Summary:

- The first scenario explores the possibility of Google falling short of revenue and net income estimates, revealing the company’s resilience even in such a scenario.

- The second scenario suggests the valuation of Alphabet if it meets analysts’ expectations for the projected period of 2023-2028.

- The third scenario paints a more optimistic picture, considering sustained growth, especially in Google’s diversified cloud business.

- The significant discrepancy between these scenarios and analysts’ expectations arises from Google’s dominant position in core markets like search engines and online video platforms.

- Regardless of market share fluctuations, Alphabet’s solid financial health and robust balance sheet underline its enduring presence in the tech landscape, making it an unlikely candidate for short selling.

400tmax

Thesis

Alphabet Inc. (NASDAQ:GOOGL)(NASDAQ:GOOG) has a very strong financial condition, with strong cashflows, and huge cash reserves, however its only growth catalyst is Google Cloud and when projecting the growth of this one to 16.3% I end with the results that revenue need to grow at 15%, something that is well above the growth rate expected by analysts. However in the three valuation models I perform in this article, we can observe that Google is fairly valued, nevertheless, the upside is limited and for now, that makes it a “hold”.

Overview

Google Cloud

Alphabet’s primary sources of revenue are its search engine, Google, and YouTube, with Google being the undisputed leader in both markets. However, it is challenging for Google to achieve further growth in these areas.

Google Cloud offers a comprehensive range of services, including computing, storage, databases, networking, operations, developer tools, data analytics, AI solutions, API management, and more. Google provides a detailed explanation on their Google Cloud webpage.

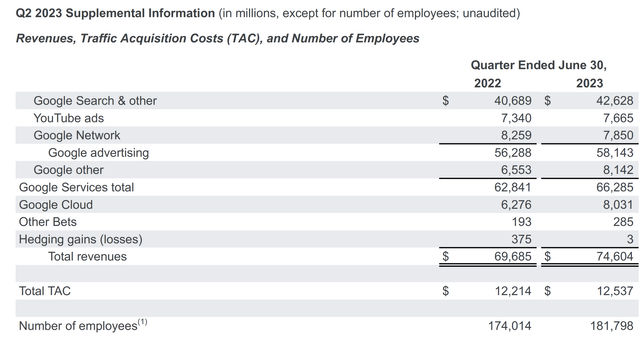

As shown in the table below, Google Cloud is Google’s fastest-growing segment, which experienced a 33% growth in just one year.

GOOG Exhibit 99.1 Q2 2023

Why Google Search Engine will remain Dominant

As the subtitle suggests, Google will maintain its dominance, at least for the duration of these projections, due to the network effect it has cultivated over the years.

