Summary:

- As is often the case for new technology, this time with Generative AI, a high dose of hype seems to have blurred the horizon, with Nvidia’s valuations pointing toward a monopoly status.

- In response, Alphabet’s release of its TPU-4 chips together with the subsequent market reaction seems to indicate that investors have been injected with a dose of reality.

- There is also competition from Intel for the inference part of ChatGPT.

- The search engine giant deserves better valuation, not only because it is undervalued, but also due to its product positioning which confers to it an end-to-end provider status, namely with Bard to rival Microsoft’s ChatGPT.

- Investors will also note my cautionary instance mainly due to the advent of new technology, with this time AI looking to make incursions in the very way we communicate with each other.

wildpixel

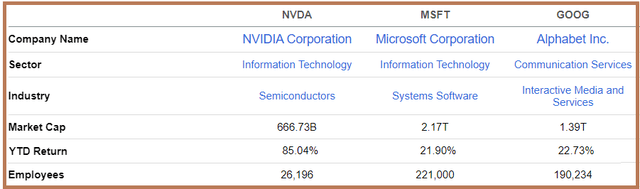

Coincidentally, since the Jan 23 announcement by Microsoft (NASDAQ:MSFT) about its sizeable investment in OpenAI whose star product ChatGPT has seen exponential usage throughout the world, it is Nvidia’s (NASDAQ:NASDAQ:NVDA) stock that has delivered gains of more than 85% as pictured below. This is four times the gains produced by either Microsoft or Alphabet (NASDAQ:GOOG) (GOOGL) and is mainly due to its A100 chip used to drive ChatGPT’s generative AI.

Comparison NVDA, MSFT, and GOOG (seekingalpha.com)

However, for those dreaming about the AI chip giant monopolizing the market, Alphabet’s release of its fourth-generation Tensor Processing Unit, or TPU appears to have injected a reality check on Nvidia’s stock on Wednesday last week when it was down by more than 2% after the news update.

Now, Alphabet is also an end-to-end player in Generative AI with its Bard or the equivalent of ChatGPT and Google Cloud, as this thesis will elaborate upon, with another aim being to identify related market opportunities while being realistic as hype seems to have blurred the horizon.

Chips for Generative AI Market with Nvidia, Alphabet, Intel, and Others

First, one important piece of precision is that applications like ChatGPT are about processing simple natural language which people commonly use instead of complicated computer codes. Also with its chatbot or chatting interface, ChatGPT makes use of Generative AI to generate text, in contrast with Recommendation AI which has been around for years whereby machine learning algorithms analyze huge data sets to recommend someone a product he or she is most likely to choose.

Furthermore, Generative AI can generate lines of phrases based on a query, but first, its algorithm has to be trained so that it basically learns the language including how information is communicated. This takes considerable computing resources and this is where Nvidia’s Tensor-based A100 GPU is key.

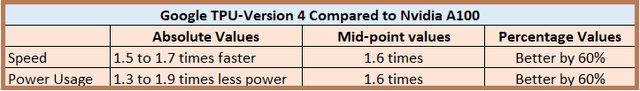

However, Alphabet has also been developing its own TPUs, since 2016. For this matter, a supercomputer used for training language models and driven by its TPU-version 4 has proven faster than Nvidia’s systems by 1.5 to 1.7 times and uses 1.3 to 1.9 times less power than the A100.

These may seem to be trivial, but, it is not as just one A100 can cost up to $10K and at least eight GPUs are required to support the computing needs of one ChatGPT instance alone. Add to this operational costs which include power and you have daily costs which can total $100K. Thus with Alphabet’s TPU being 60% faster and requiring 60% less power than those produced by Nvidia based on the midpoints as computed in the table below, big corporations now have another option involving lower Capex and operating expenses.

Table prepared using data from (www.cnbc.com/)

Consequently, the semiconductor industry’s most valuable stock now has a serious contender which endangers its monopolistic position in the lucrative Generative AI chips market, implying that it may have to reduce prices. Moreover, Alphabet is no ordinary contender as it not only competes for chips but is also an end-to-end service provider that can offer generative AI services as part of its GCP or Google Cloud Platform globally.

Moreover, Nvidia faces competition from Intel (NASDAQ:INTC) too.

For this purpose, computer processing for Generative AI is divided into two parts: the learning part as I mentioned earlier, and the inference part, which concerns how for example the ChatGPT service is consumed by users when they run queries. In this case, according to benchmarking done by BLOOMZ which supports 46 different human languages, Intel’s Zeon 4th generation Sapphire Rapids CPU and HabanaGaudi 2 GPU were able to run inference faster by 20% compared to an Nvidia A100-80G.

