Summary:

- The CCP’s regulatory scrutiny has eased, boosting Chinese equities; Alibaba Group Holding Limited surged 37% to ~$113.

- Alibaba repurchased $4.1 billion in shares, reducing outstanding shares by 2.1%, with $22 billion left for buybacks.

- China’s stimulus measures, including CNY2 trillion bonds, positively impact Alibaba’s e-commerce and cloud sectors.

- Alibaba’s stock could reach $138 in 2024 based on technical analysis, with potential upside to $178.

Robert Way

Investment Thesis

Over the past three years, my strong buy ratings for Alibaba Group Holding Limited (BABA) have reflected a high-conviction stance on the stock. The previous thesis rested not on Alibaba’s fundamentally strong business but China’s changing narrative. The CCP’s antitrust regulations had stifled Alibaba’s value, casting a shadow over its growth and market performance. However, this tide has begun to turn.

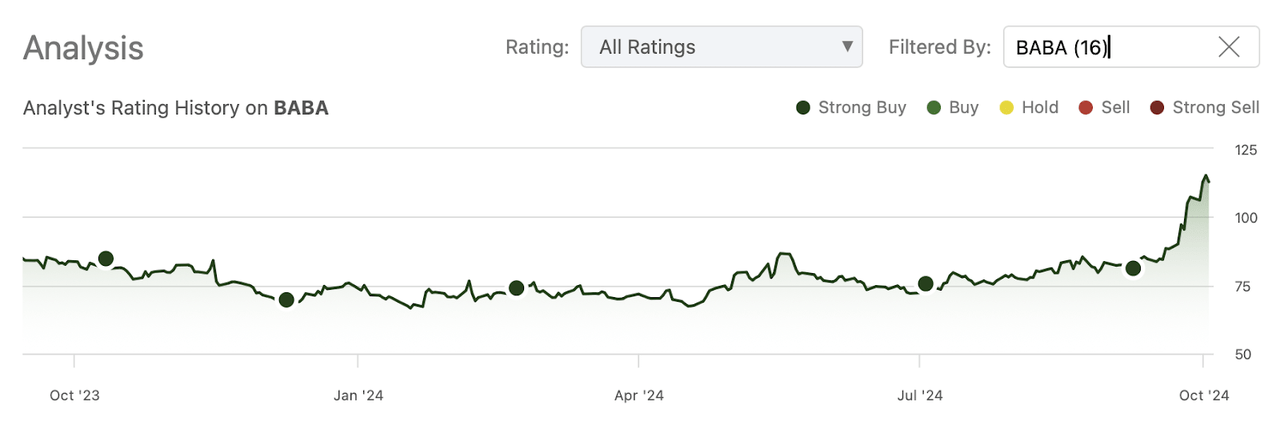

Following our last coverage, the CCP regulatory scrutiny has largely subsided, marking the start of a new era for Chinese equities. The Chinese government has also announced substantial stimulus support to reinvigorate economic growth. This has significantly boosted Chinese equities, including Alibaba, which has surged. The key catalyst is the narrative shift, allowing Alibaba’s strong fundamentals to shine and potentially driving the stock closer to its fair value.

