Summary:

- Despite decent earnings, Alibaba’s stock remains ‘dead money’ due to the underperformance of its domestic eCommerce business.

- Alibaba’s international business showed impressive growth, but it wasn’t enough to boost the stock, which remains below its 2014 IPO price.

- The company’s core eCommerce business and cloud segment underperform against global peers, with no major catalysts to drive significant appreciation.

- Although fundamentally undervalued, Alibaba’s stock is unlikely to appreciate without significant growth catalysts, making it a HOLD at best.

Robert Way

Despite reporting fairly decent earnings results earlier this month, Alibaba’s (NYSE:BABA) shares failed to gain momentum and are unlikely to significantly appreciate anytime soon. While the company’s international businesses showed impressive double-digit growth in the recent quarter, Alibaba’s core domestic eCommerce business has underperformed while its cloud business continues to grow at a single-digit rate and is unlikely to perform better than its international peers anytime soon.

Therefore, in my opinion, Alibaba’s stock continues to be ‘dead money’. Although the company itself is fundamentally undervalued at the current price, the lack of major growth catalysts is likely going to prevent a major appreciation of its shares in the foreseeable future.

International Business Performs Better Than Expected

In my latest article on Alibaba, which was published in June, I noted that the company is likely to be a value trap as it faces several major challenges that will probably make it harder for it to perform successfully in the future. While Alibaba’s shares have appreciated by ~8% since that time, I still believe that the company’s upside is limited.

However, we nevertheless saw several positive developments happening in recent months, which made some investors excited about the company’s future. First of all, a few weeks ago Alibaba released its Q1 earnings report, which showed that the company’s revenues increased by 4% Y/Y to $33.47 billion, while its non-GAAP EPADR of $2.26 was above the estimates by $0.17.

At the same time, Alibaba’s international business also performed well. Its international digital commerce business increased its revenues by 32% Y/Y to $4.03 billion, while its logistics arm Cainiao saw its revenues increase by 16% Y/Y to $3.69 billion thanks to the higher demand for cross-border fulfillment. While those results are impressive, it seems that the growth of the international business is the only major positive development that happened to the company in recent months.

The Future Growth Is Not Guaranteed

While Alibaba’s international business performed well, it was not enough to push the company’s shares higher. Right now, Alibaba is trading below its 2014 IPO price and it’s unlikely that its shares will rapidly appreciate anytime soon. Ever since the CCP got itself involved in the company’s affairs in late 2020, Alibaba as a company became uninvestable for lots of investors.

While the shares have slightly appreciated in early 2023 on Alibaba’s plans to spin off some of its business units into separate entities, the expansion of American export restrictions on chips prompted the company to cancel the anticipated spin-off of its cloud business later that year, which fully killed the stock’s momentum. Ever since that time, Alibaba’s shares have been ‘dead money’ and there are no major growth catalysts on the horizon that could’ve helped the stock appreciate in the foreseeable future.

Alibaba’s Stock Performance (Seeking Alpha)

The upcoming presidential elections in the United States are unlikely to improve Sino-American relations and lift the export restrictions on chips, so Alibaba’s cloud business is likely going to continue to underperform against its global peers. While Alibaba’s cloud revenues in Q1 increased to $3.65 billion, that translated to a Y/Y growth rate of only 6%. For comparison, the cloud businesses of Google (GOOG)(GOOGL), Microsoft (MSFT), and Amazon (AMZN) increased their revenues in the recent quarter by 28.8% Y/Y, 19% Y/Y, and 19% Y/Y to $10.35 billion, $28.5 billion, and $26.3 billion, respectively.

Considering those numbers, it’s hard to see how Alibaba’s cloud business will be able to challenge its international peers and become a major player in the cloud industry anytime soon. Therefore, investors should not place a lot of faith in the ability of Alibaba’s cloud business to revive the company’s overall momentum and push its shares higher to the previous major levels.

But what’s even more important is that Alibaba’s core eCommerce business is not showing growth anymore, which is also killing any chances to revive the momentum. In Q1, the company’s Taobao and Tmall Group revenues decreased by 1% Y/Y to $15.6 billion. Because of that, Alibaba missed the total revenue estimates in Q1 by $1.15 billion, even though the overall revenues were up Y/Y.

