Summary:

- Alpha Metallurgical Resources, Inc. offers a strong investment opportunity due to strong cash generation, low valuation, healthy balance sheet and potential aggressive share buybacks.

- Met coal, its product, is essential for steel production. It has no viable substitutes, unlike thermal coal, which faces a declining future in developed countries.

- I assign a Buy rating on AMR stock due to the dip in coal prices as well as the continued commitment by management to reduce the share count float.

Editor’s note: Seeking Alpha is proud to welcome Richard Edkins as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

Indigo Division

Business Analysis

Alpha Metallurgical Resources (NYSE:AMR) is a pure-play metallurgical coal business with a c. $3 billion market cap and annual revenues of $3.4 billion. Operating in Appalachia in the US, they supply 20% of total US met coal exports. The business has 5-year average returns on equity of 30% and no debt. It has predictable annual production in a market that seems to have a long trajectory of demand from steel manufacturers. The current opportunity is twofold: 1) the market cycle for its product is towards the trough, so its price reflects this, and 2) it takes advantage of its low valuation by using all cash flow for buybacks. I am bullish on the stock because upon market recovery, the business will be able to generate ample cash. This will then be used to reduce the outstanding share float and therefore increase earnings per share.

History

In 2016, the company was established as Contura Energy, Inc. to acquire and manage certain core coal operations previously owned by Alpha Natural Resources, Inc., as part of a bankruptcy reorganization. In 2018, the company merged with Alpha Natural Resources Holdings, Inc. In 2020, they finalized a transaction with Iron Senergy Holdings, LLC, selling their thermal coal mining operations in Pennsylvania. This move accelerated their strategic exit from thermal coal production to focus on met coal production. In 2021, the company changed its name from Contura Energy, Inc. to Alpha Metallurgical Resources, Inc. to better reflect its strategic focus on met coal production.

About the company

The headquarters are in Tennessee, and they operate mines in Virginia and West Virginia. In total, they have over 4,000 employees, most of these being hourly-based workers. They have their only Operating Segment in Met Coal. It produces c. 15m tonnes of met coal per annum. Reserves of met coal are 303m tonnes. They have 15 underground mines, 7 surface-level mines and 9 coal preparation plants. Met coal made up 95% of revenue for AMR, with sales of thermal coal (a by-product) making up the small remainder.

Last year they exported to 25 different countries, over 5 different continents but mainly in Asia and mainly to steel producers. In 2023, 71% of their met coal produced was sold at the loading port for customers to ship overseas. Most sales are linked to marked-indexed pricing, a common one of which is the Coking Coal Futures contract on the Singapore Exchange.

General

Coal Market

There are two types of coal; thermal and metallurgical (“met” or “coking”). Thermal coal is burnt in coal power plants to generate baseload electricity. Met coal though is used for producing steel (nearly 800kg of met coal is needed to produce 1,000 kg of steel) and it has a higher carbon content with less moisture. Longer-term, the future is limited for thermal coal, in the developed world at least.

Outlook

Met coal makes steel, and steel underpins modern civilization. Steel is particularly crucial for transport, construction and the energy revolution. The world needs it. This is why there’s likely a long runway of growth ahead for met coal.

There are only a handful of places around the world that have met coal reserves. These are mainly the US, Australia, Russia and Canada. The largest importers are China and India. China’s real estate recession has flattened their demand currently, but they’ve been the main reason for the steel market expansion of almost 50% over the past decade, according to the World Steel Association. India is a rising importer and is planning to double its steel production by 2030.

Moat

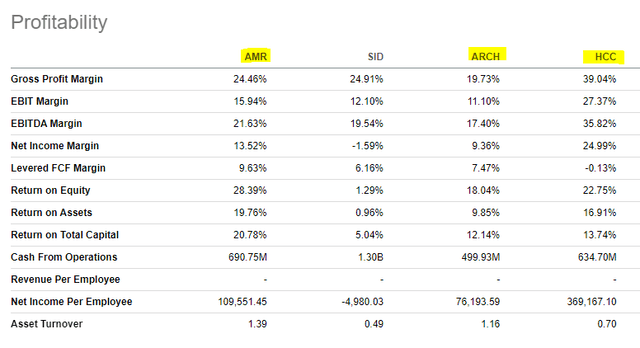

Let’s take a look at the profitability ratios of AMR versus the competition. Competitor HCC has the strongest margins to compare against:

