Summary:

- Alpha Metallurgical Resources (AMR) is a met coal company with a strong focus on exports, allowing it to escape domestic coal demand decline.

- AMR is well-positioned to capitalize on long-term global demand growth, particularly in emerging markets like India.

- Recent earnings reflect industry headwinds, but AMR’s healthy balance sheet and potential for pricing rebounds make it an attractive investment with cyclical risks.

Aferist/iStock via Getty Images

Introduction

In January of this year, I started covering Alpha Metallurgical Resources (NYSE:AMR), a company I called “One Of The Wildest Coal Stocks On The Market.”

As much as I dislike the volatility of most coal stocks and the fact that domestic coal demand in the United States has been in a steady decline since 2007, there are a lot of reasons to be bullish on what may be one of the most aggressive buyback companies on the market.

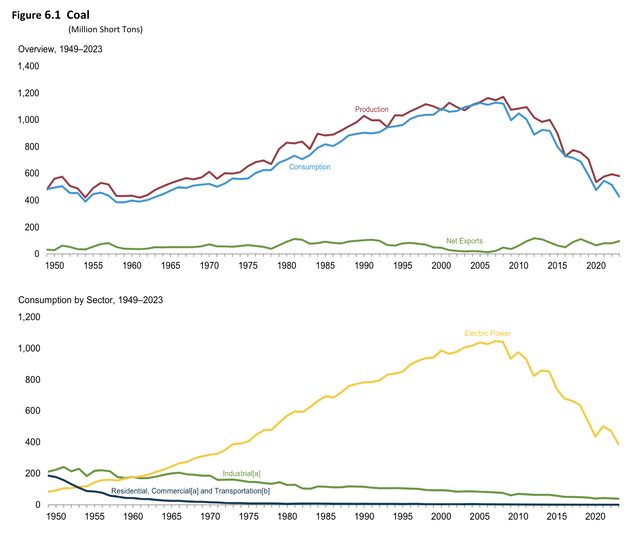

Energy Information Administration

For starters, while domestic coal consumption may be down (the blue line in the chart above), the green line, showing net exports, has been steady for many decades.

As we will discuss in this article, international coal demand remains very strong, with massive growth in emerging markets, supporting long-term exports.

Second, not all coal is equal. Just like in oil, there are different types that are used for different purposes.

In this case, there are two types of coal:

- Metallurgical (“met”)/coking coal: This coal type is mainly used in steel production. When heated in a coke oven, met coal turns into coke, which is a strong, porous fuel that is key in the process of turning iron ore into steel.

- Thermal coal: This coal type is mainly used for electricity generation. Essentially, power plants burn thermal coal in boilers to create steam. It’s the type of energy that “our” Western civilization is based on after the Industrial Revolution turned it into the engine of our economies. Now, secular headwinds from very cheap and abundant natural gas, renewables, and nuclear have created a very tough environment for thermal coal in most developed nations – at least when it comes to domestic use.

This brings me back to Alpha Metallurgical Resources. It’s a met coal company with a strong focus on exports, allowing it to escape a lot of domestic “troubles.”

Moreover, as it just reported its earnings, there’s a lot for us to discuss.

So, let’s get to it, starting with a closer look at its business characteristics!

What Makes ARM So Special

ARM is a Tennessee-based mining company operating primarily in Virginia and West Virginia. After all, that’s where a lot of coal reserves are, with great access to end markets.

As I already briefly mentioned, the company has a focus on higher-margin met coal, which it mines through a substantial portfolio of both underground and surface mines.

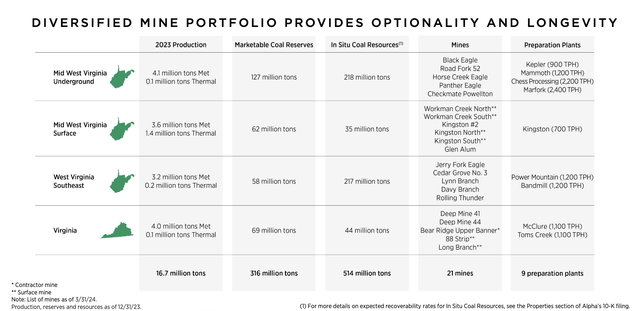

Last year, the company produced 16.7 million tons of coal in 21 mines and nine preparation plants, which (as the name already suggests) prepare coal for transportation.