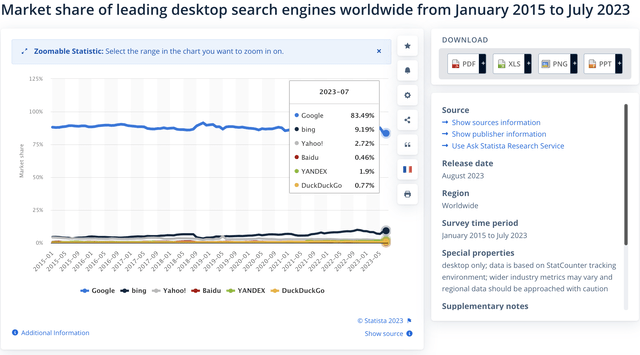

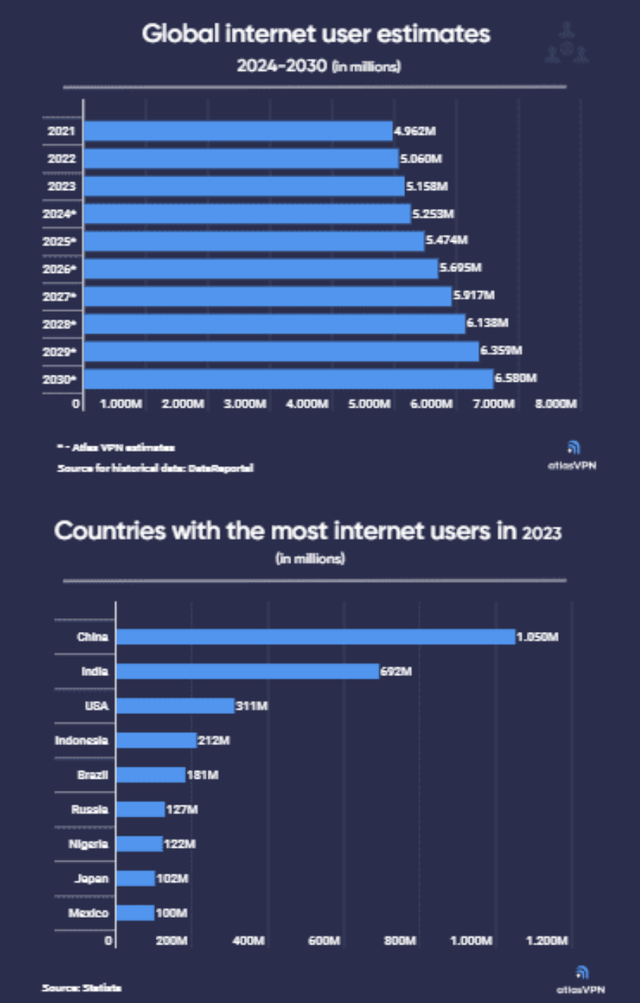

In October 2018, Google held a market share of approximately 90% in the search engine industry. By July 2023, that share had declined to 83.49%, reflecting a 6.51% decrease over five years, equivalent to an annual 1.3% reduction in market share. If we extrapolate this trend over the five-year period covered in this article, Google’s market share is estimated to be 76.98%. Nevertheless, this still represents a significant portion of the market, and the potential gains are likely to outweigh the potential losses, especially as more people gain access to the internet.

Statista

In the table below, you can observe the explanation I’m about to provide. While Google’s market share in the search engine industry may experience a decline, it’s important to note that the number of new internet users is projected to increase by 5.5% annually. In my opinion, it’s highly unlikely that Google would lose a 20% market share overnight. The only scenario in which such a significant loss could occur is if Google were to no longer be the default search engine on 50% of new devices. The reality is that many users may not be particularly concerned about which search engine they are using.

Daily Host News

YouTube

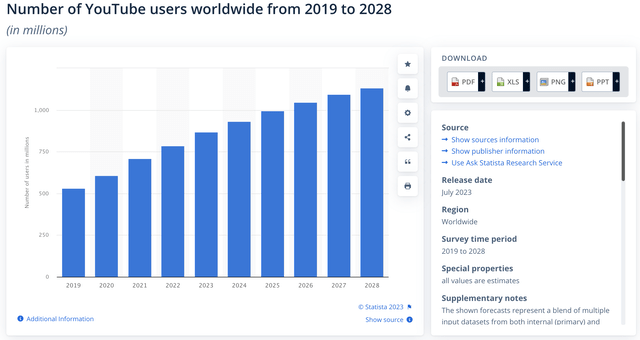

YouTube is another valuable asset in Alphabet’s portfolio. I won’t delve into it in great detail here since it aligns with what was previously mentioned. Even if it experiences a gradual decrease in market share, as shown in the table below, you’ll notice that the user base is projected to grow from 868K in 2023 to 1.13M in 2028, reflecting a 6% annual growth. Neither Twitch nor TikTok is likely to surpass YouTube because they operate in distinct ways; Twitch focuses on streaming, and TikTok specializes in short videos, whereas YouTube encompasses both. The primary risk here is the potential migration of many content creators from YouTube to Twitch due to the higher payouts, effectively leading to a price war.