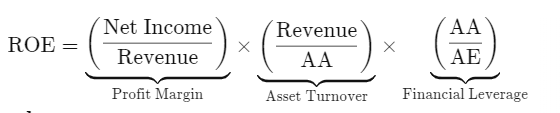

If we use Gross Profit Margin as a proxy for a moat, we can see AMR has 24.5% which lags behind its competitor Warrior Met Coal (HCC) at 39.0%. HCC has the competitive advantages of being the lowest cost operator as well as having a higher quality product. Why are we focusing on AMR, then? Well, margins are important, but returns are even more so and the Return on Equity of 28.4% for AMR beats HCC which is at 22.8%. Why are returns higher but margins lower? If we break down the Return on Equity formula, we can seek to answer this:

Investopedia

In the above formula, we can ignore Financial Leverage, given this is immaterial for AMR and largely irrelevant for the businesses considered here given low/zero debt levels. We can see from the formula then that AMR having a higher ROE must mean having higher Asset Turnover, given its lower margins. We can see this to be true at 1.4 versus HCC at 0.7. Therefore, AMR has a stronger ability to squeeze more revenue from its assets than HCC. Why is this the case? If we break down Asset Turnover further, we can see whether this is due to the way AMR uses their fixed assets (mines) or their working capital (inventory and receivables), or both.

Fixed Asset Turnover = Revenue / Average Fixed Assets

Working Capital Turnover = Revenue / Average Working Capital

Using the averages from the last four quarters, we can calculate:

| AMR | HCC | |

| Fixed Asset Turnover | 2.5 | 1.3 |

| Working Capital Turnover | 3.1 | 1.5 |

Clearly, in both the use of fixed assets and working capital, AMR is able to utilize them about double as effectively to generate revenue versus HCC. Reasons for this could be because AMR is known to have the best-in-class C-suite of industry veterans who have the know-how to work their mines well. Another could be that AMR has the scale advantage and has more horizontal integration with the port. A further reason could be that HCC is conserving cash and spending it to develop a large new mine (Blue Creek), holding this asset on their balance sheet, which is not yet operational so is not revenue-generating.

In summary, the moat for AMR, I believe, is based on a scale advantage, relative to competitors, which allows them to turn over their assets better. I hope this helps to show that AMR’s moat is not its ability to keep its costs down and its sales high, but more so its ability to extract more production and sales for each $1 it has spent on purchasing and developing its mines.

Competitors

Competitors in the developed world are mainly Australian or fellow US producers. However, the Australian producers have very different cost curve dynamics – in Queensland, where most coal reserves are, they are subject to high state royalties of up to 40%. In the US, this isn’t the case, so we will focus here on just the US met coal competitors – Warrior Met Coal (HCC) and Arch Resources (ARCH).

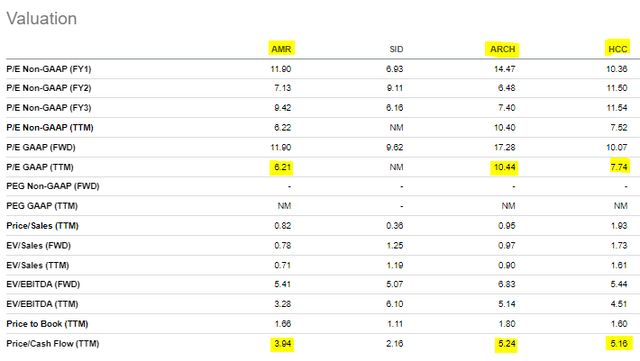

As per above, AMR is currently the cheapest based on traditional valuation metrics. Not only is it the cheapest, but as we saw above, it offers the most attractive returns to an equity investor too. Furthermore, there is stronger principal-agent alignment at AMR, with 11.5% of shares owned by insiders versus 1.75% for HCC and 3.3% for ARCH. Please find further details of the competitors below.

