Summary:

- YTD, Mega-Tech stocks dominate market performance, with Alphabet and Salesforce stock prices surging as investors seek refuge in stocks that demonstrate profitability.

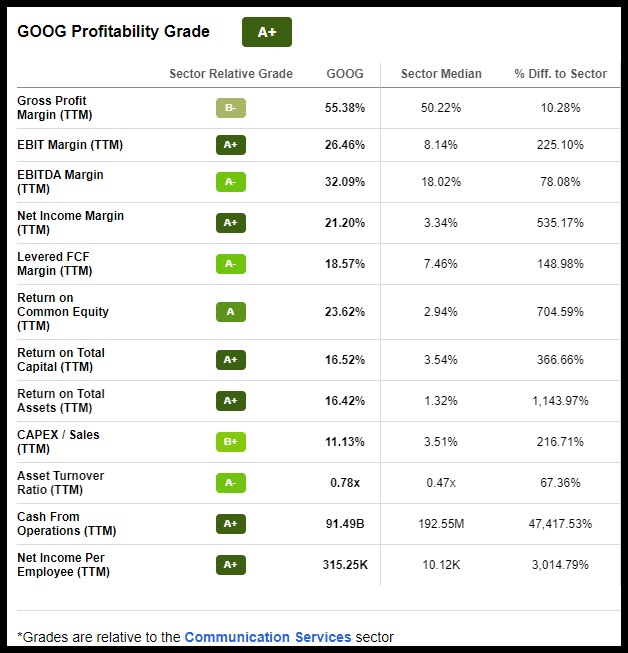

- Salesforce, the CRM king, is back on cloud nine with gross margins of 73%. A 55% gross margin drives GOOG’s profitability, and Cash from Operations is $7 billion and $ 91 billion, respectively.

- After suffering some of their worst performances in 2022, Alphabet was down 38.84%, and CRM -48.10%. The stocks rose in 2023 as their management teams adjusted to protect profitability.

- Despite slowing consumer demand, reduced advertising dollars, and macro headwinds, both companies went from Hold to Strong-Buy quant rated. YTD, both stocks are up double-digits.

- Layoffs are part of each company’s restructuring and aid GOOG and CRM’s bullish momentum, strong growth prospects, and sustained profitability. Consider both stocks for a mad comeback and safe harbors during periods of market volatility!

georgeclerk/iStock Unreleased via Getty Images

Google and Salesforce: Back to Basics

While they may not offer the same potential for high returns as they provided over the last ten years, Alphabet Inc. (NASDAQ:GOOG) and Salesforce Inc. (NYSE:CRM) manage to squeeze out profitability in a difficult environment. Both companies are on the path to cutting costs, downsizing operations, adjusting their infrastructures for declining consumer demand, and moving forward with technological developments. Alphabet’s lackluster one-year performance is due to consecutive earnings misses for the company through Q4 2022. Management has been adjusting its game plan appropriately, and investors have driven the stock up 21% this year as a reward.

Salesforce has consistently delivered strong top-and-bottom-line earnings. However, the $120B in Big Tech losses last year exacerbated Salesforce’s shakeup in executive leadership, negatively impacting the SaaS company’s price performance, and the stock was crushed last year. By the end of 2022, Salesforce was -48.10%, and Alphabet was down 38.84%. The good news is that won’t stop these companies from returning to cloud nine! Profitability is the order of the day, and both stocks score a Seeking Alpha A+ grade for profitability.

Buy or Hold Stocks

Companies can start anew. Google was my only mega-tech Strong Buy last year. Although the challenging economic outlook resulted in its rating fluctuating to Hold a couple of times, Alphabet has maintained a Strong Buy rating overall. Buy or Strong Buy stocks possess characteristics that typically reflect upside potential. Stocks rated Hold are typically expected to perform in line and at the same pace as their comparable peers.

