Summary:

- Google’s current share price presents a solid investment opportunity, as they are trading at a substantial discount to peers.

- The DOJ’s claims against Chrome are weak; Chrome’s market dominance doesn’t equate to monopolistic behavior, and banning default search engine payments could potentially benefit Google’s margins.

- OpenAI’s potential browser launch poses a risk, but Google’s resilience and brand loyalty offer confidence in defending its competitive position.

- YouTube could benefit from global regulatory scrutiny on other social media platforms, potentially capturing a larger share of the teenage demographic’s attention and ad revenue.

400tmax

Introduction:

Alphabet (GOOG, GOOGL) has been targeted by the Department of Justice (DOJ) multiple times over the past few years. Late Wednesday evening, the DOJ decided that Google should be forced to sell off its Chrome browser. This topic has already been well covered by other authors on seeking alpha (see here and here), so I won’t go into too much detail on that front. However, two other recent developments related to Google have caught my attention, and I want to delve into these topics in more detail and give my updated opinion on the firm’s current valuation.

DOJ Decision:

I will give my opinion on this situation briefly as it is undoubtedly the greatest concern for Google shareholders at the moment. I believe that the DOJ claims are unjust, given Chrome is not a monopoly in the traditional sense. The definition of a monopoly, according to Investopedia, is “a single seller or producer without direct competitors.” Through some quick research, I found two estimates that put Chrome’s market share at 54% and 67% respectively. Even using Statcounter’s higher estimate of 67%, there is still a direct competitor, Apple’s (AAPL) Safari browser, that controls 18% of the market. While it is undeniable that Chrome is the dominant player in this industry, it does not appear to me that they are acting as a monopolist. Additionally, through another quick Google search I discovered that the Chrome browser had an average rating of 4.43 stars (see here, here, and here). From my perspective, as a Chrome browser user myself, this platform is beneficial to consumers as it is free to use and offers high quality, speedy internet access. According to the FTC’s own website, one of the primary goals of antitrust law is to “protect consumers from anticompetitive mergers and business practices.” In this instance, I don’t believe consumers need any protecting. Nobody is forced to use Chrome, and oftentimes it is a conscious choice from consumers to install the browser (I am currently writing this article in Chrome which I chose to install on my Macbook device). Overall, I believe the case is feeble at best, and there is a relatively high likelihood that Google is not forced to divest of this asset.

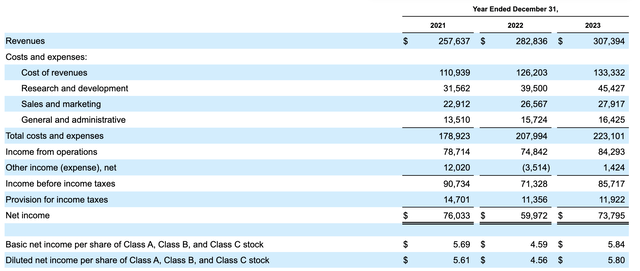

One final point I’d like to touch on is that, as a part of this decision, the DOJ has confirmed that they believe Google should no longer be allowed to pay to be the default search engine on any internet browsers. I believe this could actually be a positive for Google over the long run for two reasons. First of all, Google paid an estimated $20 billion to Apple in 2022 to be the default search engine on the safari browser, an exorbitant sum of money even for Google. This charge is included in Google’s cost of revenues section, which totaled of $133 billion at the end of FY2023.

Assuming we eliminate that $20 billion charge, their cost of revenues would fall to $113 billion resulting in gross margins improving from 56.6% to 63.1%. I think it is fair to assume that, in this hypothetical scenario, revenue would decrease by a material amount. However, this leads perfectly into my second point.

If Google is banned from paying other firms to be the default search engine, this would likely lead to browser providers implementing some sort of prompt that allows users to choose which search engine they would like to use. Given Google’s extremely strong brand recognition, particularly within this space, I believe that most consumers would likely choose the Google search engine if they were prompted to choose between a list of other search engine alternatives.

Familiarity and trust play an essential role in consumer choices, as evidenced by other brands, like Apple. In an article by BusinessDasher, they reported that “Apple has a 92% retention rate among iPhone users.” This is clearly indicative of the loyalty that consumers feel toward Apple and their suite of products. I believe this would be the exact same story if Google is no longer able to be the default search engine. Therefore, when it comes to this part of the DOJ decision, this could actually be a fantastic cost saving mechanism for Google moving forward.