seekingalpha.com

Catalysts: Reasons I Remain Bullish on Alibaba

1. Institutional Shifts Favoring Chinese Equities

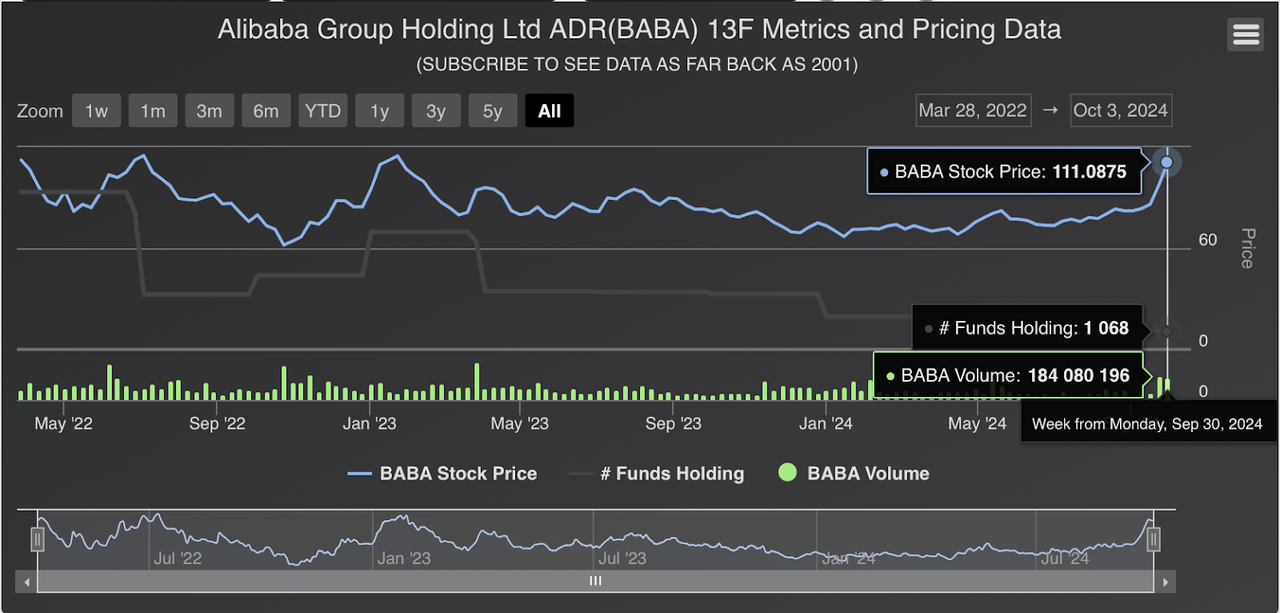

There’s a growing trend among American fund managers to take substantial positions in Chinese equities. This inflow of institutional capital demonstrates confidence in the Chinese market and provides a potential upward revaluation for Alibaba’s shares. The number of funds holding BABA has remained steady at 1068. However, this figure is expected to rise in the upcoming 13F filings, reflecting increased institutional interest.

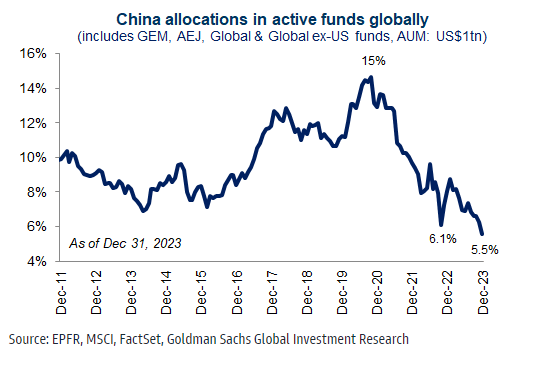

2. Historically Low China Allocations

Recent data shows that global active funds’ allocations to Chinese equities have hit a historical low, reaching the 1st percentile of the past decade at just 5.0%. This level of underallocation suggests a significant potential upside. As market conditions in China stabilize and the positive narrative around Chinese equities strengthens, there is a high probability that fund managers, including Alibaba, will begin reallocating to China. This inflow of capital could be a powerful catalyst for Alibaba’s stock price in the near to medium term.

EPFR, MSCI, FactSet, Goldman Sachs

3. Aggressive Stock Buybacks

In the September 30, 2024, quarter, Alibaba repurchased 414 million ordinary shares (52 million ADSs) for $4.1 billion in both the US and Hong Kong markets. This reduced the outstanding shares to 18,620 million (2,327 million ADSs), a 2.1% net decrease from June 30, 2024, after accounting for shares issued under the ESOP. Alibaba still has a substantial $22.0 billion remaining (around 8% of its current market cap) under its share repurchase program, authorized through March 2027.

4. Diminishing Fears Over Taiwan

Concerns over a potential Chinese invasion of Taiwan have been a point of bearish speculation for years. However, as time passes without any such geopolitical incident, these fears seem increasingly unwarranted. This shift in perception could further ease market anxieties and encourage greater investment in Alibaba and other Chinese equities.