Statista

Financials

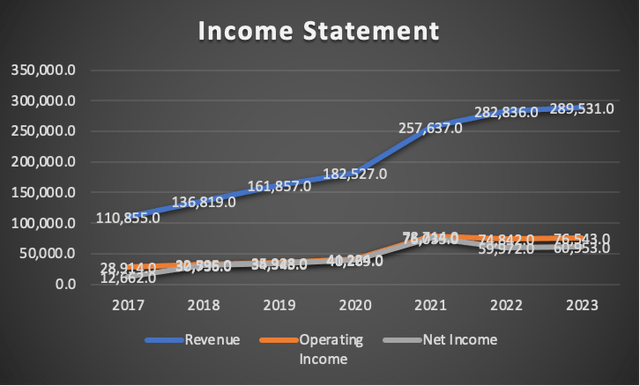

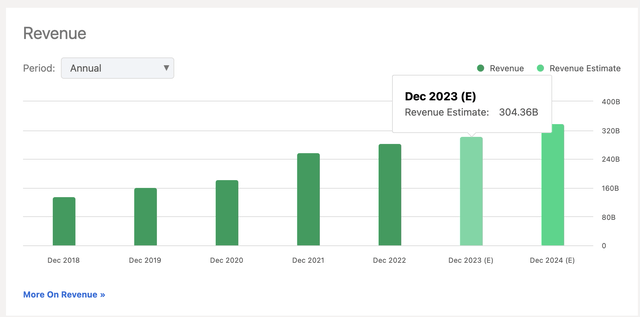

Google experienced significant revenue growth during the pandemic period, boasting an impressive annual revenue growth rate of 18.4% from 2019 to 2022. This growth can be primarily attributed to well-known factors. However, starting in 2022, there has been a slight deceleration, with revenue increasing by approximately 2.4% from 2022 to 2023.

Author’s Calculations

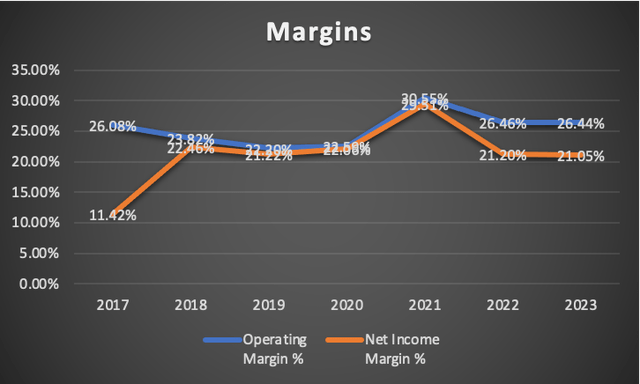

Alphabet maintains robust margins, with both operating and net income margins surpassing 20%. As illustrated in the graph below, the operating margin stands at an impressive 26.44%, while the net income margin reaches 21.05%.

Author’s Calculations

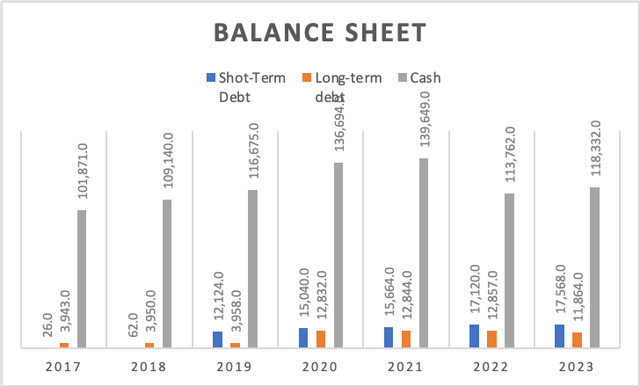

Alphabet’s balance sheet remains in excellent condition, carrying approximately $29.3 billion in total debt, offset by substantial cash reserves of around $118.3 billion.

