Summary:

- Alphabet reported great fourth-quarter results, with all major business segments contributing to growth.

- The company is fighting back with Gemini but still has a wide economic moat and a leading position in almost all markets it operates in.

- We can certainly argue that GOOG is fairly valued at this point, but considering the double top the stock currently made, I would be cautious.

SpVVK

Alphabet Inc. (NASDAQ:GOOG) was probably one of the companies and stocks I was too cautious about in 2022 and early 2023. Despite publishing a bullish article, I did not invest myself and this might have been a mistake (as I have already pointed out in a previous article). Since my last article, rated with a “Hold” once again, the stock increased about 10% and therefore slightly underperformed the S&P 500 (SPY) during these three months.

But compared to other companies among the Magnificent 7, Alphabet seems to be trading for the most reasonable valuation multiples (it was Meta Platforms (META) in the past quarters, but with the stock continuing to rally the picture is changing). So, let’s take a look at Alphabet an answer the question if we should still invest.

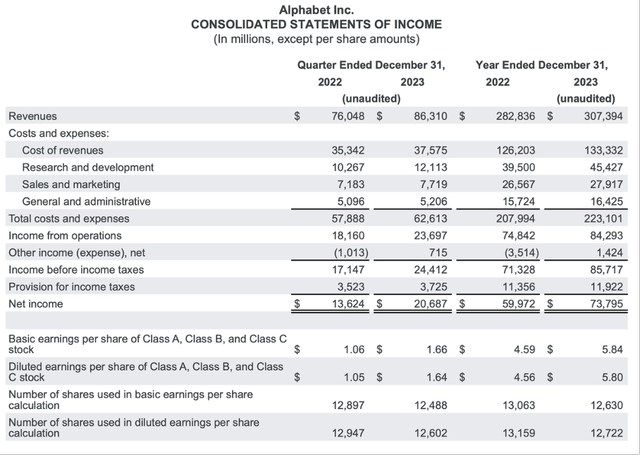

Results

Alphabet actually reported solid full-year results. Revenue increased from $282.8 billion in fiscal 2022 to $307.4 billion in fiscal 2023 – resulting in 8.7% year-over-year growth. Income from operations also increased from $74,842 million in the previous year to $84,293 million in fiscal 2023 – resulting in 12.6% year-over-year growth. And finally, diluted earnings per share increased even 27.2% YoY due to share buybacks reducing the number out outstanding shares, a lower tax rate in 2023 and $3.5 billion in “other expenses” had a negative effect in fiscal 2022.

Alphabet Earnings Release Q4/23

And when looking at the fourth quarter results, the picture looks even brighter. Alphabet increased its top line 13.5% year-over-year from $76,048 million in Q4/22 to $86,310 million in Q4/23. Income from operations increased from $18,160 million in the same quarter last year to $23,697 million this quarter – resulting in 30.5% year-over-year growth. And diluted earnings per share in the fourth quarter grew 56.2% year-over-year from $1.05 in Q4/22 to $1.64 in Q4/23.

Over the last few quarters, the overall picture improved constantly for Alphabet and top line grew for the fourth quarter in a row and operating income grew even for the fifth quarter in a row.

Segment Results

When looking at the different segments, we can start with Google Services, which is still the most important segment and generating the biggest part of revenue and operating income. In the fourth quarter of fiscal 2023, revenue increased 12.5% year-over-year to $76,311 million and operating income increased even 32.2% year-over-year to $26,730 million.

The Google Services segment can be split up in Google advertising on the one hand and Google Subscriptions, Platforms and Devices (formerly known as “Google Other”) on the other hand. Revenue for Google Advertising increased 11.0% with YouTube ads increasing revenue 15.5% year-over-year to $9,200 million. And the Google Subscriptions, Platforms, and Devices segment reported revenue growth of 22.7% YoY to $10,794 million in the fourth quarter.

After YouTube had been struggling for some quarters, it seems like the platform is now one of the drivers of growth again – not only due to ad revenue but also due to subscriptions. Recently, Alphabet reported that YouTube crossed 100 million subscribers and subscription is now a $15 billion business. Although Google One is also doing incredibly well with strong user growth, YouTube is the key driver of subscription revenues.

Another driver of growth is the Google Cloud business. Revenue for the segment increased 25.7% year-over-year from $7,315 million to $9,192 million and instead of an operating loss of $186 million in the same quarter last year, the segment reported an operating income of $864 million in the fourth quarter of fiscal 2023.