Alibaba’s Surge: How China’s Stimulus Is Fueling a Tech Titan’s Comeback

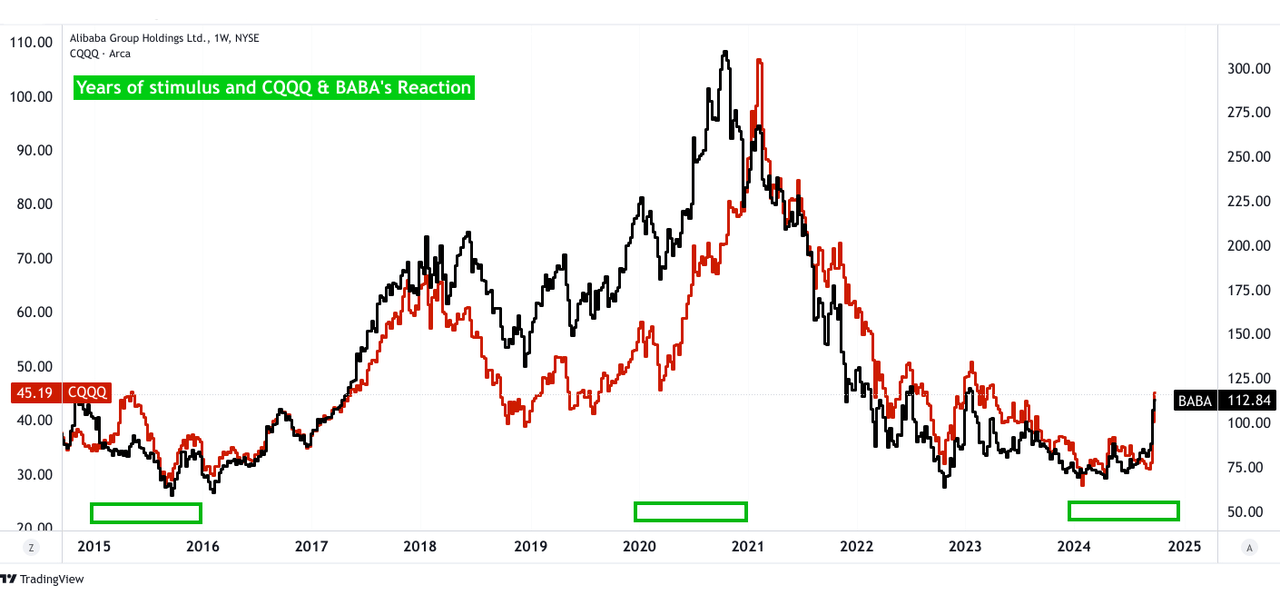

Alibaba’s stock price surged over 37% recently, reaching ~$113 per share in market trading. This is a sharp increase from its early September price of ~$83 per share. This surge is directly correlated with the introduction of China’s aggressive economic stimulus measures in September, which included an issue of CNY2 trillion ($284.43 billion) in sovereign bonds and a cut in mortgage rates by 0.5%.

When Beijing announced these policies, aimed at reigniting a sluggish economy, it provided the market with new liquidity and lowered interest rates, easing the flow of capital into sectors like technology. These measures (like lower rates) have historically led to cheaper borrowing costs for corporations and consumption, encouraging CapEx investment and discretionary spending towards high-growth tech firms such as Alibaba. Alibaba’s long-term growth, especially after a period of weakness in Chinese tech stocks., is based on the market’s optimism.

Looking forward, this sharp rise in Alibaba’s stock is based on one of the company’s core strengths: to capitalize on positive macroeconomic developments in China. The relationship between macroeconomic stimulus and Alibaba’s share price is not isolated. Fundamentally, Alibaba may be a core beneficiary of the stimulus package due to its lead in China’s e-commerce and AI+Cloud space.

This rebound signals that Alibaba stock can re-establish its market valuations. With increased consumer purchasing power due to the government’s policy adjustments, Alibaba’s market share in e-commerce may expand as consumer spending confidence grows. Reasonably, e-commerce platforms tend to experience higher transaction volumes when consumers have access to cheaper credit or more disposable income. This points to Alibaba’s forward top-line growth.

Moreover, the broader market strength driven by specific stimulus policies provides Alibaba with fertile ground for growth. With the Chinese government focusing on driving economic growth toward its 5% annual target, Alibaba stands to benefit as consumption and tech CapEx trends are likely to rise.

Given its scale and its ability to leverage digital platforms to capture consumer demand, Alibaba’s earnings growth could accelerate in an environment where Chinese households experience increased purchasing power. This would be based on a 0.5% reduction in rates (on existing mortgages that may reduce household interest expense by CNY150 billion) and reduced down payment on a second home to 15% from 25% amid inflation being considerably below target.

