Summary:

- Alibaba’s stock is undervalued, and 2025 could be a year of redemption due to China’s expansionary monetary policy, promising Alibaba Cloud growth, and massive buybacks.

- China’s changing macroeconomic environment, including significant stimulus plans, is expected to revitalize the economy, benefiting Alibaba’s diverse business segments beyond just e-commerce.

- Alibaba Cloud, a key growth driver, is expanding internationally and investing heavily in AI, positioning itself as a major player in the booming cloud market.

- With substantial cash reserves and a strong financial position, Alibaba’s aggressive buyback program and strategic investments make it a compelling investment opportunity.

William_Potter

Intro

Alibaba (NYSE:BABA) investors are probably the most patient in the world since they have been waiting for years for the stock to rebound.

Seeking Alpha

The performance over the past five years has been awful despite the fact that the S&P 500 has skyrocketed to all-time highs. The most frustrating aspect is that during these years the stock has occasionally had an outstanding performance, only to fall back into oblivion upon the release of yet another piece of negative news.

The current price is discounting any adversity, in fact, the resistance at around $70-$80 has hardly been broken downward in the past: those who wanted to sell have already sold. At the same time, it is not enough to have a low downside to invest in it; it is necessary that it also starts to generate a decent capital gain. From this point of view, I expect that 2025 may be the year of redemption and the stock will finally approach its fair value.

The reasons for my optimism are mainly three:

- Expansionary monetary policy in China will deliver its first results starting in the next few quarters. In addition, the government seems intent on further stimulating the economy.

- The market has very low expectations for Alibaba Cloud, but in 2025 it may come around. This business is by far the most promising.

- Buyback could reach figures never seen before. Alibaba certainly does not lack money and the price per share is far below its fair value.

Each point will be discussed individually.

Changing macroeconomic environment

The best macroeconomic environment in which to invest is one where a world power is stimulating the economy to revitalize it. The last 20 years of the S&P 500 were among the best ever because the Fed injected a huge amount of money into the economy and rates were kept low to stimulate economic activity: 2008 looked like hell, but after a few years the situation was already quite different.

China is currently facing its own version of 2008, also due to a major real estate crisis that wiped out the savings of thousands of families, generating panic in the country. Moreover, as if that were not enough, China’s big tech companies have been forced to follow rather questionable new regulations, and this has sunk the desire to invest in this country even further. However, compared to two years ago, the macroeconomic environment is gradually changing.

The Chinese government is no longer Alibaba’s “enemy,” but has become an ally in getting out of this crisis that threatens to result in severe deflation. The first aid has already arrived but too little is said about it because the focus is always and only on the U.S.-China trade war.

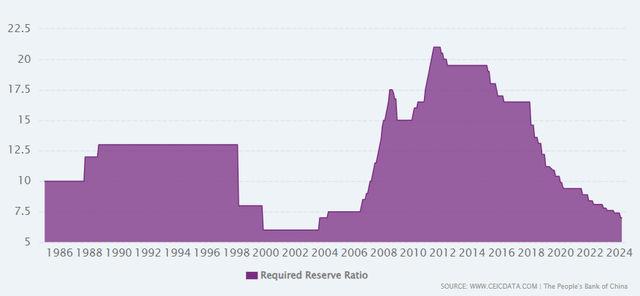

CEIC Data; The People’s Bank of China

The Required Reserve Ratio continues to decline and is reaching an all-time low. At the end of September, China’s central bank reduced it by an additional 50bps and released about $141 billion to be injected into the financial system: there is still room to reduce it further.

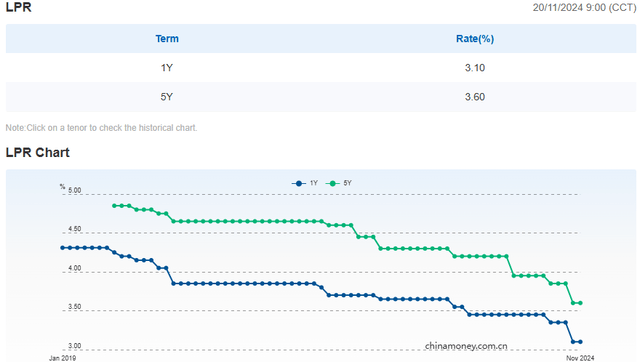

China Foreign Exchange Trade System & National Interbank Funding Center

Loan Prime Rates at 1Y and 5Y were also reduced and reached 3.10% and 3.60%, respectively. At the end of September, the cut was 25 bps, the largest in the past five years (even more than March 2020).

