Summary:

- Alphabet’s controversial Gemini demo was a reflection of the company’s current state of business.

- The company continues to lag behind its rivals with product launches, innovation, entry into new markets, and efficiency initiatives.

- The good news is that all these flaws are already priced in, and most of them are fixable.

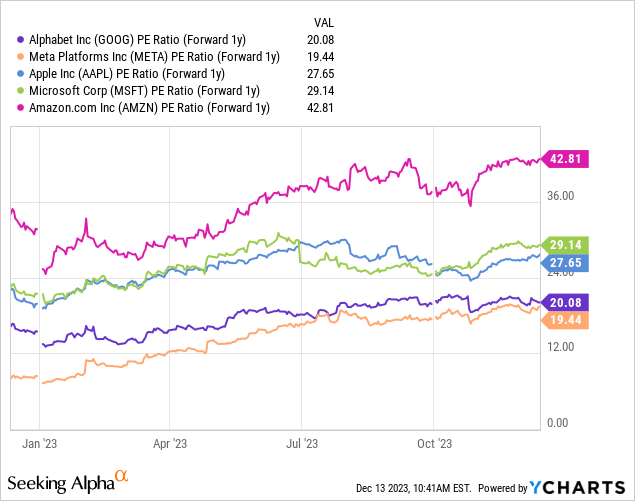

- Trading at a 20x P/E multiple over 2024 earnings, Alphabet stands nearly 23% below its historical average, and is far from big-tech leaders in Microsoft, Apple, and Amazon.

- With plenty of room for upside and improvement, combined with an undemanding valuation, I reiterate Alphabet as a Buy.

400tmax

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is probably one of the most intriguing investments among big tech, trading at a significantly low valuation compared to the rest of the group.

However, it seems that the company’s management continues to pile one mistake over another, with the latest being a demo of its highly anticipated Gemini model, which overexaggerated its current capabilities.

In my view, the controversial launch overshadows bigger and more fundamental problems, including monetization capabilities, and bad strategic decisions which span across many lines of the Alphabet enterprise.

These are problems that investors should carefully consider before jumping in on the low valuation.

Introduction – Who Gets The Credit For The Year-To-Date Performance?

I’ve maintained a Buy rating on Google since I started covering the company on Seeking Alpha back in March, although I constantly reiterated my view that the company’s management is destroying value.

In my first article, I emphasized operational inefficiencies, wasteful non-core activities, and a lack of focus on shareholder interest. In my second article, I discussed Google’s significant inferiority in the cloud and talked about the company’s complacency, claiming it’s waiting for external factors to improve rather than striving for in-house improvements.

Despite its flaws, Google has provided investors with a 49.37% return year-to-date, and it’s not too far from all-time high levels. However, in my view, the credit for its performance should be mostly attributed to a low valuation to begin the year, as well as easing external factors and changing market sentiment.

Today, Alphabet trades at a 20.0x P/E multiple over its projected 2024 EPS, which is marginally above Meta at 19.4x, and significantly below Microsoft (MSFT), Apple (AAPL), and Amazon (AMZN), which trade at 29.7x, 33.4x, and 42.8x, respectively. This is also significantly below Google’s historical average, which stands in the 25x-26x range.

Considering regulatory questions that have been weighing down on Alphabet for many years now, it’s clear that investors are far from rating the company as high as they used to.

On one hand, Google still dominates the search engine market and owns a one-of-a-kind asset in YouTube. On the other hand, the company continues to lag behind Amazon and Microsoft in cloud and AI, its most important growth drivers.

In addition, investors are quite frustrated with the company’s lack of focus on efficiency, growing losses in non-core activities, and inability to generate meaningful profit from the cloud business.

Let’s tackle each problem at a time, and assess whether or not it is fixable.

The Questionable Demo Is One Thing, But What About Monetization?

The overly positive demo naturally generated a lot of buzz. It also overshadowed a much more important question, which is how Google plans to make money from AI in general and Gemini specifically. Here’s an example from Citi analysts, who are quite bullish on the Gemini launch but fail to quantify its actual monetization impact.

