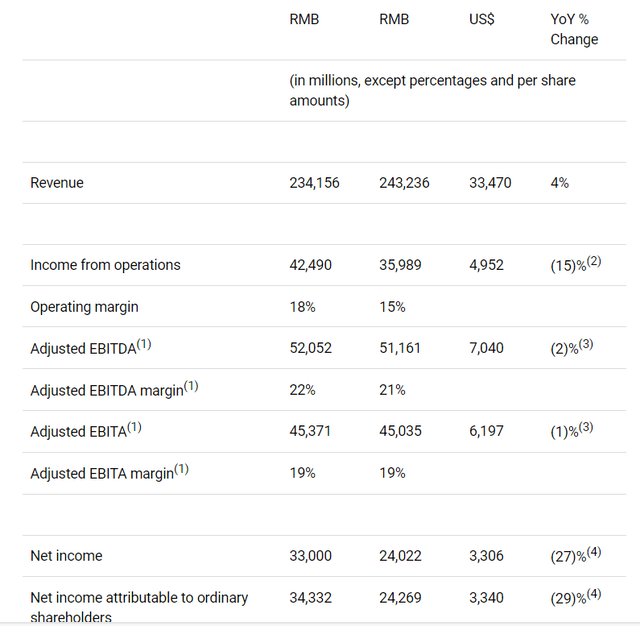

We know that in its fiscal 1Q FY2025 (calendar 2Q FY2024), Alibaba reported below-consensus sales (+4% YoY) with core China retail sales declining slightly year over year. EBIT dropped by 15% to ¥35,989 million RMB (~$4,952 million), mostly due to the absence of a significant reversal of share-based compensation expense that had bolstered the previous year’s results. Adjusted EBITDA slightly declined by 1% YoY to ~$6.2 billion, reflecting relatively good operational performance despite the challenges. On the other hand, Q1 BABA’s net income to ordinary shareholders was down 27% in net income – the fall was driven by declines in income from operations and increased impairment of investments, partially offset by favorable mark-to-market volatility in equity holdings.

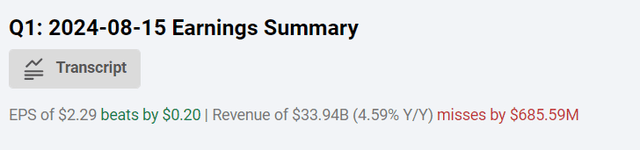

However, Alibaba’s non-GAAP net income declined by only 9% to ¥40,691 million RMB (~$5.6 billion), so with massive repurchases the non-GAAP diluted earnings per ADS of $2.26 (-5% YoY) was enough for the firm to show an EPS beat for the quarter amid all the challenges:

The Cloud Intelligence Group saw 6% revenue growth to ~$3.65 billion due to “strong public cloud development and use of AI products” as the management explains it, but in my view, this growth rate is still lagging far behind the Western peers like Amazon’s AWS (AMZN) or Microsoft’s Azure (MSFT) as it was the case in the past few years. BABA is set to continue investing in AI and cloud to retain its market dominance in the region and seize new opportunities in data science and machine learning, but I think that its global presence isn’t going to be as massive as some bullish-minded investors are hoping for.

Be that as it may, there is a ray of hope in the company’s segments. Alibaba International Digital Commerce Group (AIDC) reported an astounding 32% increase in revenue to ~$4 billion as efforts to increase efficiency and expand its supplier base are bearing fruit, and I think this trend will continue in the coming quarters. Also, Cainiao Smart Logistics Network and Local Services Group both experienced solid revenue growth thanks to the integration of e-commerce business and higher efficiency.

Alibaba was struggling to stay as profitable as it was someday through shifting markets. The company’s net cash generated by operating activities was ~$4.6 billion, a 26% decrease from the year-earlier (in RMB terms). Free cash flow, an important liquidity indicator, shrank 56% ~$2.4 billion due to increased capital spending and working capital movements.

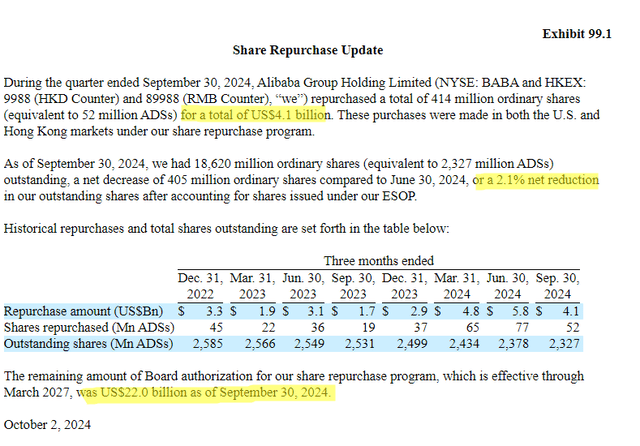

So the free cash flow, a key point of discussion among bullish investors who have cited it as a primary reason to buy Alibaba stock, was shrinking significantly in fiscal Q1 FY2025. This is due to the company’s substantial investments in its cloud segment, which is not growing as rapidly as some competitors – it’s crucial to understand this context. Nevertheless, Alibaba remains one of the most active companies in share buybacks: Management believes the stock is undervalued, consequently, they continue to actively repurchase shares available on the market and have substantial authorized buyback plans to do so going further.