But aid is not only limited to the financial system, but also to directly help the people. As mentioned, the real estate market is at the heart of the problem as Chinese households struggle to pay their mortgages, which is why the government has cut mortgage rates for existing real estate loans by 0.50%. This move will positively impact a population of 150 million and save them CN¥150 billion each year. In addition, it will be easier to buy a second home for those intent on doing so: the minimum initial payment has dropped from 25% of the property’s value to 15%.

These are just some of the policies aimed at reviving the economy, and upon the announcement of these moves, the Chinese market skyrocketed. In the following 10 trading days Alibaba achieved a rally of about 30%, a signal that the market greatly appreciates the government support. As of today, Alibaba has once again lost much of the ground it has regained because of potential high tariffs on Chinese products, but a few days ago Alibaba rose more than 7% in a single trading day. What happened?

There is news about China’s monetary policy for 2025, and this time it could really lead to a change in the trend.

At the last Politburo meeting held on Monday, Chinese authorities hinted that there will be a substantial change in monetary policy from the last decade. The Chinese central bank has typically described its monetary policy in five ways: loose, appropriately loose, prudent, appropriately tight and tight.

Well, from late 2010 to the present, the stance has always been “prudent”. From 2025 onward it will shift to “appropriately loose”, a decision that was last made during the 2008 financial crisis. Chinese authorities have not given figures about the plan to lift the country’s economy; we will know more following China’s central economic work conference that is likely to be held in the coming days.

However, we can draw some conclusions by looking at what was done in 2008 to recover from the crisis. The OECD article on the subject follows:

China was the first major economy to emerge from the global financial crisis, and it did so in spectacular fashion. After a brief – though sharp – downturn in 2008, the Chinese economy grew by 8.7% in 2009 and by 10.4% in 2010, and the robust growth in China helped a host of resource-rich countries avoid the economic downturn. A big factor behind this enviable success was the massive stimulus programme introduced in the fourth quarter of 2008 and implemented through 2009 and 2010. The initial programme that was announced totalled 4 trillion yuan renminbi (CNY) (USD 586.68 billion), comprising CNY 1.18 trillion in central government funding plus local government inputs and bank credit. The package amounted to 12.5% of China’s GDP in 2008, to be spent over 27 months. In relative terms, this was the biggest stimulus package in the world, equal to three times the size of the United States effort. Following Premier Wen Jiabao’s call to make the stimulus “big, fast and effective”, the programme was implemented with great force and in record time. Along with the huge fiscal injection, state-owned banks opened their spigots, and total credit grew by more than one-third in 2009. Local government inputs also far surpassed expectations. Altogether the total stimulus grew to an estimated 27% of GDP, with an injection of 19% in 2009 alone.

In other words, China does not like to waste time and allocated the world’s largest stimulus package right from the start (in relative terms), which is why it was the first country to emerge from the crisis. In 2008, the stimulus package amounted to about 12.50% of GDP, to be spent over the next 27 months. That’s an insane amount, and if we think that the market at the end of September was excited about a stimulus of just over $100 billion, let alone if it follows in 2008’s footsteps in the coming months. Based on China’s 2023 GDP ($17.50 trillion), the 12.50% would amount to $2.18 trillion (vs. $586 billion in 2008) to be injected in the next two years, to which additional stimulus could be added later.

This is an indicative figure; it could be much less since China’s debt to GDP ratio has increased quite a bit since that stimulus.

