Summary:

- Alpha Metallurgical Resources, a U.S.-based metallurgical coal company, offers a compelling value investment opportunity for patient investors.

- The company’s strong fundamentals and strategic positioning in the metallurgical coal market underpin its long-term growth potential.

- AMR’s robust financial health and disciplined capital allocation enhance its attractiveness as a value investment.

- Investors should consider AMR for its potential to deliver substantial returns over the long term.

Monty Rakusen

Alpha Metallurgical Resources (NYSE:AMR), a metallurgical coal company located in the U.S. is presenting a compelling value investment opportunity for the patient value investor. The stock has dropped 50% from its all-time high of $452 back in February and is trading at $226.54 per share as of the time of this writing. AMR is a wonderfully run business with an excellent management team, a board that has real skin in the game, ample met coal reserves, and optionality in their production and logistic capabilities.

With an intrinsic value of the business at $348.44 the market is presenting AMR at a deep discount.

The seaborne met coal indexes have declined from post covid highs and the world’s largest producer of steel, China Baowu, warned of a harsh winter coming for the steel industry. There are geopolitical tensions between superpowers and deglobalization/nearshoring that will impact Chinese steel production. The current environment has brought about uncertainty in the met coal and steel markets, and I believe it is ripe with opportunity.

What is metallurgical coal?

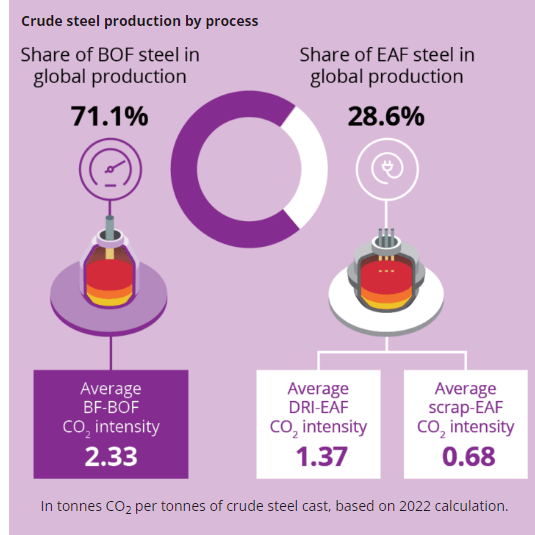

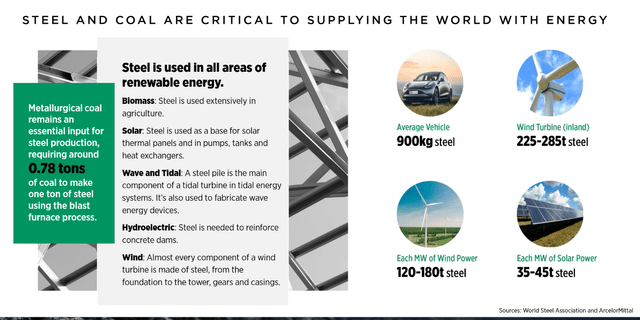

For those who do not know the difference, metallurgical coal, or met coal, is used for the production of steel in blast oxygen furnaces (BOFs). Met coal is used as both a fuel source and a reductant, which is why BOF’s are a cost-effective way to produce molten iron (which is the precursor of steel) at scale and accounted for 71.1% of the world’s steel production according to data from the World Steel Association.

World Steel Association

Met coal is very different from thermal coal, which is used by utilities and power generators to produce steam and run turbines for electricity generation.

History and Business Model

Alpha Metallurgical Resources is a pure-play metallurgical coal company that is located in the United States. AMR is an offspring from the bankruptcy of Alpha Natural Resources, which went bankrupt in 2015 after four years of straight losses due to the slowdown in steel demand during that time.

When the old Alpha went bankrupt, it split into 2 entities, Contura and Alpha Natural. The majority of the “good” met mines (and some thermal mines) were absorbed into Contura. Through a series of divestitures and mergers, Contura became the AMR we know today, officially rebranding to Alpha Metallurgical Resources on February 1, 2021. The new name was designed to pay tribute to their old roots while also aligning with their new pure play met focused business model they operate today.

AMR’s HQ is in Tennessee, and their 21 mines are located in Central Appalachia, a coal seam in the eastern United States, specifically West Virgina and Virginia.