Alpha Metallurgical Resources

Moreover, as we can see in the overview above, these mines have marketable coal reserves of 316 million tons, which translates to roughly 19 years’ worth of production (at the 2023 rate).

It also has more than 510 million tons of In Situ coal resources. In Situ is a process where coal is converted into gas using an injection of oxidants and steam in non-mined coal seams.

To quote Wikipedia:

The technique can be applied to coal resources that are otherwise unprofitable or technically complicated to extract by traditional mining methods.

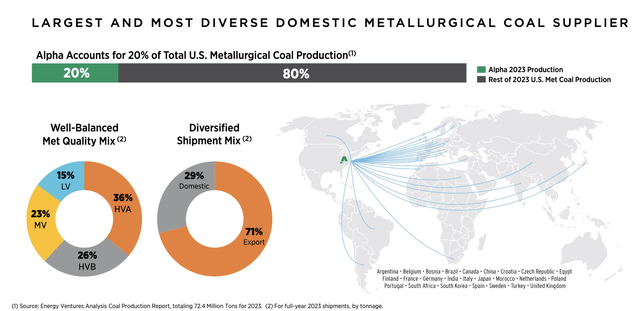

After closing its thermal coal operations, it is now so large that it produces one-fifth of the U.S. met coal supply, making it a critical player in the global met coal industry as well.

Hence, I’m glad to say that more than 70% of its production went to export customers.

Alpha Metallurgical Resources

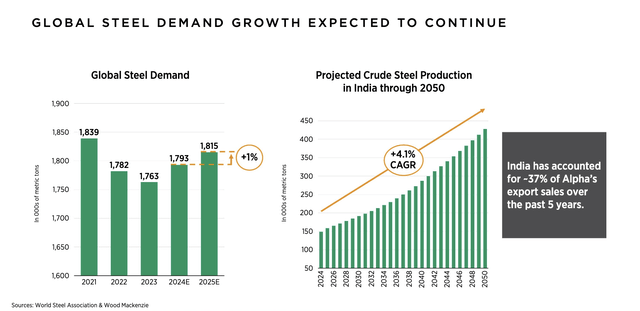

As bullish as I am on U.S. steel production, the emerging market is “where it’s at.”

India, for example, is expected to grow its steel production by 4.1% per year through 2050. This market accounted for 37% of the company’s export sales over the past five years. That’s a huge deal for AMR and its shareholders, as it’s essentially a play on emerging market growth without having to buy equities in “foreign” jurisdictions.

Alpha Metallurgical Resources

To add some color. Short-term growth in India is expected to be even stronger than the longer-term CAGR of 4.1%.

India’s steel demand is expected to grow at a CAGR of 7 per cent to touch 190 Million Tonne (MT) level by 2030, according to a report by SteelMint India. The demand will be largely fuelled by construction and infrastructure sectors, which contribute 60-65 per cent to the demand […].

Even better, most of this growth is coming from blast oxygen furnaces, which require a lot of coking coal. Using the same source behind the quote above, India will emerge as the largest importer of sea-borne met coal in the world, with a market share of 30%.

So far, so good.

What matters as well is keeping an eye on shorter-term developments, which have pressured the stock this year.

This has a lot to do with industry headwinds.

Alpha Metallurgical’s Struggles In A Tough Environment

Don’t get me wrong, AMR isn’t doing poorly. It’s just not doing as well as it did when coal prices were elevated.

As a result, it has decided to slow its buyback program in order to focus on building cash reserves instead.