With that out of the way, I’d like to touch on two other pieces of news released today and their potential future impacts on Alphabets business model.

OpenAI Risk

On Thursday afternoon, The Information reported that OpenAI is considering launching their own web browser to compete directly against Google. From an investor perspective, this is concerning for a number of reasons. First and foremost, this announcement was almost certainly released today on purpose given the DOJ decision regarding the Chrome browser. This is certainly an ideal time for OpenAI to come out with a new internet browser to compete with Google considering one of the DOJ’s primary goals with this case is to increase competition within this industry.

My biggest fear as a Google shareholder is the potential that this product could be absolutely incredible. As an avid generative AI user myself, having tried both ChatGPT and Gemini, I believe that ChatGPT is currently the superior product. I read a few different articles (here and here) comparing the two chatbots, and both concluded that ChatGPT offers a better value proposition to consumers. This is not to say that Gemini cannot become the dominant player within the industry, as it is certainly a close second in terms of popularity, but competition from the undisputed king of generative AI is not exactly what Google needs right now.

If OpenAI were to release their own browser software, they would certainly integrate ChatGPT to enhance the user experience and entice consumers to leave Chrome and Safari. Additionally, from my anecdotal experience ChatGPT has become synonymous with generative AI technology, and as this technology evolves and begins to become a more integral part of everyday life OpenAI’s browser may begin to take market share from Chrome.

Now you may be asking, why does this matter if Google is forced to divest of the Chrome asset entirely? In my opinion, the most likely divestiture scenario would be Alphabet spinning off Chrome as a separate publicly traded company. In this scenario, current shareholders would receive shares in the new entity proportional to their ownership of Google shares and would therefore have a vested interest in the continued success of the Chrome browser.

A good historical precedent to support my view is EBay’s (EBAY) spin-off of PayPal (PYPL) back in 2015. While not a directly comparable situation, as it was done for different reasons, I believe that this makes the most sense and would preserve value for Google shareholders. If Google went a different route and decided to sell off the asset to a third party, they would likely be selling the Chrome asset at a lower valuation than what it is worth due to the forced nature of the sale.

Given that background and my opinion on the direction Google would go if the DOJ’s decision is approved, the OpenAI browser certainly presents a relevant risk to current Google shareholders. While it is not confirmed whether or not OpenAI will indeed be launching a competing browser, I view it as a likely possibility that must be considered as part of the overall investment thesis for Google.

A Beacon Of Hope:

The last time I covered Google on my page, I focused on the YouTube asset as I believe it is a hidden gem that is overshadowed by its big brother, Google Search. My confidence in this asset has not wavered, and I am now going to present another piece of recent news that I believe strengthens the bull case for this segment specifically.

Australia recently introduced new legislation aimed at children’s access to various social media platforms. They have proposed a ban that would prohibit users under the age of 16 accessing well-known applications like TikTok (BDNCE), Facebook, and Instagram (META). However, they have decided not to pursue a ban on YouTube (NASDAQ:GOOG) as it “is widely used in schools and has already rolled out safeguards for children.”

If this legislation is passed, it could set a precedent for other countries to pursue similar bans, and they may also choose to exempt YouTube given the reasoning outlined above. If this were to come to fruition, it would likely lead a significant reduction in advertising revenue.

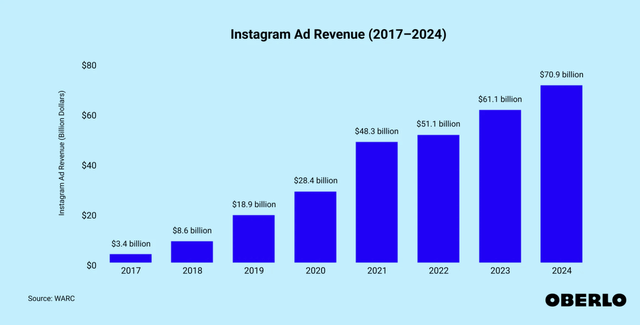

Given that Instagram has approximately 1.4 billion active users, and teenagers from the age of 13-17 make up 8% of this figure, this would give us roughly 144 million users in this age range. Assuming that only 60% of these users would be banned (13-15 year olds), this would give us approximately 86.4 million users. To break down the impact this could potentially have on Instagram’s top line, you must start with their projected advertising revenue for the current year ($71 billion projected).

