Summary:

- Alibaba’s recent rally is driven by broader market optimism around the government’s economic stimulus package, not by improvements in its fundamentals.

- My analysis reveals several systemic risks that the Chinese economy is poised to face, and offering more affordable mortgages could exacerbate issues with non-performing loans.

- Therefore, the Chinese government’s stimulus package may offer temporary relief, but is unlikely to resolve deep-rooted economic issues sustainably.

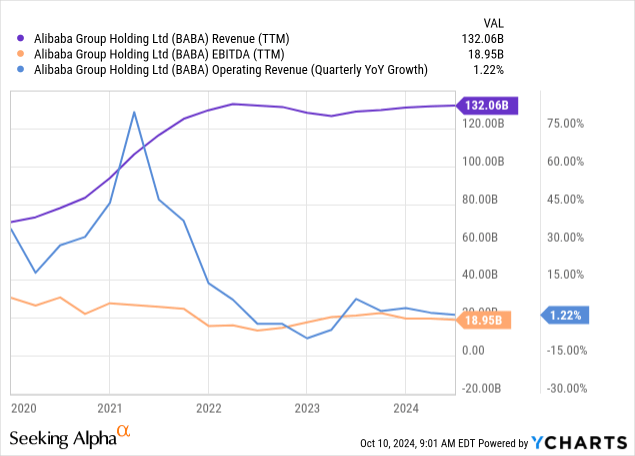

- BABA’s stagnant revenue and EBITDA since 2022 suggest weak performance, questioning the long-term viability of its current valuation.

MAXSHOT

Introduction

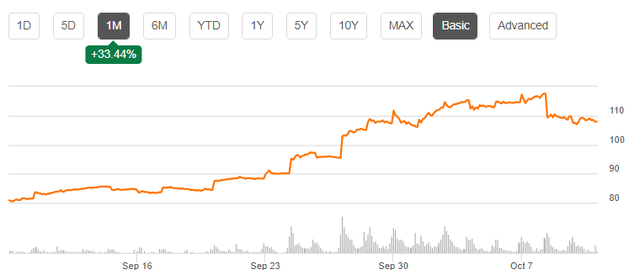

I had a ‘Sell’ recommendation for Alibaba’s (NYSE:BABA) stock in July. This did not age well, as the stock soared by almost 40% over the last three months. Despite such a rally, I am now even more bearish.

In today’s article, I paid a lot of attention to the Chinese government’s economic stimulus package, which was the only real reason behind Alibaba’s rally. There are numerous reasons that indicate that the stimulus package is unlikely to be a game-changer because the problems of the country’s economy lie much deeper, and the housing crisis is just the tip of the iceberg. Therefore, it is better to focus on BABA’s fundamentals, which remain quite weak. Moreover, the stock currently trades with a premium, which means that I have to downgrade BABA to ‘Strong Sell’.

Fundamental analysis

A major part of BABA’s rally since my bearish call was gained over the last month. The reason is not explained by some notable improvements in BABA’s fundamentals, but by the stimulus package from the Chinese government. For example, PDD Holdings’ (PDD) stock, one of BABA’s main e-commerce rivals, gained 55% over the last month. Another Chinese e-commerce giant, JD.com (JD) soared by 66% over the last 30 days.

SA

Therefore, BABA’s recent success was not unique, and it is not explained by the company’s strengths. My above paragraph suggests that optimism around other large Chinese e-commerce players was even stronger, as these stocks gained notably more compared to BABA.

I tend to believe that while such catalysts can lead to share price spikes, they are unlikely to have long-lasting positive effects. There is a good summary of key aspects of the package summarized by this source. In short, the package includes monetary easing through interest rate and reserve requirement cuts, support for the real estate sector with reduced mortgage rates and down payment ratios, and new financial market tools to boost stock market activity.

While the package looks very generous, I see a few drawbacks. It is widely known that the Chinese housing industry is in crisis due to a large oversupply. China has been the world’s most populated country for decades, and the fact that there is a housing oversupply in a country with a population of 1.4 billion sounds like nonsense. But if we delve a bit deeper, this problem does not look that surprising.