YTD Price Performance, GOOG & CRM

YTD Price Performance, GOOG & CRM (SA Premium)

Despite poor price performance over the last year (CRM -4.18% and GOOG -23.90%), year-to-date, both companies have made a turnaround, as evidenced in the chart above. Because Alphabet and Salesforce trade at a premium, it’s essential to consider their fundamentals and evaluate their metrics to determine whether these premium frameworks are “priced to perfection.”

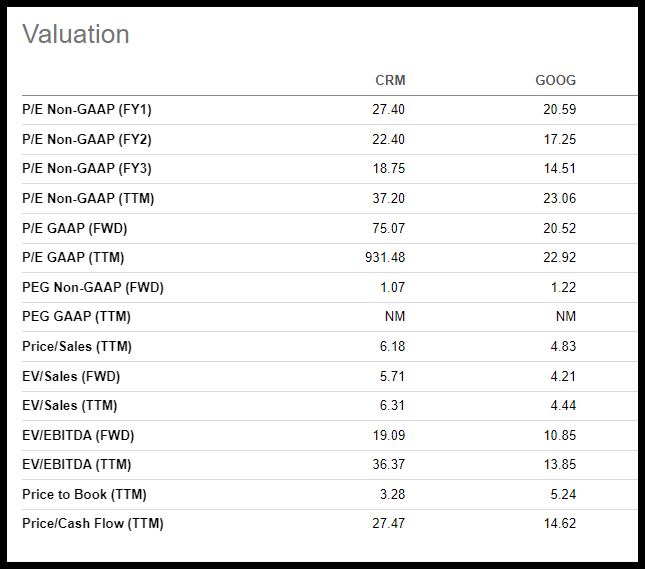

The valuations below indicate that CRM and GOOG are priced at a premium. However, their essential PEG ratios indicate some discounting. CRM’s forward PEG of 1.07x is highlighted by a B+, a -35% discount to its sector, and Alphabet’s forward PEG of 1.22x is a B- grade, trading at a -25.88% discount.

Alphabet Stock and Salesforce Stock Valuations (SA Premium)