Author’s Calculations

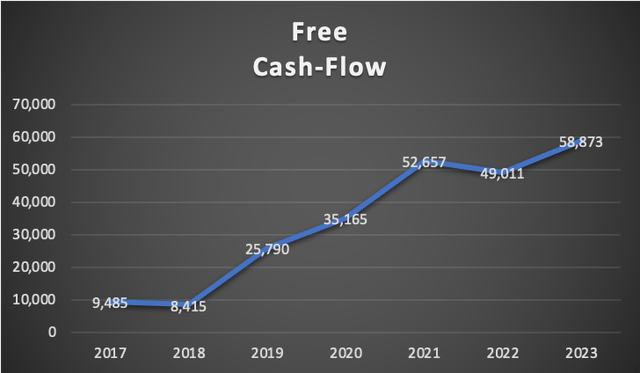

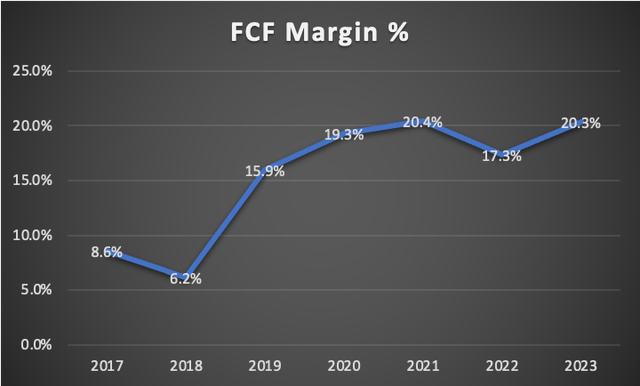

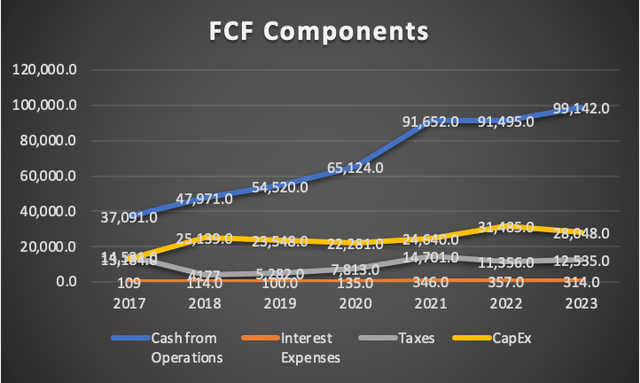

In terms of free cash flow, Alphabet generates approximately $58 billion, a sum more than sufficient for acquiring entire companies. The current FCF margin sits at 20.3%, marking an all-time high since 2017. The graph labeled “FCF Components” indicates that from 2021 to 2022, Alphabet increased its capital expenditure from $24 billion to $31 billion.

Author’s Calculations

Author’s Calculations

FCF Components

In summary, Alphabet’s financial health is truly enviable, underscored by substantial free cash flow, affording the company ample resources for mergers and acquisitions or investment in the development of new products. This strategic approach is pivotal in securing its dominance in the computing market.

Valuation

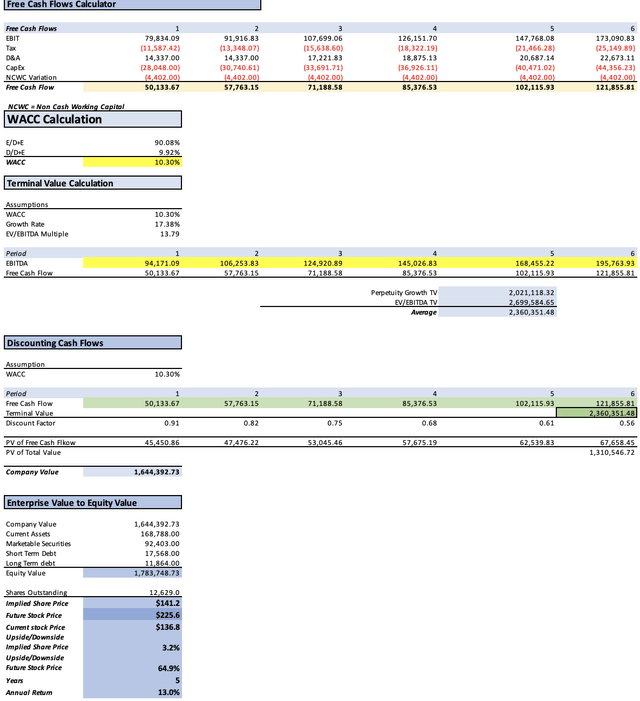

In this valuation, I will present three models to explore various scenarios for Alphabet. The first model considers a situation where Alphabet falls short of expected revenue and net income. The second model assumes that Alphabet can maintain the anticipated revenue growth rate of 9.61% and the expected EPS growth rate of 17.38%. Finally, the third model examines the potential outcomes if Google Cloud sustains a revenue growth rate of 16.3%.