During the earnings call, CEO Sundar Pichai also pointed out that customers are mostly choosing Duvet AI now:

Customers are increasingly choosing Duvet AI, our packaged AI agents for Google Workspace and Google Cloud Platform to boost productivity and improve their operations. Since its launch, thousands of companies and more than a million trusted testers have used Duvet AI. It will incorporate Gemini soon. In Workspace, Duvet AI is helping employees benefit from improved productivity and creativity at thousands of paying customers around the world, including Singapore Post, Uber and Woolworths.

And management also gave a small update on “Other Bets”, which increased revenue from $226 million in the same quarter last year to $657 million this quarter (but of course, the segment is still not profitable):

In our Other Bets portfolio of companies, Waymo, which is deeply focused on safety, reached over 1 million fully autonomous ride-hailing trips. And Isomorphic Labs entered into strategic partnerships with Eli Lilly and Novartis to apply AI to treat diseases, which has great potential.

You Shall Not Fear Competitors

One of the major themes in the last few quarters was the question if Alphabet must fear new competition – especially Open AI and ChatGPT. And one of the questions was also if Alphabet might lose its moat, which was previously considered to be one of the best of all time.

Fighting Back With Gemini

For starters, Alphabet responded quite well to the challenge that arose by OpenAI and ChatGPT. After introducing Bard, the chatbot is now being rebranded to Gemini and according to Pichai, Alphabet is now entering the “Gemini era” and the company will bring the new capabilities to several products including Workspace and Google Cloud. During the last earnings call, Pichai commented:

We closed the year by launching the Gemini era, a new industry-leading series of models that will fuel the next generation of advances. Gemini is the first realization of the vision we had when we formed Google DeepMind, bringing together our two world-class research teams. It’s engineered to understand and combine text, images, audio, video and code in a natively multimodal way and it can run on everything from mobile devices to data centers.

Additionally, Gemini might make the Search Generative Experience faster for users. Gemini will power a new conversational experience in Google Ads. While being only a beta version (open to users in U.S. and UK) early tests show higher-quality search campaigns with less effort.

Leading The Market

Alphabet also does not have to fear the competition because Alphabet is continuing to keep its dominant position it has in most of its markets (already pointed out in my last article). And so far, we don’t see any signs of Alphabet struggling or its moat showing any cracks.

When trying to search for terrible news, we can point out that YouTube’s market share declined to 8.5% (compared to above 9% in the months July 2023 till November 2023). But the overall share of streaming also declined a little bit – in July 2023, the total market share of streaming was 38.7%, and it declined to 35.9% in December 2023. And in streaming, YouTube is not really ahead of its competitors, with Netflix (NFLX) having a market share of 7.7%.

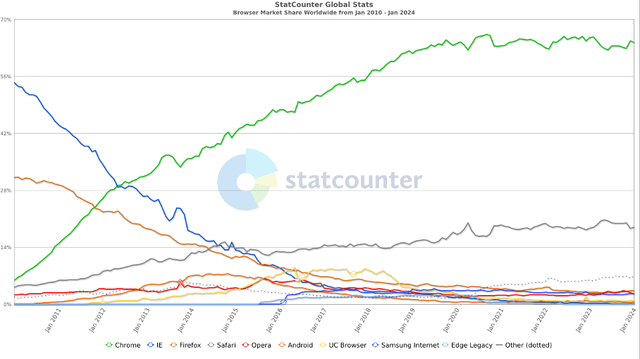

While YouTube does not have a clear leading position in streaming but is rather in close competition with Netflix, it is clearly ahead of most competitors in many other segments and markets. Android is the dominating operating system and although Windows is not so far behind and iOS should also be taken seriously as a competitor, Alphabet is the market leader. Chrome is also the leading browser around the world and over the last five years, Google Chrome held a market share of 60% to 65%.

And of course, Google is the dominating search engine, and it kept its market share stable in the last few years. Despite some people wondering if Bing was able to take market shares from Google due to its corporation with OpenAI and ChatGPT, we see no effects so far and Google is holding on to its over 90% market share.

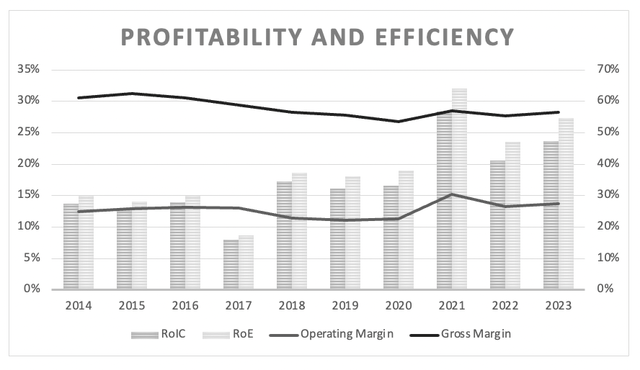

Wide Economic Moat

These metrics are all indicating that Alphabet does not have to fear the competition and its moat is remaining strong. This can also be shown by the gross margin as well as the operating margin remaining stable (or even improving again). Over the last ten years, we can see gross margin declining a little bit, but that is nothing to worry in my opinion.