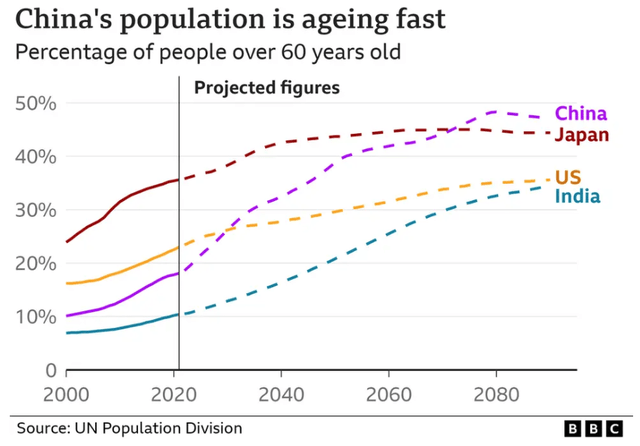

BBC

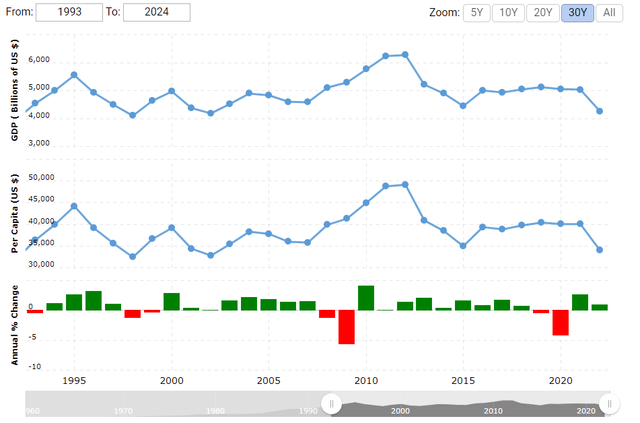

China faces a big demographic crisis as its population is ageing fast. As demonstrated above, Japan has the oldest population, and this was one of the primary factors that has led to so-called “Lost decades” for the Japanese economy. The chart below demonstrates that Japanese GDP has been stagnating over the last 30 years and is currently at the same level as it was in 1993. Since China’s population is expected to become the oldest over the last few decades, there is a big risk that with the large portion of people over 60 years old, it will be extremely difficult to drive economic growth.

macrotrends.net

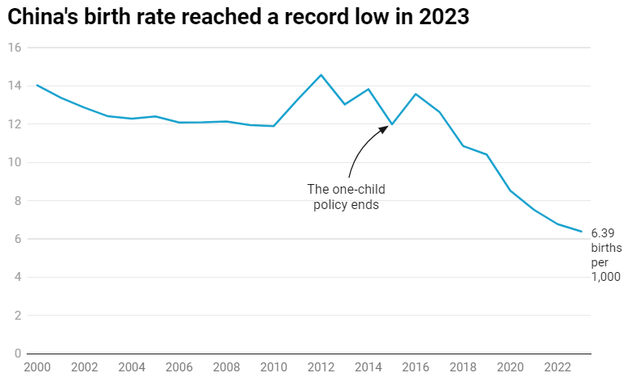

Another big systematic problem for the Chinese economy is a sky-high unemployment rate among young people, and it’s rapidly increasing. When young people do not have stable income sources, it is unsurprising that they are not eager to create families and take mortgages to buy an apartment or a house. According to voanews.com, the unmarried rate among young people in China is significantly higher than it was a decade ago. As a result, China’s birth rate has been reaching new lows every year.

theguardian.com

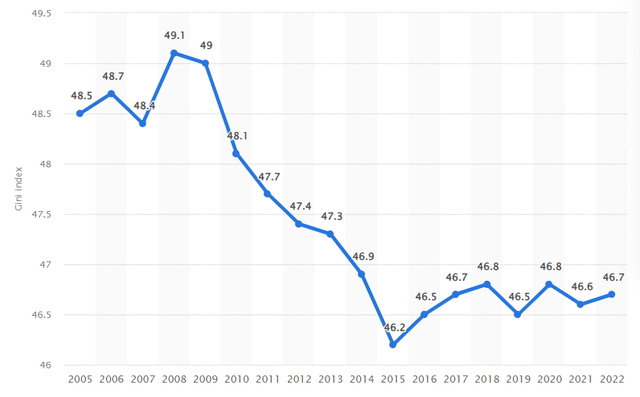

Apart from huge demographic problems, there is another big problem that might mitigate the effect of the government stimulus. According to Statista, China’s Gini Coefficient is notably above 40, which indicates high inequality. While inequality is usually a common problem in rapidly developing economies, we see that the situation is not improving and has even become worse over the last decade.