Below is the table of assumptions, which incorporates all the current financial data available on Alphabet. Notably, D&A (Depreciation and Amortization), interest expenses, and CapEx (Capital Expenditures) are projected using margins linked to revenue. This methodology aims to yield more realistic figures.

| TABLE OF ASSUMPTIONS | |

| (Current data) | |

| Assumptions Part 1 | |

| Equity Value | 267,141.00 |

| Debt Value | 29,432.00 |

| Cost of Debt | 1.07% |

| Tax Rate | 17.06% |

| 10y Treassury | 4.60% |

| Beta | 1.14 |

| Market Return | 10.50% |

| Cost of Equity | 11.33% |

| Assumptions Part 2 | |

| EBIT | |

| Tax | 12,535.00 |

| D&A | 14,337.00 |

| CapEx | 28,048.00 |

| Capex Margin | 9.69% |

| Assumption Part 3 | |

| Net Income | 60,953.00 |

| Interest | 314.00 |

| Tax | 12,535.00 |

| D&A | 14,337.00 |

| Ebitda | 88,139.00 |

| D&A Margin | 4.95% |

| Interest Expense Margin | 0.11% |

| Revenue | 289,531.0 |

Alphabet misses revenue & net income estimates for 2023 and 2024

In this initial scenario, I will illustrate the potential outcomes if Alphabet falls short of revenue and net income estimates, which are available on Seeking Alpha’s summary page for the Alphabet stock ticker.

Revenue Estimates for Google (Seeking Alpha)

As evident, analysts have high expectations, anticipating Alphabet to achieve $304 billion in revenue for 2023, while I am conservatively setting it at $289 billion, in line with Alphabet’s revenue on a trailing twelve-month basis.

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2023 | $289,531.0 | $67,932.67 | $79,520.09 | $93,857.09 | $94,171.09 |

| 2024 | $317,326.0 | $78,254.75 | $91,602.83 | $105,939.83 | $106,253.83 |

| 2025 | $347,789.3 | $91,683.27 | $107,321.87 | $124,543.71 | $124,920.89 |

| 2026 | $381,177.0 | $107,416.12 | $125,738.31 | $144,613.44 | $145,026.83 |

| 2027 | $417,770.0 | $125,848.72 | $147,315.00 | $168,002.14 | $168,455.22 |

| 2028 | $457,876.0 | $147,444.36 | $172,594.25 | $195,267.36 | $195,763.93 |

| ^Final EBITA^ |

Author’s Calculations

The DCF analysis for this scenario reveals a current fair price of $141.2. This suggests a 3.2% potential upside from the current stock price of $136.8. Moreover, it implies an annual return of 13% until the stock attains the suggested future value of $225.6. Even in this conservative scenario, Alphabet is evidently undervalued.

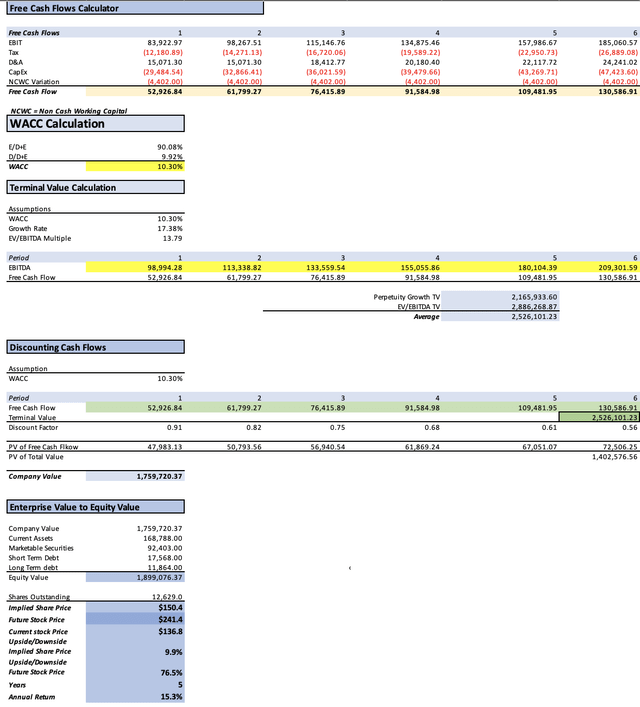

Default Scenario

In the initial valuation scenario, we take into account Alphabet’s anticipated revenue growth rate of 9.61%, in accordance with analysts’ projections. This scenario, being the default revenue growth rate, necessitates no further clarification.