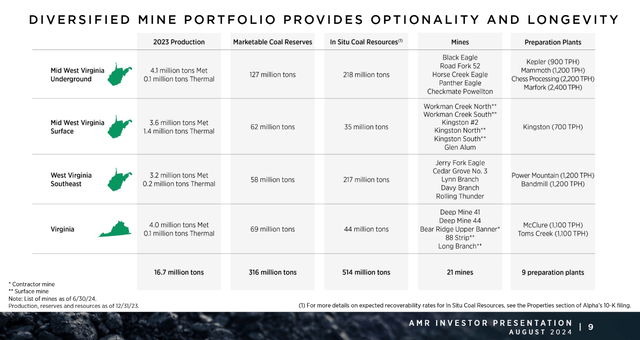

AMR’s 2Q supp package

As can be seen above, AMR’s mines are a combination of underground and surface mines with over 316mt of marketable reserves. AMR uses three main methods to extract their coal. Traditional shovel/excavation in surface mines (think big pit in the ground), highwall mining (surface mine), and continuous mining with a room and pillar technique for underground mining.

AMR also has 9 preparation plants, and these prep plants are essentially the hubs of AMR’s operations. Essentially, the coals from their mines are sent to these prep plants (by truck or rail) where coal is cleaned and sometimes blended with purchased higher quality coal to meet customer specifications.

Domestic met customers typically enter into one-year agreements with a fixed price for the entire contract year. Any longer-term agreement would generally have a renegotiation of price each subsequent contract year.

Export sales are generally made on an annual, quarterly, or spot cargo basis. Annual and quarterly agreements typically have market-indexed pricing that changes with the market monthly. Any export agreement with a term greater than one year would generally have a renegotiation of pricing terms for each subsequent contract year.

Domestic customers, which accounted for 25% of their revenues in 2023, purchase their coals and are responsible for the cost of transportation from the processing facility to their own facility. Export sales are transported by rail to a port and loaded onto a coal barge. Once the coals are loaded, the customer is responsible for the transport at sea, but AMR is responsible for the rail and freight costs to the port.

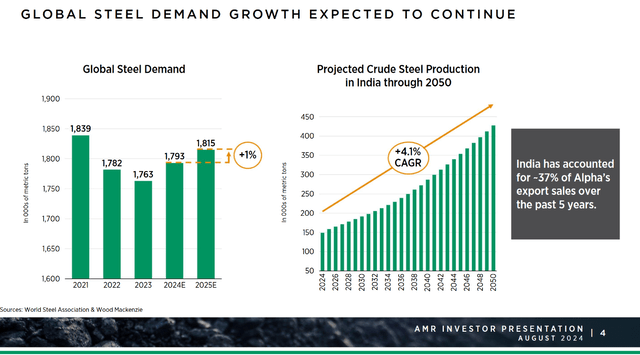

AMR owns 65% of DTA, a coal storage and loadout facility (a competitor Arch Resources (ARCH) owns the other 35%) in Newport News, Virginia. The port facility allows AMR to store their coal that is destined for transport. 71% of AMR’s coals are destined for international markets, with India accounting for 37% of AMR’s export sales over the past 5-years.

The objective of AMR, like all coal miners, is to produce their coal as efficiently as possible by controlling costs and getting the highest possible price for their quality of coals.

When met indexes went through the roof after the Covid reopening, management focused on using FCF to pay down debt and then went on a massive repurchase program. From the end of FY 21 to the end of FY 23 AMR repurchased over 30% of their float while also issuing a dividend. This massive shareholder return program rewarded shareholders handsomely compared to the S&P.

Seeking Alpha

AMR’s scale, and their spoke and wheel model, does extremely well when met markets are strong, but AMR suffers more than others when met markets reverse.

Why the Drop?

Like all international commodity businesses, AMR does not have the ability to set their prices. Prices are determined by traders, coal quality, sales practices, and volume to an extent. However, the main driver of price is steel demand, which impacts global seaborne met indexes. According to the World Steel Association the best growth markets for steel demand are India and Southeast Asia. China is the largest producer of steel by far, with over 50% of global output.