This is the reason which may have prompted Nvidia to develop the H100 NVL, which not only comes with more performance and memory but also with relatively fewer inference costs, in order to fully avail of the market opportunities offered by AI-assisted report writing.

Valuing the Opportunities

Given the $126.5 billion of opportunities by 2033, the Generative AI market has become hot with other stakeholders coming to the fore. These include Advanced Micro Devices (NASDAQ:AMD) which produces Radeon GPUs and EPYC CPUs which are used for machine learning purposes, with the company recently unveiling its RYZEN 7000 which features an AI engine specifically designed for content creation purposes.

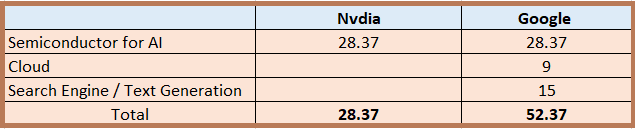

Talking valuations, the market specifically dedicated to AI chips was valued at around $16.86 billion in 2022 and is expected to reach $28.37 billion by 2024. In addition to semiconductors, there is the specialized AI cloud market, where, based on a CAGR growth of 20.3% between 2021 and 2026, I calculated a market size of around $9 billion for 2024. Next, there is text generation enabled by tools like ChatGPT and Bard in the Generative AI market which is expected to grow by 32% CAGR from 2022 to 2033. Extrapolating this data, a $15 billion market size can be expected for search engine/text generation in 2024.

Adding up those three different market opportunities as pictured below, Alphabet has access to a much larger $52.37 billion market, compared to only $28.37 billion for Nvidia.

Table prepared using data from (www.seekingalpha.com)

Investors should note that I consider Alphabet to be a contender for AI-based text generation in the sense that it will complement its Google search engine, despite its failed launch of Bard in February, as it has made considerable progress since. For recall, Bard is an AI-powered chatbot tool designed for simulating human conversation that the Search Engine giant has been developing since 2017. Now, in its haste to make up for its lagging position after the ChatGPT launch in November last year, the company launched Bard on Feb 23, but it did not proceed according to plan and the company is estimated to have lost about $100 billion in market value in just one day.

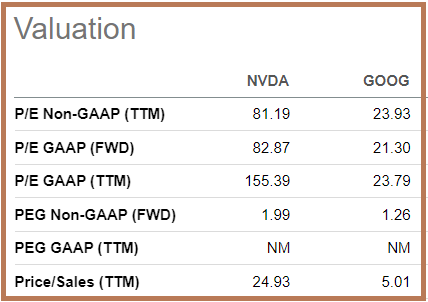

Now, that progress has been made, the stock deserves better, and, with its presence in the three markets shown above, Alphabet is a better choice for investors looking to invest in the Generative AI theme. Also, given the sales opportunities, Alphabet is significantly undervalued with a trailing price-to-sales ratio of only 5x which is nearly a fifth of Nvidia.

Comparison of Metrics (seekingalpha.com)

In addition to the market opportunities, there is also the product positioning aspect to consider. In this context, on the one hand, you have Microsoft which is in advance with ChatGPT but has to rely on partner OpenAI (in which it has made a $10 billion investment) plus on Nvidia for chips, and on the other, there is Alphabet, which, has developed its own text generating tool plus the AI chips too.

Concluding with Caution

Therefore, with the release of its latest TPU, Alphabet has positioned itself as a strong contender in the type of chips that drive Generative AI, while at the same time breaking Nvidia’s monopoly. Going one step further, with the possibility of offering cloud AI as part of GCP and its Bard text generator, this thesis also highlights Alphabet’s role as an end-to-end player in the Generative AI ecosystem. This also represents significant differentiation from Microsoft.

Consequently, I am bullish on the stock which I value at around $130, based on a 20% upside applied to the current share price of $108. Coincidentally, 20% is the amount by which it is down for the last year, and this target remains below Wall Street’s average of $125. As for Nvidia, given the competitive landscape and the fact that it is already overvalued, I have a hold position.

However, on a cautionary note, some may prefer to wait for more clarification about Alphabet’s strategy during its earning call which should take place on April 27. Here, some of the key points to look for is whether Alphabet intends to offer its semiconductors for sale directly to companies willing to set up their own private ChatGPT-style infrastructure, or could offer them indirectly through GCP (Google Cloud Platform). Along the same lines, it would also be useful to obtain an update on Alphabet’s advertising business which should be impacted by recessionary pressures this year.

Finally, as is often the case with technological developments, there is a debate as to how AI will impact jobs and different fields of study, especially medicine, with some nation-states like Italy having chosen to ban ChatGPT. In this context of disruption, there should be a high level of regulatory scrutiny as AI-led text generation touches upon natural languages and, as such, should impact the way human beings communicate with each other, with the possibility that the technology could be weaponized, especially when generating images.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.