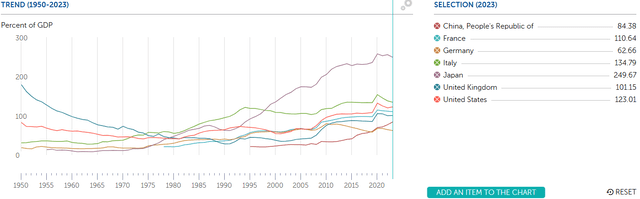

International Monetary Fund

84.38% vs. about 27% in 2008 is a big difference, even though China is among the least indebted compared to the world’s major countries’ economies.

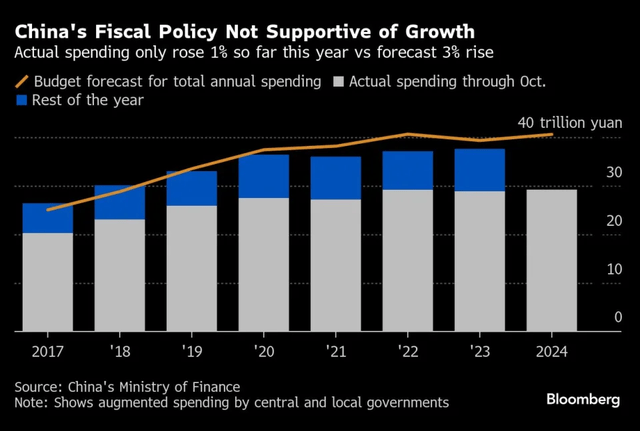

Bloomberg, China’s Ministry of Finance

Certainly, it has good leeway and can stimulate the economy much more than it has in recent years. There is a need for a major fiscal package to restore investor confidence, and I am confident that we will have important updates on this in the coming weeks. Of course, should my hunch be confirmed, you cannot expect a total economic recovery overnight.

The effects of monetary/fiscal policy are not immediate on the economy, and one must wait several quarters before observing the results. Just as it took the Fed more than a year to reduce inflation, at the same time it takes a while for Chinese households to return to spending. In any case, investing only when you see relevant improvements means giving up much of the capital gain: the market is always 6-12 months ahead of the real economy.

Alibaba is not only e-commerce

My impression is that people often believe that Alibaba is simply an e-commerce company and nothing more, but that is totally wrong. In fact, most of the growth prospects come not from Taobao and Tmall, i.e., the main Chinese e-commerce, but from the Cloud.

E-commerce in China has been a saturated market since competitors like PDD Holdings and JD came into play, so even increasing revenues by 3-4% per year would already be a decent result. They only increased by 1% in the last quarter, but that is not such a bad outcome given China’s economic situation and cutthroat competition.

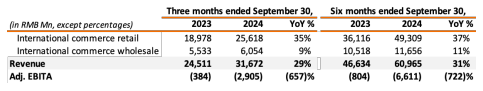

Alibaba Group September Quarter 2024 Results

Different discussion for International commerce, up 29% from the same quarter last year. Growth is fast but so is the loss, about RMB 2.90 billion. Alibaba is trying to expand as much as possible overseas through platforms such as AliExpress, and is willing to lose out in the short term to do so. Once users increase, it can then think about profitability.

When Trump threatens to raise tariffs, this is the business segment that gets hit the hardest, but even if he did, it would not move Alibaba’s balance much. Not all of the RMB 31 billion ($4.51 billion) comes from the United States, and even if it did, it would amount to only 13.40% of total revenues. If, paradoxically, e-commerce in the United States were shut down, operating income would increase.

Alibaba is not dependent on the U.S., or more generally on the West, since it already has 1.41 billion people in its country, plus all the other eastern countries with which China has intense trade relations due to geographical matters.

The only thing that could really weaken it is if the United States continues to restrict China’s growth in terms of developing the most advanced chips. The latter are the basis of AI and the Cloud, which is why they could slow down Alibaba’s ability to improve its services and not be internationally competitive.

This strategy adopted by the United States at the moment is working but there are two aspects to consider:

- To date, we do not know the true technological level of China. Semiconductors have become a political issue, which is why the information is confidential. We can certainly claim that it is behind the United States as it does not have access to EUV lithography machines, but not by how much. Public opinion last year believed that it could not even produce 7-nanometer chips independently, but then Huawei surprised everyone.