Warrior Met Coal ($1.6 billion in revenue)

Warrior is based in Alabama and its mines are closer to its nearest coal exporting terminal at Mobile (300 miles away) which is along the Southern coast of the US. When we compare this to the journey from mines in Appalachia to the East-coast port of Dominion Terminal Associates which Alpha uses (400 miles away) we can see a shorter journey to market for Warrior. Moreover, Warrior has the option of sending coal barges down the Blue Warrior River, a cheaper method of moving heavy materials, rather than having to use rail. Warrior therefore has natural cost advantages as well as producing a superior quality product for now, giving them margins in 2023 of $109 per tonne versus $68 for AMR. (See William Walsh’s article for more detailed numbers.

Arch Resources ($2.7 billion in revenue)

Arch is headquartered in St Louis, Missouri and generates 88% of their revenue from thermal coal, rather than met coal. They produced around 8.25m tonnes of met coal in 2023 from 4 metallurgical coal mines. They also have thermal coal mines in the Powder River Basin and a number of other states. Arch is currently in the process of undergoing a merger-of-equals with Contura Energy, a producer of thermal coal. Arch had margins in 2023 of $77 per tonne versus $68 for AMR. (I would recommend readers to look at SA author William Walsh’s article for more detailed numbers).

Balance Sheet

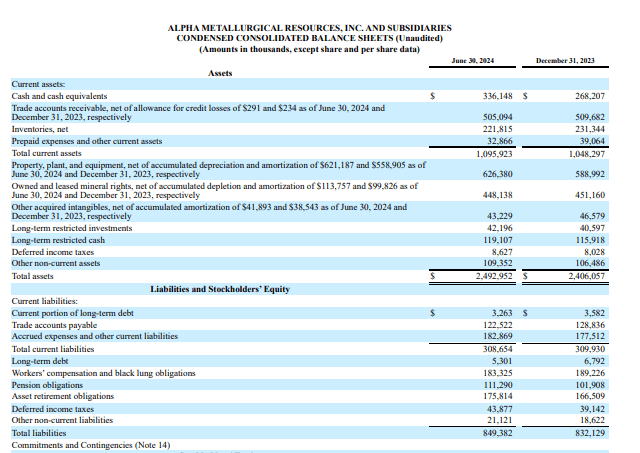

Q2 2024 (Alpha Metallurgical Resources, Inc.)

Cash – a conservative amount held of $336 million (incl. equivalents). To give a sense of how much dry powder they need, they’ve spent $356 million repurchasing stock over the last 12 months and $240m on capex.

Liquidity – Current ratio is 3.55, indicating strong ability to pay off short-term obligations. They also have a $155m revolving credit facility available if needed.

Cash conversion cycle – total of 70 days to convert the cash spent on producing coal back into cash from sales (35 Days Inventory Outstanding + 51 Days Sales Outstanding – 16 Days Payables Outstanding)

Property, plant and equipment – $626 million in costs have been incurred (net of depreciation) to expand capacity of operating mines, and it is written down on the units-of-production method. Depreciation is very close in magnitude to capex for the average of the last 5 years.

Mineral rights – $448 million – these are to obtain or lease the rights to mine for underground resources.

Obligations – $469 million is the total for worker’s comp, dismantling and remediating the mines upon retirement and pension obligations. Seems reasonable when considering that in 2022 the business generated nearly $1.5 billion in net income.

Debt – AMR has only $5.3 million in longer-term debt. It is very difficult to go bankrupt with debt at this minimal level.

Opportunities

How is free cash flow being used? AMR is committed to using all free cash flow for share repurchases – it has no intention of investing for growth in the future. It has the most aggressive buyback program, having cannibalized a third of its share float over the last 5 years and has a further $350 million approved and one could expect this to be expanded further. The buybacks have no execution risk, unlike investing for growth. The current GAAP (TTM) earnings yield is 16% for AMR. This means investing for growth needs to comfortably beat this hurdle before it would even be considered as a way to allocate available cash.

Buybacks are common in the industry given there is a lack of growth opportunities available and because traditional bank lenders are less willing to support projects. It is looking more and more like tobacco companies two decades ago, whose return of capital to shareholders has driven their outperformance over this period. Buybacks also catalyze share price gains so they are more tax efficient – typically investors will pay capital gains tax rates from them versus paying higher dividend income rates if the cash was to be distributed out as a dividend.