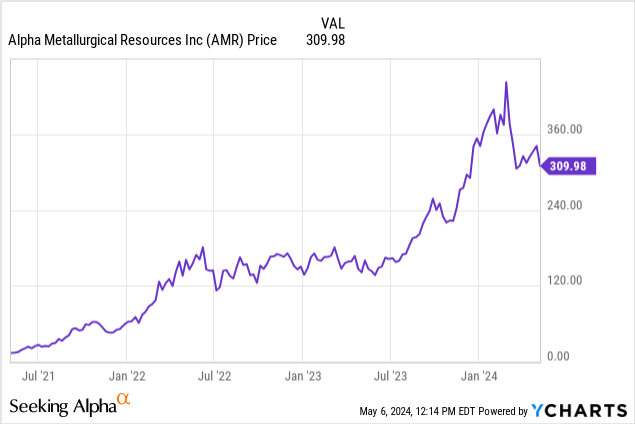

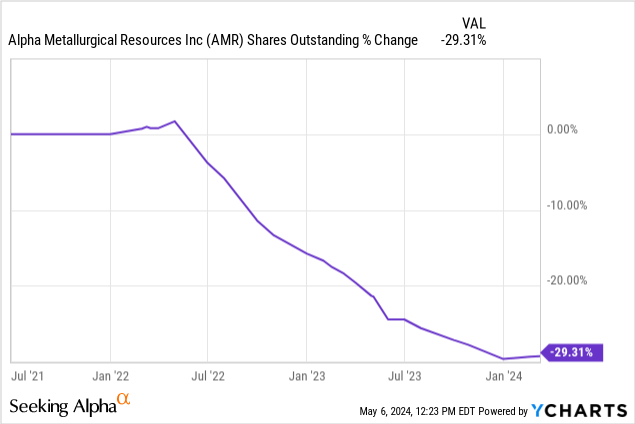

Over the past three years, the company has bought back almost 30% of its shares, making it one of the most aggressive buyback companies on the market – this has also fueled a massive stock price rally from less than $20 in 2021 to currently more than $300 (down from $450 earlier this year).

Now, the company is slowing buybacks to focus on financial stability. This makes sense, as the industry has become weaker.

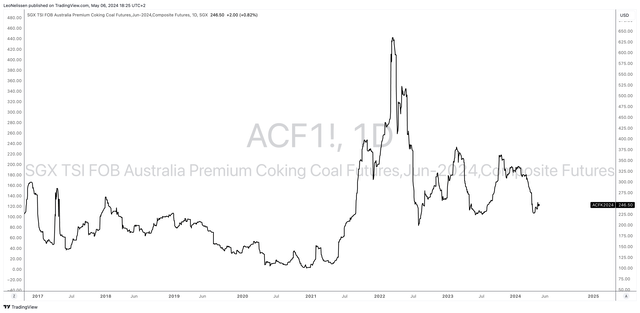

Using Austria Coking Coal futures as a pricing proxy, we see that while prices are still elevated compared to pre-pandemic levels, they have come down substantially.

TradingView (SGX Australian Coking Coal Futures)

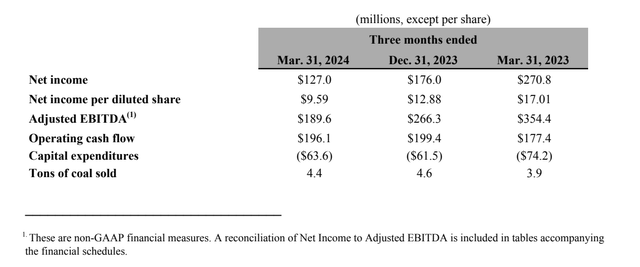

Based on this context, in the first quarter of 2024, the company reported $190 million of adjusted EBITDA, which is down from last year’s $354 million result.

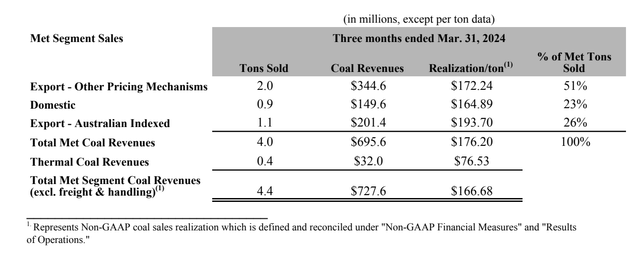

As we can see in the overview below, this is due to pricing, as coal volumes actually improved by 13% to 4.4 million tons.

Alpha Metallurgical Resources

Using the data below, the company sold its products at prices between $165 and $194 per ton, with a total (ex-freight) price of $167 per ton. That’s down from $184 per ton as of December 31, 2023 (not included in the table below).

Alpha Metallurgical Resources

According to the company, during the first quarter, all four major price indices saw major declines. The Australian PLV index, which represents a major portion of the company’s market, saw the largest decline of 25%.

The good news is that the cost of coal sales also declined. In this case, $115.65 per ton, to be precise. That’s down 3% since the end of 2023.

In general, the company struggled with inflation, labor, and supply chain issues.