Alphabet: Gross margin, operating margin, RoIC (Author’s work)

And aside from margins that can be described as stable, Alphabet is reporting improving return metrics over time. Especially, return on invested capital – one of the most important metrics – is improving in the last few years. In the last ten years, Alphabet reported a return on invested capital of 17.13% (already great) but in the last five years it improved to 21.09% on average.

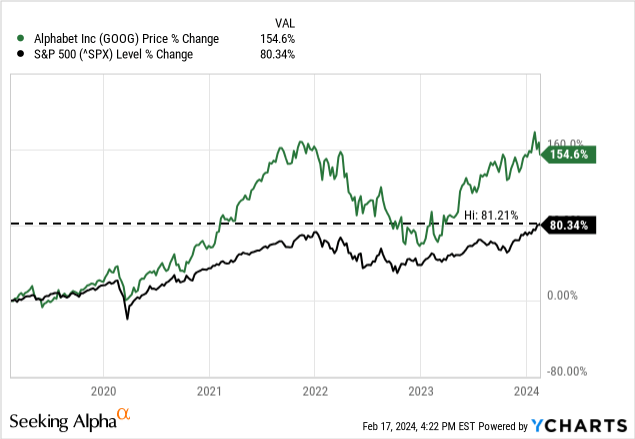

Aside from stable margins and a high return on invested capital, Alphabet is still outperforming the stock market. And the outperformance of Alphabet is not just stemming from past days and the great performance. Alphabet is also outperforming the major indices – in this case the S&P 500 – in the last few years. While the S&P 500 increased about 80% in value in the last five years, Alphabet increased 155%.

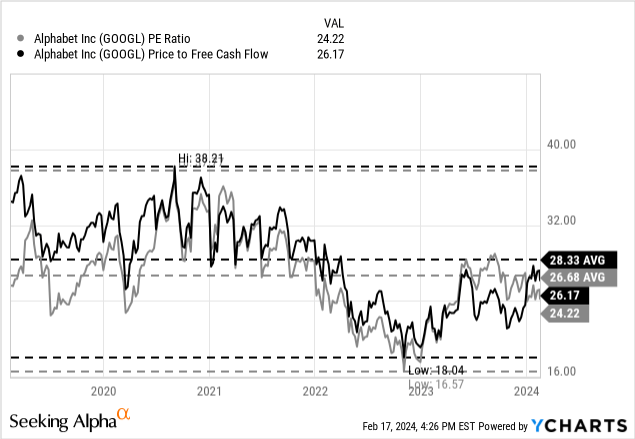

And what is even better: Alphabet did not create its outperformance in the last five years by the expansion of valuation multiples (like some other stocks). The stock is actually trading for a lower P/E ratio and P/FCF than five years ago – indicating that it is really the fundamental business outperforming and not just investors overvaluing the stock.

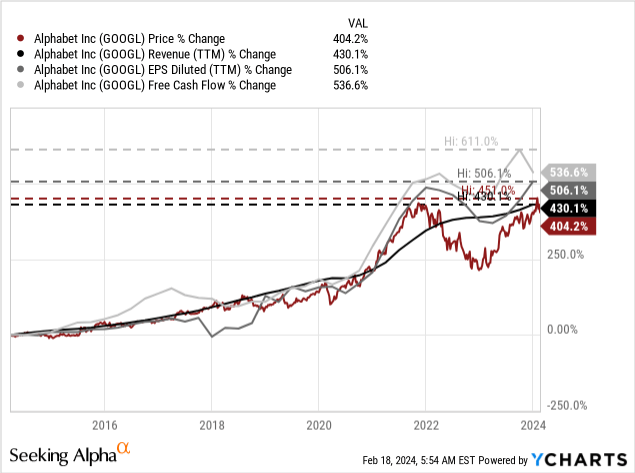

It also becomes obvious when looking at the share price in comparison to revenue growth, EPS growth or free cash flow growth. The stock price more or less performed in line with the fundamental metrics, but revenue growth and especially EPS and free cash flow outperformed the stock price in the last ten years, which could also be a hint that the stock is slightly undervalued at this point.