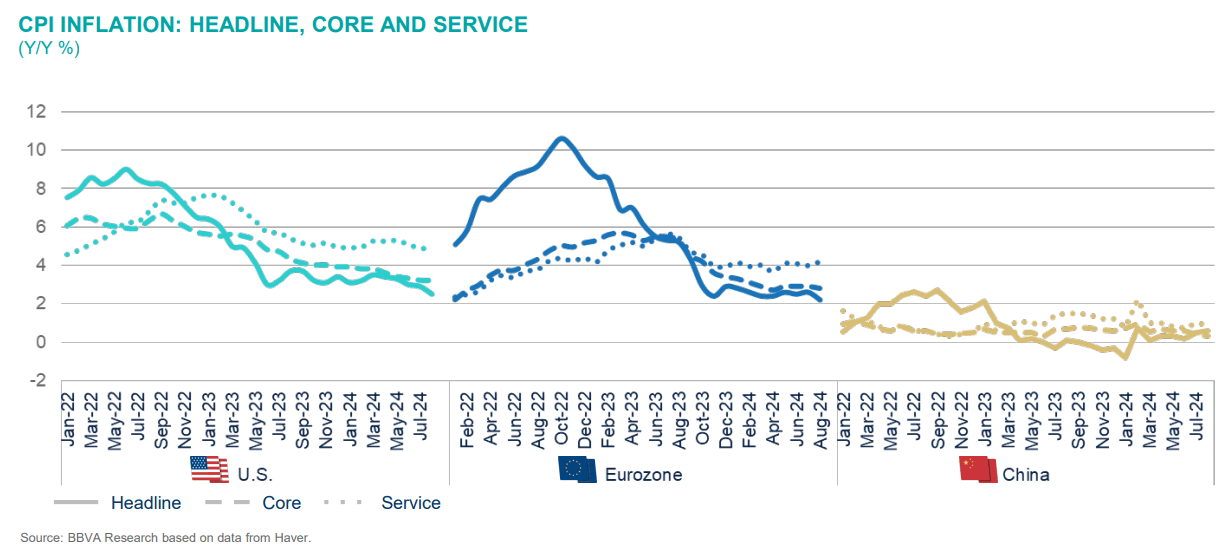

BBVA Research

Historically, Alibaba’s stock performance has correlated with increased consumer activity during periods of economic stimulation (2015 and 2020) based on revenue from its e-commerce platforms. Therefore, the broader gains across China’s markets are a catalyst for Alibaba’s business expansion and market valuation. Moreover, as per Chinese economist Mao Zhenhua, the 2024 stimulus has to be ~CNY10 trillion ($1.4 trillion) in treasury bonds to boost consumption and sustain momentum. Therefore, there may be more announcements and a sentiment boost to come for Chinese stocks.

The Risks Behind the Rally

One primary downside for Alibaba stock is the unpredictability of China’s stock market due to government intervention. Moreover, Alibaba’s business model depends on the broader Chinese economy (domestic consumer and e-commerce sectors). Despite the recent upswing in Chinese stocks, Alibaba remains vulnerable to the current slowdown in China’s economic growth.

Beijing’s stimulus measures directly responded to this slowdown and aimed to hit the country’s modest growth target of 5% for the year. However, hitting this target is not guaranteed, and Alibaba’s performance could suffer if the broader economy fails to rebound as hoped. The stimulus is not a new thing, but a new normal, similar to those tried before.

For instance, China’s manufacturing sector contracted for the fifth consecutive month in September, indicating broader economic challenges. This contraction suggests a cooling in consumer and industrial goods demand and directly impacts Alibaba’s core e-commerce business. A continued slowdown in manufacturing could ripple through the economy, which may continue to reduce disposable income and consumer spending power and curb demand for online goods and services.