World Steel Association

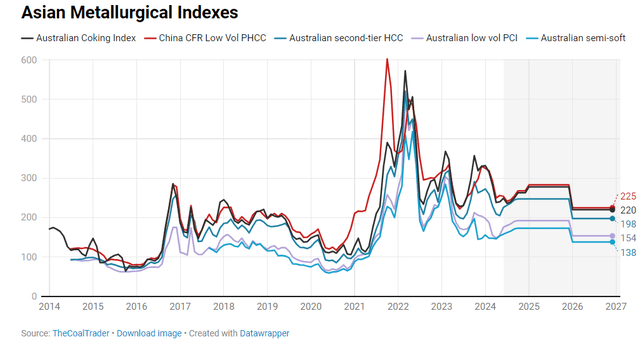

As can be seen below, data from TheCoalTrader.com gives a good visual representation of Asian met indexes since 2014. The reason I am showing Asian indexes and not Atlantic is because the majority of AMR’s export sales go to India and Southeast Asia, which get their pricing from Asian Indexes.

The Coal Trader

As one can see, prices for met coal skyrocketed from 2021 to 2022 during the reopening of the world, and there was a sharp pullback at the end of 2021. Once Russia invaded Ukraine in February 2022, we see another jump in prices. Fast-forward to today, and we see indexes potentially trying to find a floor slightly below the 2016 high.

To be conservative, I look at the Australian low vol PCI index to get an idea of what AMR can charge for their coal. AMR’s management has disclosed that during strong markets they can sell their product at a premium to indexes, and in weak markets they sell at a discount to the indexes.

I believe current index prices reflect the subdued steel demand market along with warnings from China Baowu’s CEO stating that the steel industry in China is going to see a “harsh winter”. This spooked markets in the middle of the low met market activity time of the year known as the Shoulder Season.

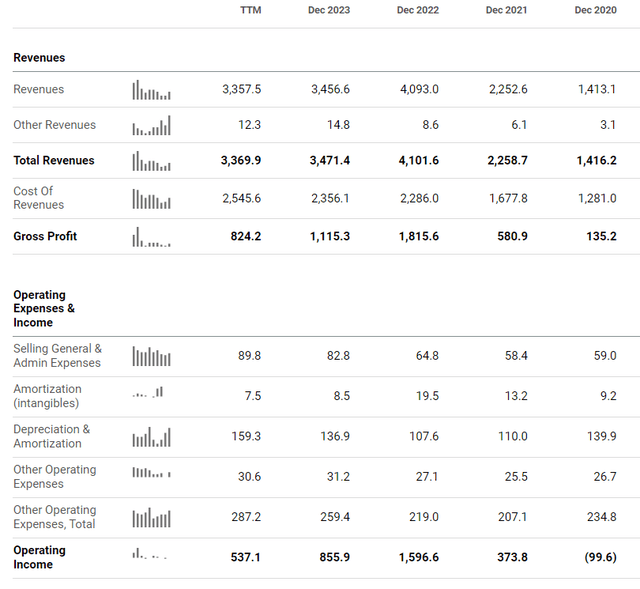

The drop in indexes directly correlates to the drop in AMR’s financial performance.

Seeking Alpha

As the data from Seeking Alpha shows above, revenue dropped over 15% in 2023, and operating income was slashed by 46%. OI dropped substantially more than revenue due to the deleveraging of fixed costs AMR has due to the nature of their business. AMR has to pay for fuel, labor, mechanical parts and machines, environmental expenses, and 65% of whatever expenses are incurred at the DTA port facility. With AMR being the most diversified miner in America, if AMR idles mines, these idling costs are greater than any other miner in America.

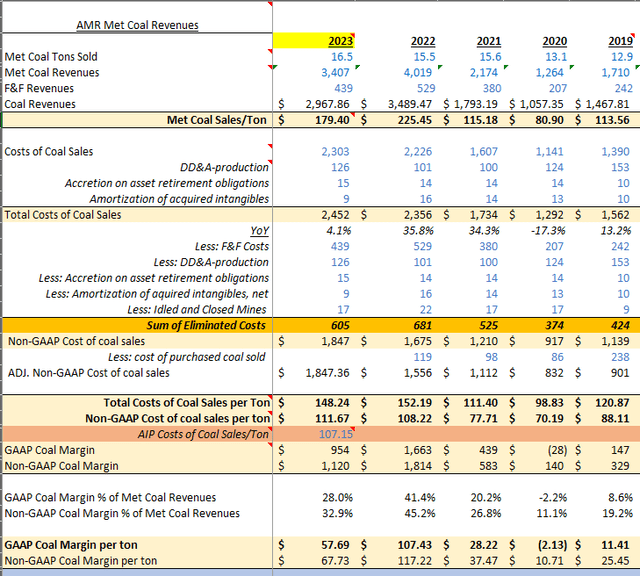

Below are the KPIs from the 10-Ks. We see that AMR’s Met Coal Sales/Ton went from $225.45 to $179.40 from FY 2022 to FY 2023. We also see Non-GAAP Costs of coal sales/ton increasing, showing the deleveraging of fixed assets.