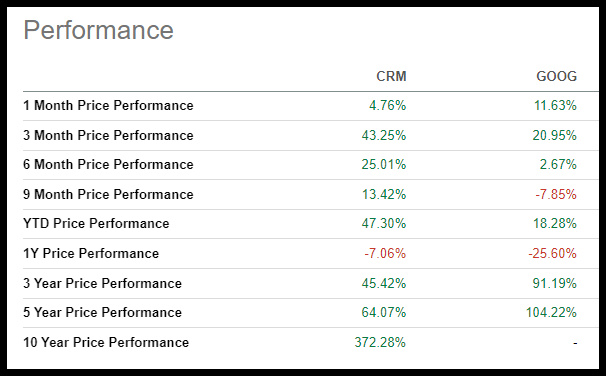

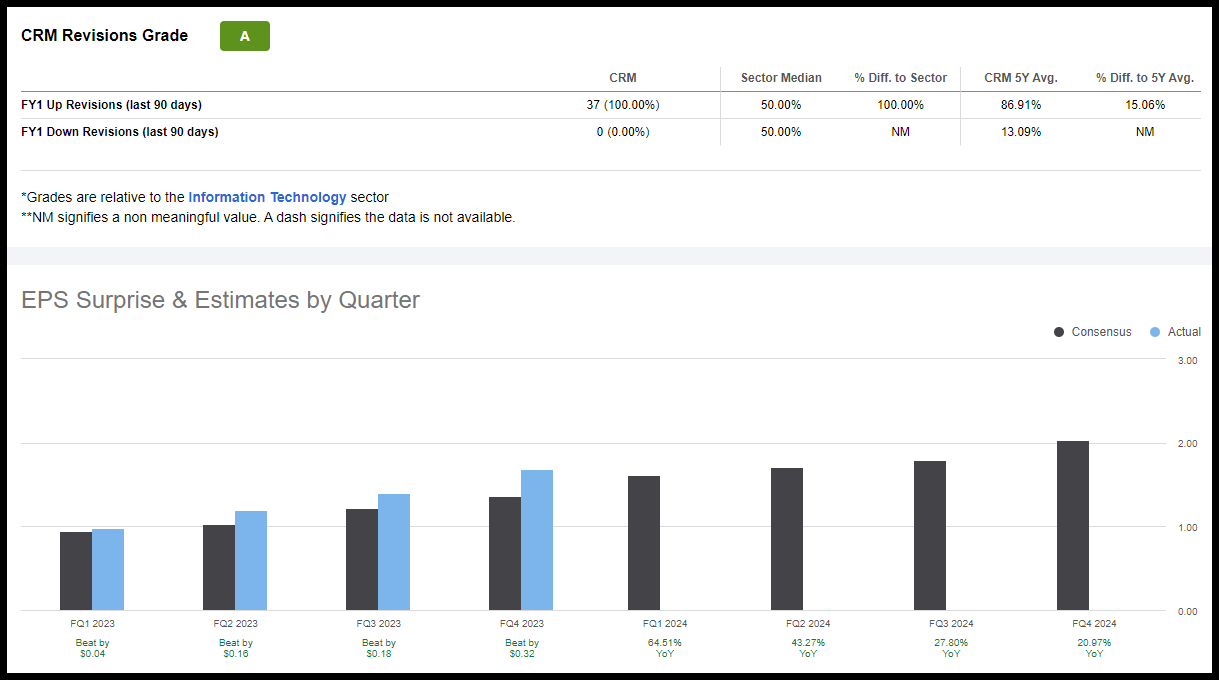

Bearing this in mind, both stocks have significant momentum, showcased in strong one-month, three-month, and six-month price performance. Where Wall Street analysts love Salesforce and have continued to deliver upward revisions, CRM’s 37 FY1 Up Revisions are a vast difference from Alphabet’s 13 upward revisions that come on the heels of four consecutive misses. Nevertheless, both companies are innovators in their sector and industries, differentiating themselves from the competition.

Salesforce & Google Price Performance Table (SA Premium)

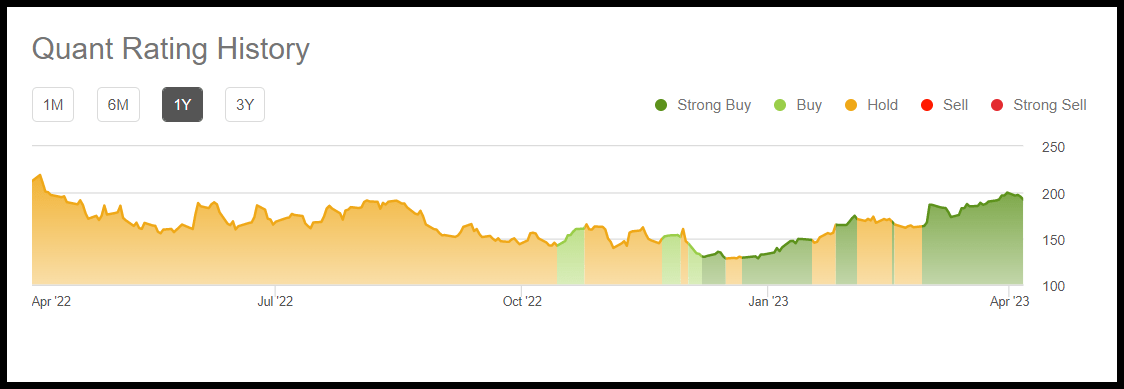

Analyst revisions aside, quant ratings and factor grades offer an instant characterization of stocks’ data relative to their sectors. Where Alphabet and Salesforce were once Hold recommendations based on their Seeking Alpha report card grades of ‘C,’ which are middle-of-the-road grades, as illustrated in CRM’s history below, the stock has turned a new leaf.

