Summary:

- Alibaba is at an inflection point. The company has addressed key regulatory challenges and is now focused on leveraging its core strengths in e-commerce and technology to drive profit expansion.

- Meanwhile, Alibaba Cloud is poised to be a key growth engine for Alibaba Group, with a clear pathway to revenue expansion and margin improvement.

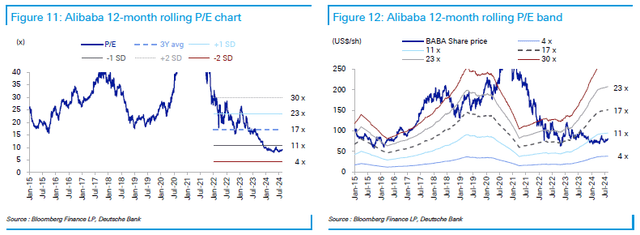

- With shares trading at less than 10x P/E compared to a 3-year average of 17x and an industry benchmark of 14x, I anticipate BABA’s valuation could rise to 14-15x earnings.

- As key driver of upside, I highlight Alibaba stock’s inclusion in the Stock Connect program on Sept. 9, and the company’s ongoing $65 billion share repurchase plan.

maybefalse

Alibaba Group (NYSE:BABA) presents an attractive value opportunity for investors seeking exposure to China’s digital economy. While the stock has faced significant volatility in recent years due to regulatory headwinds and macroeconomic uncertainty, I believe the worst should now (finally and hopefully) be behind Alibaba. Indeed, with growth in the core e-commerce business stabilizing, and growth in the Cloud business accelerating, all while management is pushing a group-wide focus on profitability, I argue Alibaba stock is poised for a re-rating. With shares trading at <10x P/E, vs. 17x 3-year average and 14x for the industry benchmark, I expect that BABA’s valuation could jump to 14-15x earnings. As potential upside catalysts for the re-rating, I highlight (i) Alibaba’s inclusion in the Stock Connect program on September 9, 2024, and (ii) ongoing $65 billion share repurchase plan with a potential yield over 10% p.a. — catalysts that are certainly poised to drive buying pressure.

For context, Alibaba stock has under-performed the broad equity market in 2024, with shares gaining “only” 10% YTD, vs. a gain of 17% for the S&P 500 (SP500).

Seeking Alpha

Core E-Commerce Business Is Stabilizing

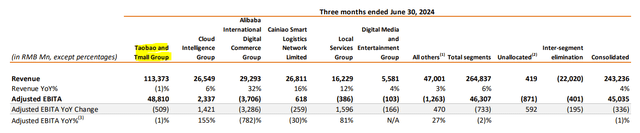

Alibaba’s core domestic e-commerce segment, which accounts for the bulk of its revenue, has shown signs of stabilization in H1 2024. Indeed, although recent quarterly results indicate a modest 1% YoY contraction in this segment, the underlying gross merchandise volume (GMV) has stabilized with “high-single digit” growth, suggesting that the company’s efforts to retain market share and enhance monetization are beginning to bear fruit. Alibaba has implemented strategic shifts aimed at transforming its narrative from that of a “market share loser” to a “profitable growth engine.” Specifically, I expect upside to Taobao’s monetization rates, which should support higher revenue growth in the coming quarters.

Alibaba June Quarter Reporting

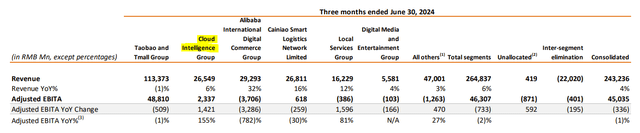

Cloud and AI: Leveraging Technology for Future Growth

Alibaba’s cloud computing division is the a cornerstone of the company’s growth strategy, in my view: As the largest cloud provider in China and the third-largest globally, Alibaba Cloud is positioned at the forefront of the rapidly growing cloud services market. Indeed, recent strategic moves, including investments in AI and new partnerships, signal that Alibaba is serious about expanding its footprint in this high-margin segment. And as regulatory concerns begin to dissipate, I expect the market to recognize the value of Alibaba’s cloud business more fully, which could lead to multiple expansions for the stock.

The Cloud division contributed approximately 10% of Alibaba’s total revenue in FY 2023, with revenue growth of 20% YoY, reaching RMB 109.5 billion (approximately $15.1 billion). Indeed, despite a challenging macroeconomic environment, Alibaba Cloud’s revenue growth remains robust, driven by strong demand for cloud infrastructure, data analytics, and AI services. In the most recent quarter, Alibaba Cloud grew its topline at about 6% YoY. This growth was primarily fueled by increased usage from key verticals such as internet, financial services, and retail, as well as the expansion of its international business. Notably, I highlight that Alibaba Cloud’s profitability is also improving: In Q1 FY 2024, Alibaba Cloud’s adjusted EBITDA margin improved to 12%, up from 8% in the previous quarter. This margin expansion reflects higher utilization rates, economies of scale, and disciplined cost management. A target of 20%+ adjusted EBITDA margins by FY 2026 looks very reasonable to me.