Nonetheless, I’m not worried about inflation, as commodity players like coal producers are usually great places to be when inflation is elevated (due to pricing power).

Already such a competitive labor market became even more challenging, recruiting new talent work in a crowded hands-on environment seemed almost impossible times. As a result, Inflation caused business costs like supplies and labors to grow to unprecedented highs, while critical supply component availability created. Frankly, in some cases, you just couldn’t get supplies. – AMR 1Q24 Earnings Call

Moreover, with regard to downside protection, so far this year, roughly 49% of total met coal production has been committed (contracted) at an average price of $168 per ton. Another 49% has been contracted, but not yet priced.

In other words, if prices continue to decline, the company will have some protection.

Balance sheet-wise, the company had $269.4 million in unrestricted cash as of March 31, 2024, remaining relatively flat compared to the previous quarter.

Total liquidity, including unused availability from credit facilities, stood at $288.1 million, which is roughly 7% of its current market cap.

In other words, I’m not too worried about buybacks being halted. If anything, I think it’s a smart move that protects the company in case prices see another leg down.

The company’s balance sheet is healthy, and any pricing rebounds in the future should immediately lead to double-digit declines in shares outstanding.

Valuation

Putting a valuation on any commodity-focused company is tough. Very tough. After all, while I’m bullish on coal, I have no idea where it will trade in the future.

Any coal price changes have an impact on expected earnings.

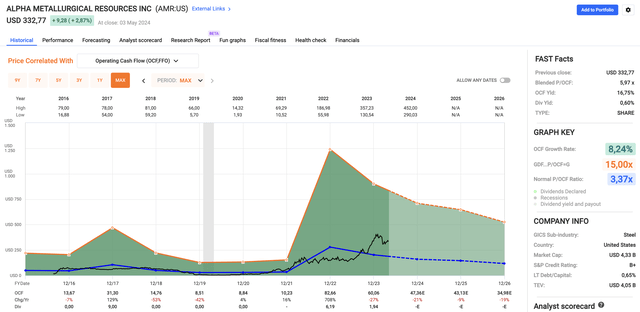

Currently, the company trades at a blended P/OCF (operating cash flow) ratio of 6.0x, which is below the 7-7.5x multiple I believe is fair for the company (I mentioned this in my prior article as well).

FAST Graphs

Last year, the company generated roughly $60 in per-share OCF. As I expect coal prices to gradually rise back to levels seen back then, I expect the company to achieve no less than $60 in per-share OCF in the next three years. This excludes higher output.

It also implies a longer-term price target of $450, 50% above the current price.

That said, investors need to be aware of the cyclical risks we’re dealing with here. AMR is very volatile and prone to steep downtrends during coal price declines.

Unless we get a bottom soon, we could see another 20-40% downside.

So, while I will stick to a Buy rating, I want conservative dividend growth investors (most of my readers) to know that this stock may not be right for them.

Takeaway

Despite facing short-term challenges in the coal market, Alpha Metallurgical Resources remains a compelling investment opportunity for those comfortable with volatility.

With a strategic focus on met coal and strong export sales, AMR is well-positioned to capitalize on long-term global demand growth, particularly in emerging markets like India.

While recent earnings reflect ongoing industry headwinds, AMR’s decision to slow buybacks shows its commitment to financial stability when prices are a headwind.

With a healthy balance sheet and potential for future pricing rebounds, AMR presents an attractive value proposition, albeit with significant cyclical risks.

Pros & Cons

Pros:

- A Focus on Met Coal: AMR’s emphasis on higher-margin met coal positions it well to benefit from sustained demand in the global steel industry.

- Robust Export Sales: With over 70% of production going to export customers, AMR is less prone to domestic weakness, including a focus on electric arc furnaces.

- Healthy Balance Sheet: Despite industry challenges, AMR maintains a healthy balance sheet with substantial unrestricted cash reserves.

- Potential for Pricing Rebounds: Any future pricing rebounds in coal could lead to significant improvements in AMR’s financial performance and shareholder returns (buybacks).

Cons:

- Industry Volatility: AMR operates in a highly cyclical industry prone to price fluctuations, exposing investors to significant downside risks during coal price declines.

- Short-Term Headwinds: Recent earnings reflect industry headwinds, leading AMR to slow its aggressive buyback program to focus on financial stability.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.