Summary:

- Alibaba stock has cratered recently, and buyers fled after the stock hit its peak in October 2024.

- The early momentum from China’s stimulus measures has dissipated. However, has the market taken the sell-off too far?

- Alibaba’s monetization has improved, and its cloud segment has remained profitable.

- Its international e-commerce business has also performed admirably, demonstrating its ability to rejuvenate growth.

- I argue why investors who didn’t chase the previous surge can consider taking advantage of BABA’s recent pessimism.

maybefalse

Alibaba Stock: Suffering Another Hammering

Alibaba Group Holding Limited (NYSE:BABA) investors have endured a hammering recently, as the stock’s upward momentum peaked in early October 2024. As a result, the early euphoria in BABA has given way to rationalization over its growth profile, notwithstanding its relatively attractive valuation. In my previous Alibaba article, I underscored my confidence about why China’s massive stimulus package has spurred investors to return to boost BABA. However, the failed breakout above its $120 resistance zone has led to intense profit-taking over the past seven weeks, as earlier investors likely rotated out. As a result, the stock has dropped firmly into a bear market, declining more than 25% through this week’s lows.

In Alibaba’s fiscal second-quarter earnings release, the improved monetization in its Taobao and Tmall Group helped to stabilize its core e-commerce growth drivers. As a reminder, the e-commerce leader instituted a 0.6% software service fee, benefiting its customer management revenue. Accordingly, CMR accounted for more than 75% of its China commerce retail revenue, up 2% YoY. Hence, it mitigated the weakness in its retail segment’s direct sales component, although overall revenue retail growth was flat.

Therefore, I assess that the significant downside observed over the past couple of months in BABA is likely attributed to lowered optimism on Alibaba’s e-commerce growth drivers. Although management expressed confidence in stabilizing its take rates following the implementation of the service fee, further increases seem uncertain, given the intense competitive environment in China’s e-commerce market. In addition, it remains to be seen whether the improved purchase momentum from China’s 11.11 festival could continue through CY2025, as China’s economic and consumer spending recovery has remained uneven.

Alibaba: Needs To Diversify Its Earnings Growth Drivers Better

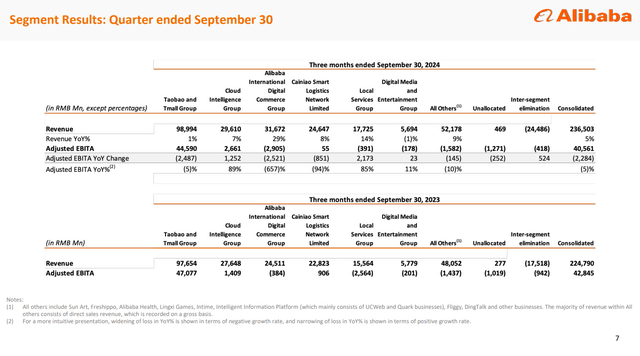

Alibaba segment performance (Alibaba filings)

As seen above, concentration risks in Alibaba’s TTG business are expected to hold back the market’s confidence in its recovery prospects. Accordingly, Alibaba’s TTG segment delivered an adjusted EBITA of RMB44.6B in FQ2, over and above its consolidated adjusted EBITA of RMB40.6B (after inter-segment adjustments). Therefore, Alibaba’s Cloud Intelligence Group is far from gaining sufficient momentum to help diversify Alibaba’s earnings risk profile. Although its international business (AIDC) posted a 29% surge in revenue growth, it remains a loss-making business.

Therefore, I assess that while Alibaba’s growth initiatives in its ex-China business have delivered solid momentum, investors are expected to remain cautious about the recovery in its domestic e-commerce business prospects. Despite that, there are sufficient reasons to remain optimistic about Alibaba’s overall opportunities. The company has invested significantly to bolster its AI-driven strategy, which is expected to enhance its user engagement and optimize purchase frequencies.

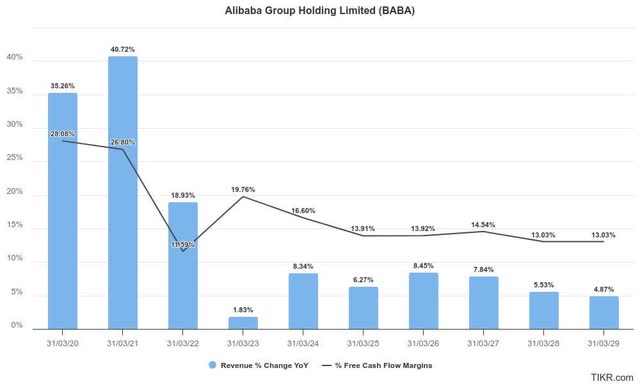

Hence, it should help stabilize its GMV growth momentum moving ahead. In addition, Alibaba management has telegraphed its confidence in lifting its monetization opportunities while working to scale its international e-commerce business. However, the need for BABA to manage potentially higher execution risks as it continues investing in loss-making businesses outside of its TTG platform could affect near-term investor sentiments. Given the market’s tempered optimism on Alibaba’s “D” growth grade, it’s imperative for the company to demonstrate more resolve in lifting its operating efficiencies to drive profitability accretion.