- After countless bans were implemented, China recently responded to the United States by imposing a ban on exports of some key components to make semiconductors and EV batteries. These include gallium and germanium, two key components in which China dominates world production: 94% and 83%, respectively.

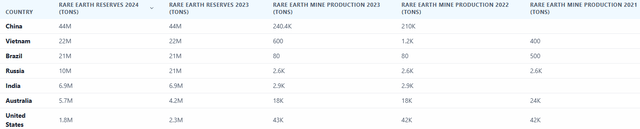

As far as I am concerned, U.S. policy is simply driving China to its actual goal, which is to be self-sufficient. Both countries have the best talent in the world, but China has the raw material, something the United States lacks. In terms of rare earths, China has absolute dominance.

World Population Review

In the not-too-distant future, I expect that China will have the technology to move closer to the United States and the country will be less and less dependent on foreign sources. Companies like Alibaba that are investing heavily in AI within the country will be able to be competitive on an international basis within a few years as well.

In an increasingly digitized world that needs to be more and more efficient, the infrastructure provided by the Cloud is the foundation of any economy. In addition to storing a huge amount of data securely, the Cloud enables improved production efficiency by being available anytime and anywhere with an Internet connection. Integrated with AI capabilities, no company will be able to do without it; the same goes for individuals.

That said, let us return to the present and see in which markets Alibaba Cloud is most prevalent.

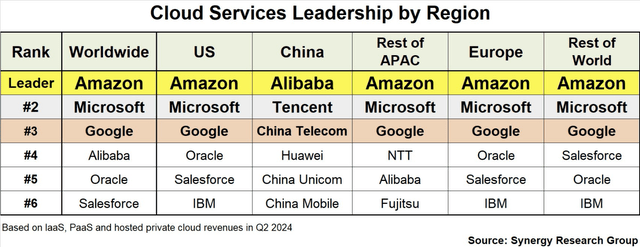

Synergy Research Group

Worldwide, Alibaba is in the fourth position, yet it is not even in the top five in the United States, Rest of the World and Europe. How is this possible?

The answer lies in its dominant position within the huge Chinese economy; that is enough to be among the world’s top Clouds. The Chinese Cloud market is the second largest in the world and has been valued at $85 billion in 2023 and could grow to $293 billion by 2027; a CAGR of about 36%. This is a huge potential growth and one that no other country can match currently. More and more Chinese companies are realizing the importance of the Cloud, and the amount of data China could generate in 2025 is staggering: 48.60 zettabytes vs. 30.60 zettabytes in the United States. This data will have to be stored somewhere.

Returning to the question regarding leadership in China, it is curious to note that the top six places include only local companies. Alibaba, Huawei and Tencent control 72% of the domestic market; Alibaba is the leader with 37%. Yet, AWS, Azure and Google Cloud dominate worldwide. Why is this not the case in China?

The answer is quite intuitive; China does not want U.S. companies to circulate freely in its territory and store a huge amount of personal data. Microsoft and Amazon operate in China’s territory, but they have to cooperate with some local companies. The latter will always be preferred, and Alibaba is currently the most technologically advanced in China.

According to the company’s claims, its Qwen Max 2.5-Max language model has outperformed Meta’s Llama and OpenAI’s GPT4 in several areas, including reasoning and language comprehension. Considering the issue related to sourcing the best chips, this result is surprising.

In China, Alibaba Cloud dominates because of the technologies at its disposal, but worldwide its market share is only 4%. Rather than the West, the company’s expansionist sights are primarily directed toward Southeast Asia for geographic and geopolitical reasons: in fact, it is the only other area besides China where Alibaba Cloud has a larger presence. Over the next three years, new data centers will be deployed in Malaysia, the Philippines, Thailand, and South Korea. It will also launch its first Cloud region in Mexico.

To be dominant in this market on both a domestic and international basis, it is critical to have a huge amount of capital to invest, and Alibaba has no shortage. To finance these plans, it can either use its cash ($55.40 billion), issue debt given its strong financial position (-$22.11 billion net debt) or self-finance itself (5Y average cash from operations $26.81 billion).

