Summary:

- Alibaba’s 2QFY25 revenue miss highlights ongoing challenges amid China’s value-seeking consumption and rising competition from low-cost rivals and live-streaming platforms.

- BABA’s focus on user growth and retention underscores churn pressure, with users migrating to value platforms like PDD, exacerbating share price and investment sentiment.

- Despite trading at 10x forward earnings, BABA is a value trap due to macro, structural, and competitive challenges, making it less attractive than PDD.

- BABA’s global growth lags behind peers like Temu, with slower revenue and earnings growth, justifying a preference for PDD with higher growth potential.

xefstock

Alibaba’s (NYSE:BABA) 2QFY25 revenue miss reinforces the fact that the company’s turnaround remains challenging amid China’s value-seeking consumption environment and increasing competition from low-cost competitors and live-streaming platforms.

Management’s ongoing focus on user growth and retention illustrates that BABA continues to face churn pressure as users migrate to money-for-value platforms such as PDD (PDD) and this trend seems unlikely to abate in the near term. (See: PDD Holdings: Brand Migration Driving Long-Term GMV Growth)

The lack of consumption-driven stimulus from the policymakers exacerbates BABA’s share price outlook and investment sentiment toward the stock. We note that the share price has increased by ~30% since the September 24th stimulus announcement but has given up most of the gains since early October.

With the stock trading at 10x forward earnings, BABA is a value trap rather than a value play and better be avoided as its core Taobao and Tmall Group continue to face a number of macro, structural, and competitive challenges that will unlikely to be addressed in the foreseeable future.

Our thesis on China’s internet sector is that population growth is no longer the key driver for industry growth and that Chinese internet companies need to shift their volume/user-based model to a value-based model through innovation so they can compete with other internet companies on a global scale. So far, Bytedance has done exceptionally well given its global coverage, followed by PDD (see: PDD: Shop Until You Drop). Ctrip (TCOM) has done well with its expansion into Southeast Asia, while Meituan is starting to expand its overseas presence in emerging markets (see: Meituan: Riding On Keeta To Drive Overseas Growth).

Although BABA had the early mover advantage with its AliExpress, Lazada, and Trendyol assets, the company never capitalized on the global e-commerce growth opportunity. We note that AliExpress, one of the earlier cross-border shipping platforms that was accessible to US and European users, lost its competitive edge to PDD and Shein, while the recent resurgence in Sea’s (SE) Shopee and TikTok Shop in Southeast Asia is making BABA to rethink its Lazada strategy.

Given the multiple challenges faced by BABA, we expect the share price to pull back to the level before the surge in late September and trade between 8x – 10x P/E until there are visible signs of revenue reacceleration in Taobao and Tmall Group. Without it, BABA’s share will likely be a value-trap, as this was the case for most of the calendar year 2024 and investors are better off avoiding this stock and sticking with PDD that is capitalizing on China’s soft macro backdrop with the global growth optionality in Temu.

The core business continues to face macro and competitive headwinds

BABA’s Taobao and Tmall revenue of RMB 98.99bn was largely in line with consensus, but worth flagging that the stabilization in the take-rate was partially helped by the introduction of 0.6% software service fee onto the Taobao merchants during the quarter. Without this extra fee, the CMR take rate would have been weaker, since BABA historically does not charge a commission from the Taobao merchants.

Although the 0.6% software service fee is widely seen across the industry, the current e-commerce competition has resulted in platforms lowering various fees for merchants as part of their merchant retention strategy. We note that PDD has been lowering software service fees for merchants along with other fees covering logistics, marketing, use-now-pay-later, etc. When BABA’s key competitor is waiving these fees to retain merchants, we question whether BABA’s take rate has hit a trough and that we believe a prolonged soft consumption environment could add further downside risk to BABA’s take rate and revenue trajectory.

Additionally, another concerning issue lies in the Adjusted EBITA of RMB 44.59bn, which fell short of the consensus RMB 45.14bn as BABA continues to invest in user experience and retention through aggressive marketing and promotions. Management guided that EBITA is likely to fluctuate in the coming quarters as Taobao and Tmall remain in the investment phase. In short, BABA is fighting an uphill battle, making large investments without clear visibility on when the investments will pay off. Hence, we are skeptical at a near-term turnaround in the business profile and prefer to avoid this stock until greater stability on its core commerce units.

Falling behind peers in global growth

AIDC revenue growth of 29% y/y was largely driven by cross-border e-commerce, AE Choice. Although AE Choice covers over 200 countries globally, its GMV is still relatively small compared with Temu which is generating roughly $350mn – $400mn weekly GMV run-rate, per YipitData.

User experience, rather than geographic coverage, is a key determinant of e-commerce success rate. Temu has been actively shortening the cross-border shipping time to the US, as well as working with the semi-managed model to onboard new merchants and expand its SKU selection to compete against larger incumbents such as Amazon (AMZN).

Anecdotal evidence indicates that AE Choice’s shipping time continues to underwhelm, while Temu has been able to narrow down the delivery window to around two weeks.

The longer BABA takes to bring a comparable user experience in terms of product selection and delivery time, the wider the gap BABA has with its biggest competitor and the farther back it will trail in terms of customer experience.

Valuation likely to remain depressed in the near term

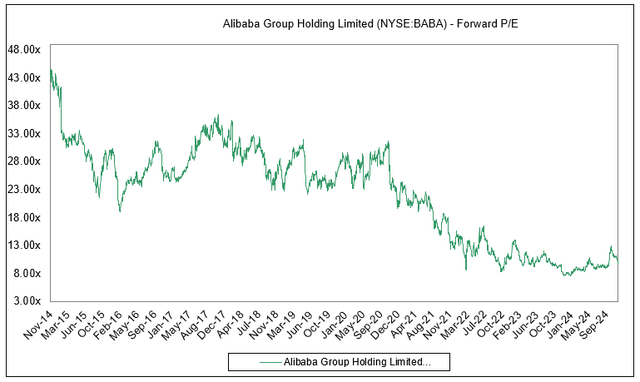

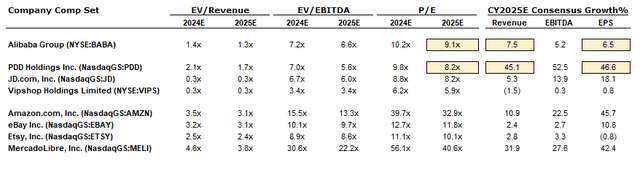

In the context of valuation, BABA’s 9x 2025E consensus earnings may appear to be a value play given that the current forward multiple is trading at a 10-year low and well below its historical average.

However, we feel that it is more of a value trap given its soft near-term growth trajectory. We note that the current consensus is looking at 7.5% revenue growth and 6.5% earnings growth for 2025E, which is significantly below that of PDD which is growing at 6x faster revenue and earnings growth while trading at 1 turn below that of BABA on a forward P/E basis.

With a slower growth profile, we simply do not believe that BABA’s current valuation is justified, even when it is trading at a historically low single-digit forward P/E. As such, we believe investors are better off with PDD, given its higher global growth potential and its position as a market share gainer in China’s e-commerce space.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.