Summary:

- Alpha Metallurgical Resources had a very weak Q3, with an adjusted EBITDA of $49M and a net income of only $4M.

- The free cash flow was surprisingly good in Q3, though.

- The 2025 guidance was also positive with lower costs and capital commitments, lowering the breakeven next year.

Indigo Division

Overview

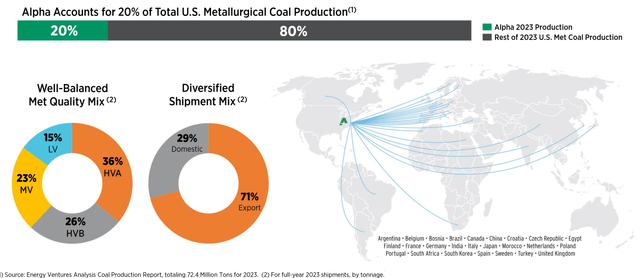

Alpha Metallurgical Resources (NYSE:AMR) is the largest U.S. metallurgical (“met”) coal mining company in the United States. The company has relatively competitive operating costs, but it is not the lowest cost producer.

The portfolio is comprised of 21 mines and 9 preparation plants in the Eastern United States. The annual sales volume is around 17 million tons of coal, and much of the production is sold on the export market.

Figure 1 – Source: AMR Corporate Presentation

The company released its Q3 2024 results and hosted a conference call on the 1st of November, which this article will focus on. My prior article on AMR can be found here.

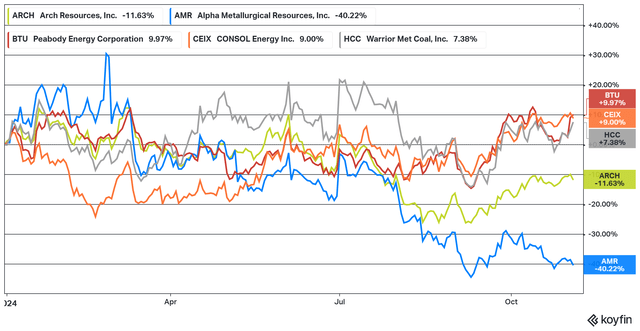

This year, AMR has performed very poorly, where the stock is down a massive 40%. This is due to a few different factors, and it is fair to say I have underestimated how much this stock could correct during a period of weaker coking coal prices, not just in absolute terms but in relation to peers.

- AMR had a strong return last year, up much more than most other coal miners, so part of the underperformance is likely a natural retracement from higher levels.

- Many other coal miners are more diversified, where thermal coal prices have done better in 2024, which has benefitted less met focused coal mining companies.

- A coal miner like Warrior Met Coal (HCC), which is also met focused, has a better margin at the depressed coal prices we have seen lately. So, that stock has offered much better downside protection, even if the divergence looks to be rather large now.

Q3 2024 Results

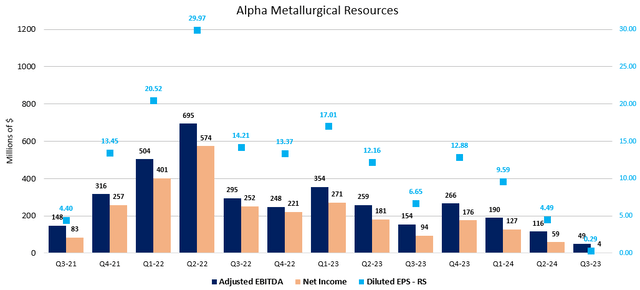

In Q3, AMR reported an adjusted EBITDA of $49M and a net income of $4M, which is the weakest quarter in quite some time. The diluted earnings per share was $0.29, which missed the consensus estimate of $1.03 by a large margin, and that estimate has been lowered several times over the last few months.

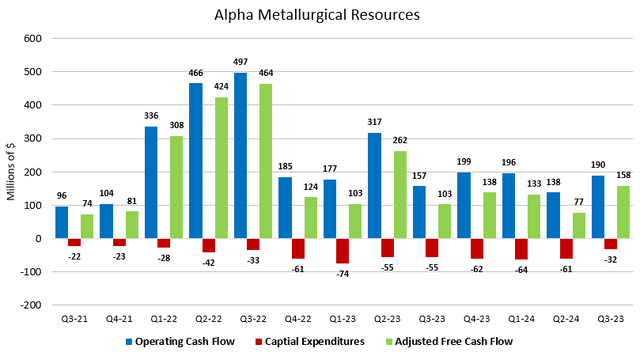

Figure 3 – Source: AMR Quarterly Reports

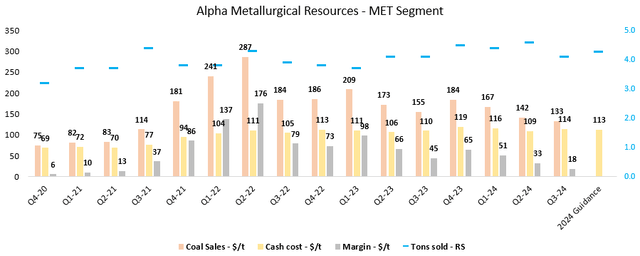

The weak quarterly results were mostly due to the weak coking coal price environment in Q3, but a slightly lower sales volume also had an impact. The company sold 4.1 million tons of coal in Q3, down 11% from the prior quarter. The sales price was $133/t and the cost was $114/t, which led to a margin of $18/t. The slight cost increase was mostly due to lower productivity.