Intrinsic Value Calculation

Although it is good to know that Alphabet is trading for lower valuation multiples than five years ago, this is not enough information to decide if the stock is a buy or not. At the time of writing, Alphabet is trading for 24.5 times earnings and 26.5 times free cash flow. These are valuation multiples, making it difficult to be seen as extremely expensive or as cheap. But as pointed out countless times in the past, simple valuation multiples have several limitations and with different companies growing with different rates, they are never a good way to compare businesses on an absolute basis.

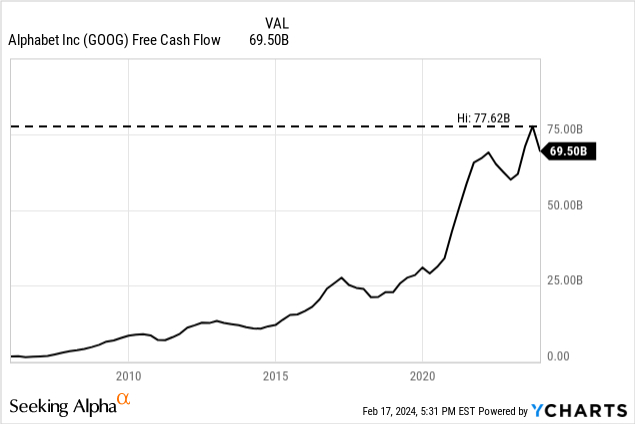

A much better way to determine an intrinsic value for any stock is a discount cash flow calculation. As basis for our calculation, we can take the free cash flow of the last four quarters, which was $69.5 billion. Additionally, we calculate with 12,602 million outstanding shares and a 10% discount rate as this is the return we like to achieve. To be fairly valued, Alphabet has to grow its free cash flow about 6% annually from now till perpetuity (this leads to an intrinsic value of $137.87). And instead of trying to calculate an intrinsic value for the stock, let’s turn the process around and ask the question if Alphabet is able to achieve the necessary growth rates (or maybe even higher growth rates) to be fairly valued.

Growth

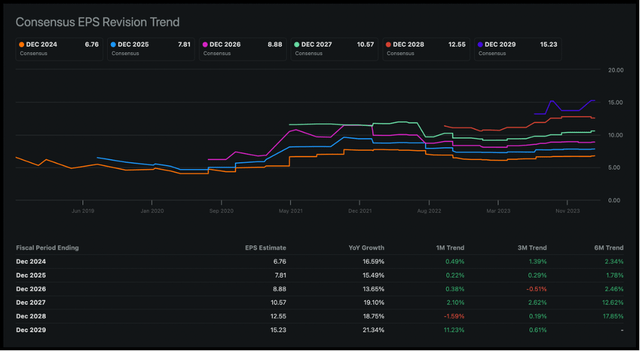

When trying to determine growth rates for the coming years that are realistic, we can start by looking at what others (i.e. analysts) are expecting. And according to Seeking Alpha, analysts are expecting earnings per share to grow with a CAGR of 17.5% in the years till fiscal 2029. It is also worth pointing out that analysts are getting more optimistic again: Compared to early 2023, analysts are now on average expecting higher earnings per share for the coming years.

Alphabet: Consensus EPS Revision Trend (Seeking Alpha)

We all know investing is about the future. Nevertheless, past growth rates can give us some hints what growth rates might be realistic for a business. Expecting double-digit growth rates for a business which has been reporting low-to-mid single digit growth in the past has to be well justified. Expecting Alphabet to grow at least 6% annually for the next few years seems way more reasonable when looking at past growth rates.

|

Revenue |

Operating Income |

Earnings per share |

|

|---|---|---|---|

|

3-year CAGR |

18.98% |

26.93% |

25.55% |

|

5-year CAGR |

17.57% |

21.84% |

21.56% |

|

10-year CAGR |

17.78% |

19.69% |

19.79% |

And growth can stem from different sources. One way to grow the bottom line is by continuing share buybacks. In the last six years – since 2018 – Alphabet reduced the number of outstanding shares about 2% annually, and we can expect Alphabet to continue using a larger part of its free cash flow for share buybacks (even if management might follow Meta’s footsteps and initiate a small dividend as well). Taking a current market capitalization of $1.75 trillion and a free cash flow of $70 billion, Alphabet could repurchase 4% of its outstanding shares annually (assuming a stable share price).