Statista

Therefore, several significant systemic issues have led to the housing oversupply, and these are unlikely to be resolved sustainably by slightly more favorable mortgage terms. While mortgage incentives might provide some temporary relief for the housing oversupply, given the aforementioned challenges facing the Chinese economy, aggressively increasing mortgage lending could trigger a credit crisis due to potentially higher non-performing loans.

With that being said, I would not bet much on this stimulus package and the market highly likely overreacted to this news. It is better to look at Alibaba’s recent financial performance to get a better understanding of how the fundamentals are moving.

The above picture does not look good at all. Both revenue and EBITDA have been stagnating since 2022, which is not a dynamic that a technology conglomerate with strong exposure to e-commerce and cloud should demonstrate. Alibaba’s revenue growth has been in low to mid-single digits over the last few quarters.

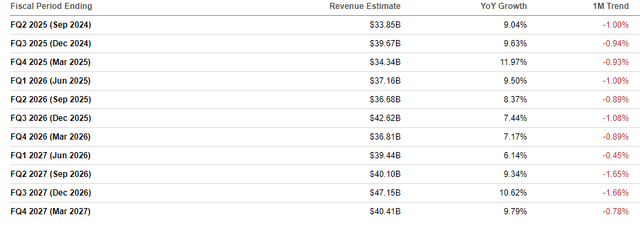

Moreover, Alibaba has quite a weak earnings surprise history over the last few quarters, which does not add optimism. As a result, Wall Street analysts are quite cautious about projecting future quarters. In the below chart, we can see that revenue revisions were negative over the last few months for several upcoming quarters.

SA

That said, Alibaba’s fundamental strength remains questionable and the rally over the last month is related to the overall significant improvement of sentiment around all large Chinese companies. However, my analysis suggests that the market’s optimism is likely not justified because systematic challenges for the Chinese economy lie much deeper than just unaffordable mortgages.

Valuation analysis

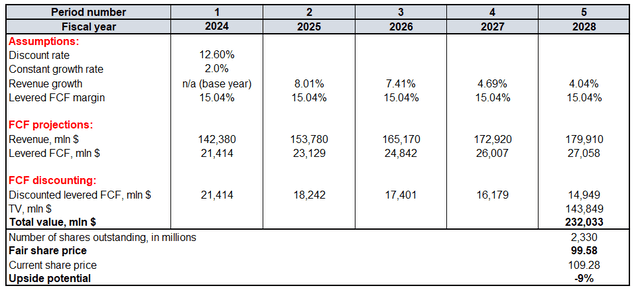

The DCF model will help in figuring out the stock’s fair value. Alibaba’s WACC is 12.6%. Revenue growth projections for the next five years are from consensus. The TTM levered FCF margin is 15.04%. Since Alibaba’s profitability stagnates, I do not incorporate improvements in the FCF margin. Due to all the systematic problems of the Chinese economy, and Alibaba’s weak revenue growth of recent quarters, I incorporate a modest 2% constant growth rate to calculate terminal value (‘TV’).

Calculated by the author

The fair share price is $100, while the last close is at around $109. Thus, the stock trades with a 9% premium over the fair value. I think that the premium is not justified due to all the red flags outlined in my fundamental analysis.

Mitigating factors

As we saw, the market tends to overreact to some positive news, even if benefits for the Chinese economy look quite uncertain. My previous call does not look good as the stock price soared even despite all my bearish explanations given in the previous article. This underscores that the stock market is a voting machine over the short term, and there is always a possibility for share price spikes.

I think that Alibaba has two apparent strengths – its ecosystem of services and a fortress balance sheet. The company sits on a multibillion dollar cash pile, which provides it with various opportunities to invest loads of cash to revitalize revenue growth. The company’s ecosystem together with strong financial flexibility means there is a probability of BABA unlocking new synergies or revenue streams. On the other hand, Alibaba’s ecosystem and its balance sheet are not new, and the company has struggled to capitalize on these strengths for the last couple of years.

Conclusion

I think that Alibaba’s recent rally is explained by the market’s overreaction, and there are no really strong fundamental reasons for the optimism behind the government’s stimulus package.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.