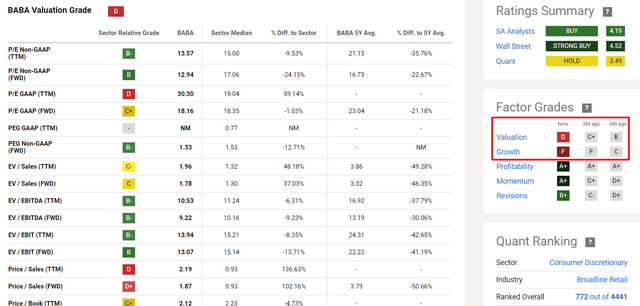

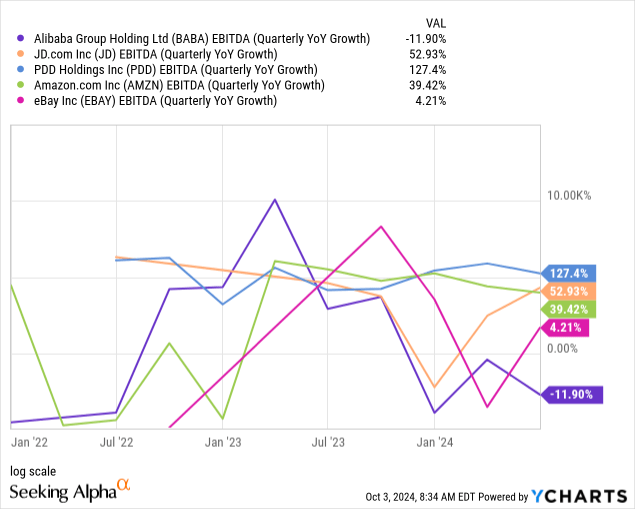

However, it’s crucial to understand why the shares were valued at a discount. If you examine the company’s growth rates over the past period, you’ll see that they have generally remained consistently low, not only compared to Western peers but also to Chinese counterparts:

It’s clear to me that new incentives from the Chinese Communist Party could potentially boost the Chinese economy and possibly lead to a rebound in Alibaba’s business growth rates. However, competition remains intense, particularly in the cloud segment, which continues to lag behind in the market. So from the fundamental perspective, I believe the stock may have already experienced enough significant growth, capturing much of its potential upside. The company’s valuation has deteriorated considerably over the past few months, even though its key multiples remain among the lowest compared to similarly sized companies.

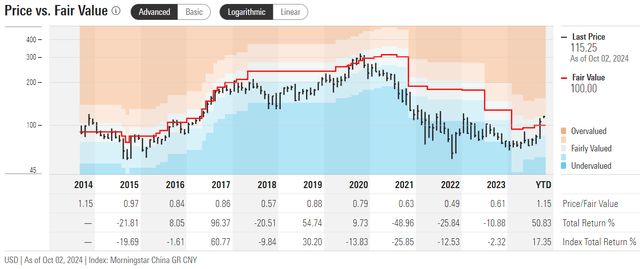

Additionally, the Morningstar rating (proprietary source, October 2024) suggests that the recent BABA rally has exceeded the fair value estimates calculated by their model. As a result, I don’t see strong potential for growth at current levels in the short to medium term.

Morningstar research, BABA, proprietary source

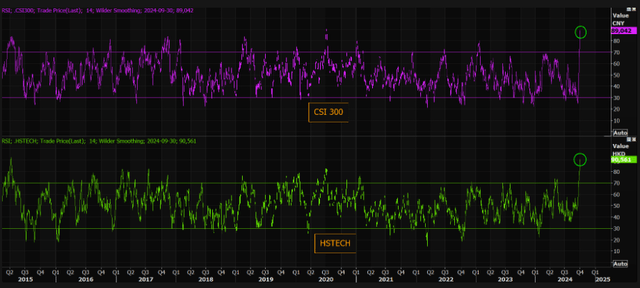

What I believe is that we are likely facing a significant correction at current levels, as the Chinese stock market appears to be more overbought today than ever before.

zerohedge’s newsletter (proprietary source)

No matter how hard China tries to boost the economy and its real estate sector, fundamental problems such as the aging population and youth unemployment will likely persist. As Ray Dalio has noted, China may face a more serious problem than Japan did in the 1990s, and this issue is unlikely to be solved by fiscal or monetary stimulus alone, in my opinion.

Therefore, taking into account both company-specific fundamentals and general macro conditions, I conclude that while Alibaba stock can continue to grow given its recent rapid rise as such explosive growth typically doesn’t end abruptly, I believe that the upper limit of growth potential that I had previously identified has now been fully exhausted.

The Verdict

My article today suggests that it might be time for those who speculatively bought Alibaba stock to temper their enthusiasm.

While I think the explosive growth following the announcement of macro stimuli may continue indeed, I believe that at least some healthy correction is clearly necessary. In the long term, I still perceive structural risks for both the Chinese economy and Alibaba, which faces intense competition both domestically and globally. Therefore, I don’t recommend investing in the stock shares for the long term, despite its appeal and potential for generating substantial free cash flow. As we’ve seen, this potential could significantly diminish as the company invests heavily in the cloud, which has yet to yield outstanding results.

Consequently, I maintain my rating at “Hold” unchanged.

Thank you for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!