Using that figure and the current approximation for user count, the average revenue per user (ARPU) is ~$50.70. Eliminating 86.4 million users would therefore lead to a $4.3 billion reduction in advertising revenue. However, I think it is more apt to apply a discount to the ARPU for this demographic given their limited purchasing power. Using an ARPU of $30, this would mean a loss of $2.6 billion in advertising revenue on an annual basis, which is a significant blow.

While not all countries have begun the process of implementing this kind of legislation, I believe that it is only a matter of time until other countries come to their senses and realize how problematic social media platforms can be for impressionable teenagers in this age demographic.

This is not to say that Google will be able to capture all of this advertising revenue, however I believe that teenagers would begin to use YouTube significantly more if they were banned from accessing other social media platforms. Given the addictive nature of social media, it is natural to expect that something will fill the void. Additionally, YouTube currently presents the best alternative to users in this demographic given their Shorts content that is incredibly similar to Instagram Reels and TikTok.

I am relatively worried that, if this legislation is passed and becomes a broader trend across the globe, YouTube shorts may become a target. This is especially true if YouTube becomes the new go-to social media platform for teenagers, and this must also be considered as a potential future risk factor down the road.

Valuation:

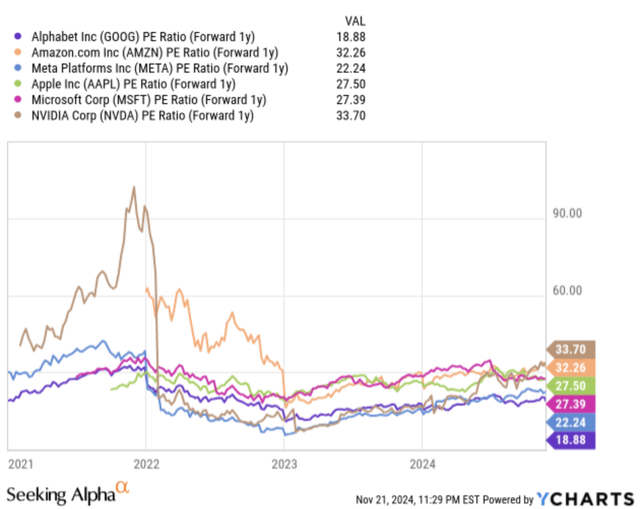

I want to revisit the current valuation multiples of Google relative to some of its primary competitors, specifically the other big tech giants. Google currently trades at a substantial discount to its competitors, particularly following the significant decline in its stock after the recent DOJ decision.

While a discount to some of its hyper growth peers (namely NVIDIA (NVDA)) is justifiable, I just can’t understand why it is trading at an 8.62x lower multiple than Apple. For reference, Apple is expected to grow its bottom line 9.5% next year, whereas analysts expect Google to top this years figure by 11.9%.

Similarly, Meta (META) currently trades at a multiple 3.36x higher than Alphabet but is expected to grow it’s earnings at a nearly identical rate over the next year.

Simply put, I believe there is room for Google to expand its multiple over the medium to long term. There are certainly risks, as outlined above, but there are also potential catalysts present which can serve to mitigate downside for investors.

Conclusion:

All in all, I see Google as a solid potential investment opportunity given the current discount to peers as a result of recent price action. Uncertainty for this company is higher than ever, but overall I don’t see any imminent threats to Google’s business model. Google’s strong brand recognition in search, along with the potential savings they may realize, are two primary reasons I am bullish on this stock moving forward.

When it comes to competition in the browser industry, OpenAI certainly has introduced a meaningful risk. However, Google has proven their resilience over the past two decades and I am confident in their ability to defend their competitive moat, even in the face of adversity.

Finally, YouTube presents a silver lining, particularly as other social media platforms face increasing regulatory scrutiny. If this type of legislation becomes more commonplace across the globe YouTube will stand to benefit massively from the demographic these laws would affect.

I am currently rating shares of Google a BUY, and I will continue to watch this company as the DOJ lawsuit continues to progress. Additionally, investors must stay informed about OpenAI’s browser plans and evolving laws regarding teenagers’ use of social media platforms to maintain a holistic perspective on this conglomerate.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.