Summary:

- Alpha Metallurgical Resources, Inc. focuses on metallurgical coal for steelmaking, aiming to generate cash flow and return capital to shareholders.

- The company has paused its buyback program due to normalized coking coal prices, waiting for improved cash flow before resuming.

- Despite current market challenges, Alpha Metallurgical Resources maintains a clean balance sheet and conservative management approach, positioning it for potential future growth.

12MN/iStock via Getty Images

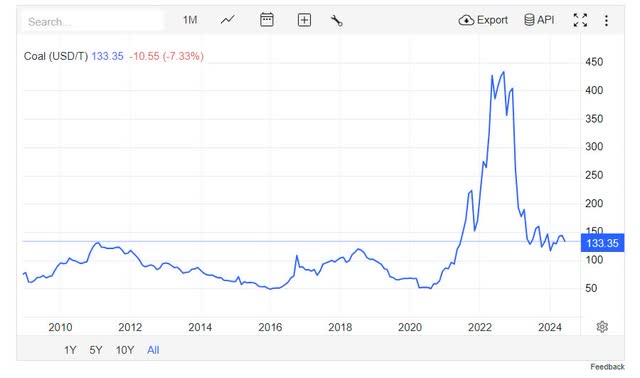

Alpha Metallurgical Resources, Inc. (NYSE:AMR) primarily produces metallurgical or coking coal used in steelmaking. The company is focused on generating cash flow and returning capital to shareholders. This has worked out beautifully in the recent past. In the last few months, the stock paused its previously relentless advance. This is mainly due to normalized or low-ish coking coal prices, which also caused the company to cease its buyback program.

Often companies will set up buyback programs to buy below a 200-day moving average or something of that nature. In this case, management wants to see solid cash flows and maintain a cushion of liquidity before hitting the buyback (per the recent earnings call):

During our fourth quarter earnings call, we discussed our intention to slow or pause the buyback program in an effort to build cash balances back up to our targeted levels. Especially given the market dynamics currently at play, we continue to believe this is the right strategy. Our capital return philosophy remains the same and will continue to be driven by our cash flow. As minimum cash levels and market conditions allow, we will utilize available free cash flow for the buyback program.

This makes it more difficult to take out undervalued shares because once coal pricing starts improving, the share price is going to respond. The company’s cash flow responds with a delay to an even greater extent because it sells forward production about a year out.

Currently, the company has a ~$4 billion market cap or an enterprise value of $3.6 billion. Last quarter it generated $190 million in adjusted EBITDA or $132 million in free cash flow.

On its recent earnings call, the company also expected further price deterioration, something that I didn’t see realized in the Australian Coking Coal SGX futures. Over the past month, its price is more or less unchanged. Management hit quite a bearish tone and observed soft demand across the board (emphasis mine):

I guess, this market, I would describe is still kind of a balanced market. We – there’s no doubt steel production around the world is down. It’s been a long time, I guess, since I’ve seen all of our markets have kind of depressed steel markets. There’s not a lot of good demand in any markets. India, as you know, is a little weaker than they’ve been in a few years.

And I guess a lot of that is obviously due to economic circumstances. Another piece that people don’t talk about as much as it affects us. There are a lot of metallurgical coke out there that’s been kind of an overhang situation, and I think that’s affecting our coking coal shipments.

Even if coking coal prices start to rally, this will not immediately result in increased cash flow because the company sold 49% of its tonnage at $168.26 per ton. Another 49% has been sold as well, but not priced yet. Meaning, it will likely be priced because of one or a number of benchmark prices at a certain point. On the flip side, this also protects the cash flow in case prices deteriorate further.

I think the shares aren’t rich here, given the asymmetrical upside/downside from here. The balance sheet is quite clean. Management runs the company conservatively, careful not to get into trouble. Meanwhile, coal is hated, and the industry can’t easily access capital to fuel excessive expansion. This makes it more likely we’ll see additional price spikes and generally a higher floor.