Alibaba: Lowered Estimates Could Intensify Near-Term Volatility

Wall Street’s revenue estimates on Alibaba have been downgraded, as analysts parsed the momentum from China’s stimulus on its domestic economy. Furthermore, the increased tariffs threat from Trump’s return has likely weakened investor sentiments. Despite that, I assess that Alibaba’s earnings drivers remain well-anchored in its domestic e-commerce segment. Therefore, I assess that the market could have overstated Alibaba’s geopolitical risks.

In addition, hedge funds have also returned more favorably to holding Chinese equities in their holdings. The relative valuations between the US market and Chinese equities could also drive a market reallocation into leading companies like BABA. Moreover, management indicated that the company still has $22B remaining in its share repurchase authorization, communicating a substantial war chest for significant dip-buying opportunities.

BABA Stock: Solid Momentum Suggests Investors Aren’t Unduly Worried

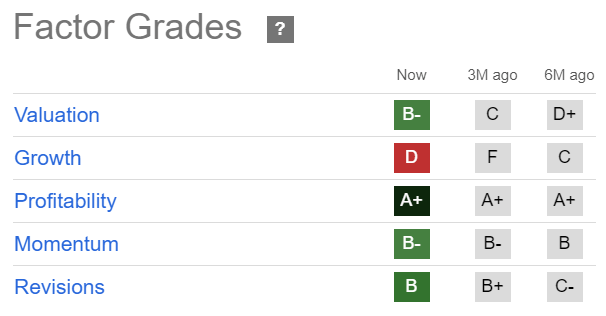

BABA Quant Grades (Seeking Alpha)

Consequently, I assess that the market remains relatively optimistic about BABA stock. As seen above, the stock boasts a “B-” momentum grade, corroborating my observation. Coupled with its relatively attractive valuation (“B-” valuation grade), the recent bear market has significantly improved BABA’s appeal.

Notwithstanding my optimism, investors are urged to consider potentially more intense geopolitical headwinds between the US and China as Trump returns in January 2025. These uncertainties could weigh on near-term sentiments, although I believe the market has already priced them in.

In addition, investors should consider unanticipated headwinds to Alibaba’s ex-China growth opportunities if Trump initiates a debilitating trade war. Although the company’s core e-commerce growth engine should remain relatively insulated, Alibaba’s growth profile could be dampened further, potentially spurring a valuation de-rating. Hence, investors must remain cautious and consider adding progressively to the stock to mitigate unanticipated downside volatility.

Is BABA Stock A Buy, Sell, Or Hold?

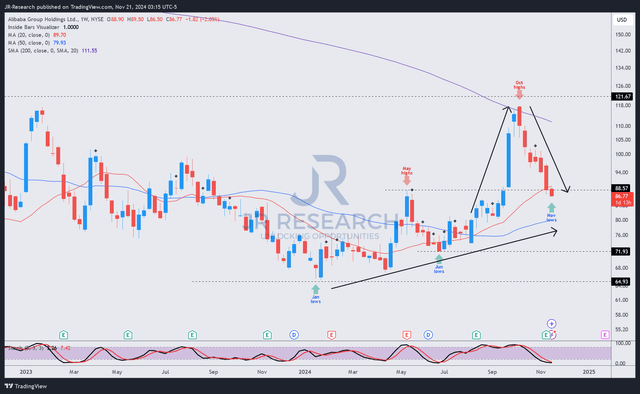

BABA price chart (weekly, medium-term, adjusted for dividends) (TradingView)

BABA’s momentum has been battered recently but has not reversed decisively into a structural decline. Although the bear market has likely spooked late buyers who bought close to its October 2024 peak, its price action remains bullish.

As seen above, a series of higher-low price structures remain in play, helping to underpin BABA’s uptrend continuation thesis. Therefore, the “vertical” surge observed in its late September 2024 surge has likely been resolved, affording a potentially more attractive entry point for investors who didn’t chase.

However, I’ve not determined a bullish reversal price action yet, suggesting near-term volatility shouldn’t be ruled out. Despite that, BABA’s constructive upward momentum is consistent with improved sentiments, as indicated earlier. Furthermore, Alibaba’s domestically focused e-commerce earnings profile should help mitigate the uncertainties linked to worsened geopolitical challenges between the US and China.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!