Summary:

- Netflix, Inc.’s valuation is growing towards $200 billion, despite the company’s growth slowing down dramatically.

- The company’s revenue growth isn’t even matching inflation, and the company is pushing away customers with household etc. restrictions.

- We expect the company will struggle to generate shareholder returns anywhere near its valuation, especially with the impact of continued dilution.

- Netflix has been caught up in the strength of the tech markets, but we think it’s a poor investment.

Riska/E+ via Getty Images

Netflix, Inc. (NASDAQ:NFLX) is one of the largest streaming companies in the world, and now its share price has recovered to highs not seen since late-2021. That’s pushed its market capitalization to almost $200 billion. As we’ll see throughout this article, the company’s almost non-existent growth makes it a poor investment at this valuation.

Competition Galore

Netflix faces massive competition from incredibly deep-pocketed competitors. That includes Amazon (AMZN) Prime, Disney (DIS) Plus, Max, and more. These competitors are also much wealthier than Netflix. Amazon, for example, has a $1.3 trillion market capitalization, enabling it to spend massive amounts of money on new series such as The Hobbit.

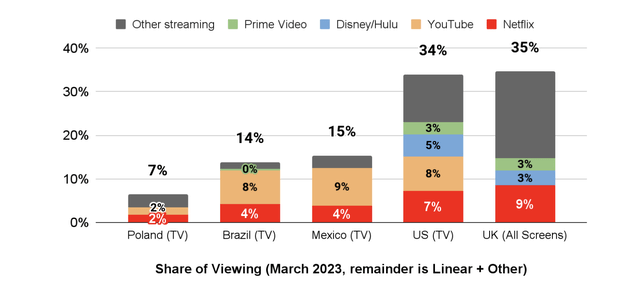

Netflix remains a dominant streaming service. In the U.S. the app continues to get 7% of watch time. Internationally, Google’s (GOOG, GOOGL) YouTube continues to lead, but there’s a more interesting story to be told in the premium markets of the U.S. and the U.K. In the U.S., Disney / Hulu are almost as big as Netflix, and Prime Video is already half as big.

In the UK, YouTube is much smaller, but Prime Video / Disney and Hulu are each 1/3 as launch. Given that these competitors have enormous other businesses, we expect competition to continue its growth, putting Netflix in a difficult position.

Q1 2023 Financial Results

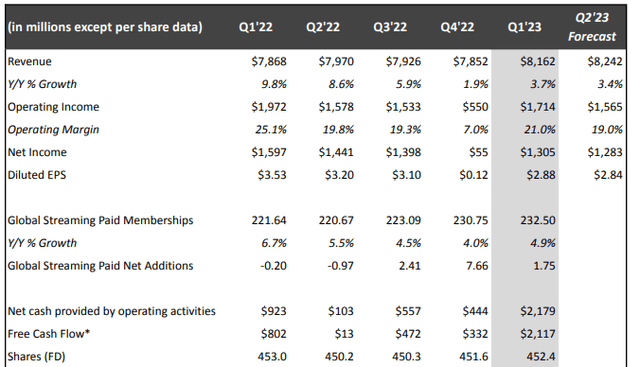

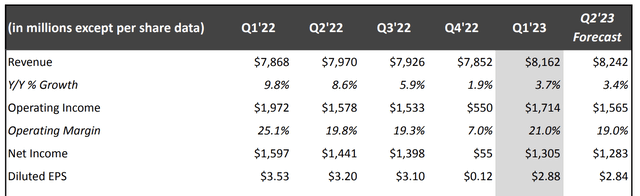

Netflix’s growth has effectively halted, showing the company’s full market penetration size and minimal additional opportunities. Chasing new ideas (such as growth) has failed to pan out.

The company’s Q1 2023 revenue grew by a mere 3.7% YoY and less than that QoQ. For the company, that was lower than the impact of inflation, indicating that the company’s real revenues declined YoY. The company’s net income also declined YoY, impacting its EPS. The company’s annualized EPS was $9.95 / share last year (P/E >40), and this year will likely be lower.

The company saw stronger growth in paid memberships of 4.9% YoY, but the revenue impact indicates the company’s customers are shifting towards lower-cost memberships. At the same time, the company’s net additions remain low showing continued struggles for its business. Free cash flow (“FCF”) remains weak as well despite the 1st quarter normally being the strongest, and dilution continues.

That dilution is worth paying close attention to. In the last quarter, the company added 800 thousand shares but $2.1 billion in FCF (its strongest FCF quarter). Those additional shares actually means that true FCF was almost 20% lower for the company, impacting what’s already a weak number.

The Capital Spending Won’t Stop

At the same time, the company continues to have massive capital expenditures worth paying close attention to.

First, the company has $6.7 billion in net debt after cash and investments. The company has a reasonable strong credit rating, but that’s still something it’ll need to make up and pay off with FCF. At the company’s FCF rate for last year, not counting dilution, that’s almost 4 years of FCF, a massive amount. The debt position might be low versus market cap, but it’s still relatively high.

On top of debt, the company still has massive capital obligations to sustain content. The company’s 2024 content guidance is for $17 billion worth of capital spending. The company’s annual revenue is $33 billion, which means outside of any capital spending its obligations are already relatively high. Those baseload obligations will keep earnings down.

Unfortunately, even with that massive content spending, the company isn’t defeating competitors which have massive traditional operations that can continue to provide subsidies. Disney is planning to spend $30 billion and Warner Bros. Discovery (WBD) $20 billion. New giants in the industry Apple (AAPL) and Amazon are spending $7 and $10 billion, respectively.

To remain competitive, Netflix will need to keep its capital spending at least at current levels if not higher.

Guidance

Netflix’s guidance also remains incredibly weak, showing that the company has no path towards justifying its valuation.

The company’s guidance for revenue is $8.2 billion for the quarter, up less than 1% QoQ and 3.4% YoY. That’s another quarter where the company’s revenue growth will be less than inflation. The company expects both operating and net income to drop QoQ, impacted by increased expenses hurting its margins.

The next quarter for the company shows essentially no growth for the company. That doesn’t include any subscriber impact as the company rolls out its household restrictions.

Thesis Risk

The largest risk to our thesis is that streaming is growing overall. The company also has a commanding lead here. Multi-trillion dollar players getting into the market might be interested in Netflix. Any of these scenarios could result in strong growth or earnings for Netflix, making the company a valuable investment.

Conclusion

Netflix, Inc. has a strong portfolio of television, and it continues to have a commanding lead in the streaming industry. However, the company has also heavily penetrated its target markets and growth rates have slowed down dramatically. The company’s revenue growth is no longer even matching inflation.

At the same time, deep-pocketed competition is ramping up substantially. Netflix is already spending more than 50% of its revenue on growth, and even then it’s not competitive with the two most competitive streaming services, Disney Plus and Max. Going forward, we expect the company to continue struggling, making it a poor investment with continued dilution.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.