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2023 | $304,360.0 | $71,412.00 | $83,592.89 | $98,664.20 | $98,994.28 |

| 2024 | $339,270.0 | $83,666.30 | $97,937.43 | $113,008.74 | $113,338.82 |

| 2025 | $371,839.9 | $98,023.44 | $114,743.50 | $133,156.27 | $133,559.54 |

| 2026 | $407,536.6 | $114,844.26 | $134,433.48 | $154,613.88 | $155,055.86 |

| 2027 | $446,660.1 | $134,551.53 | $157,502.27 | $179,619.98 | $180,104.39 |

| 2028 | $489,539.4 | $157,640.58 | $184,529.65 | $208,770.67 | $209,301.59 |

| ^Final EBITA^ |

Author’s Calculations

As illustrated in the DCF analysis, this scenario produces a current fair price of $150.4. This indicates a noteworthy 9.9% potential upside from the current stock price of $136.8. Additionally, it implies an annual return of 15.3% until the stock reaches the suggested future value of $241.4.

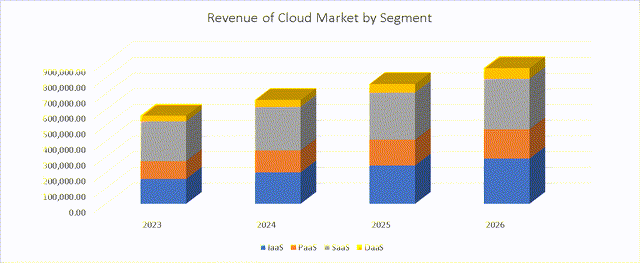

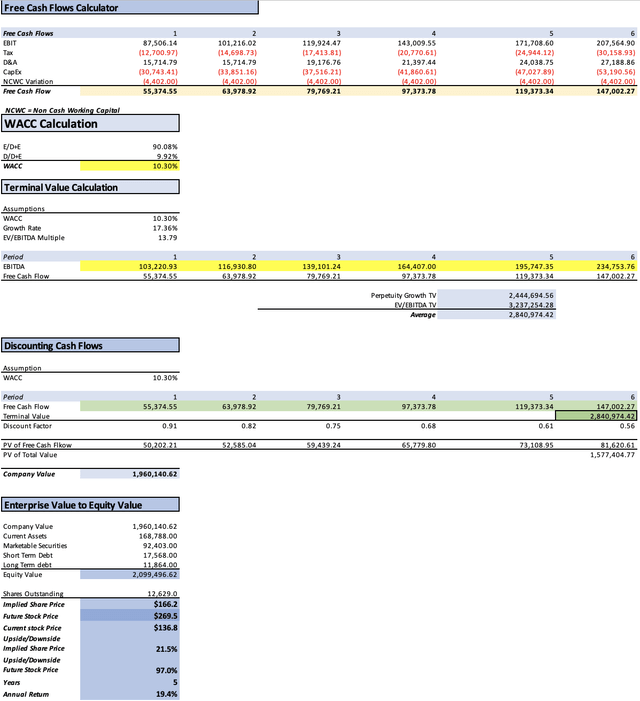

Projecting Google Cloud

Now, let’s explore the second scenario, where I’ll explain why Google’s revenue could potentially be even higher due to its cloud revenue. Google Cloud is a highly diversified cloud system, and I’ll assume the expected growth rate for the cloud market, which is approximately 16.3%. The table below presents the results of this scenario.