Salesforce Stock (CRM) Moves from Hold to Strong Buy Rated

Salesforce Stock (CRM) Moves from Hold to Strong Buy Rated (SA Premium)

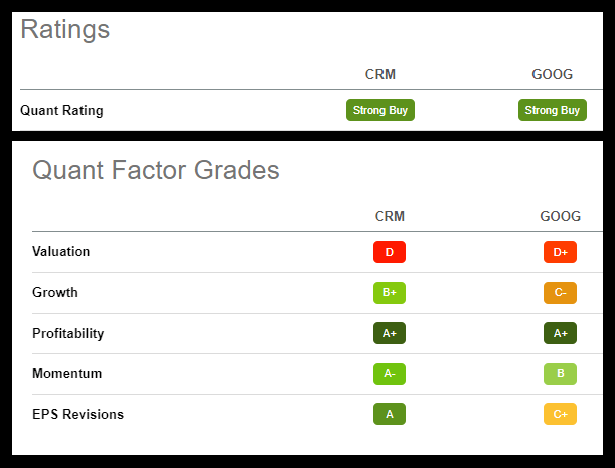

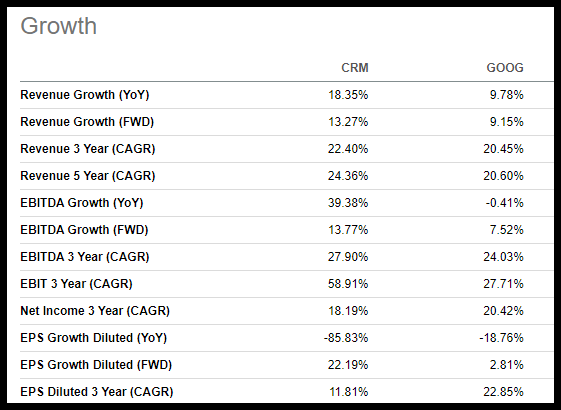

While there are many opportunities to find top-rated stocks, the key is finding those with strong fundamentals and forward EPS growth rates ranging. Stocks with excellent profitability and momentum. Seeking Alpha Factor grades rate investment characteristics on a sector-relative basis. Below, CRM and GOOG’s Growth and Earnings grades are solid, and both possess A+ Profitability, making them extremely attractive investments compared to their sector peers.

Salesforce and Google Quant Ratings & Factor Grades (SA Premium)

Both companies are currently ranked #3 in their industries, with CRM offering consistent double-digit growth and Alphabet near double-digit growth. Alphabet and Salesforce possess strong forward EBITDA and EPS growth estimates, which helps substantiate SA’s quant Strong Buy ratings.

Salesforce and Google Growth Figures (SA Premium)

Where Google is an Interactive Media Services company in the Communications sector, Salesforce is an Application Software company in the IT sector. While there is overlap in their customer base, each company offers unique revenue streams that have allowed them to possess such strong profitability and withstand slowdowns and many of the challenges negatively affecting smaller companies. Although supply chain constraints, currency fluctuations, and the loss of digital advertising dollars have played a part in their fall and Hold statuses last year, both companies have been strategically focused on rallying through 2023. Let’s briefly dive into the benefits and risks of investing in two popular stocks that have made a quant comeback.

1. Alphabet, aka Google Stock (GOOG)

-

Market Capitalization: $1.34T

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 4/6): 11 out of 252

-

Quant Industry Ranking (as of 4/6): 3 out of 63

Alphabet Inc., formerly known as Google, is the Communications trailblazer offering global products and services, including advertising, cloud-based tools, and popular items like Android, Chrome, and various hardware and Google products. Unlike other social media platforms, Google owns YouTube, which has been a cash cow.

With cash from operations of $91.49B, gross profit margins of 55.38%, and net income margins of more than 535% difference to the sector, it’s no surprise that GOOG has A+ Profitability.

GOOG Stock Profitability Grade (SA Premium)

In addition to offering exceptional products and services that benefit economies and users worldwide, driving GOOG’s consistent and stale earnings, revenue, margins, and return on equity. While periods of downturn and the challenging macroeconomic outlook have served as headwinds, Alphabet’s robust product portfolio, which adopts more and more users daily, continues to thrive, where other big names have experienced a fall. With bullish momentum and the dominant online search engine, the stock continues to see the upside. Even as advertising dollars have fallen, google remains a beneficiary of ad dollars. In addition to Google’s Android reaming the doming global market share of smartphones, it should see more upside in top-line growth. As a result of its cash hoard and ability to generate substantial cash from various sources, Alphabet remains focused on innovation, which bodes well for long-term growth and wards off competition.

