Summary:

- China’s massive stimulus package has bolstered Alibaba stock, spurring a potential breakout above the critical $90 resistance zone.

- Alibaba’s profitability growth inflection from FY2026 has been lifted, justifying improved buying sentiments.

- Given its exposure to China’s core commerce engine, China’s commitment to attaining its 2024 GDP growth target should lift Alibaba.

- I explain why the golden buying opportunity I’ve been waiting for on BABA has finally arrived. Read on to find out more.

Robert Way

China Unleashes A Massive Stimulus Package

Alibaba Group Holding Limited (NYSE:BABA) investors have likely received the jolt they were waiting for as BABA stock attempted to break out above the critical $100 zone. BABA has already surged over its $90 resistance zone, as Chinese equities were bolstered by the “bazooka” stimulus measures initiated by the PBOC (China’s central bank).

In a significant move, the PBOC unleashed a flurry of measures, including “interest-rate cut, lower capital requirements for banks, and special funds to buy stocks and facilitate buybacks.” The bullish signaling by China’s central bank regulators suggests the Chinese government is committed to achieving its 5% GDP growth target for 2024. However, uncertainties remain for its trajectory in 2025. In addition, the ongoing stress in China’s banking, real estate, and local government finances has not been decisively resolved. Hence, these structural issues could hamper a more sustained improvement in the market’s perception of Chinese equities. The market will likely scrutinize whether the Chinese authorities would follow up with more demand-side measures and additional fiscal stimulus to bolster investor sentiments.

Alibaba Stock: Turnaround Already Underway

In my previous BABA article, I downgraded the stock as I anticipated prolonged challenges that could spur a more optimistic recovery for China’s e-commerce leader. I assessed that Alibaba must first resolve “underlying challenges.” However, the debilitating decline in China’s real estate market has continued to hamper a more sustained turnaround in China’s consumer spending. In addition, the weak employment outlook has also weakened my assessment of BABA’s overall thesis, leading to my previous downgrade.

Notwithstanding my caution, I assess that BABA’s increasingly constructive buying sentiments suggest the tide seems to have turned decisively. The firm commitment demonstrated by the Chinese authorities to bolster its ability to attain its GDP growth target has also improved the market’s confidence in Chinese equities. While uncertainties relating to whether additional fiscal or demand-side boosts still exist, BABA isn’t priced at a significant premium. Hence, I assess the risk/reward in BABA remains highly attractive, lifting the clarity over its forward earnings profile.

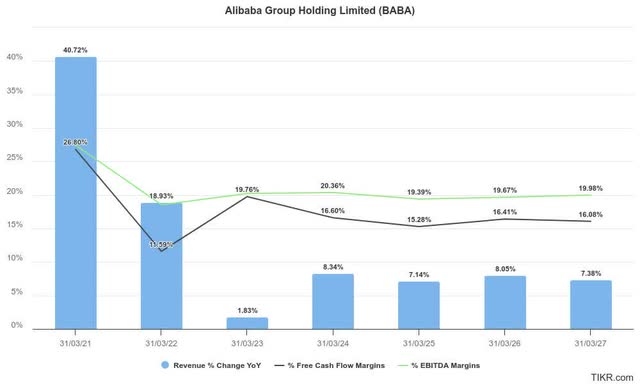

Alibaba: Profitability Growth Inflection More Likely

In addition, Alibaba’s profitability growth estimates are expected to bottom out in FY2025 (year ending March 2025) before a growth inflection through FY2027. The significant improvement in BABA’s buying momentum (from “D+” to “B+”) suggests the market is increasingly confident that the company could meet its growth targets.

Therefore, I assess that this week’s mega stimulus package announced by the Chinese authorities has likely spurred a significant improvement in investor confidence. The market is likely more confident in Alibaba’s earnings estimates, corroborating an anticipated bottom in FY2025.

Alibaba’s ability to execute a sustained turnaround shouldn’t be dismissed. Notwithstanding current geopolitical risks affecting a more aggressive valuation re-rating, Alibaba’s core commerce growth prospects remain tied to the health of the Chinese consumer.

As a result, investors are likely more confident in its recovery, as recent survey results suggest “69% of SME decision-makers are more optimistic about their growth opportunities.” In addition, the recent growth caution by Pinduoduo (PDD) likely indicates that the competitive efforts executed by Alibaba have started to pay off. Hence, it has likely compelled PDD to revise its sales and investment strategy to cope with the challenges of a more competitive BABA. Investors must note that Alibaba has a significant profitability moat (“A+” profitability grade) to compete more aggressively with its keen rivals if needed.

Is BABA Stock A Buy, Sell, Or Hold?

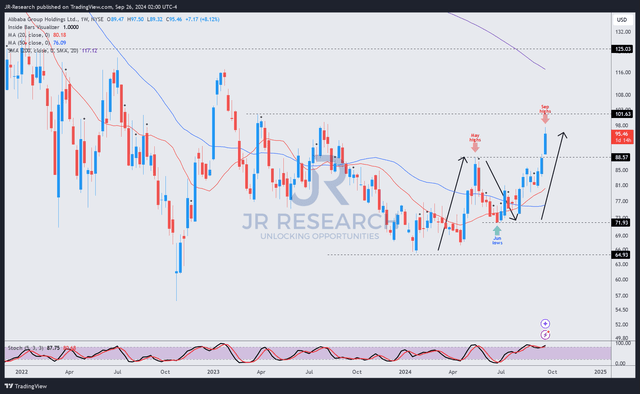

BABA price chart (weekly, medium-term) (TradingView)

As seen above, BABA has soared over the $90 resistance zone that previously saw steep selling pressure in May 2024. The stock has also exhibited robust recovery characteristics of a higher-low and higher-high price structure, underpinned by its “B+” momentum grade.

BABA’s forward adjusted PEG ratio of 1.13 is more than 25% below its sector median, corroborating its relative undervaluation. As a result, I assess that the significantly improved market sentiments have a solid fundamental foundation supported by a relatively attractive valuation.

Notwithstanding my optimism, investors must remain cautious and assess whether the government could follow through with additional fiscal and demand-side stimulus. The market seems to have reflected some optimism on the possibility, leading to potential disappointment if the government fails to execute accordingly.

Also, BABA’s $100 zone is assessed as a critical resistance zone that must be decisively breached for its bullish thesis to reassert itself. A failure to retake that level convincingly could discourage more momentum investors from returning, potentially leading to another steep pullback.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PDD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!