Revenue Growth of Cloud Market (Author’s Calculations)

| Cloud Revenue | |

| 2023 | $32,763.85 |

| 2024 | $38,104.35 |

| 2025 | $44,315.36 |

| 2026 | $51,538.77 |

| 2027 | $59,939.58 |

| 2028 | $69,709.74 |

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2023 | $317,354.9 | $74,461.00 | $87,161.97 | $102,876.75 | $103,220.93 |

| 2024 | $349,435.2 | $86,173.12 | $100,871.84 | $116,586.63 | $116,930.80 |

| 2025 | $387,268.4 | $102,090.66 | $119,504.48 | $138,681.24 | $139,101.24 |

| 2026 | $432,114.3 | $121,770.31 | $142,540.92 | $163,938.37 | $164,407.00 |

| 2027 | $485,454.7 | $146,238.00 | $171,182.12 | $195,220.87 | $195,747.35 |

| 2028 | $549,070.0 | $176,810.50 | $206,969.43 | $234,158.28 | $234,753.76 |

| ^Final EBITA^ |

Author’s Calculations

As demonstrated in the DCF analysis, this scenario yields a current fair price of $166.2. This suggests a substantial 21.5% potential increase from the current stock price of $136.8. Furthermore, it implies an annual return of 19.4% until the stock reaches the suggested future value of $269.5..

So what?

However, there’s a notable discrepancy between the estimates I’ve formulated and those of the analysts. This disparity becomes evident when we examine the anticipated revenue growth. In the model I’ve constructed, Alphabet needs to achieve a revenue growth of 14.63%, while analysts expect a forward revenue growth of 9.61%. Furthermore, you can observe how analysts project a $303 billion revenue, while I require $317 billion for this scenario to be viable.

The challenge I see with Google is that its primary growth driver is Google Cloud, as YouTube and the search engine essentially dominate their respective markets. It’s challenging to expand significantly when you control, for instance, 83% of the market. This is compounded by the fact that other players continually vie for a share of the market, and maintaining that share requires intense effort. Nevertheless, even if Alphabet were to lose market share in these core markets, the expected growth in these markets surpasses the rates at which I anticipate Alphabet might lose market share.

Lastly, when evaluating tech companies, there are other options that could potentially yield better returns without necessitating the beat of expectations. For instance, in my article about Microsoft Corporation (MSFT), I elaborated on this, and similarly, in my article about Netflix, Inc. (NFLX), which experienced a recent 15% surge, published just before their earnings. Therefore, I rate Alphabet as a “Hold” and assign it a target price of $150.4.

Risks to Thesis

There’s essentially one risk to this somewhat bearish thesis, and that’s the possibility that Google could surpass expectations and deliver the 21% upside discussed in the third and final scenario. However, this is a game of probabilities, and in this instance, I wouldn’t place my bets on Google.

A macro-level risk for this thesis could be the acceleration of internet adoption, which would likely boost Google’s search engine revenue, and potentially also benefit YouTube, as it’s the premier online video platform.

However, it’s important to clarify that, as you may have observed, in all three models, Alphabet is indicated to be fairly valued. With its strong balance sheet and substantial cash flows, Alphabet is not on the verge of disappearing anytime soon. Consequently, short selling the stock would not be a prudent course of action.

Conclusion

In assessing the future outlook for Alphabet, it’s evident that the tech giant faces a unique set of challenges and opportunities. The first scenario scrutinizes the likelihood of Google missing revenue and net income estimates, highlighting the potential resilience of the company even in such an event. The third scenario examines Google’s prospects under more optimistic assumptions of sustained growth, especially within its diversified cloud business. However, one cannot overlook the stark contrast between these models and the expectations of industry analysts. This discrepancy stems from the formidable dominance of Google in the search engine and video platform markets. Even if market share experiences marginal losses, the anticipated growth in these core markets may well outpace the rate of such decline.

One critical macro risk is the acceleration of internet adoption, which could significantly boost Google’s search engine revenue and benefit YouTube as the preferred online video platform. Nevertheless, these valuation scenarios ultimately converge on a fundamental insight—Alphabet’s financial health and its enviable balance sheet underscore its robust presence in the tech landscape. Even in a scenario where expectations fall short, Alphabet remains a strong and resilient player, providing ample resources for strategic endeavors. While the company’s growth might not be as stratospheric as some might hope, it’s clear that Alphabet isn’t disappearing anytime soon, making it an unlikely candidate for short selling in the near future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.