Every company has risks, including Alphabet. The Justice Department filed suit against Google, citing it as a monopoly given that it is the dominant search engine. Demanding the breakup of its ad-tech business, where ad dollars have been shrinking, this also poses another concern for Google, which relies on these income streams. It also poses concerns for customers, should the Justice Department make any headway to prevent Google’s monopolization. In the meantime, Google’s subscription business continues to grow, with YouTube averaging 50B views per day, and its Premium subscription has more than 80M subscribers. If those numbers don’t impress you, perhaps my next pick will.

2. Salesforce, Inc. (CRM)

-

Market Capitalization: $195.31B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 4/6): 12 out of 595

-

Quant Industry Ranking (as of 4/6): 3 out of 213

Salesforce, the largest Customer Relationship Management (CRM) company, pioneered its Software as a Service ((SaaS)) in the late 1990s, and its technology has been bringing together companies and customers ever since. Through market plans and services, salesforce has continued to deliver tremendous margin expansion and share buybacks.

CRM Stock EPS & Revisions (SA Premium)

Delivering significant Q4 earnings, Salesforce EPS of $1.68 beat by $0.32, and revenue of $8.38B beat by $391.63M. With revenue that grew 14% Y/Y amid a difficult environment as companies lay off employees and small businesses have seen declines, CRM has grown eight of its 13 cloud products for +50% ARR growth. In addition to a non-GAAP operating margin of 29.2% compared to last year’s 15%, Salesforce has proven resilient despite declines.

Over the years, Salesforce has added customer service, marketing, automation, and other product and service diversifiers for growth. After the company’s management shakeup to get back to business as usual, management focuses on scale, profitability, and expanding margins. As Co-Founder and CEO Marc Benioff said,

“We’re incredibly happy that these phenomenal executives are joining us to help guide our next level of profitable growth…We know that we have the right team, the right strategy, and the right products to compete and complete this transformation. And we’re continuing to build our future. I’ve never been more inspired by our engineering teams, and it’s no wonder that we’re ranked #1 CRM by IDC for the ninth year in a row.”

While it’s great to have new leadership at the helm, it poses a potential risk to changes in operations and the successes the company has experienced. In addition to layoffs and a complex acquisition of Slack, investor and shareholder confidence shuddered for some time. As fellow SA writer Virginia Backaitis wrote, “The downside of “sticky” and a close customer and developer community is that it makes news of mass layoffs, over-hiring, executive exodus’ and misjudgments spread fast among stakeholders all around.” Where Salesforce and Alphabet continue to make strides in reducing spending and focusing on growth and profitability, consider these stocks that were once Holds and are now strong buys for your portfolio.

Conclusion

In difficult economic environments, companies need to adjust and pivot. When the economy faces a potential downturn, investors will seek out corporations that can maintain profitability and reduce the bite of a recession. Salesforce and Google are two of the most closely followed mega-cap stocks. Google has one of the largest weights in the major indexes. Historically, both stocks have offered strong financial performance and growth, innovation, and brand recognition, giving off the perception of stocks that may serve as safe havens during economic uncertainty. But as macroeconomic challenges presented and fear moved the markets, Salesforce and Google experienced substantial declines in 2022, resulting in a fall in their ratings from Strong Buy to Hold.

Since 2022, consumers have begun spending less as inflation and interest rates have surged. Fewer advertising dollars, economic tightening, leadership turnover, and geopolitical headwinds contributed to both stocks’ price deterioration. Despite some of these challenges and premium valuations, I believe both stocks have returned to their fundamentals, focusing on reducing expenses, strategically emphasizing growth, and remaining profitable. These investment characteristics are reflected in their quant comeback to Strong Buy ratings. With positive analysts’ upward revisions and bullish momentum, consider both stocks for a portfolio or, as an alternative, Top Technology Stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.