Obviously, investing billions and billions of dollars for Cloud + AI infrastructure implies a sharp contraction in free cash flow, but this is not necessarily a negative aspect.

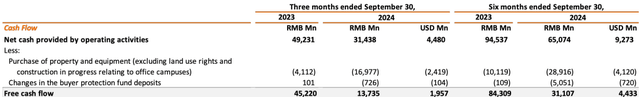

Alibaba Group September Quarter 2024 Results

Compared to last year, there has been a 70% drop, but only because there has been heavy investment in a booming market. One should not stop at appearances.

Free cash flow this quarter was RMB13.7 billion, a decrease of 70% compared to RMB45.2 billion in the same quarter last year. This was mainly attributed to our investments in Alibaba Cloud infrastructure. In addition, there was a refund to Tmall merchants after we cancelled the annual service fee, and some other working capital changes related to factors including scale down of certain direct sales businesses. Given the sustained and strong demand for Al, we will continue to invest in AI infrastructure as we anticipate future demand for Al-driven cloud services.

Management will continue to follow this approach, and I personally believe it is the right choice. Gaining a competitive advantage in such a market nowadays means being among the most dominant companies in the world in the next decade. By itself, the e-commerce segment is not enough, and by the way, it is also less profitable than the Cloud. The latter is a very scalable business, and once the ideal infrastructure and a large user base are in place, there can be a strong improvement in the operating margin of the entire company (AWS has a 38% operating margin and continues to improve).

Alibaba Group September Quarter 2024 Results

In terms of quantity, Alibaba Cloud is still in its earliest days, but after years of investment we can already see the first effects of operating leverage: revenues are growing by 7% but Adj. EBITA has grown by 89%.

You might not be surprised by the single-digit growth rate, but you have to consider two aspects:

- The first is that it represents an improvement over the stall of a few quarters ago. The causes certainly include the difficult macroeconomic environment that needs a shake-up.

- The second is that demand for AI services is increasing. Public cloud products have been growing at double-digit rates, while revenues from AI-related products have seen triple-digit year-on-year growth for the fifth consecutive quarter.

So, Alibaba Cloud is returning to growth, and with a more favorable macroeconomic environment, I expect it can return to double-digit growth in 2025. By the way, the company is prioritizing user growth over profitability with regard to AI services, so the potential growth of Adj. EBITA margin (today it is only 9%) is huge:

Regarding the outlook for cloud profitability, we must factor in the AI variable. For both AI software and compute power, we’re taking a longer-term view. So you’ll continue to see price reductions for our Tongyi model’s API tokens, as well as for our platform’s inference and compute services. We believe both the AI business and industry demand for AI are still in very early stages. In this space, we prioritize user expansion when pricing these products.

Overall, Alibaba is the leader in China in the Cloud market (the second largest and with huge potential) and is unaffected by U.S. competition given the country’s regulations. Expansion into Mexico and Southeast Asia may make it a major global player, but much will depend on how quickly China can catch up with the U.S. Technology gap: it will not be easy if it cannot import ASML’s most advanced machines. Anyway, the Qwen language model seems to be at an advanced level already.

Huge buyback

Typically, I do not consider buyback as a relevant factor in an investment thesis, but in Alibaba’s case I have to include it. Earlier I mentioned some figures to give you an understanding of the huge amount of money it has at its disposal, and some of it is used to buy back its own shares.

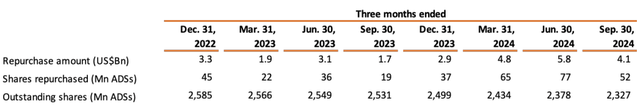

Since I believe Alibaba is severely undervalued, the fact that it still has $22 billion more available for buyback until 2027 is something to consider.

Alibaba Group September Quarter 2024 Results

Outstanding shares have plummeted in recent quarters, implying a major boost for EPS. If the price remained $90 per share, with the $22 billion on hand it could buy another 245 million shares, bringing it to a total of 2.082 million by the end of 2027. Basically, 10.50% less in just three years.