Valuation

To value AMR, we can discount appropriately the net cash flow expected over the life of the business, a concept known as Owner Earnings. It is worth noting this valuation method works better when earnings are more stable and predictable. Operating in a commodity business, AMR is at the mercy of the market price for metallurgical coal, and therefore I have no ability to forecast where earnings will be at particular points in time. We will use the 5-year average numbers to give a longer-term look to smooth out the volatility of the commodity cycle. The formula is Owner Earnings = Net Income + Depreciation/Amortization – Maintenance Capex

Owner Earnings is essentially the same as Free Cash Flow apart from only maintenance capex is used rather than growth capex too; i.e. include only the level of spending on property, plant and equipment that would keep sales where they currently are. This is simple for AMR given it is not looking to increase capacity and expand its production volume in tonnes, therefore all its capital expenditure is maintenance-based.

So, using the formula above:

= $339 million + $177 million – $168 million = $348 million

Over 5 years, the average annual depreciation amount ($177 million) is close to the annual maintenance capex ($168 million), as you would expect over the longer-run. However, this masks the fact that in recent years the maintenance capex has been significantly higher than the depreciation write-down due to recent inflation, whereas in the earlier part of the 5-year period it was the opposite.

Discount rate

Now, based on an Owner Earnings number of $348 million per annum, we can create a simple intrinsic value estimate for the business. We can use a discount rate equal to the longer-term rate on government bonds (US 10 year Treasury yield), currently equal to 4.25%. We will ignore any equity premium on top of this risk-free rate proxy. The idea of an equity premium is based on volatility being a proxy for risk. I don’t believe volatility reflects accurately the risk of losing one’s money if an investment is made, hence why we will ignore this.

Growth rate:

We will assume no growth in Owner Earnings in our calculation, given that AMR is focused only on maintaining current tonnage output and using all cash for buybacks.

Intrinsic Value (estimate):

= $348 million / 4.5% = $7,700 million

Market value (actual):

Share Count (13 million) * Share Price ($206) = $2,700 million

When we compare the estimated intrinsic value above against market value, we see the intrinsic value is 190% higher, offering a large margin of safety in the purchase price. I believe this cushion more than compensates for using a discount rate equal to that of the proxy for the risk-free rate.

Long-term Risks

Longer-term structural risks include metallurgical coal no longer being required as a crucial ingredient in steel production. But a practical substitution likely will take decades – for now over 70% of steel production needs it. But hydrogen could replace it over the long-run. However, hydrogen is very energy-intensive to produce, and the result is steel production at twice the cost of the traditional blast furnace, in one of the world’s most competitive markets.

Electric arc furnaces, which melt down scrap steel for re-use, is another threat given that met coal is not required. However, if the world economy is to grow, then this won’t be sufficient – you can’t recycle your way to growth. So the need for metallurgical coal is likely to persist!

Met Coal Prices

With prices per tonne near production costs, some analysts believe we are near the trough in the typically 5-year commodity cycle. The flagship met coal benchmark is currently around $205 per tonne. There may be mean reversion upwards – as the adage says, low prices are the cure for low prices. Interestingly, surprises in supply are typically downside in mining – this has generated an asymmetry in the market that pushes the odds in favor of higher market prices.

Summary

Debt-free and ignored by institutional asset managers who are tied to negative screening mandates which exclude coal, this is a simple business selling at an unreasonable discount.

Cash generation is plentiful, which is used for shareholder buybacks. This is unique and what makes the opportunity so compelling – businesses generating plenty of cash normally sell at much higher valuations. Being able to buy back shares at these prices is a rarity, and that is the investment case here. One could stipulate that management will buy back shares until only the 11% insider shares are left – think of how high the share price could get to.

The business is exposed to high cyclicality, but this could be near a bottom given the coal price has dropped significantly this year and shoulder season is nearing the end. A rebound in met coal prices to more normalized levels could boost earnings, compounding the accretion from the buybacks. This is why I would rate AMR a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.