Author and AMR 10-Ks

Due to the temporary uncertainty in met markets, management announced their focus is on capital preservation and liquidity. They have eliminated the dividend and suspended the repurchase program until they are comfortable this downcycle is behind them. Smart for long-term viability, bad if you are a Wall Street participant.

On top of the negative financial performance, management stated on the last earnings call that the negative performance in the met markets is likely to continue for the short term.

Why am I Bullish? Valuation and Long-Term Tailwinds

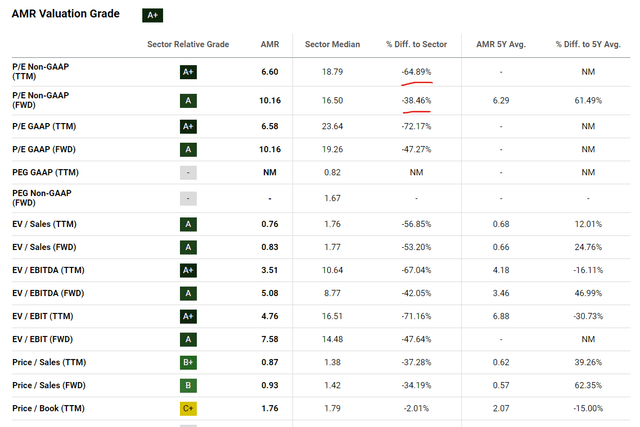

Seeking Alpha

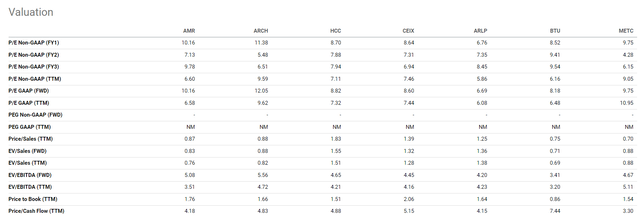

AMR is significantly undervalued when looking at almost every traditional valuation metric, and Seeking Alpha’s Valuation grade is showing A’s almost across the board. This is because of the huge disparity “% Diff. to Sector” column showing AMR has essentially been thrown out with the bathwater. While this is a good quick view, I would encourage investors to set up a Comparison on Seeking Alpha’s platform of the major coal companies to get a better understanding. A more apples-to-apples comparison, if you will. I have posted some data from the comparison below.

Seeking Alpha

Seeking Alpha

Seeking Alpha

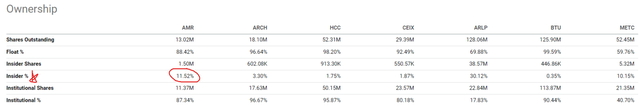

AMR’s insiders own over 11% of the company, and its market cap is currently $2.898B. I would advise you to scroll back up and look at the OI AMR generated in FY 22. It was $1.5B! Now I hear what you are saying, “that was a one-time outlier year with the bullwhip effect from Covid and the Russia invasion presenting a unique period for met markets.” I partially agree with you.

However, with inflation in sticky areas like labor, central banks stimulating today, less investment in coal mines globally (limiting supply), and the long-term demand for steel going nowhere, the price of met coal is unlikely to go below the $150 floor for an extended period of time before small miners are forced to close down because their production levels will be underwater. I would not be surprised if in an upcycle year, AMR can hit at least $1B in OI again.

I look at an investment in AMR like this, if I know one year over the next 5-10-years I am going to receive $1B in OI (in just one year) from a company I can purchase for less than $3B, well, I am going to load up the truck.

However, for the sake of not being too simplistic, I have done a DCF on AMR as well.

I believe a normalized EPS for AMR is $20.39, conservative from the last 2-years, but this also takes into account the inevitable down years in commodity markets AMR will experience. I believe a realistic 10-year growth rate for AMR is 15% and a reasonable exit multiple is 10.

I think an exit multiple of 10 is justified for two reasons.

First, AMR being the largest producer of met coal has advantages of economies of scale during strong met market periods. I believe this scale leads AMR to have a multiple at a premium to competitors.

Second, AMR’s management team has shown their intention of what they will do when they generate large FCF in market upcycles, they give it back to investors in droves. Since AMR has large-scale capacity that has the optionality to be turned up/down, they do not need to invest in massive mine expansions. With the majority of FCF inevitably coming back to investors when it is generated, I also believe this justifies the premium multiple of 10.