Alibaba June Quarter Reporting

On a long-dated perspective, Alibaba Cloud’s growth trajectory is supported by robust tailwinds in the cloud computing market. And given Alibaba Cloud’s current market position and strategic initiatives, I project the division’s revenue to grow at a 15-20% CAGR over the next three years, reaching approximately RMB 200 billion ($27.5 billion) by FY 2026. Combined with the assumption on EBITDA, the Cloud business could generate more than $5 billion in operating profits by 2026.

Upside Catalysts: Stock Connect Inclusion and Share Buybacks

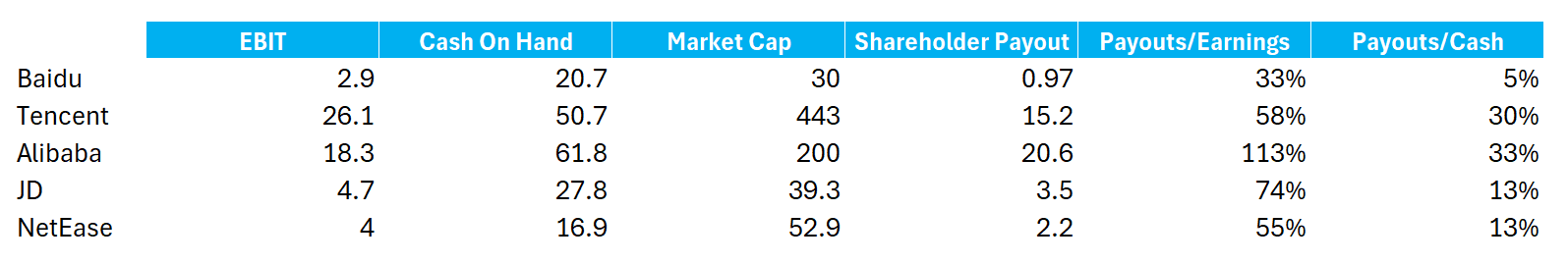

A key catalyst for Alibaba’s stock in the near term is the company’s stock inclusion in the Stock Connect program (start September 9, 2024). This inclusion should enhance liquidity and investor access, potentially triggering a re-rating of the stock as broader investor participation drives demand. Moreover, Alibaba’s ongoing $65 billion share repurchase program is a critical lever for value creation. With $26.1 billion still available under the current authorization, this program could offer a yield exceeding 10% p.a., providing a strong downside cushion for shareholders. To highlight Alibaba’s attractive payout policy, I prepared an analysis that compares BABA’s payouts to the company’s earnings and cash on hand. Interestingly, Alibaba’s payouts as a percentage of operating earnings are now >100%. The respective metric for JD, NetEase and Tencent is 74%, 55% and 58%.

Company Financials; Refinitiv; Author Analysis

Valuation Highlights Re-Rating Potential

Given the anticipated EPS growth rate of over 10% beyond FY24, according to data collected by Refinitiv, and Alibaba’s current valuation at a forward P/E multiple of just below 10x, the stock appears undervalued relative to the industry (40% upside, according to Seeking Alpha benchmark). Moreover, as the chart from Deutsche Bank below highlights, Alibaba is trading at its cheapest P/E multiple level since being a public-listed company, with the 3 year average set at 17x, apprx. (Source: Deutsche Bank research note on BABA, dated 20th August: “Halftime break”).

Deutsche Bank

My December 2024 price target of $108 is based on a combination of core e-commerce stabilization, strategic share repurchases, and the potential for cloud growth to accelerate. In my view, if Alibaba can successfully execute on its strategic priorities, I see room for a substantial re-rating. The stock’s valuation could rise to 14-15x earnings, in line with other major e-commerce players, particularly if sentiment around Chinese equities improves.

Risks to Consider

Investors should be aware of potential risks, including a slower-than-expected recovery in consumer spending in China, heightened competition from domestic and international rivals, and the possibility of renewed regulatory scrutiny. However, with Alibaba’s recent focus on compliance and operational efficiency, I see these risks as increasingly manageable.

Investor Takeaway

Alibaba is at an inflection point. The company has addressed key regulatory challenges and is now focused on leveraging its core strengths in e-commerce and technology to drive profit expansion. Meanwhile, Alibaba Cloud is poised to be a key growth engine for Alibaba Group, with a clear pathway to revenue expansion and margin improvement. With shares trading at less than 10x P/E compared to a 3-year average of 17x and an industry benchmark of 14x, I anticipate BABA’s valuation could rise to 14-15x earnings: As key driver of upside, I highlight Alibaba stock’s inclusion in the Stock Connect program on September 9, 2024, and the company’s ongoing $65 billion share repurchase plan with a potential yield over 10% annually. Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.