The primary reason behind the decline of the core business is outside of Alibaba’s control. As of now, consumer confidence in China is close to its historical low levels, and even Alibaba’s competitors like Baidu (BIDU) and PDD Holdings (PDD) are now reporting mixed earnings results. It’s yet to be seen whether the government’s efforts to stimulate the economy will succeed, but the company is once again hostage to China’s political developments, which could be considered a bad signal for lots of investors.

That’s why it’s not a surprise that Alibaba received dozens of downward revenue revisions in recent months given all of those developments. At the same time, its bottom-line performance is also not that impressive. While it beat the estimates, the company’s non-GAAP EPADR in Q1 was down 5% Y/Y, as the company’s income declined by 27% Y/Y to $3.31 billion. Considering this, it’s hard to see why Alibaba’s stock should increase in value in the foreseeable future, given that at this stage it lacks major growth catalysts to move the needle.

The Valuation Dilemma

Despite all the challenges that Alibaba faces, its shares continue to be undervalued at the current price. Back in June, my DCF model showed that Alibaba’s fair value is $115.39 per share. Considering that nothing much has changed since that time and the street continues to expect a single-digit revenue growth rate in the following years, it makes sense to assume that Alibaba’s fair value hasn’t changed much and could be similar to my previous calculations, plus or minus a few basis points. The consensus price target currently is $105.22 per share.

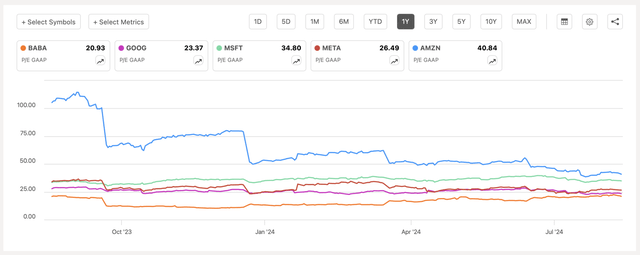

However, I believe that no matter if the fair value is ~$105 per share or ~$115 per share, the issue is that Alibaba has been fundamentally undervalued in the last 12 months at the very least, but that did not result in the appreciation of its shares. At the TTM P/R of 21x, the company is undervalued against its Western peers and the broader market, and it has been undervalued in comparison to them for a while.

Stock Comparison (Seeking Alpha)

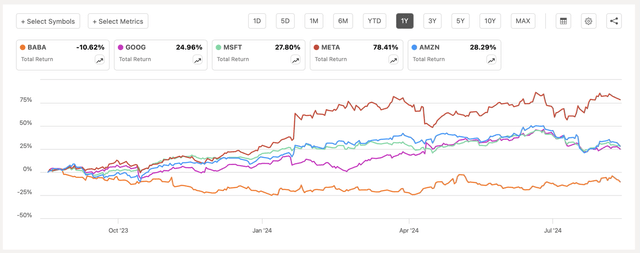

Despite this, not only did its shares never traded above $100 per share in the last year, but they also greatly underperformed against the same Western peers, which were able to create shareholder value in recent quarters.

Stock Comparison (Seeking Alpha)

This shows that no matter how undervalued Alibaba is, it’s unlikely that its shares will be able to appreciate without a major growth catalyst. That’s why Alibaba could even be considered a value trap by some investors, considering how its shares performed recently.

The Bottom Line

At this stage, Alibaba has two major things going for it. Its international business continues to perform well, and its stock remains undervalued. However, the international business is unlikely to offset the underperformance of Alibaba’s domestic eCommerce business and the relatively weak performance of the company’s cloud business against its global peers. At the same time, Alibaba has been fundamentally undervalued for a long time, but that did not help its shares to regain their momentum and appreciate due to a lack of major growth catalysts.

Considering that there are no major growth catalysts on the horizon, Alibaba’s stock is likely to remain ‘dead money’ and investors shouldn’t expect a major appreciation in the foreseeable future. That’s why I believe that Alibaba is a HOLD at best, as its stock is unlikely to greatly move in one way or another anytime soon.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.