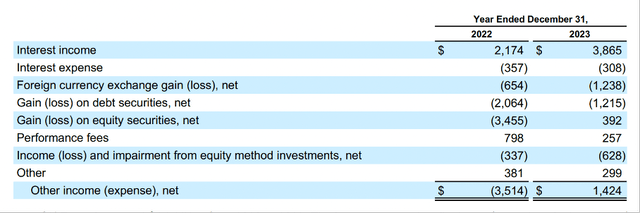

The company also has $24.0 billion in cash and cash equivalents, as well as $86.9 billion in marketable securities – an amount of $110.9 billion that could be used for share buybacks as well. But considering that these marketable securities are government bonds, corporate bonds and mortgage-backed securities with – I assume – acceptable yields, I don’t know if selling these assets and using the cash for share buybacks is a decision management would make. The marketable securities generated an interest income of $3,865 million for Alphabet (accounting for 5.2% of Alphabet’s total net income).

Growing the bottom line by share buybacks is fine, but more important is top-line growth, as this is the only way for businesses to grow long-term. And one major contributor to top-line growth for Alphabet will probably be generative AI. The market is expected to grow from $45 billion in 2023 to more than $200 billion in 2030 and Alphabet should be able to participate well in this market.

And as already pointed out several times in the past, the cloud business is expected to continue growing in the double digits and Alphabet, as one of the leading businesses, will probably be able to grow in the double digits as well. There is the risk of Alphabet losing market shares a little bit as new competitors might enter the market, but we can still expect the segment to grow at least in the double digits.

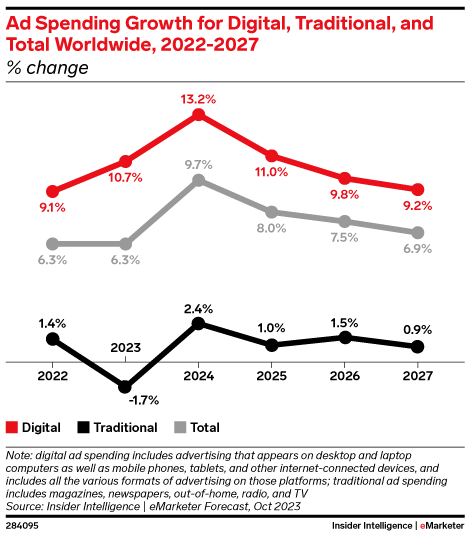

Aside from these major growth contributors, we should not ignore the “bread-and-butter” business of Alphabet and how the company is generating most of its revenue – by ad spending. And according to Statista, the ad spending in the search advertising market will grow with a CAGR of 8% in the years till 2028 with an expected shift towards mobile.

Insider Intelligence

Insider Intelligence are expecting similar growth rates for the next few years. Digital ad spending will grow in the high single digits or double digits in the next few years. And assuming that Alphabet will be able to keep its market share, it should be able to grow at least at the same pace as the overall market.

In my opinion, Alphabet should be able to grow at least 6% for the next few years – expecting growth rates to be at least in the high single digits but most likely even in the double digits. Nevertheless, I am making the case to be a bit cautious right now.

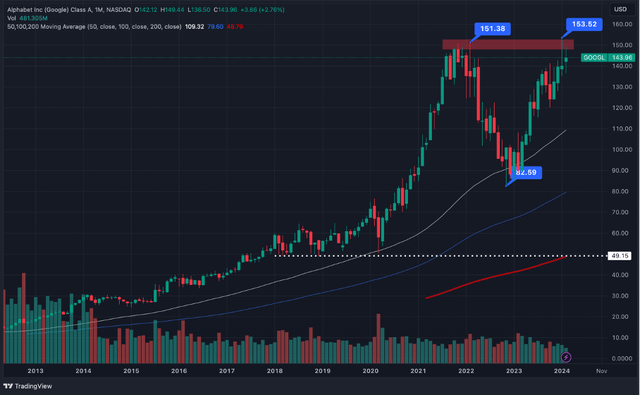

Technical Picture

One of the reasons to be cautious becomes obvious when looking at the chart. It seems possible for the Alphabet to form a double-top, which must be seen as rather bearish. Amazon’s chart looks quite similar, and both stocks reached the previous highs again (the level the stocks traded at before the 2022 correction – or bear market).

Alphabet: Monthly Chart (TradingView)

And while we can make the argument for a double top with potential downside risk, we should also be open to the possibility of the bull market continuing.

Conclusion

Alphabet’s business seems to improve again, and the company can grow at a higher pace again. And so far, it also seems like competition from businesses like OpenAI is not a threat for Alphabet and the company is able to keep its market shares. And while we could certainly argue that Alphabet is fairly valued at this point, I would be cautious nevertheless. One of the reasons to be cautious is the chart and the double top Alphabet might be forming right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.