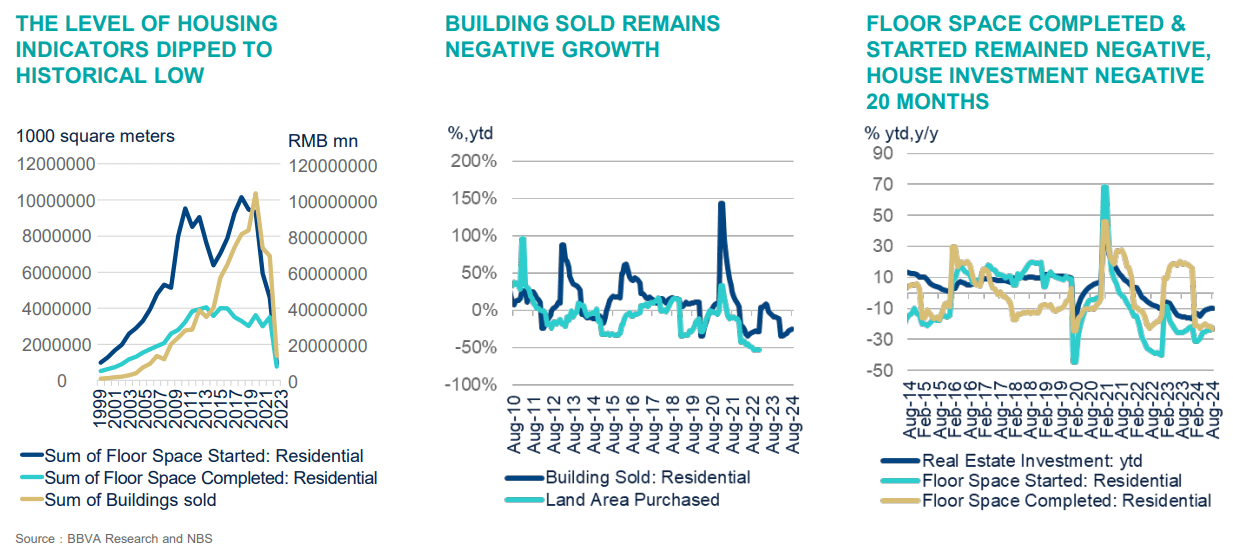

Moreover, the stimulus is primarily directed towards the struggling real estate sector. The stimulus measures may prop up the property market by cutting the interest rates on existing mortgages. However, even 2023 government efforts have yet to show concrete results. Large cities like Beijing and Shanghai have been hit the hardest by the property slump and have not experienced a solid rebound. Since Alibaba stock’s sentiment is attached to urban consumers and broader nationwide economic activity, any uneven recovery or further failures in the property market could further dampen its valuation growth prospects along with other US-listed Chinese stocks/ADRs.

BBVA Research

Finally, the stimulus may benefit Alibaba’s competitors, like JD.com (JD) and PDD Holdings (PDD), both in e-commerce and tech sectors like AI and cloud computing. For instance, JD has outpaced Alibaba in terms of stock performance over the ten days by surging ~50% compared to Alibaba’s ~25%. The strong relative performance of JD following stimulus measures indicates that Alibaba is not the primary beneficiary of the government’s economic intervention and may face aggressive competition to differentiate itself and maintain its market share.

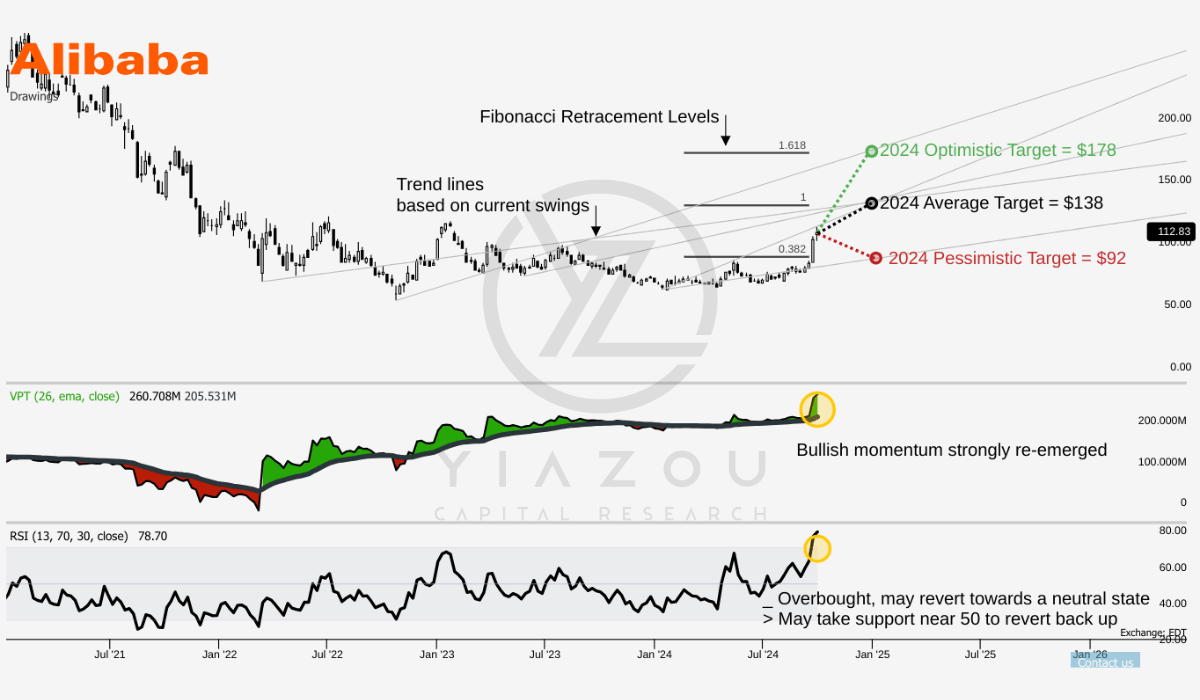

Technically, BABA Stock May Hit $138 By 2024

Based on the technical analysis, Alibaba’s stock may hit $138 as an average target for 2024, aligned with the Fibonacci level of 1.0. The target is projected over recent price swings. Optimistically, the price may reach $178 with a 1.618 Fibonacci expansion following the current momentum. On the downside, the price may revert to $92 if the stock loses momentum or market sentiment changes. This pessimistic target is in line with the Fibonacci retracement level of 0.382.