Figure 4 – Source: AMR Quarterly Reports

AMR has paused its buyback program during the last few challenging quarters, to make sure the company has a minimum liquidity if things get even worse from here. The communication is that the buybacks will be used opportunistically.

The timing and amount of share repurchases will continue to be determined by the company’s management based on its evaluation of market conditions, the trading price of the stock, applicable legal requirements, compliance with the provisions of the company’s debt agreements, and other factors.

The company reported a very healthy $158M in free cash flow during Q3, which is encouraging in a challenging quarter, even if it was mostly due to working capital changes. AMR has $485M in cash and $7M in debt & leases. So, the liquidity position is very strong for AMR, and I wouldn’t rule out buybacks if the stock price continues to be weak.

Figure 5 – Source: AMR Quarterly Reports

Valuation

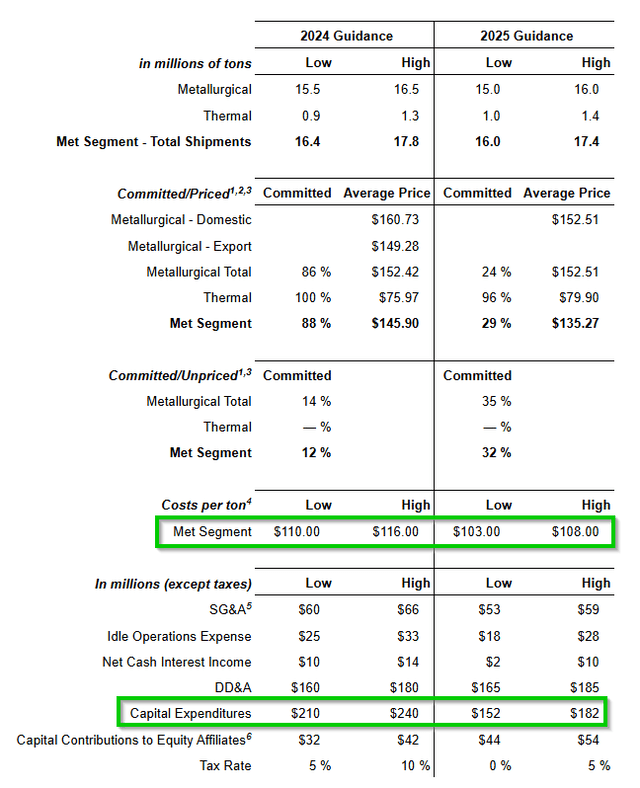

The company made some minor tweaks to the 2024 guidance and released its guidance for 2025 in conjunction with the Q3 2024 results. While the Q3 2024 results were weak, the guidance for 2025 is surprisingly good, with lower operating costs and capital commitments next year.

Figure 6 – Source: AMR Press Release

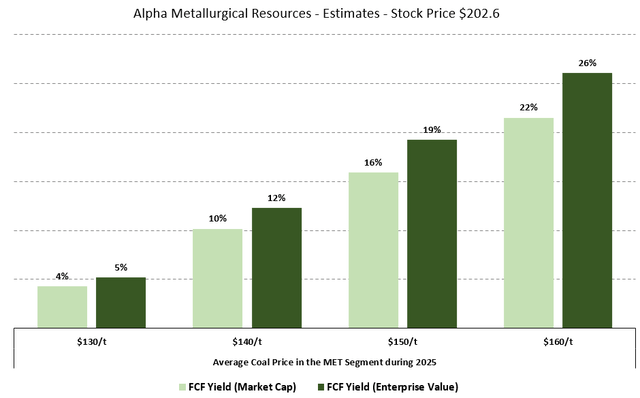

The company is on track to deliver a free cash flow yield at the lower end of a 5-10% range for 2024. However, if we assume similar coal prices next year, which is a rather conservative assumption, the free cash flow yield is around 10% due to lower operating costs and capital commitments, which is far from an expensive valuation.

Figure 7 – Source: My Estimates

Conclusion

AMR is one of the best managed met coal mining companies around, which is partly why the stock has outperformed most companies and its peers over the last 5 years.

Due to better thermal coal prices, there is an argument to be made that more diversified coal miners will perform better in the near term than AMR, as the thermal coal sales are generating better cash flows while coking coal prices are more depressed.

With that said, I do think metallurgical coal is likely to outperform in the long run, and I consider this an excellent opportunity to add AMR to the portfolio, as I have done in my investing group Off The Beaten Path recently. I think the recent correction has been excessive, both in relation to what I think mid-cycle coking coal prices will be and how some of the peers have performed.

If AMR had an overleveraged balance sheet or a smaller liquidity position, the substantial stock price correction might be more understandable, but there are no balance sheet or liquidity concerns with AMR. We have also seen the company proactively cut its cost going forward, which further highlights the quality management team.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMR, HCC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like this article and are interested in more frequent analysis of my holding companies, real-time notifications on portfolio changes, together with macro and industry analysis. I would encourage you to have a look at my marketplace service, Off The Beaten Path.

I primarily invest in turnarounds in natural resource industries, where I have a typical holding period of 1-3 years. Focusing on value offers good downside protection and can still provide great upside participation. Portfolio Returns: 42% in 2019, 81% in 2020, 39% in 2021, -8% in 2022, 12% in 2023, and 14% YTD2024.