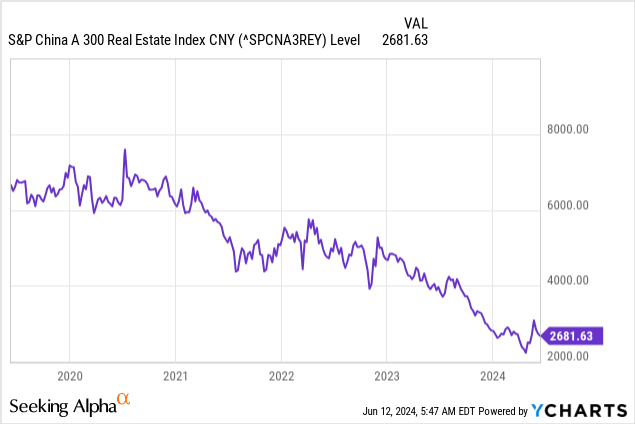

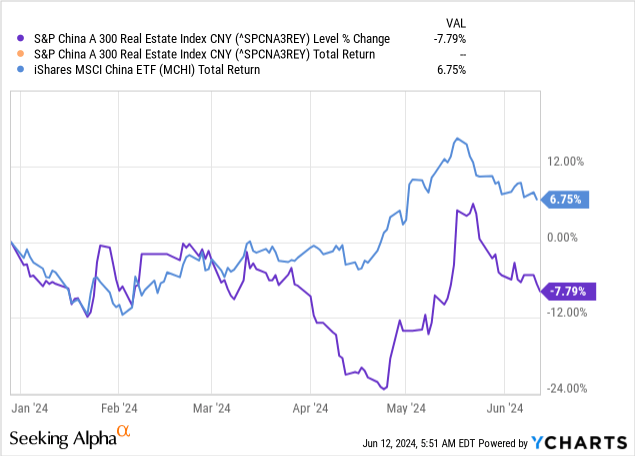

One thing that’s been holding coal back, notwithstanding capital constraints, is the poor performance of the Chinese real estate sector. China is a major consumer of metallurgical coal to fuel steel production. But with less construction, there isn’t as much steel needed.

This year, there’s been a brief rally in the real estate sector. This can be observed in its stock markets as well.

In addition, China just announced plans to measure carbon content in products. This legislation would go into effect in 2027. Local governments are being pushed to develop ideas to incentivize lower carbon production/consumption. Coal, and likely steel, will be measured, which is a positive for AMR because it produces a high-quality type of coal. China also produces coal domestically, but it is of much lower quality. This legislation is likely to increase AMR’s competitive position.

Something else worth mentioning in this vein is that 38 countries are planning to cut off private sector funding towards coal development. To an extent, ESG has led to greenfield developments having been moved to the private sector, and that likely would have continued as long as demand isn’t curbed more aggressively. The idea is to halt new financing from banks and insurers for new and existing coal projects, as well as the infrastructure. This leaves out private equity, but without debt financing these funds will require very high projected rates of return.

What I didn’t love on the recent call was a question asking about M&A. It sounded encouraging to do an M&A deal. That can certainly work when a company can pick up a very cheap asset, but generally, it works out horribly. To my relief, management didn’t seem overly interested, though.

In the short term, I don’t love the immediate prospects here. The coking coal market is looking a bit sluggish still. By this time, the company is probably taking a fixed price for the majority of this year’s production. Even if there’s a price surge, the company will benefit marginally. Then, AMR will only get serious about buybacks once they observe a better pricing environment.

The Alpha Metallurgical Resources, Inc. share price will go higher if the market sniffs out better coal pricing. The company will start buying back once its cash flow improves. I think this sets shareholders up for the share price to do nothing or slowly decline until it suddenly starts ripping higher within a relatively short period of time. I don’t think it’s likely to be this month. For now, I’ll stick to a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign up here for a 14-day free trial of my weekly premium trade & investment ideas. Discover the best things I can find in this market. Unique and hard-to-find ideas, selected based on the presence of edge, outstanding risk/reward and being uncorrelated or being less correlated to the S&P 500.