If Alphabet doesn’t want to help us and Citi doesn’t want to help us either, we’ll have to attempt and answer that question ourselves. In my view, there are three primary fronts where AI (and Gemini) can produce tangible value for Google shareholders, namely, Google Cloud, search, and ad-targeting.

Increased Demand For Google Cloud

Following various product announcements from Amazon and Microsoft, Google will finally introduce its own Gemini-based add-ons to the Google Cloud suite, which could support growth.

The problem is that both Microsoft and AWS are the dominant players in the space, with a first-movers advantage. Gemini will have to be significantly superior in order to make enterprises choose Google over the dominant players.

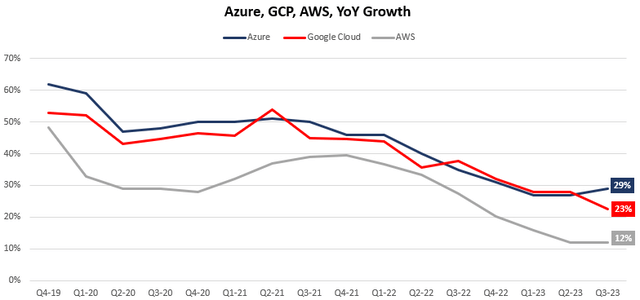

Created and calculated by the author using data from the companies’ financial reports; Microsoft’s fiscal quarter is two periods ahead of the calendar year, meaning Q3-23 is Microsoft’s fiscal Q1-24.

As we can see, Alphabet’s GCP, despite its smaller size, grew slower than Azure in calendar Q3-23, and was the only one that experienced deceleration in the quarter. The inferior performance can be attributed to general weakness compared to the other players, as well as no real AI contribution.

Accelerated Growth In Search & Bard

Starting with search, it’s hard to imagine a world where Google captures more value from search than it already does. I am of the opinion that Google’s AI ambitions in this space are more defensive than offensive, especially as the company continues to lose share to non-pure search options like TikTok or Instagram (ask yourself where you go to search for a restaurant, travel ideas, or a product review).

And on the Bard front, the business model remains unclear. Meanwhile, ChatGPT surges ahead with its 2-million developers base, premium subscriptions, and already available API modules.

Improved Ad-Targeting

As Citi mentions in their analysis, better ad-targeting, fueled by better AI capabilities, should support growth and profitability in Google’s legacy advertising businesses, across YouTube, search, and the rest of the divisions.

However, I believe the Gemini launch isn’t a game-changer on that front, as machine learning has been fueling these businesses for many years. For an anecdote, OpenAI was initially founded by poaching leading AI engineers from Google and Facebook, driven by a goal to take some of the AI power away from big tech. So ad-targeting is already exploiting significant machine-learning technology, and there’s no reason to expect a sudden acceleration in that front from Google.

And even on the advertising front, it seems that Google is lagging behind Meta, with Meta growing advertising revenues by 23.5% in the quarter, compared to Google Services’ 10.8% growth (although it’s not a perfect comparison).

Lagging Behind…

Microsoft stated AI will be its quickest business to reach $10 billion in revenues and has already launched several products including Copilots, and OpenAI-based products in Azure. Amazon has had Bedrock, CodeWhisperer, and several other AI offerings available for quite some time.

Meanwhile, even after the Gemini launch, there’s still a lot of uncertainty surrounding Google’s AI products, and its ability to compete with the two dominant players. To me, until there’s a much more quantifiable plan and higher clarity, the stock will continue to trade at the low end of its valuation range.

Strategic YouTube Decisions

I decided to highlight YouTube specifically, as I think it’s a good example of the overall questionable strategy set out by Alphabet’s management.

Core YouTube, in my view, is one of, if not the most, impeccable assets owned by Google. YouTube’s value proposition for content creators is by far the leading offering, and while it does compete with the likes of TikTok and Instagram, there’s really no alternative for 60-second-plus videos. In addition, these other platforms are way less attractive for creators, who typically need to go outside the platform for monetization or build their own advertising business (i.e. influencers).