I would not rule out an increase in the buyback plan; after all, the Chinese government is favoring this practice. Included in the aid allocated in September is the possibility for companies and majority shareholders to borrow at low-interest rates to buy back their own shares.

Valuation

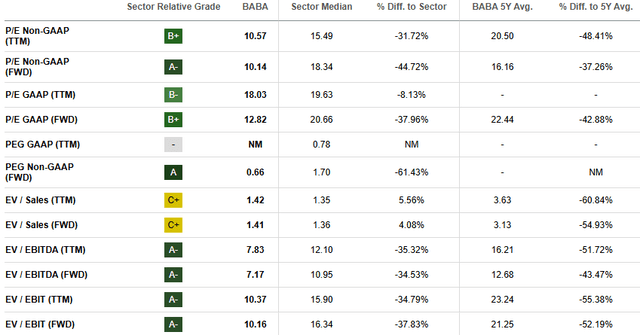

It is really hard to find a way to prove that Alibaba is overvalued given its current price multiples and growth prospects.

Seeking Alpha

In the past, I have calculated its fair value through a DCF model, this time I will use an even simpler methodology. I will calculate the value of each individual business unit using a P/S ratio as a multiple, since most of them are currently operating at a loss.

- Starting with China commerce (Taobao and Tmall), the revenue generated in the last 12 months was RMB 434.64 billion. With due differences, I believe eBay is the listed company with the most similar business model and is trading at a Price/Sales of 3.12x. I want to be conservative and assume that Alibaba’s China commerce for some unknown reason is worse, so I consider a multiple of 2x. As a result, the value of this segment is RMB 869.28 billion.

- Cloud has generated revenues of RMB 109.80 billion in the past 12 months. The potential of this market has already been widely discussed, and I believe it deserves at least a Price/Sales of 2.50x. It is essentially the future of this company since a large part of the CapEx is invested in it, and it has all the prerequisites to excel. Based on that, the value of this segment is RMB 274.50 billion.

- International commerce is growing by 30% every quarter, but since its profitability is an unknown, I want to consider a P/S of just 1x. Revenue for the last 12 months was RMB 116.91 billion, so the value is the same.

- Cainiao is the world’s largest service provider by parcel volume and is growing in double digits through international expansion. Alibaba’s logistics network is among the best in the world and also serves other companies. This business has generated RMB 104.47 billion. FedEx is trading at a Price/Sales of 0.79x and that seems reasonable for Cainiao as well. Its value therefore is RMB 82.53 billion.

- Local Services is the business composed of popular apps in China such as Amap, a leading provider of digital maps. It generated RMB 63.73 billion in the last 12 months, grew 14% in the last quarter, and is almost about to become profitable. Again, I want to be cautious here and consider a P/S of only 0.50x. Thus, its value is RMB 31.86 billion.

- Digital Media and Entertainment is perhaps the weakest segment and in the last quarter it was down 1%. Its revenue in the last 12 months was RMB 21.25 billion, and I think a P/S of 0.40 is reasonable. So it is worth RMB 8.50 billion.

The last segment is All Others and includes services such as Sun Art, Freshippo and Alibaba Health. In the last quarter this segment improved by 9% over last year and generated RMB 197.64 billion in the last 12 months. Multiplied by a conservative P/S of 0.5x, its value amounts to RMB 98.82 billion.

Overall, the value of all operating segments is RMB 1,482.40 billion, or $203.81 billion (USD/CNY 7.2734). But this is not the end of the story, because we have to add two figures:

- The net debt of $22.11 billion.

- The 33% stake in Ant Group, China’s leading digital payments company. Since it is not listed, it is difficult to tell how much it is worth today, but last year it was valued at $79 billion. Thus, $26.33 billion must be added to Alibaba’s valuation.

Add it all up, and its total value is about $252.25 billion ($108.40 per share), about 25% upside from current levels. In any case, I think this is really the worst-case scenario, and if I had considered multiples that are not too conservative, the valuation could have easily reached $300-$350 billion.

As far as I am concerned, Alibaba is one of the best companies to invest in for 2025, especially considering the excessive euphoria that is running rampant in the U.S. market.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.