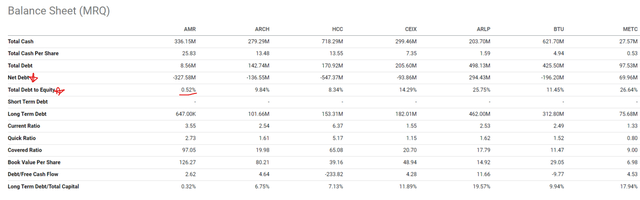

On top of these two factors, the fortress balance sheet with no long-term debt justifies a multiple premium compared to their direct peers’ average. I would also like to point out that this forward multiple of 10 is also 40% lower than the FWRD Non-GAAP multiple of 16.5 for the sector median shown above.

I use a discount rate of 9% and after inputting the data I come out with an intrinsic value of $348.44.

At a current price of $226.54, this represents a 53% upside to where the stock is trading at the time of this writing. This is the deep value proposition AMR presents to investors.

Long-Term Tailwinds

I believe that AMR can grow earnings by 15% on average over the next 10-years because there are some structural tailwinds for AMR.

First, AMR does not sell met coal to China, but to India, where the government has an initiative to grow BOF production at scale to help develop its economy. Management highlights the growth prospects of India, and I believe India will be able to join the developed world over the next few decades. This is very bullish for AMR. India can’t produce the quality met coal they need internally, so they will have to rely on the seaborne met market.

AMR Q2 2024 Supp

Second, the green initiative of the western world means less investment in coal, yet steady demand for steel. Over time, this will lead to higher prices for met coal. Again, met prices can’t stay low forever before weaker miners start to drop off because their coal is priced underwater. This self-reinforcing cycle will eliminate supply (supporting prices) and, as the old adage states, commodities fail upwards.

AMR Q2 2024 Supp Package

Third, AMR has a fortress Balance Sheet, with management prioritizing capital preservation and liquidity in this down market. Management and some members of the board understand what made companies go bankrupt back in 2015; being over levered after consolidation at the top of the market is what did them in. As you can see from the Comparison Tab on Seeking Alpha, I believe all coal miners remember that time period and most are well-prepared with negative net debt positions. AMR has a D/E ratio of just .52%! If AMR is able to survive until the next market upcycle (which is a high probability with no debt), I believe AMR will execute extremely well as in the past and reward their shareholders with repurchases and dividends.

Seeking Alpha

Risks

Geopolitical tensions boil over and create a global conflict. This is a real concern of mine, and AMR will be hurt if maritime trade is impacted due to a broadening of the Middle East conflict, or an invasion of Taiwan.

A complete collapse of Chinese steel demand due to a weakening economy from the housing bubble burst. While AMR does not sell to China, cheap Chinese steel producers can dump cheap steel on the global market and until those stockpiles are depleted, Indian and southeast Asian countries could hold off on purchase orders for an extended period of time.

Since AMR does employ unionized labor, and unions have been throwing their weight around, this is always a risk we must be aware of.

The proposed merger between CEIX and ARCH poses a risk. If that merger goes through, that new company will be able to produce 12mmt of met coal in the 1st quartile cost curve (allegedly). AMR produced 16.5mmt in 2023, but as we saw, costs/ton increased as well. If a big-time met supplier in the U.S. with a better cost curve comes in, customers are going to go to the low-cost provider if the quality of the coals are similar.

Another risk that I find troublesome is if the DOL has their new initiative passed where coal companies will have to put up additional collateral requirements to secure self-insured federal black lung obligations. Management estimates the required capital could be as high as $80-$100M, and this would impact AMR’s liquidity at a difficult time. However, with the SCOTUS overturning the Chevron deference, the legal battle to have this implemented will take years if not a decade to figure out in the courts.

Lastly, there is always a risk that one of the reclaimed mines have some form of environmental issue that could come back and hurt them. The previous entity before AMR had this same issue, but through some legal gymnastics was able to offload a majority of these liabilities. Nevertheless, we should remain diligent.

Summary

In summary, AMR’s cheap price is presenting investors with a deep value play. The macro uncertainties and poor short-term performance has led to traders unjustifiably dumping the stock. AMR is poised to handle this market downturn and execute well in the market upcycle, rewarding patient investors. I rate AMR a Strong Buy.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ARCH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.