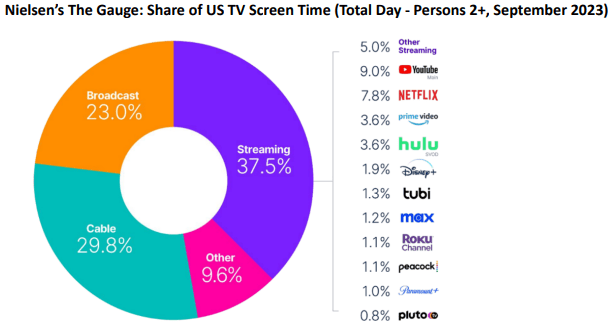

Netflix Q2-23 Letter To Shareholders; Based on Nielsen Data.

YouTube consistently takes more share of TV time, and remains the number one streaming option in the U.S., confidently above Netflix. And, YouTube has a significant advantage over rival streamers, as it doesn’t have to spend any money on content, and any risk of success or failure that comes with it.

But what did Google’s management decide to do? It decided to enter the lower-margin TV business. Reportedly, the company is paying $2 billion dollars annually for NFL rights and is now in the business of selling TV bundles. In a similar ‘late-to-the-party’ fashion, just like with Bard, Alphabet entered the field after another big rival, Amazon.

It also entered the short-form video landscape with YouTube Shorts, yet it remains way behind in Shorts monetization (unlike Meta which has reached neutrality with Reels).

While it could be argued that those are adjacent attractive businesses Google should want to participate in and are accretive to core YouTube, I think this demonstrates some kind of pattern from Google’s management.

Valuation

It all comes down to this. As you can see in my previous article (and spoiler alert: in this article as well), I kept a Buy rating for Google throughout the year, which turned out to be correct. I did so despite my very long list of problems with the company, and the reason is quite simple – most of these problems are already priced in.

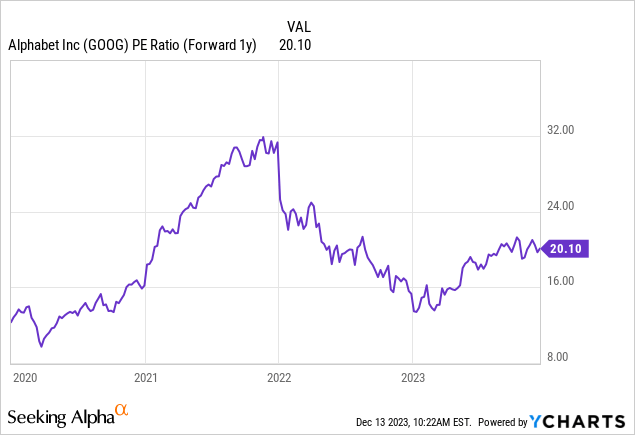

In the first section of the article, we saw that Alphabet is nearly tied with Meta for the cheapest stock among big tech. Now, looking at Alphabet’s valuation relative to its historical levels, we can also see that it’s trading at the low end of its range. With a 20.1x P/E over expected 2024 earnings, Google’s parent is trading nearly 23% below its 5-year average.

In my view, the market is currently valuing Alphabet based on the assumption no in-house turnaround is going to happen in the foreseeable future. What do I mean by a turnaround? Well, there’s plenty that Alphabet’s management can do to receive more credit from the market.

They can use the huge pile of cash that’s been sitting dead on the balance sheet and go for accelerated buybacks. They can cut non-core projects. They can become more transparent and ambitious about their targets with new initiatives like Gemini. The list goes on and on.

Conclusion

Alphabet operates several of the highest-quality businesses in the world with YouTube, Google, and GCP. Following many years of leadership, it seems the market views Google’s parent as one of the ugly ducklings of big tech, as the company trades for a significantly lower valuation compared to its peers and compared to its historical levels.

In my view, it becomes more and more apparent that Alphabet has plenty of pillars to improve upon, as the company lags behind its rivals with product launches, innovation, and efficiency improvements.

However, I estimate all these problems are already priced in. This much potential for improvement combined with a very undemanding valuation, leads me to reiterate Alphabet as a Buy, despite its many flaws.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, META, AMZN, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.