Regarding the RSI, bullish momentum has reemerged and deviated from neutral strength to an oversold level. However, in the coming weeks, the strength may revert to neutral but may regain strength toward an oversold trajectory. During this phase, the stock price may show some weakness. On the other hand, the volume price trend (VPT) line has deviated considerably from the annual moving average. This is a signal that bullish momentum may prevail in the short term.

Yiazou (trendspider.com)

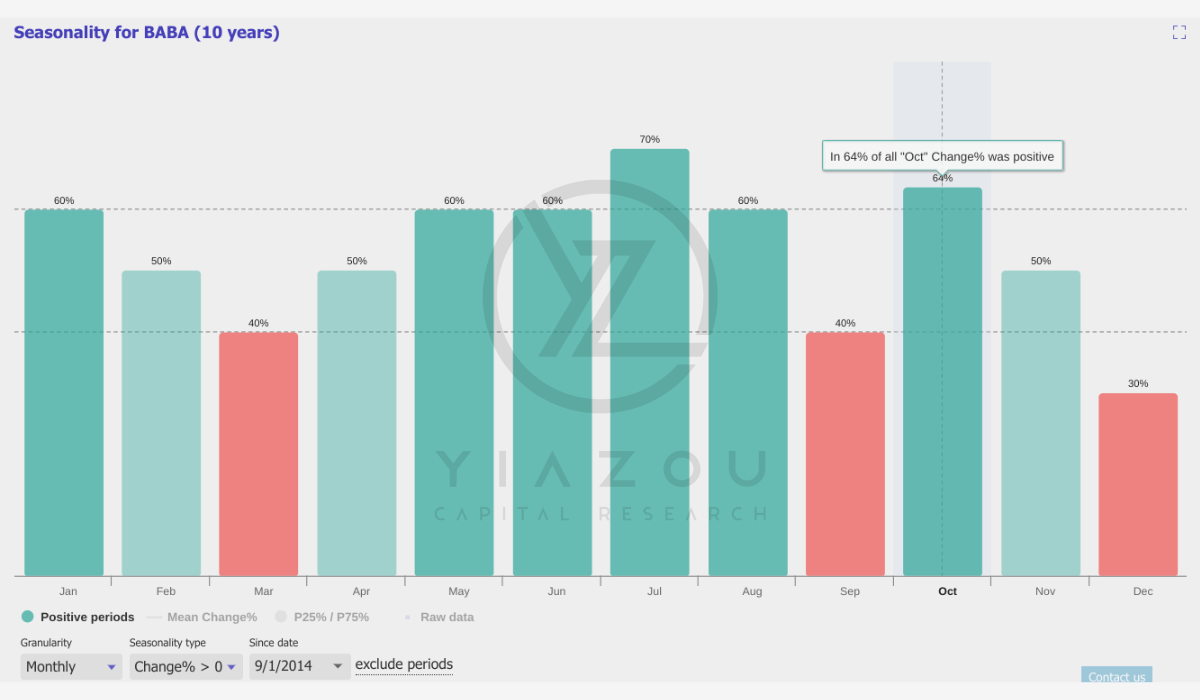

Finally, October is a favorable month for investing in BABA based on its historical seasonality (over 10 years). The stock may deliver a positive price return with a 64% probability.

Yiazou (trendspider.com)

Takeaway

Alibaba’s recent surge reflects a positive shift in China’s economic narrative, spurred by regulatory easing and government stimulus. Institutional capital is increasingly flowing into Chinese equities, with Alibaba’s strong fundamentals poised for growth. Despite economic uncertainties, aggressive buybacks, diminishing geopolitical fears, and an expanding cloud business bolster Alibaba’s bullish outlook.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, 9988 either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have a beneficial long position in the shares of Alibaba Group, through both NYSE: BABA and HKG: 9988. More than 97% of my position is held in 9988 through Hong Kong Exchange.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.